Posted:

- MicroStrategy lately invested $147.3 million into Bitcoin, growing its holdings to $4.7 billion.

- Nonetheless, Bitcoin wanted to cross $30k to make sure earnings.

Not too long ago, MicroStrategy was within the highlight for its unwavering dedication to accumulating Bitcoin. Notably, the American agency made headlines for investing an extra $147.3 million to increase its Bitcoin [BTC] holdings.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

This newest buy added a considerable 5,445 BTC to MicroStrategy’s present cryptocurrency reserves.

Nonetheless an extended method to go

MicroStrategy’s complete funding in Bitcoin stood at a formidable $4.7 billion on the time of writing, a transparent sign of the corporate’s continued bullish stance on cryptocurrency.

Nonetheless, regardless of its conviction, the corporate confronted challenges. Only a month in the past, they have been having fun with a slight revenue, however their valuation sat at $4.15 billion at press time. This represented an unrealized lack of over $550 million.

On the time of publication, MicroStrategy’s Bitcoin holdings amounted to 158,245 BTC, with a mean buy value of $29,582 per coin. For these holdings to show worthwhile, Bitcoin’s value should surpass the $30,000 vary, a vital threshold that can decide MicroStrategy’s success on this enterprise.

🚨 Key Graphs Revealed: MicroStrategy Pronounces One other Vital BTC Acquisition!

MicroStrategy has as soon as once more demonstrated its dedication to #Bitcoin with an extra buy of 5,445 BTC. This acquisition has elevated the corporate’s complete Bitcoin holdings to an… pic.twitter.com/AuUWADVFx3

— Maartunn (@JA_Maartun) September 25, 2023

Beneath stress

Whereas MicroStrategy appeared dedicated to its long-term Bitcoin accumulation technique, different cryptocurrency holders could not share the identical endurance.

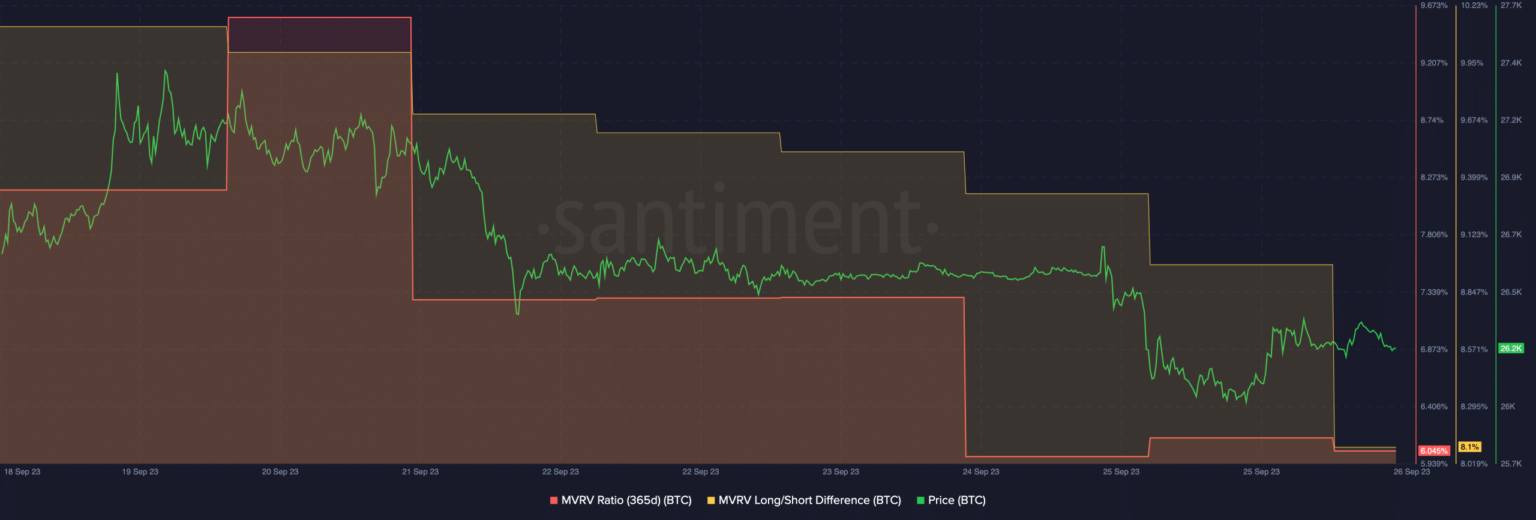

Notably, the MVRV (Market-Worth-to-Realized-Worth) ratio for Bitcoin was on a decline on the time of writing, indicating that each Michael Saylor, the founding father of MicroStrategy, and different BTC holders, have been witnessing reducing profitability.

If Bitcoin’s value have been to rise considerably, bringing the MVRV ratios again to earlier highs, it may incentivize these holders to promote their holdings, probably triggering a value correction for the cryptocurrency.

Supply: Santiment

The important thing query is whether or not different Bitcoin holders will observe MicroStrategy’s lead and preserve a long-term perspective, or if they may select to promote as costs method or exceed the important $30,000 mark.

Retail traders starry-eyed as miner income declines

Past massive institutional traders, retail contributors additionally confirmed vital curiosity in Bitcoin. Glassnode’s information revealed that the variety of addresses holding 0.1 or extra Bitcoins reached an all-time excessive of 4,499,669.

Nonetheless, it’s essential to notice that each massive and small traders could possibly be influenced by the promoting stress exerted by Bitcoin miners. Over the previous few days, miner income has skilled a considerable decline, dropping from $32,000 to $24,000 at press time.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Miners could thus be compelled to promote a portion of their holdings to take care of profitability, probably impacting Bitcoin’s value dynamics.

Supply: Blockchain.com

On the time of writing, Bitcoin was buying and selling at $26,259.39, reflecting a modest 0.51% value enhance within the final 24 hours.