- BTC ETFs ramped up accumulation regardless of current drawdowns.

- Glassnode founders had been bullish on BTC regardless of overhead obstacles on worth charts.

Regardless of Bitcoin [BTC] declining by almost 20%, U.S. spot BTC ETFs scooped the dip although the biggest digital asset dropped under $55K.

In June, BTC dropped from $71.9K to $58.4K. Additional damaging sentiment in July noticed it drop to a brand new low of $53.4K earlier than reclaiming $58K as of press time.

Bitcoin ETFs holding regular

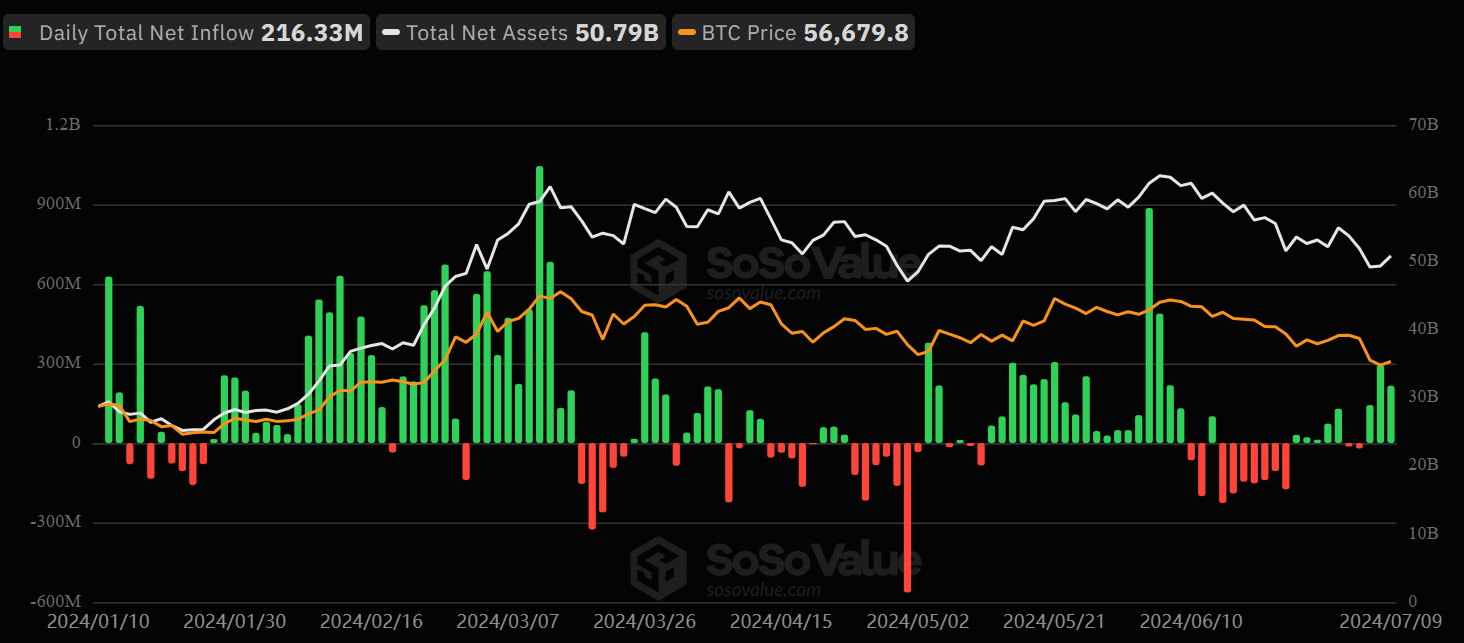

Whereas acknowledging the current drawdown as “nasty,” Bloomberg ETF analyst Eric Balchunas famous that ETFs’ AUM (property beneath administration) and YTD (year-to-date) flows remained regular.

‘Bitcoin had 20% drawdown in a month flat. Fairly nasty. I’d have been impressed if 90% of aum hung in there, but it surely was over 100% as they noticed inflows…saved the all-important YTD internet quantity at +$15B.’

Balchunas added that BTC ETFs’, which he equated to boomers’ holdings, had been “hanging robust” throughout drawdowns.

Farside Traders data supported Balchunas’s assertion, as YTD flows reclaimed the $15 billion mark after dropping to $14.3 billion in late June.

Supply: Bitcoin ETF

However Soso Worth data revealed that BTC ETFs’ AUM declined by almost $10B. Amidst current drawdowns, it dropped from $62.5 billion to under $50 billion.

Group reactions on BTC ETFs

Nevertheless, AUM has since recovered as flows improved initially of the week. The merchandise have seen optimistic internet flows since final Friday.

On Monday and Tuesday, BTC ETFs noticed $294.9 million and $216.3 million in inflows, respectively.

However, different market observers considered the improved ETF flows as irrelevant to BTC worth motion on the chart.

In truth, one consumer claimed the inflows had been hedge funds to quick BTC on the futures market by money and carry commerce.

One other market analyst, Jim Bianco, countered Balchunas’ boomer narrative in BTC ETFs.

Bianco underscored that boomers held a “tiny proportion,” with nearly all of BTC ETF holders coming from ‘self-directed buyers.’

How’s Bitcoin worth motion?

Supply: BTC/USD, TradingView

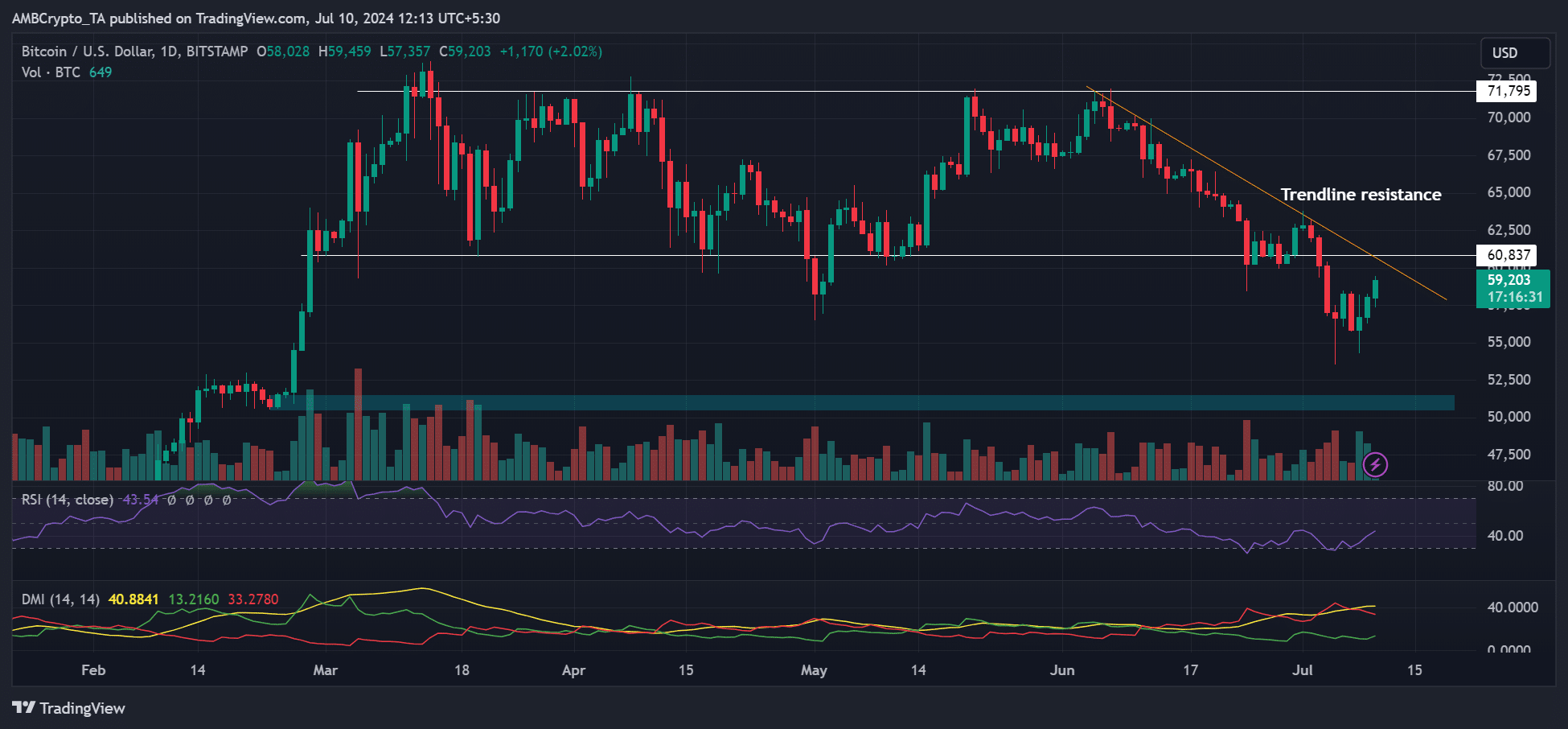

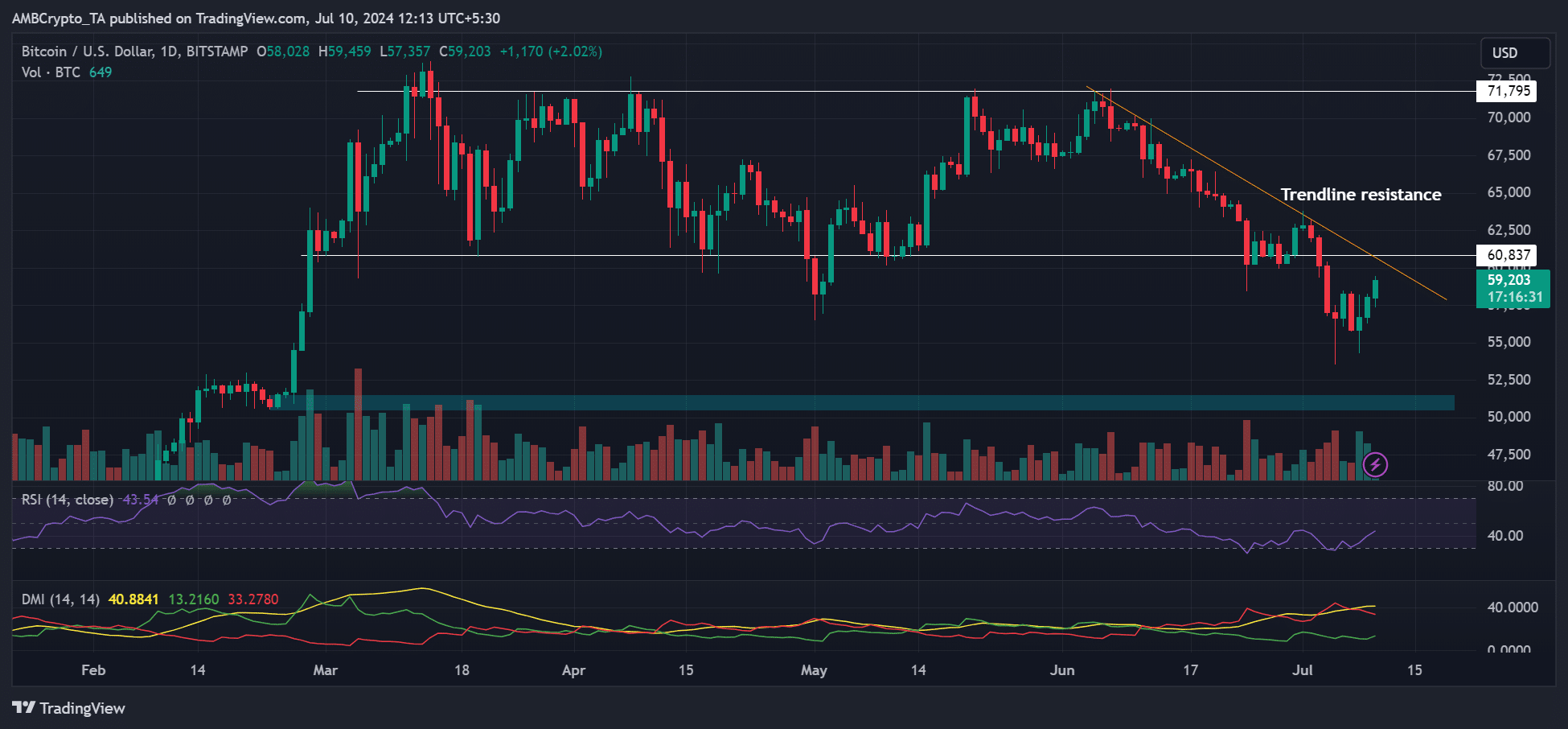

As of press time, BTC was up 5.8% on a weekly foundation and barely above $59K. Nevertheless, to point out additional power, the restoration should clear the trendline resistance and reclaim the range-low of $60.8K.

The RSI (Relative Power Index) and the Directional Motion Index (DMI) confirmed exceptional optimistic strengthening.

Nevertheless, RSI was under common, and DMI was removed from a optimistic crossover, indicating that bulls nonetheless didn’t have absolute market leverage.

Apparently, Glassnode founders, Negentropic, claimed that BTC’s RSI has bottomed on the day by day chart, tipping them to take a bullish stance on BTC.