- Bitcoin ETFs noticed a resurgence, with inflows reaching $365.7 million as of the twenty sixth of September.

- BlackRock’s spot Bitcoin ETF recorded a $184.4 million influx, the month’s highest single-day surge.

After dealing with weeks of uncertainty, Bitcoin [BTC] ETFs are as soon as once more gaining momentum.

Regardless of September’s bearish fame for BTC, each the cryptocurrency and its related ETFs have defied expectations with a pattern reversal.

Bitcoin ETF, analyzed

As of the latest knowledge on the twenty sixth of September, complete inflows for all Bitcoin ETFs have reached a powerful $365.7 million.

Main the cost was Ark’s ARKB with $113.8 million, adopted by Blackrock’s IBT at $93.4 million.

Constancy’s FBTC recorded $74 million, whereas Bitwise’s BITB sits at $50.4 million.

VanEck’s HODL, Invesco’s BTCO, and Franklin’s EZBC additionally contributed inflows of $22.1 million, $6.5 million, and $5.7 million, respectively.

Though two extra smaller ETFs confirmed modest inflows under $5 million, the general surge underscores the renewed investor confidence in BTC ETFs.

Notably, on the twenty fifth of September, BlackRock, the world’s largest asset supervisor, witnessed a rare surge of $184.4 million in inflows for its spot Bitcoin ETF, making it the very best single-day influx of the month for any fund.

What’s behind this?

This spike comes amid rising market hypothesis, doubtlessly influenced by developments in Asia.

For these unaware, Chinese language shares rallied following studies that the Chinese language authorities could inject as much as ¥1 trillion($142 billion) into its main state banks, geared toward boosting an economic system that has confronted challenges just lately.

Earlier within the week, the Individuals’s Financial institution of China (PBOC) took easing measures by reducing the reserve requirement ratio for mainland banks by 50 foundation factors and decreasing the seven-day reverse repo charge by 20 foundation factors to 1.5%.

These actions have seemingly fueled optimism, which can be enjoying a task within the inflows seen in world markets, together with Bitcoin ETFs.

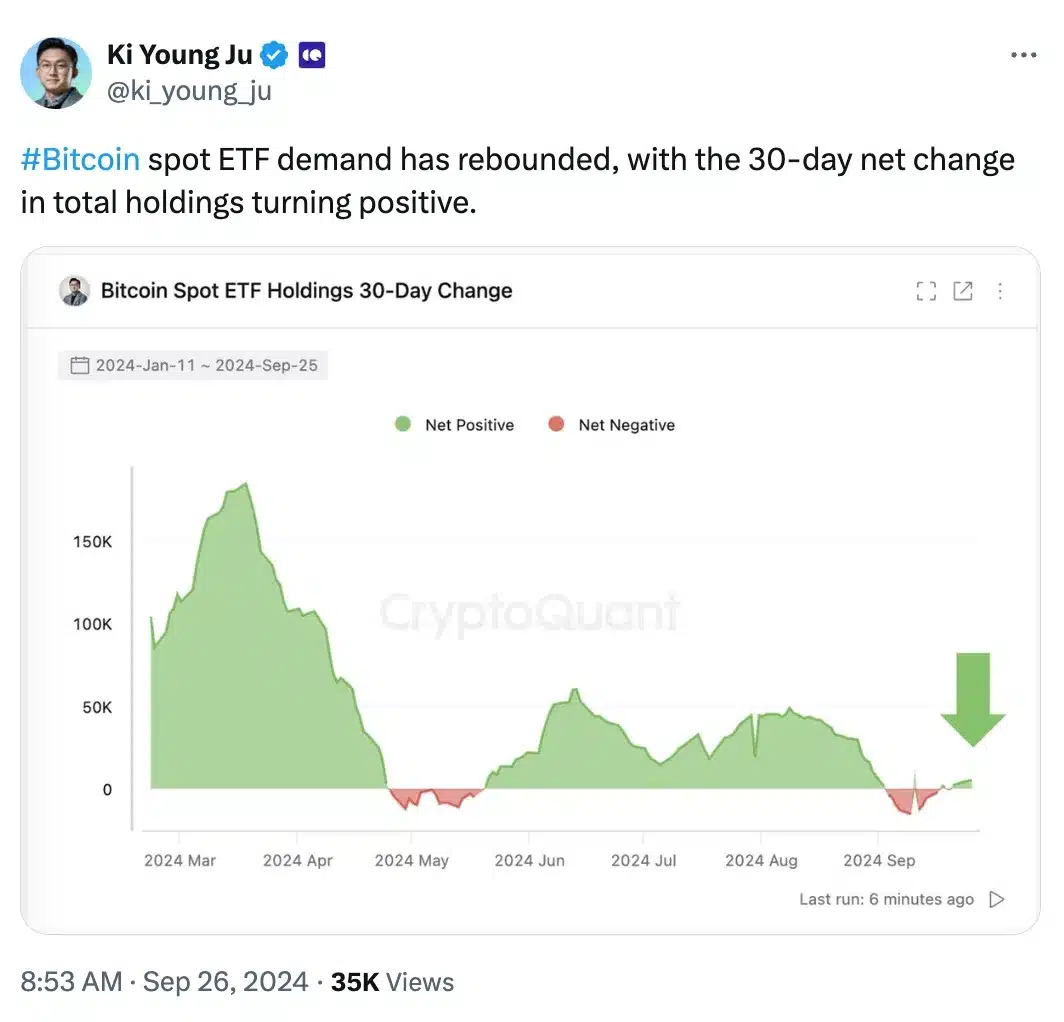

Remarking on the matter, Ki Younger Ju, Founder and CEO of CryptoQuant, stated,

Supply: Ki Younger Ju/X

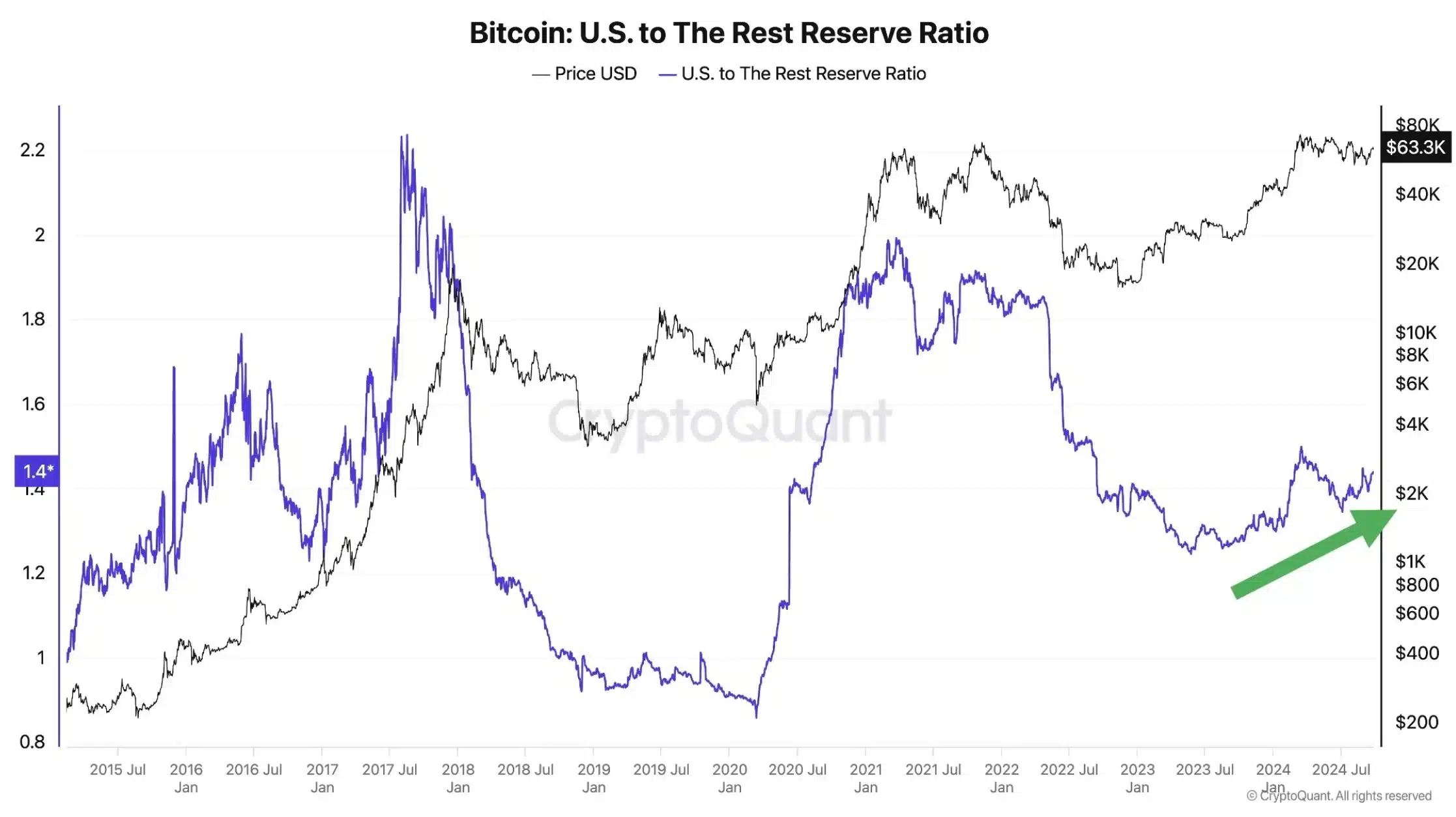

He additional added,

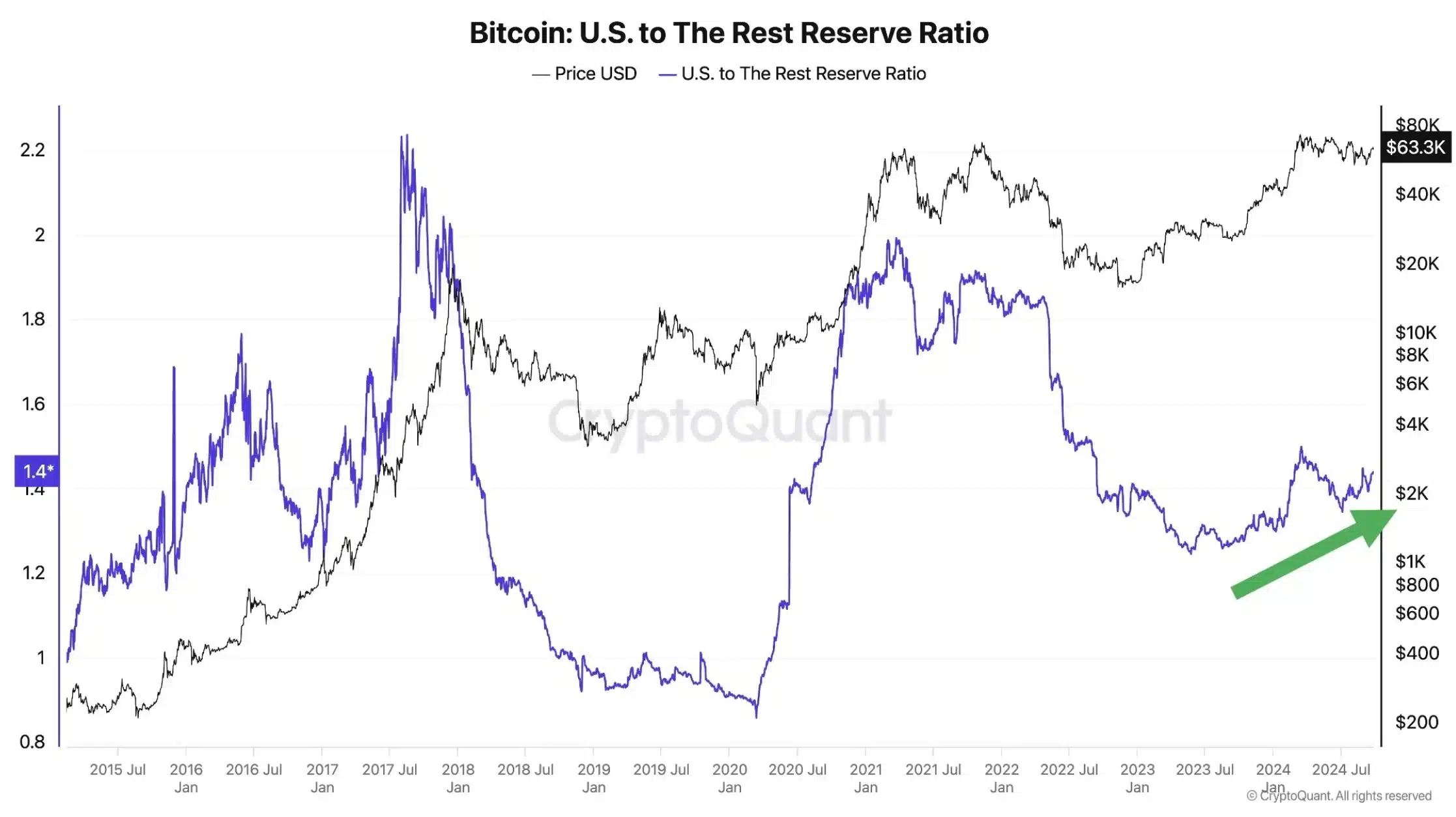

“The U.S. is regaining dominance in #Bitcoin holdings. Its ratio in comparison with different nations is rising, pushed by spot ETF demand. Solely identified entities are included.”

Supply: Ki Younger Ju/X

A take a look at the value entrance

In the meantime, on the value entrance, BTC’s worth motion has proven exceptional resilience.

After struggling to interrupt previous the $60,000 barrier for days, the main cryptocurrency surged, reaching $65,642. This marked a 2.89% acquire within the final 24 hours.

Because the month attracts to an in depth, Bitcoin has exhibited a robust bullish pattern with a powerful month-to-month rise of 10.98%, signaling sustained upward momentum available in the market.