- Bitcoin ETFs noticed sturdy inflows, with $298M web influx on the thirty first of July.

- Alternatively, Ethereum ETFs skilled outflows of $77.2M on the thirty first of July.

On the primary day of August, Bitcoin [BTC] ETFs skilled vital inflows, with $50.6 million pouring into spot Bitcoin ETFs.

Notably, BlackRock’s IBIT ETF led the cost, capturing $25.9 million in inflows as per Farside Investors.

Bitcoin ETF circulation evaluation

This pattern mirrored a broader sample of Bitcoin ETFs steadily accumulating BTC, regardless of a short decline in early June. Because the 1st of July, inflows have surged, outpacing the averages of the earlier two months.

Infact, on the thirty first of July, spot Bitcoin ETFs noticed a web influx of $298 million, together with $17.99 million into the Grayscale mini ETF BTC and $20.99 million into BlackRock’s IBIT, per SoSo Value.

Supply: Wu Blockchain/X

Expressing optimism concerning the growth, X (previously Twitter) account Crypto Empire, a outstanding crypto content material hub, shared,

“That’s fairly the monetary rollercoaster! Fascinating to see the completely different actions within the ETFs for Bitcoin.”

Affect on BTC

Nonetheless, BTC skilled a bearish motion on the worth entrance, dropping to the $62K level on 1st August.

By press time, it had recovered to $64K, although the each day charts remained within the purple, reflecting a modest 0.30% decline over the previous 24 hours.

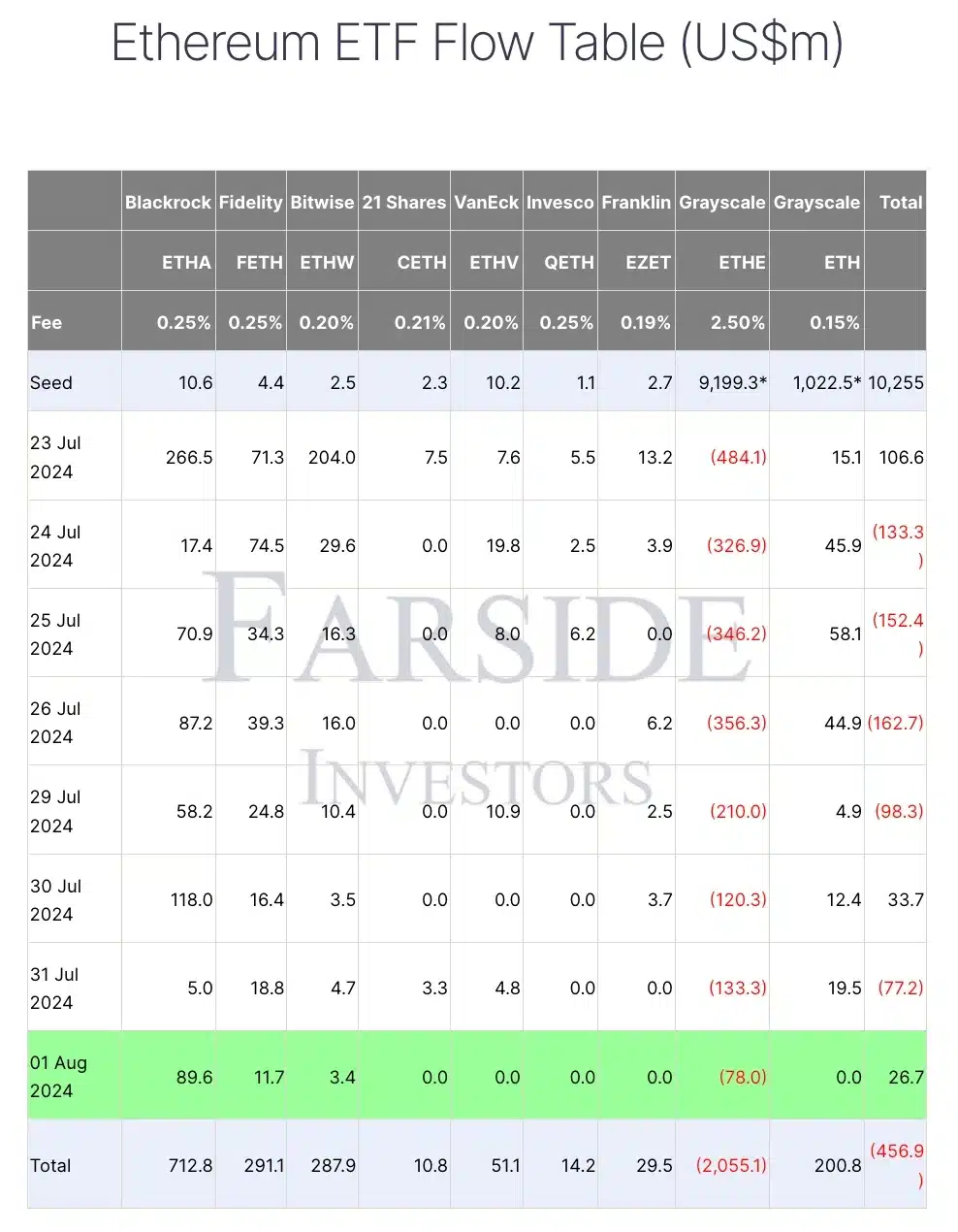

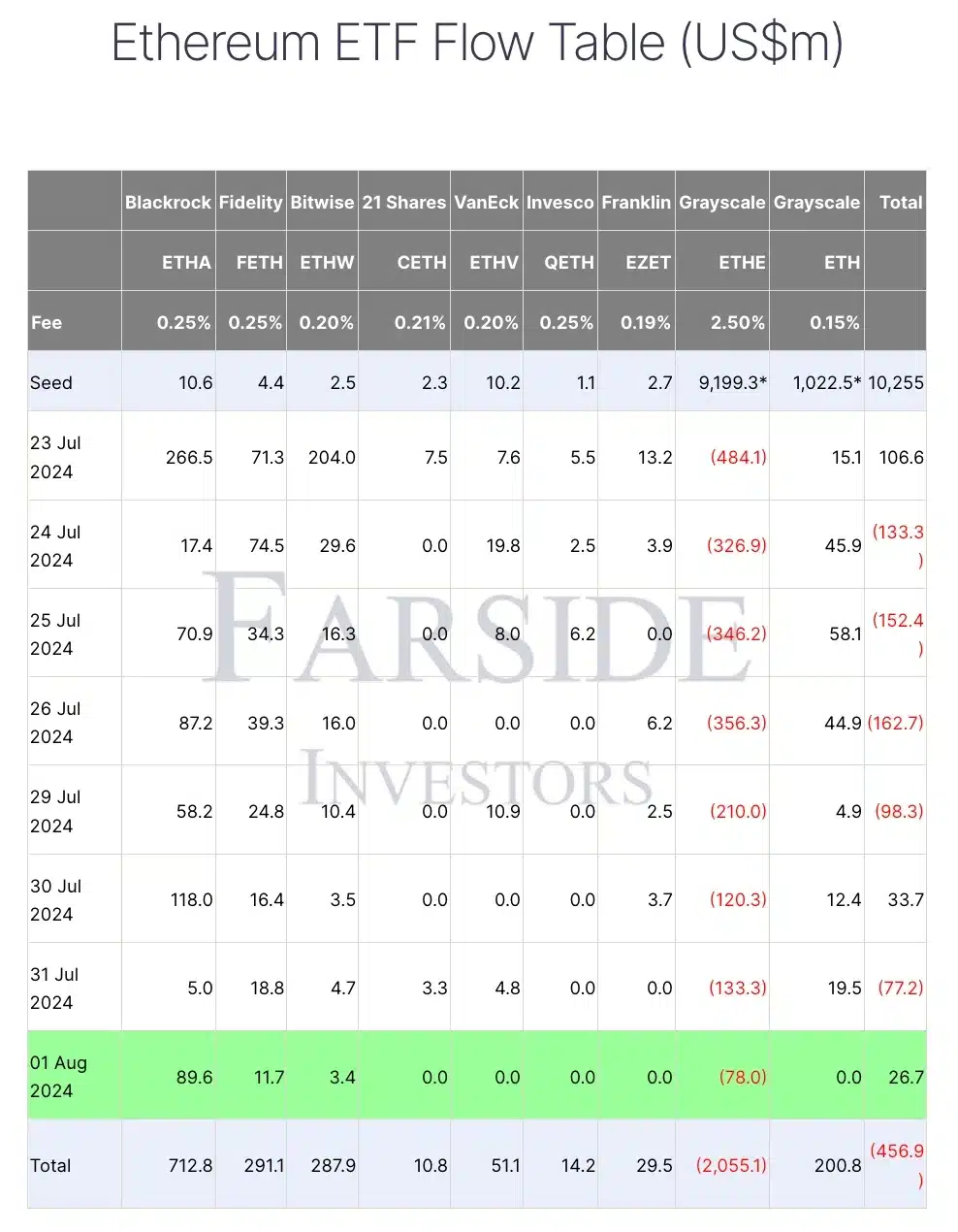

Ethereum ETF evaluation

Curiously, the efficiency of BTC ETFs contrasted sharply with that of Ethereum [ETH] ETFs.

Whereas the ETH ETF recorded inflows of $26.7 million on the first of August, it had seen vital outflows of $77.2 million only a day earlier, on the thirty first of July.

Supply: Farside Traders

Consequently, ETH’s each day value chart confirmed purple candlesticks, indicating a decline. On the newest replace, ETH was down by roughly 1% over the previous 24 hours, buying and selling at $3,142.

Remarking on the identical, George from StepFinance famous,

“If you’d like a retailer of worth narrative sound cash and many others. theres btc. If you’d like some decentralised world pc for constructing apps there’s solana. Theres no place for eth in that world.”

Right here, George is underlining that Ethereum doesn’t have a novel or obligatory operate in a market dominated by Bitcoin and Solana [SOL].

Thus, with steady inflows into Bitcoin ETFs, it is going to be intriguing to look at whether or not ETH ETFs can surpass BTC or if BTC will proceed to guide within the ETF race.