- Bitcoin’s try at restoration within the final 24 hours noticed a minor setback with the present decline.

- Lots of BTC has now piled up with no patrons in sight.

Just lately, Bitcoin’s [BTC] value has skilled a downturn, although there was an effort within the final buying and selling session to slim the hole.

Alongside the value slip over the previous few days, the king coin’s market dominance has additionally diminished. Moreover, as the value decreased, the Over the Counter (OTC) balances continued to rise.

BTC Dominance drops

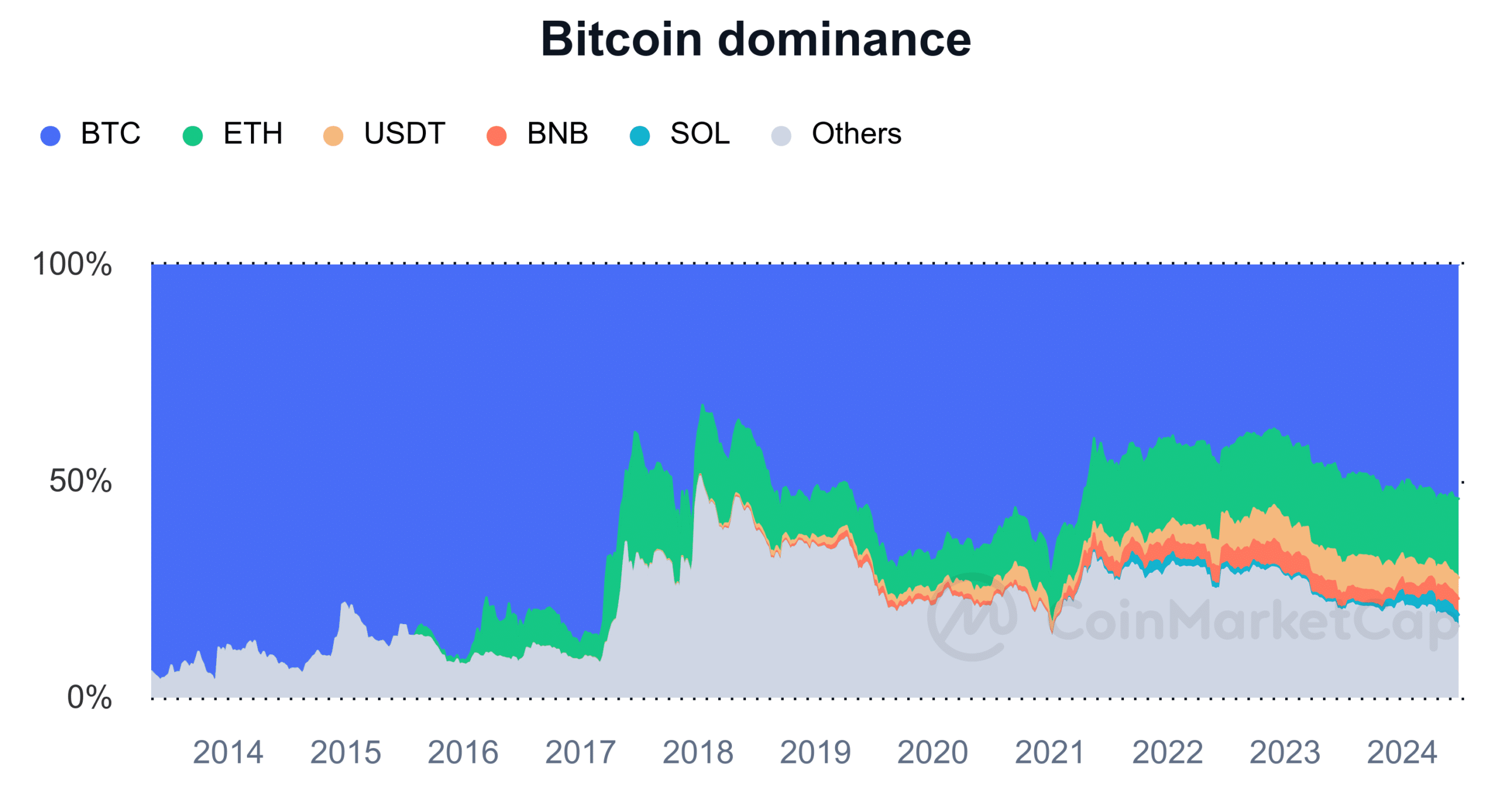

Just lately, Bitcoin’s dominance within the cryptocurrency market has seen a notable lower because it struggled to take care of its worth.

AMBCrypto’s evaluation showed that on the finish of the buying and selling session on the twenty fourth of June, BTC dominance was above 54%.

Nonetheless, by the top of the following day, the twenty fifth of June, it had fallen to round 52.28%.

This fast decline inside 24 hours urged that whereas Bitcoin was dropping worth, some altcoins have been performing comparatively higher and gaining market share.

Supply: CoinMarketCap

As of this writing, BTC dominance has skilled a slight lower, however nonetheless hovered across the 53% mark.

This stage of dominance indicated that Bitcoin nonetheless accounted for over half of the full cryptocurrency market capitalization.

Bitcoin dominance vs. different property

Bitcoin’s market cap stood at over $1.2 trillion at press time, with the full crypto market cap at roughly $2.27 trillion.

Ethereum [ETH] has the second-largest market dominance, making up nearly 18% of the full market cap.

The evaluation confirmed that adjustments in BTC’s value and efficiency can considerably affect the distribution of market capitalization amongst varied cryptocurrencies.

Extra Bitcoin hits reserves

Based on latest knowledge from CryptoQuant, there was a noticeable improve within the quantity of Bitcoin held in Over the Counter (OTC) reserves.

During the last six weeks, greater than 103,000 BTC, valued at over $6 billion primarily based on present costs, have been added to those reserves. This accumulation indicated a major rise within the OTC reserve stability.

The continual improve in OTC reserves urged an absence of patrons for the time being, which could possibly be attributed to the latest decline in Bitcoin’s value.

This fall in value could also be deterring potential patrons, resulting in the buildup of the reserves.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The dynamics between the falling value and the growing OTC reserves spotlight the cautious stance of bigger market individuals in periods of value volatility.

As of this writing, Bitcoin was buying and selling at roughly $61,680 on a every day timeframe chart. It was buying and selling with a minor decline of lower than 1%.