- Bitcoin dominance and a technical indicator advised it could be time for swing merchants to take a look at altcoins.

- Relative power towards BTC is a crucial issue alongside long-term assist zones to gauge underperforming altcoins.

Bitcoin [BTC] was buying and selling inside a variety inside a variety. With a short-term bearish bias, Bitcoin and the remainder of the crypto market weren’t enticing to long-term buyers.

The market might take just a few weeks to consolidate, particularly contemplating the large positive aspects within the months resulting in the halving. This would possibly current a shopping for alternative for altcoins that confirmed power.

Inspecting the current BTC reset

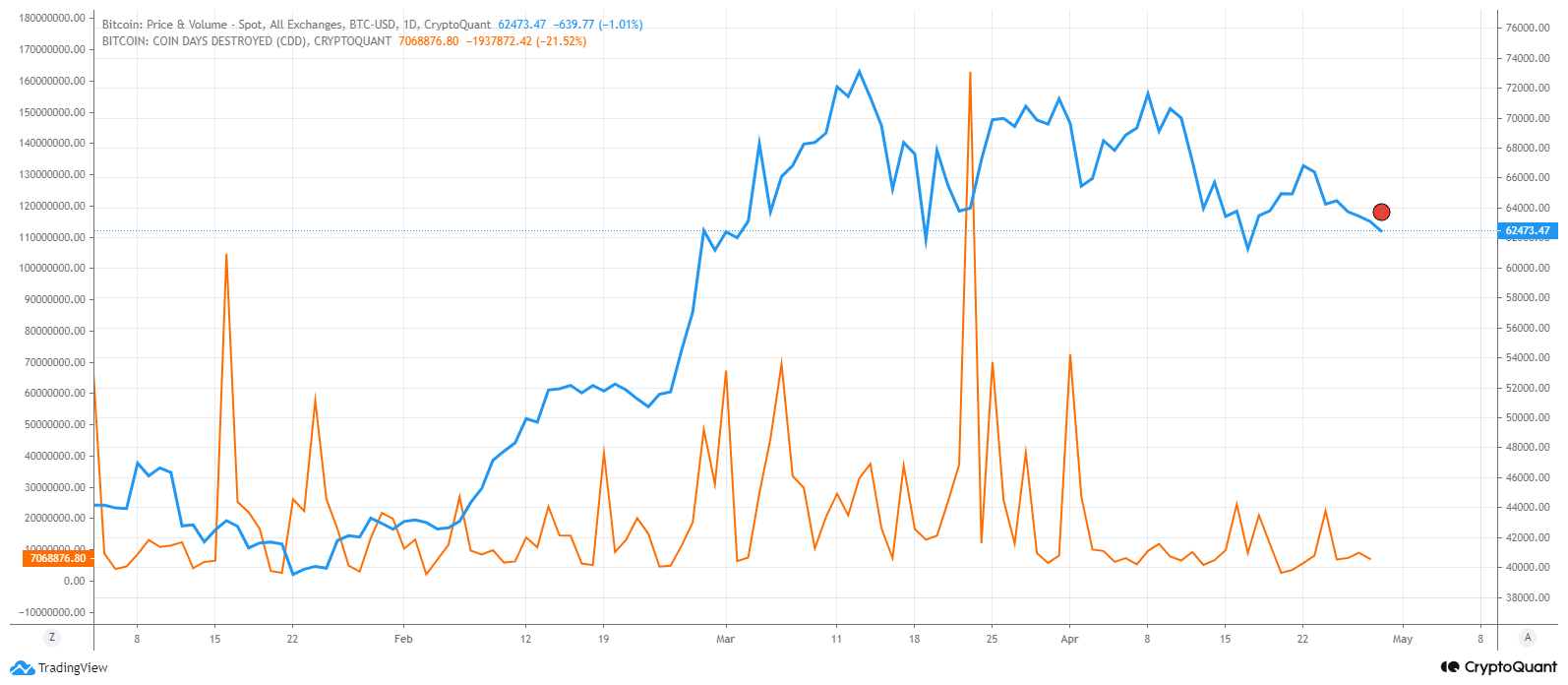

Coin days destroyed (CDD) is a metric that measures the age of the cash moved throughout a transaction. It’s calculated by multiplying the variety of cash in a transaction by the variety of days the coin has not moved.

Therefore, a big spike in CDD implies that long-dormant Bitcoin was moved. Lengthy-term holders would possibly select to ebook income throughout a rally (prefer it did on the twenty third of March), or after a very deep pullback (the first of April).

Whereas it’s not a crystal ball, it’s a helpful metric to gauge the HODLer sentiment.

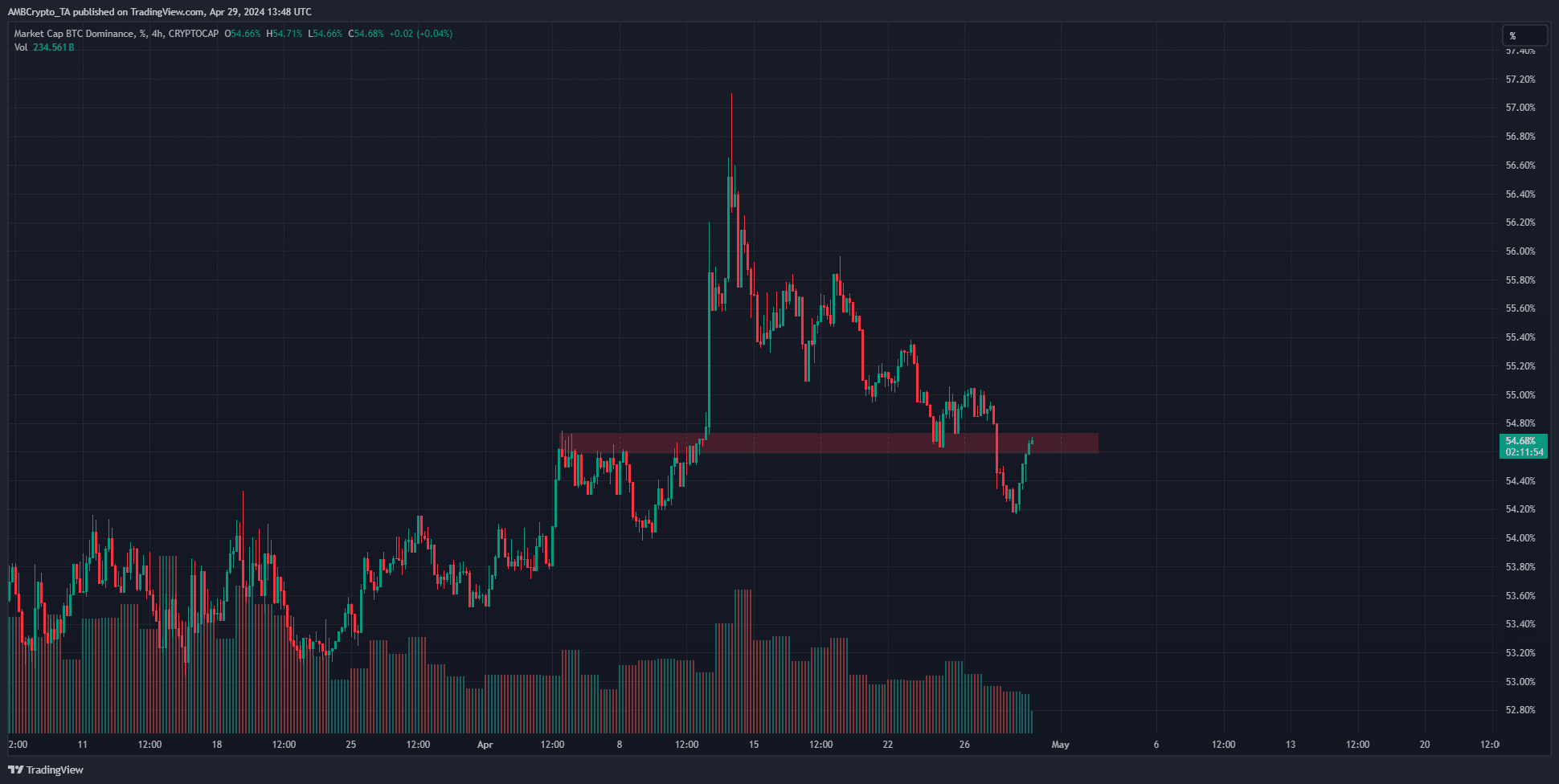

Supply: BTC.D on TradingView

The Bitcoin Dominance chart measures the market capitalization of BTC as a share of the full crypto market capitalization. It stood at 54.68% at press time and has fallen beneath a former assist degree.

This zone, highlighted in pink, is anticipated to function resistance. Subsequently, if the BTC’s dominance resumed its downtrend, it might give altcoins an opportunity to make positive aspects.

Which altcoin might you give attention to?

In a recent post on X, crypto analyst Ali Martinez famous that the TD Sequential Indicator flashed a purchase sign for Chainlink [LINK] on the 12-hour chart. But, LINK has misplaced near 33% because the twenty sixth of March.

In the identical interval, Bitcoin has misplaced 12.2%. An indication of power in an altcoin is when it holds up fairly nicely towards BTC losses. LINK didn’t exhibit power towards Bitcoin previously month.

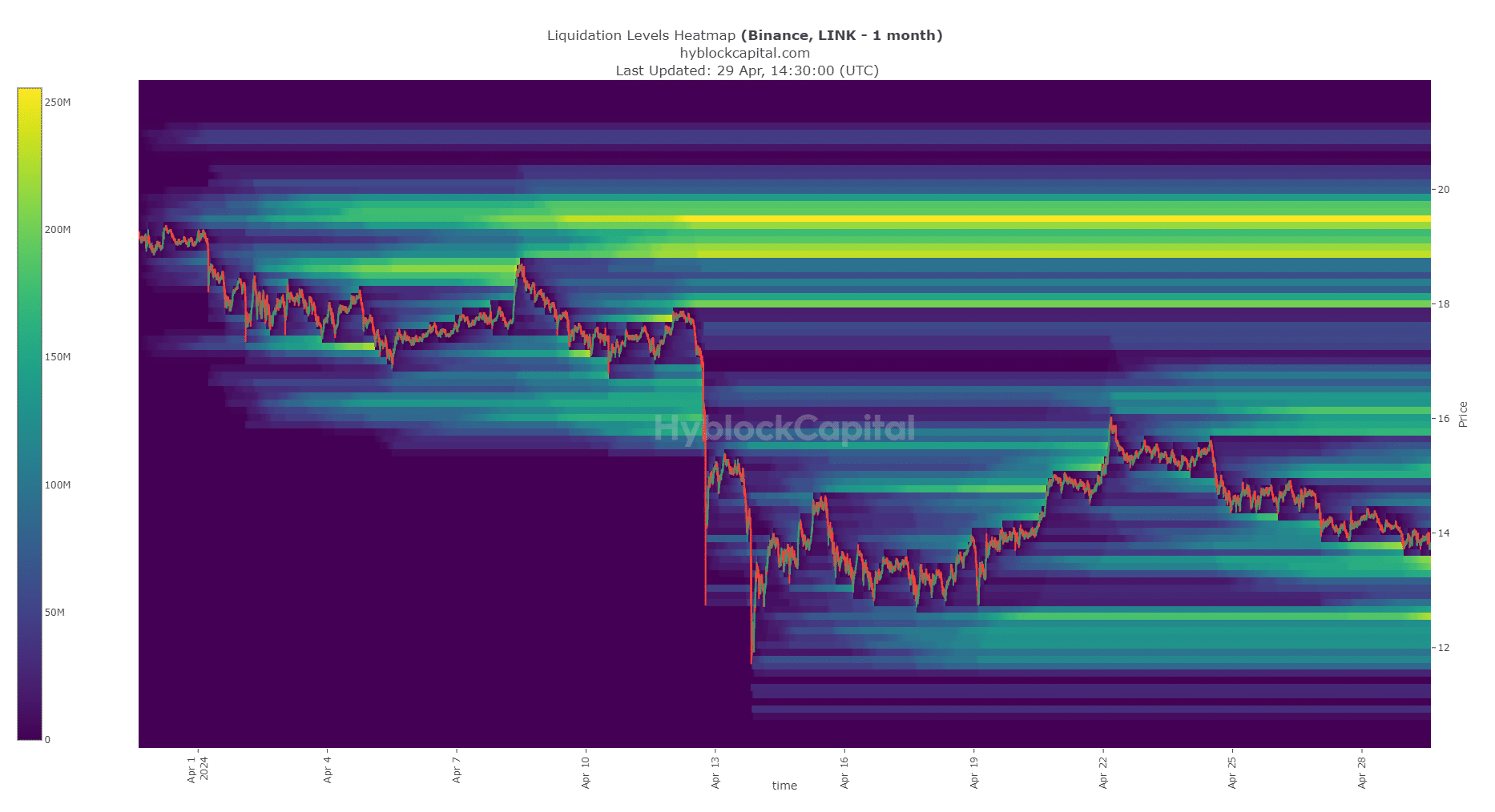

The liquidation heatmap confirmed that $16, $18 and $19.5 had been the areas with the very best focus of liquidation ranges to the north. This marked them as bullish targets. Nonetheless, the downtrend was nonetheless in play.

Is your portfolio inexperienced? Verify the Chainlink Revenue Calculator

The liquidity at $13.5 and $12.5 was a lot nearer and extra seemingly for LINK costs to succeed in within the coming weeks.

Subsequently, regardless that BTC Dominance and the TD sequential gave swing merchants a purpose to go lengthy, the potential for a drop to those assist ranges should be stored in thoughts earlier than getting into commerce positions.