- Bitcoin’s worth whipsawed after stronger-than-expected Could U.S jobs report

- Market watchers can now shift focus to subsequent Wednesday’s Fed assembly

Bitcoin [BTC] dropped under $71k on Friday, within the early hours of New York’s buying and selling session, following a hotter-than-expected Could U.S jobs report. The truth is, inside 24 hours of the identical, the cryptocurrency additionally dropped under $70k on the charts.

Could’s U.S jobs report revealed that 272k jobs have been added in Could, properly above the anticipated 190k. Nonetheless, unemployment charges hit 4% in opposition to the anticipated 3.9%.

Though this was nice information to staff, it sophisticated the prospect of the Fed chopping rates of interest in June’s assembly. The roles report is among the datasets the Fed makes use of to make choices on its financial coverage.

A weaker one may improve the percentages of price cuts, however a stronger one, like Could’s report, may tip the Fed to be hawkish.

Commenting on BTC’s wild response to Friday’s report, Scott Melker of ‘The Wolf of All Streets’ stated,

“Bitcoin drops $1000 in a matter of minutes as a result of too many individuals have jobs. LOL. We stay within the the wrong way up. Sturdy jobs imply much less probability of cuts, which implies belongings go down as a knee-jerk response.”

What’s subsequent for Bitcoin?

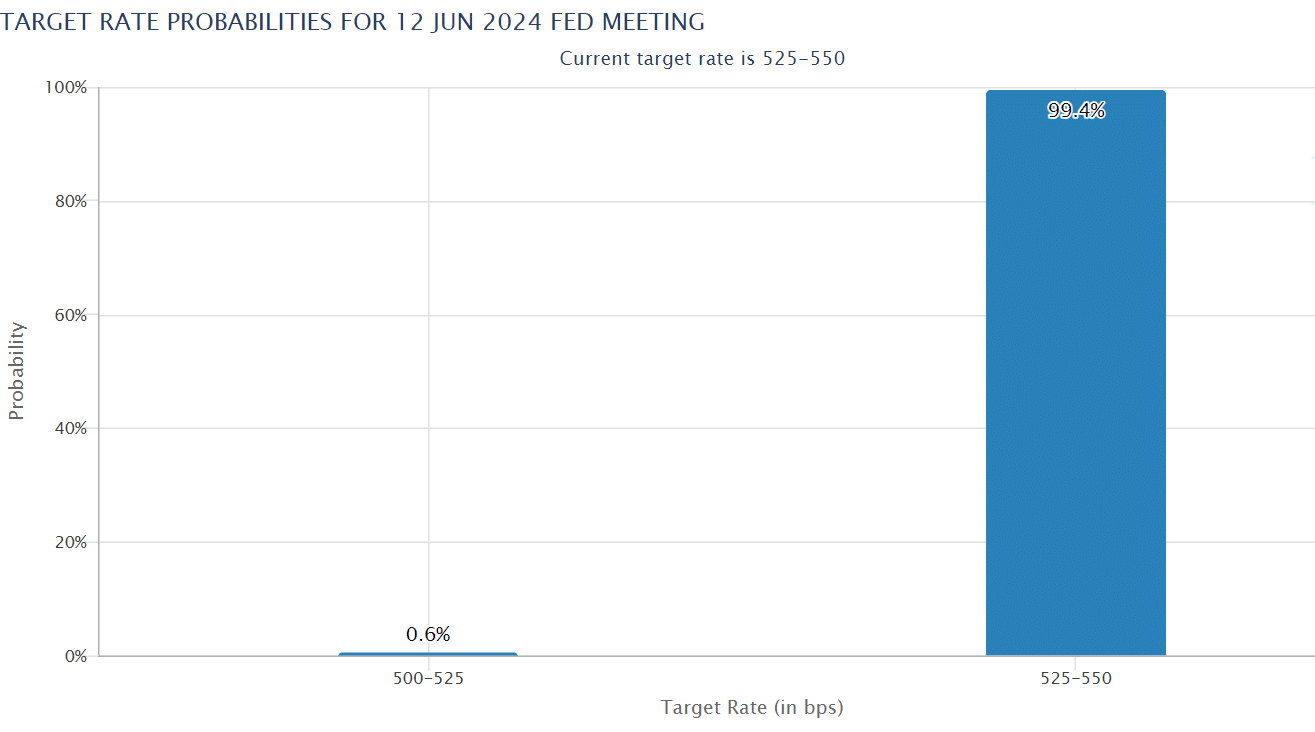

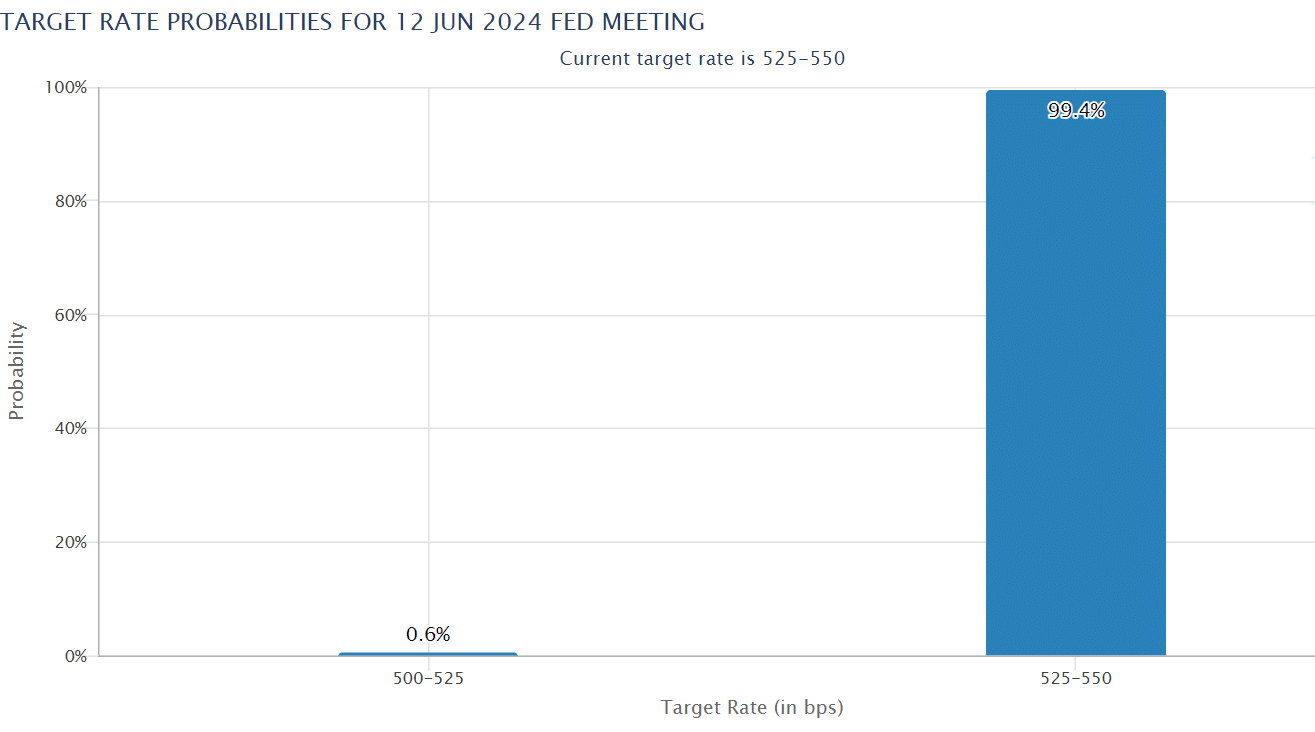

All eyes will now shift to the Fed’s announcement subsequent Wednesday (June 12). Nonetheless, in keeping with the CME Fed watch software, 99% of rate of interest merchants count on these charges to stay unchanged.

Supply: CME Group

As such, market watchers will probably be eager on Fed chair Jerome Powell’s press convention subsequent Wednesday to study whether or not the company adopts a dovish or hawkish place.

Many trade analysts anticipated the U.S Jobs report back to be a key stepping stone in shaping BTC’s subsequent worth path. In response to Quinn Thompson of crypto hedge fund Lekker Capital,

“The market wants conviction that Powell goes to chop in July. That might come from a weak jobs report Friday, weak CPI, and/or dovish Fed subsequent Wednesday.”

Bullish expectations have been raised after the European Central Financial institution (ECB) and Financial institution of Canada (BOC) lower their rates of interest, which may provoke international quantitative easing.

The most recent U.S job report complicates that. Nonetheless, in keeping with Charles Edwards, founding father of crypto hedge fund Capriole Investments, price cuts have been inevitable in the long term.

“Time will inform. But it surely for positive appears to be like like unemployment has bottomed now, which suggests US liquidity might want to rise and rise quickly. Fee cuts incoming.”

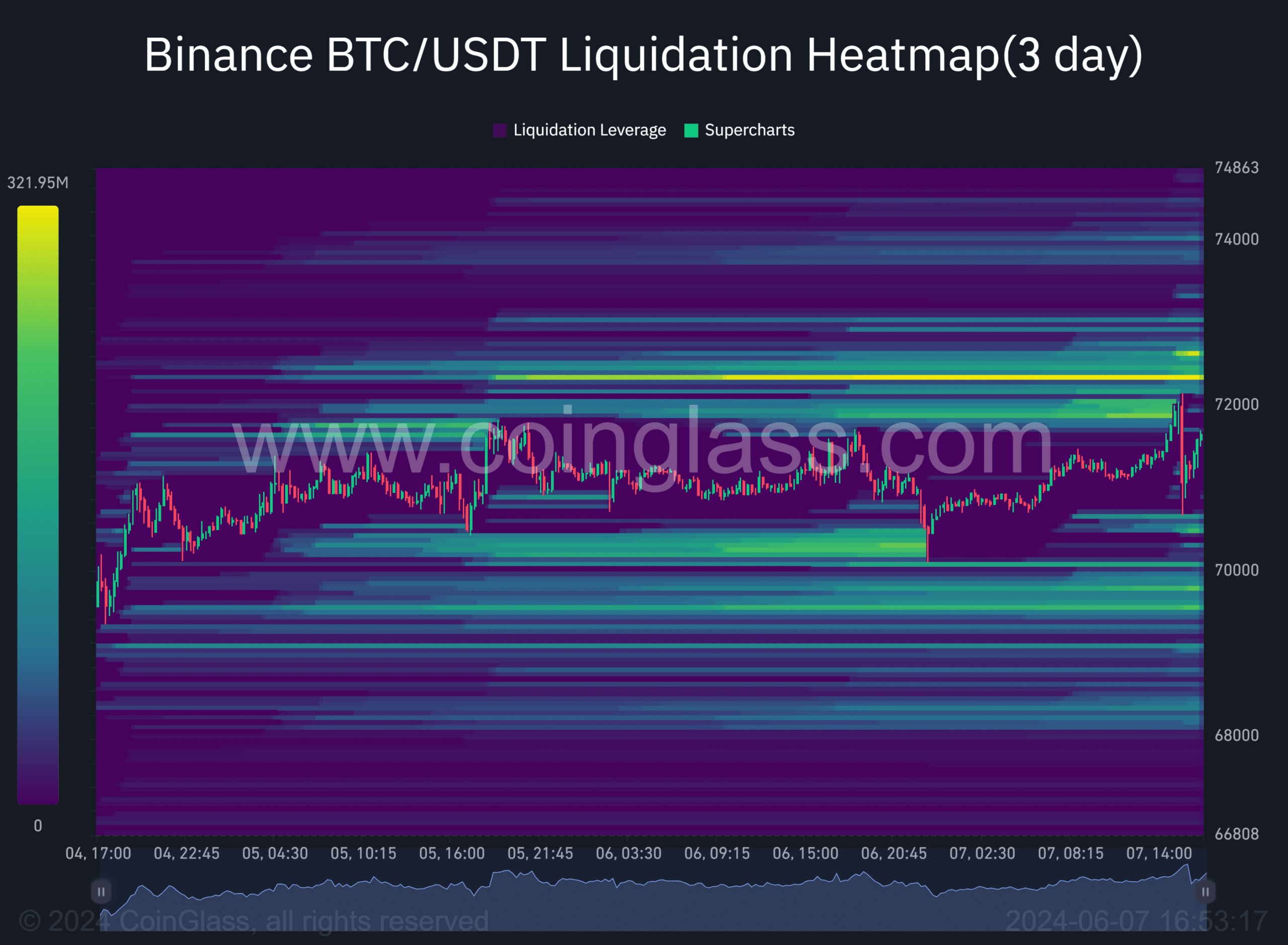

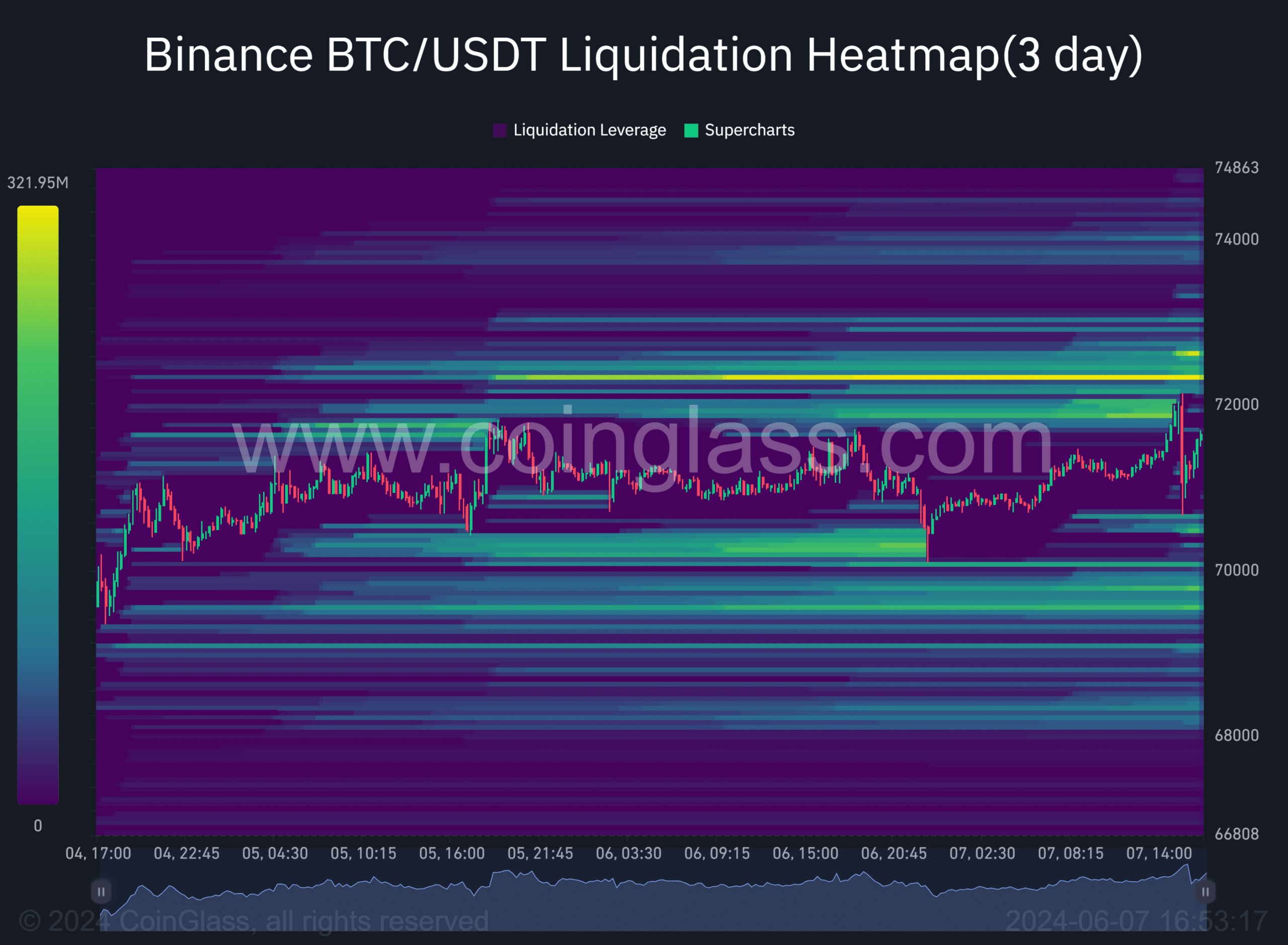

Supply: Coinglass

Within the meantime, there may be nonetheless appreciable liquidity above $72k, marked orange, which may act as a magnet for worth motion. Nonetheless, Bitcoin’s sideways motion may prolong till the Fed assembly subsequent week.