- Bitcoin’s dominance was set to surpass 60% on the time of writing.

- Bitcoin pockets actions noticed a resurgence regardless of destructive Funding Charges.

Bitcoin’s [BTC] dominance has steadily been rising, with 60% at attain throughout press time.

The dying cross, the place the short-term common falls beneath the long-term common, has crossed over on the each day chart, however stays on the weekly chart.

In 2023, Bitcoin started to rise proper after this occasion, shifting above its 50-day shifting common and sustaining it as assist.

Nonetheless, in 2022, Bitcoin had a small rally earlier than the dying cross, however it pale afterward, just like 2021.

Supply: TradingView

In 2020, Bitcoin additionally rose into the dying cross, had a short pullback, and continued upward, just like 2023.

The energy of the present transfer relies on Bitcoin staying above $60K and holding that degree as assist. If it fails, a sluggish decline may observe till the Fed makes a transfer.

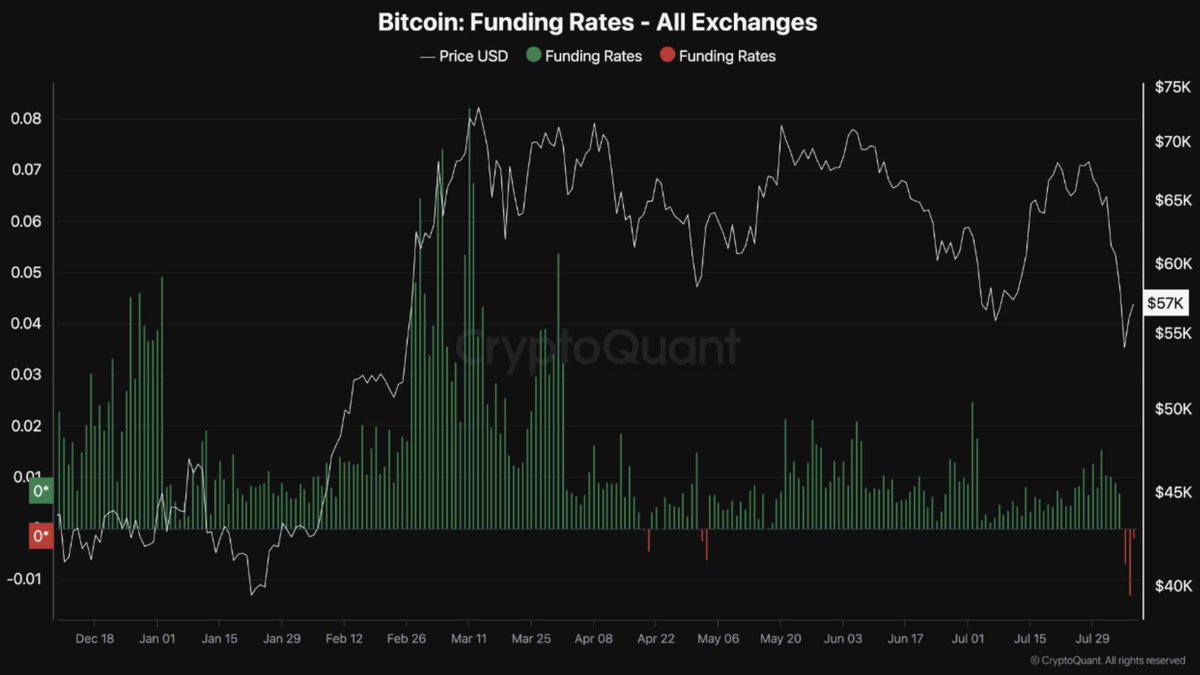

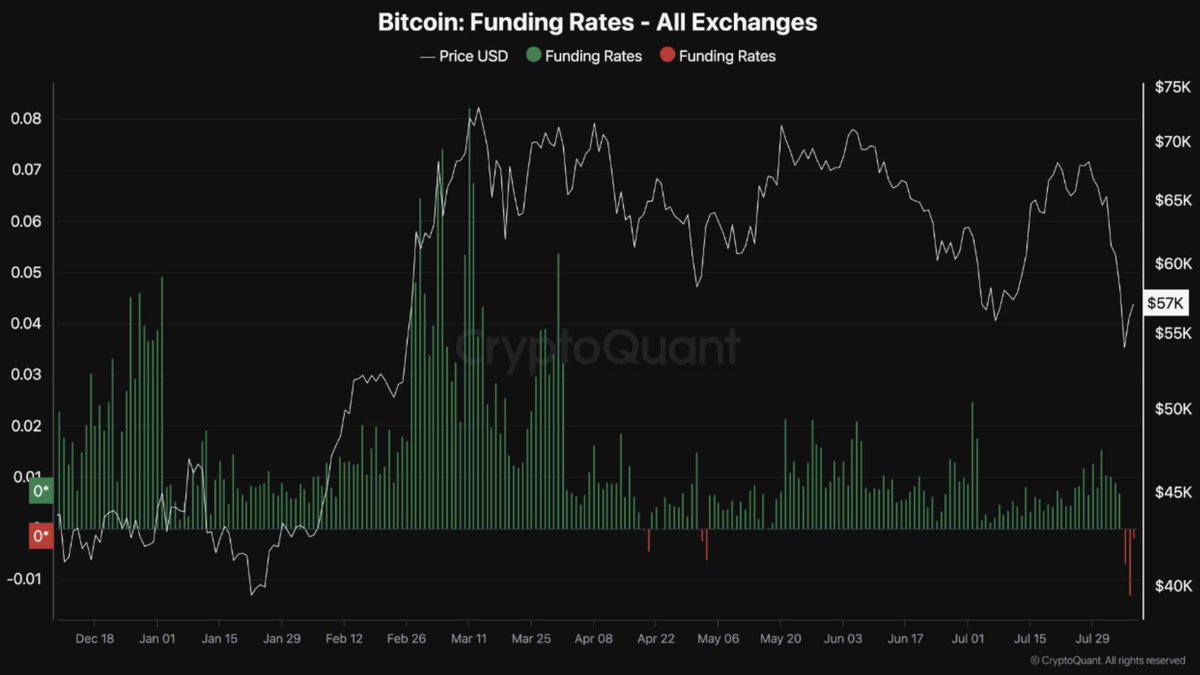

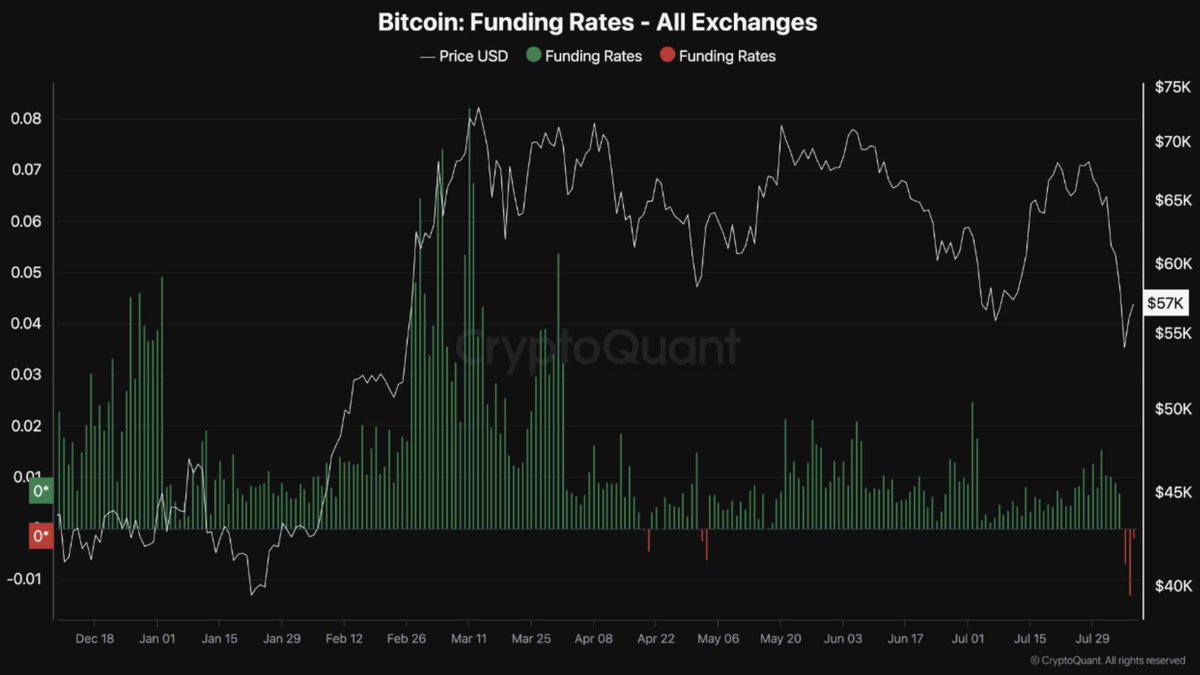

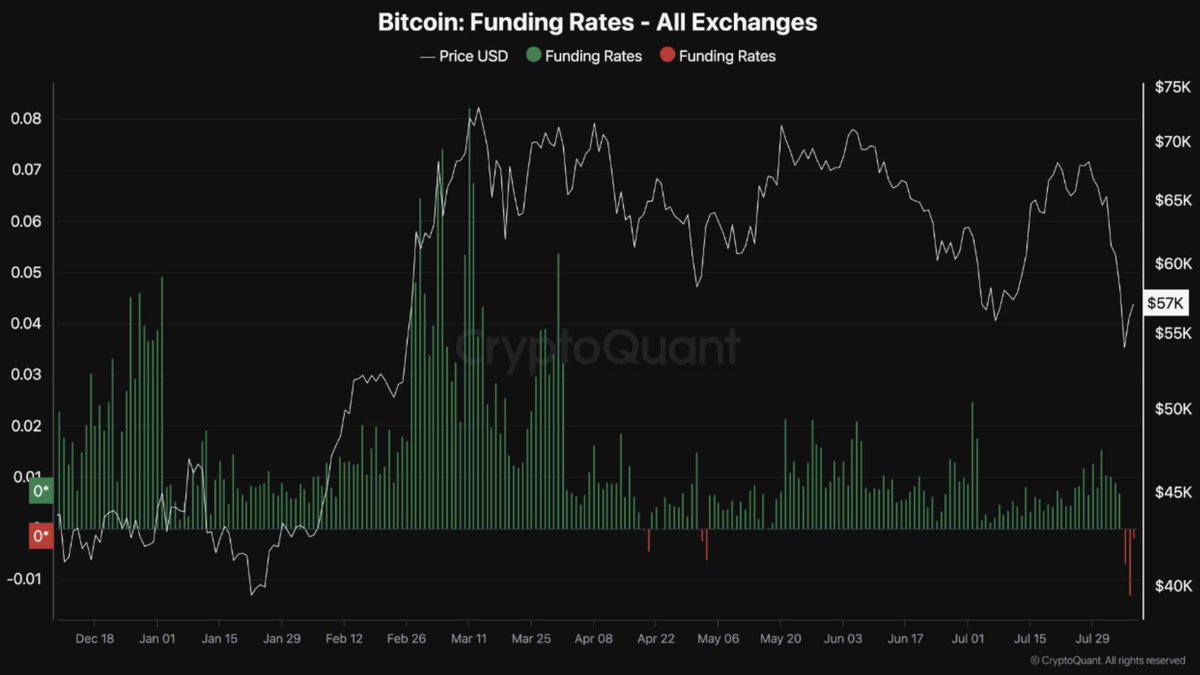

What does the destructive BTC Funding Fee imply?

Bitcoin has just lately skilled its first main, 33% decline on this bull market. The Funding Fee for BTC has gone destructive once more, signaling a possible shopping for alternative for long-term traders.

Main patrons comparable to Blackrock and MicroStrategy are rising their Bitcoin holdings.

Because the enterprise cycle reaches a low level with the ISM index beneath 50, Bitcoin’s dominance available in the market is anticipated to rise.

Supply: CryptoQuant

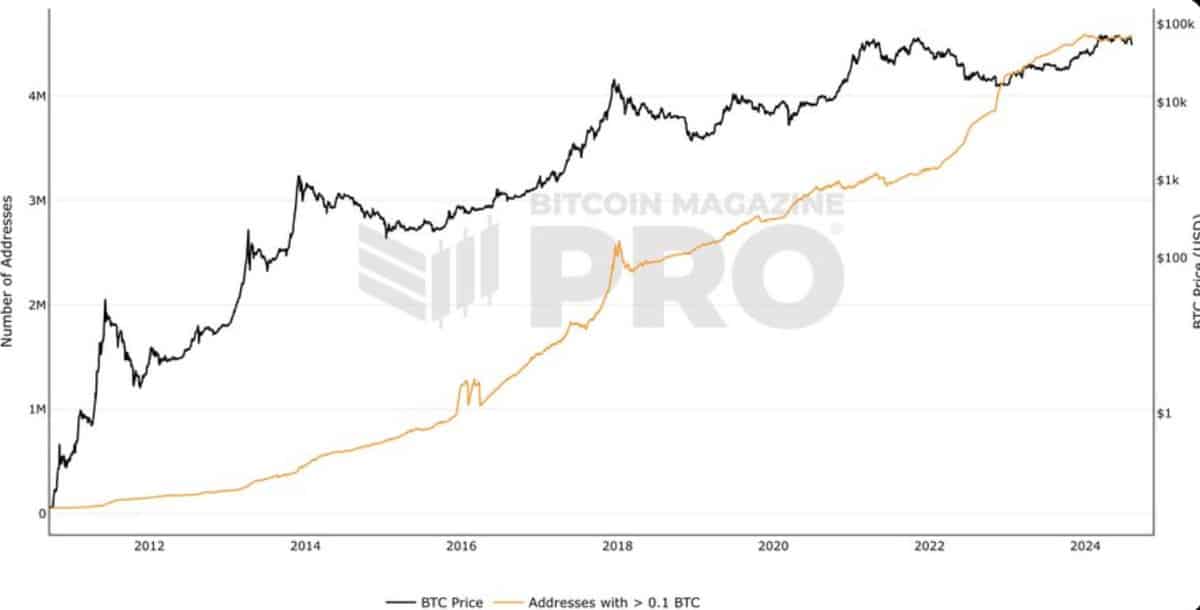

Bitcoin addresses holding greater than 0.1 BTC hits ATH

The variety of Bitcoin addresses holding greater than 0.1 BTC is rising steadily, signaling dominance is rising in addition to whales’ shopping for actions.

Over the previous month, they’ve accrued $23 billion value of Bitcoin. Lengthy-term holders, those that plan to maintain their BTC for the foreseeable future additionally moved 404,448 BTC, valued at $22.8 billion, to their addresses.

This important accumulation signifies a powerful perception in Bitcoin’s future potential.

Supply: Bitcoin Journal PRO

Is your portfolio inexperienced? Try the BTC Revenue Calculator

ETH/BTC rotates again up

Ethereum initially rebounded strongly after this week’s market crash, however shortly misplaced these positive aspects as Soar Buying and selling continued to promote.

The declining ETH/BTC chart signifies that Bitcoin’s dominance will probably proceed to develop, particularly contemplating Ethereum is the biggest cryptocurrency after Bitcoin.

Supply: TradingView