- Bitcoin dominance weakens as altcoin efficiency rises.

- A possible worth correction could also be tempered if this pattern holds.

Bitcoin [BTC] bears have thwarted one other breakout try, sustaining strain as bulls maintain above $62K. At $63,390 at press time, a reversal towards $70K might not be imminent.

Whereas some analysts predict a rebound, others counsel BTC dominance is likely to be topping out, hinting at a possible dip. Might this set the stage for an altcoin season?

Bitcoin dominance is likely to be in danger

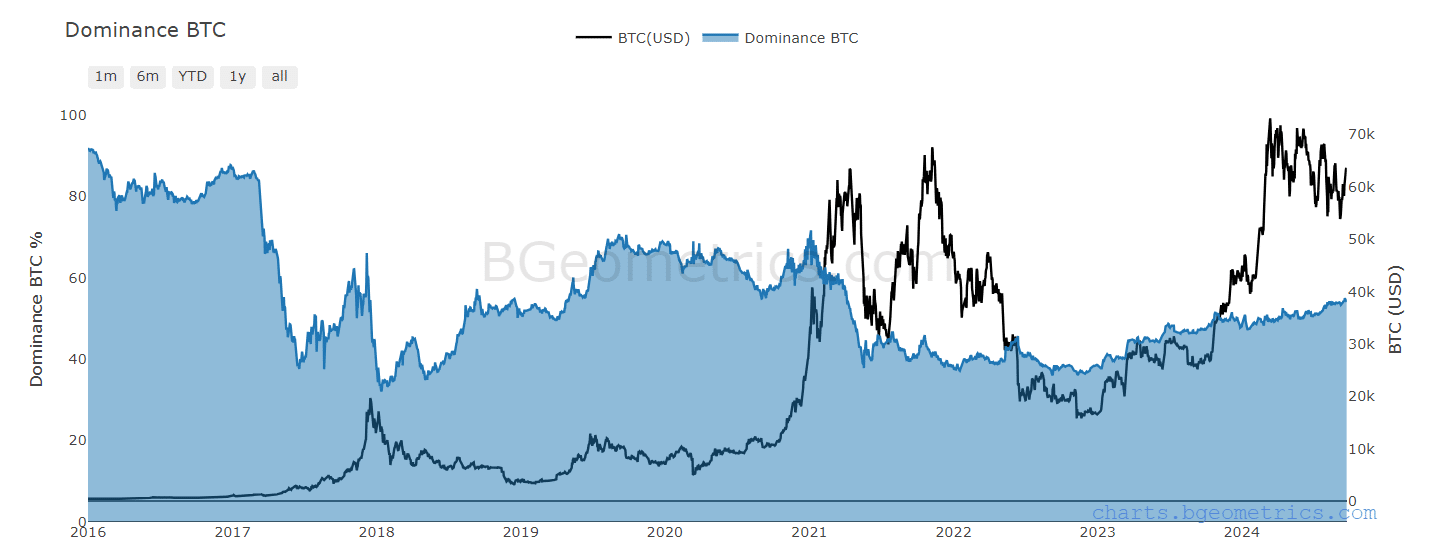

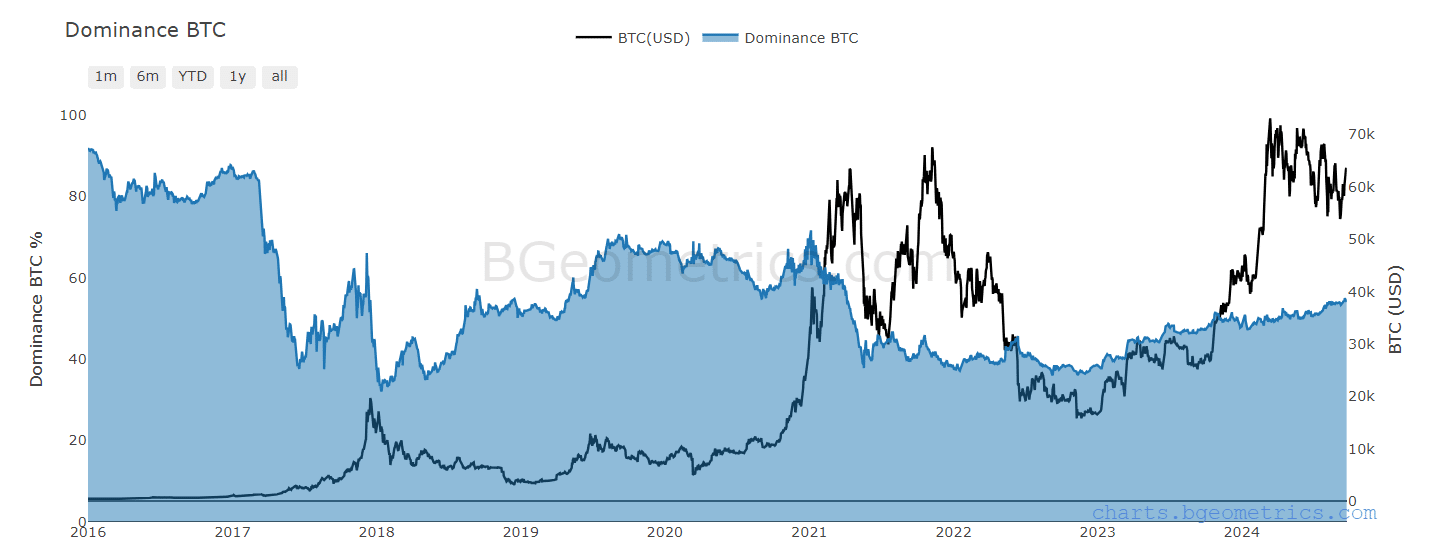

Traditionally, Bitcoin dominance has performed an important position in forecasting market tops, reflecting Bitcoin’s large share within the crypto market.

Usually, when BTC approaches a key resistance stage, a corresponding peak in its dominance is usually noticed.

Nevertheless, the chart beneath revealed a divergence throughout BTC’s ATH of $73K in March. Regardless of the worth surge, BTC dominance stayed flat, suggesting a decoupling between worth motion and market dominance.

Supply : BGeometrics

Per AMBCrypto, this hinted at rising altcoin curiosity, with buyers viewing them as much less dangerous alternate options to Bitcoin amid its worth surge.

Curiously, Ethereum’s [ETH] latest worth motion supported this speculation, as ETH has outpaced BTC with a double development charge over the previous week, surging greater than 15% to $2,656 at press time.

In abstract, ought to altcoin buyers monitor BTC’s essential resistance stage for a possible surge? This may very well be key to predicting the subsequent market strikes.

Diversification indicators potential market prime

In response to this knowledge, 15 altcoins have outperformed Bitcoin within the final 90 days, with TAO main the group, boasting a formidable 80% achieve over BTC.

Whereas this quantity is half of what’s wanted for an altcoin season, the numerous distinction definitely challenges Bitcoin dominance.

Moreover, TAO has recorded a staggering 18% surge within the final 24 hours, far exceeding BTC’s 2%, which reinforces AMBCrypto’s earlier speculation.

Notably, TAO’s surge coincided with Bitcoin breaching the important thing $63K vary.

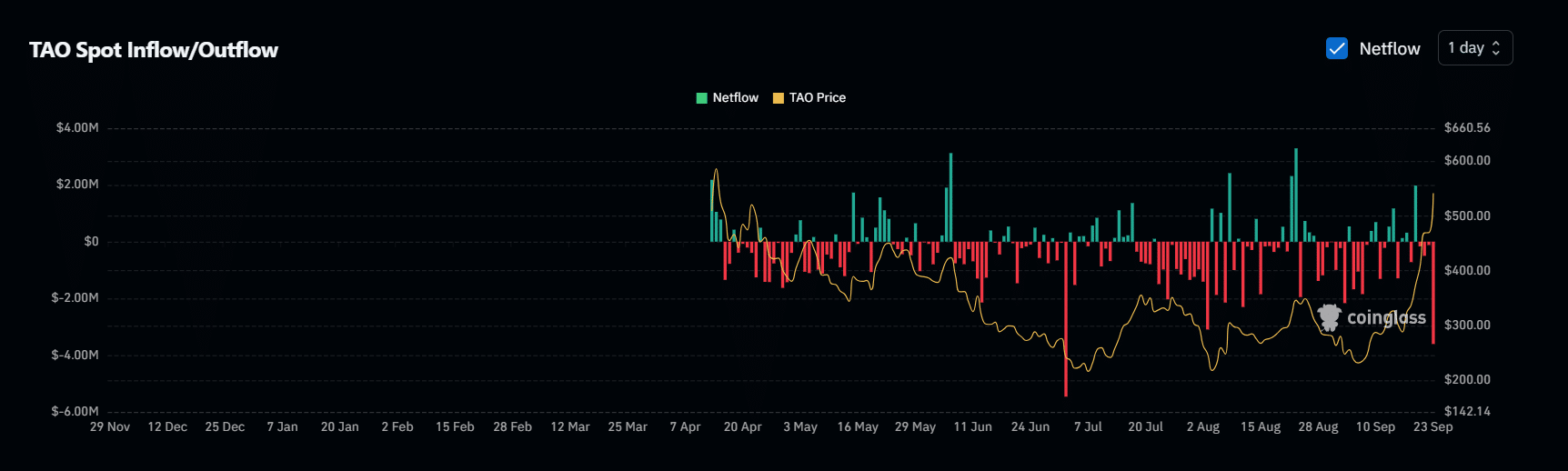

At present, a spike in TAO outflows has reached a two-month excessive of $3M, indicating that buyers are transferring into altcoins as BTC costs rise, signaling a direct correlation between the 2.

Supply : Coinglass

Put merely, this correlation signifies a possible market prime, as many buyers are shedding religion in a pattern reversal and shifting their capital towards much less dangerous alternate options.

If this pattern holds, a worth correction to $68K – the subsequent resistance – may very well be tempered, particularly as Bitcoin dominance weakens with extra altcoins coming into the highest 50, setting the stage for a possible altcoin season – What are the percentages?

The market is at an important juncture

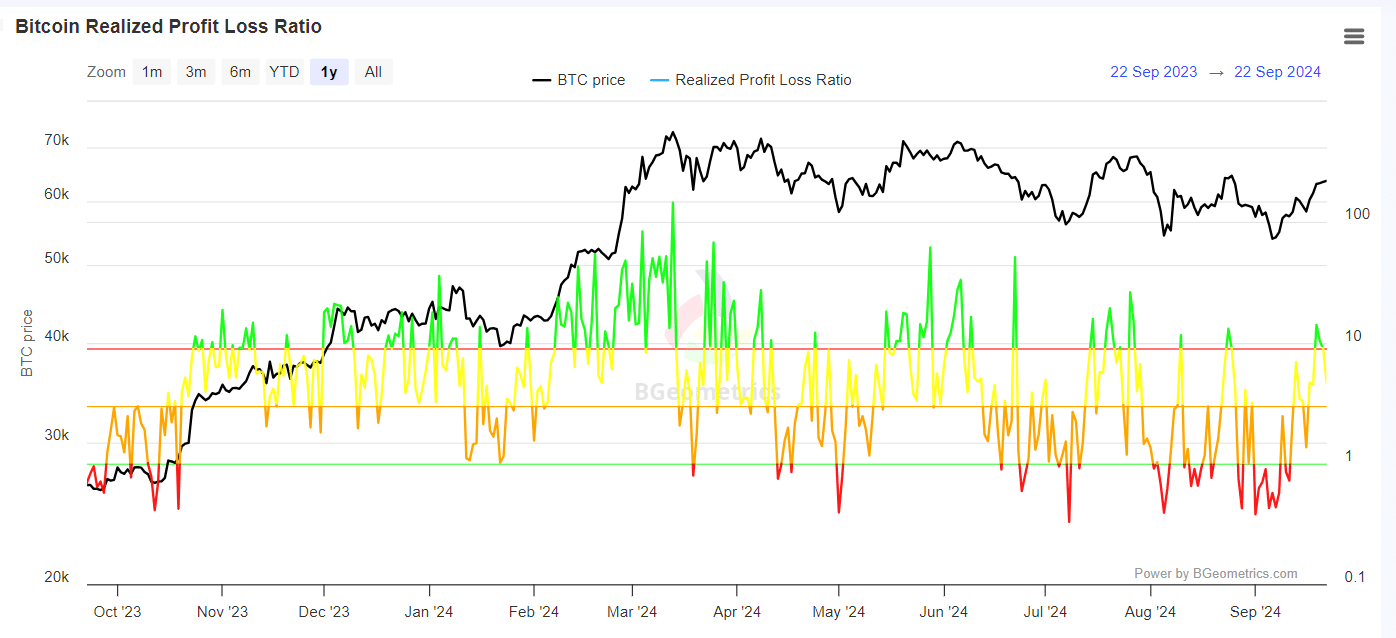

Curiously, on the day Bitcoin retested the $63K vary, a good portion of buyers have been in revenue, as highlighted by the inexperienced wig nearing 14.

Nevertheless, as bulls did not set off a breakout and bear dominance reasserted itself, a good portion of stakeholders started realizing losses.

Supply : BGeometrics

If these buyers lose confidence in a worth correction, it may result in panic promoting, additional weakening Bitcoin dominance.

Moreover, this will set off a shift in asset allocation towards altcoins, which buyers would possibly view as a safer possibility.

In abstract, the market is at an important juncture. If Bitcoin dominance holds and bulls assist a breakout, the altcoin season may falter except BTC reaches its subsequent resistance at $68K.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nevertheless, if bulls fail to take care of the $64K vary and a retracement beneath $60K happens – which appears probably – many altcoins would possibly see a brief surge.

But, for a sustained altcoin season, belief in future good points is important, which is instantly or not directly tied to Bitcoin dominance. Thus, monitoring it’s important.