In keeping with this on-chain indicator, an analyst defined how the following potential native high for Bitcoin could possibly be $89,200.

Bitcoin CVDD “Assessing Tops” Metric May Recommend Subsequent Potential Prime

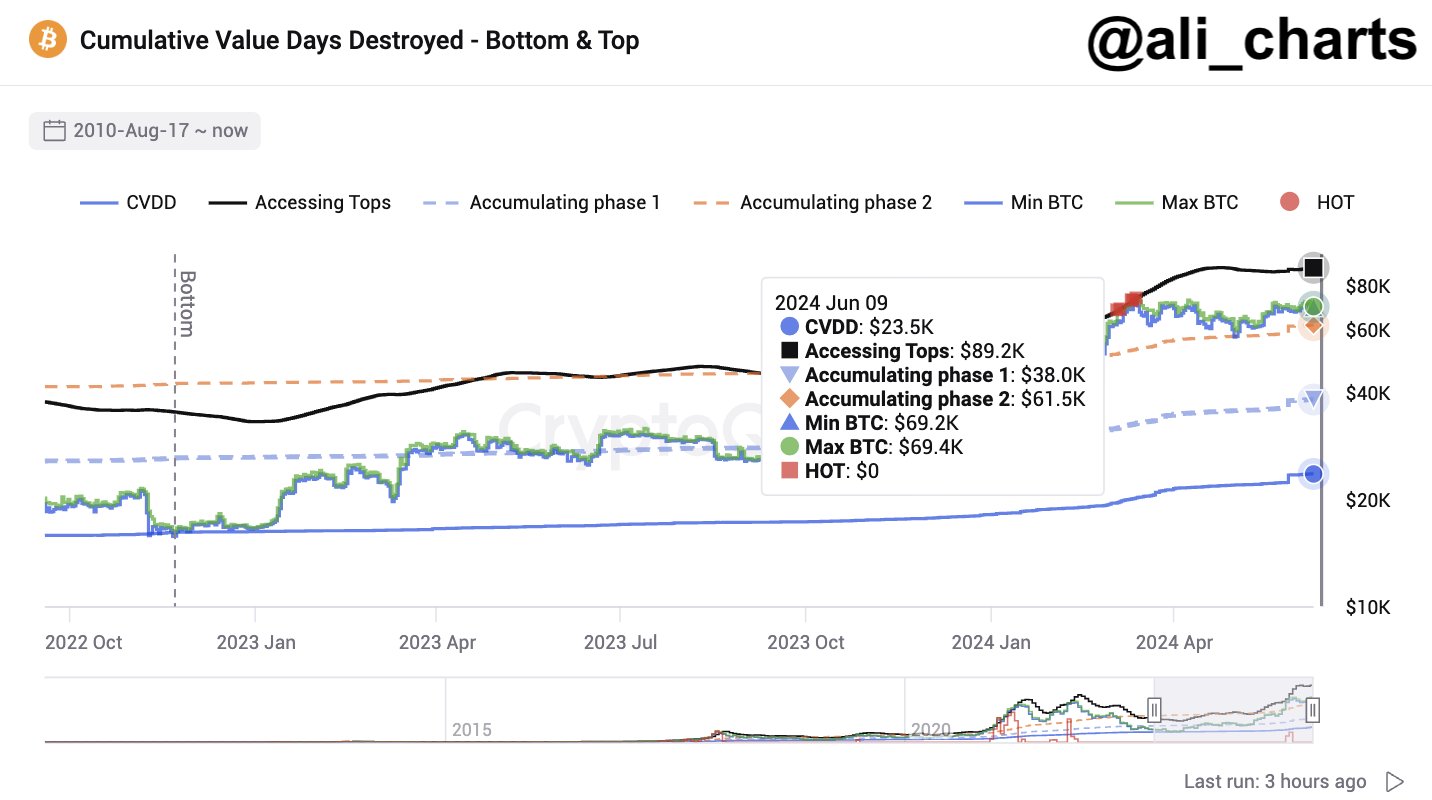

In a brand new post on X, analyst Ali Martinez has talked about the place the following high for BTC could possibly be based mostly on the Cumulative Worth Days Destroyed (CVDD). The CVDD is an on-chain metric derived from the “Coin Days Destroyed” (CDD).

A “coin day” is the amount that 1 BTC accumulates after sitting dormant on the blockchain for 1 day. When a coin that has collected a sure variety of coin days is moved on the community, the coin days it was carrying naturally reset again to zero and are stated to be “destroyed.”

Associated Studying

The CDD measures the variety of coin days being destroyed throughout the market on any given day. Since each transaction additionally carries some USD worth based mostly on the value at its time, the CVDD provides one other layer of context to the CDD by accounting for the USD worth of each coin, breaking dormancy to destroy its coin days.

Not like the CDD, which tracks solely the variety of coin days being destroyed on any given day, the CVDD is a cumulative sum of the asset’s historical past. Extra formally, the CVDD is calculated as a ratio between the cumulative sum of the value-time destruction on the community divided by the age of the cryptocurrency.

Analyst Willy Woo devised the unique CVDD, which has confirmed remarkably correct for finding historic bottoms within the asset’s value. Within the context of the present matter, although, the “Assessing Tops” modification from CryptoQuant creator Binh Dang is of curiosity.

This indicator combines the 50-day transferring common (MA) of the Bitcoin spot value with the CVDD and goals to evaluate possible factors of tops within the asset, as its title suggests.

Now, here’s a chart that exhibits how the worth of the Bitcoin Assessing Tops has regarded like not too long ago:

From the chart, it’s seen that the Bitcoin spot value had briefly breached the Assessing Tops again in March. When the asset exceeds this indicator, its value is usually overheated and susceptible to forming tops. It will seem that this had additionally held up throughout this current break, because the asset had shortly reached a high following it.

Associated Studying

The Bitcoin Assessing Tops indicator presently has a price of $89,200. Whereas a high might not essentially kind if Bitcoin rises to this stage, a peak might certainly at the very least grow to be shut when it does so if this indicator is to go by.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $69,300, down greater than 1% over the previous week.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com