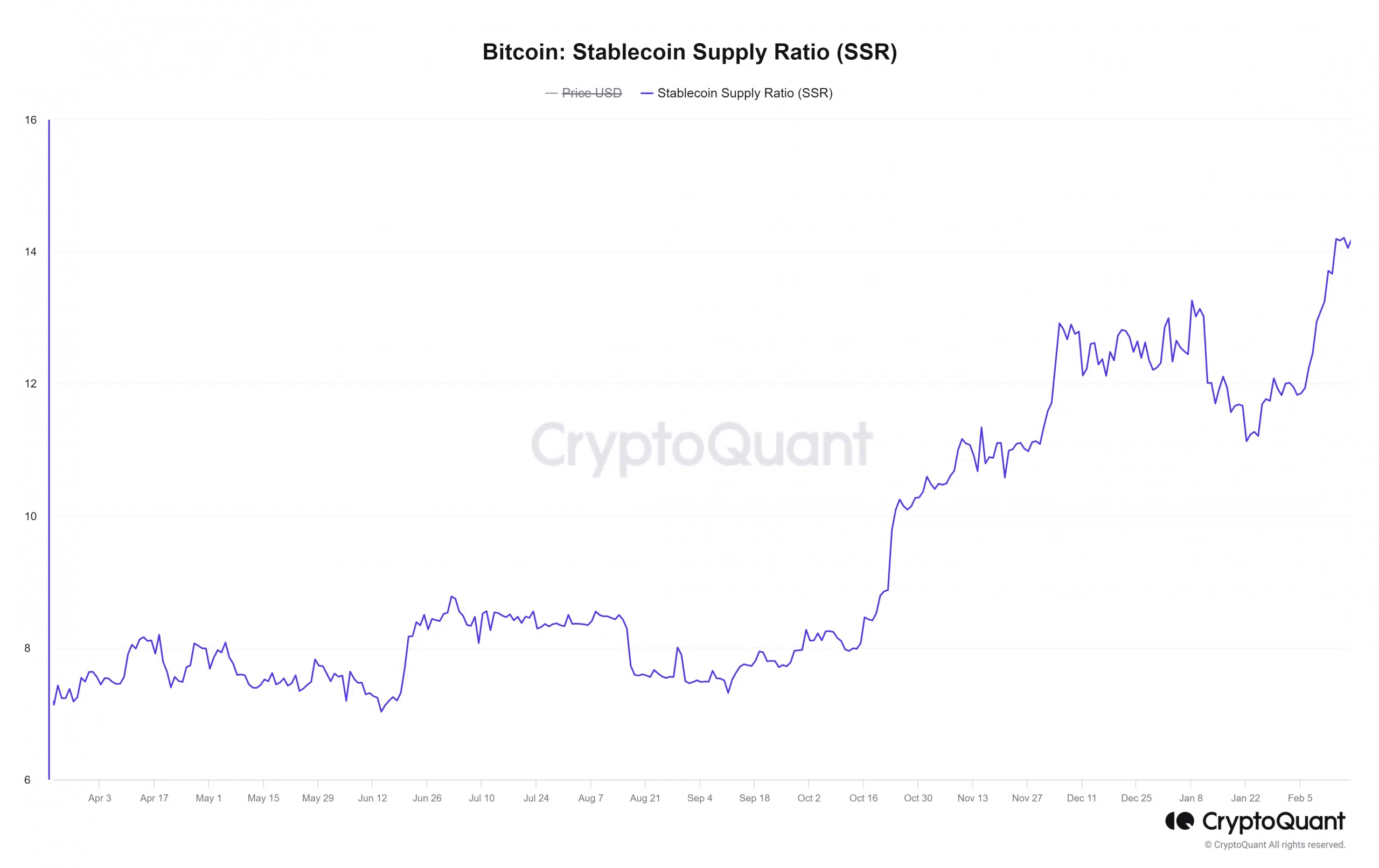

- The stablecoin provide ratio hinted at a bearish sentiment.

- The Tether Dominance chart might be helpful for figuring out BTC’s native high

Bitcoin [BTC] fashioned a spread after crossing the $50k threshold, which was additionally a psychological resistance stage. The bullish momentum had stalled, though the upper timeframe market construction remained bullish.

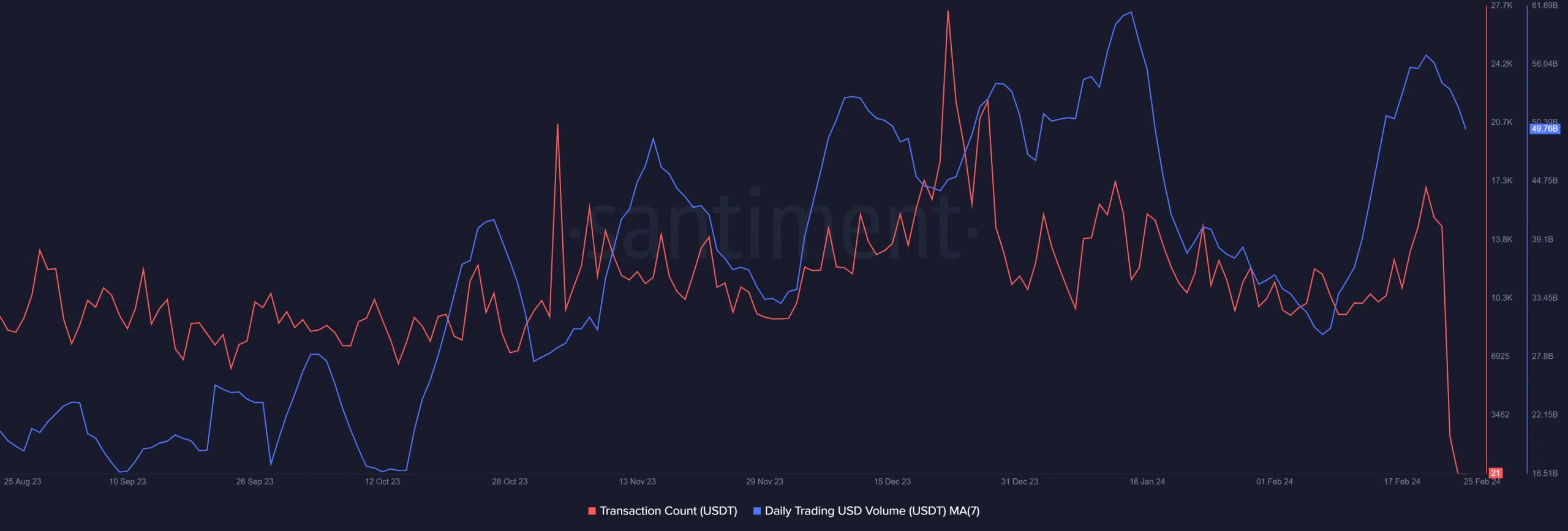

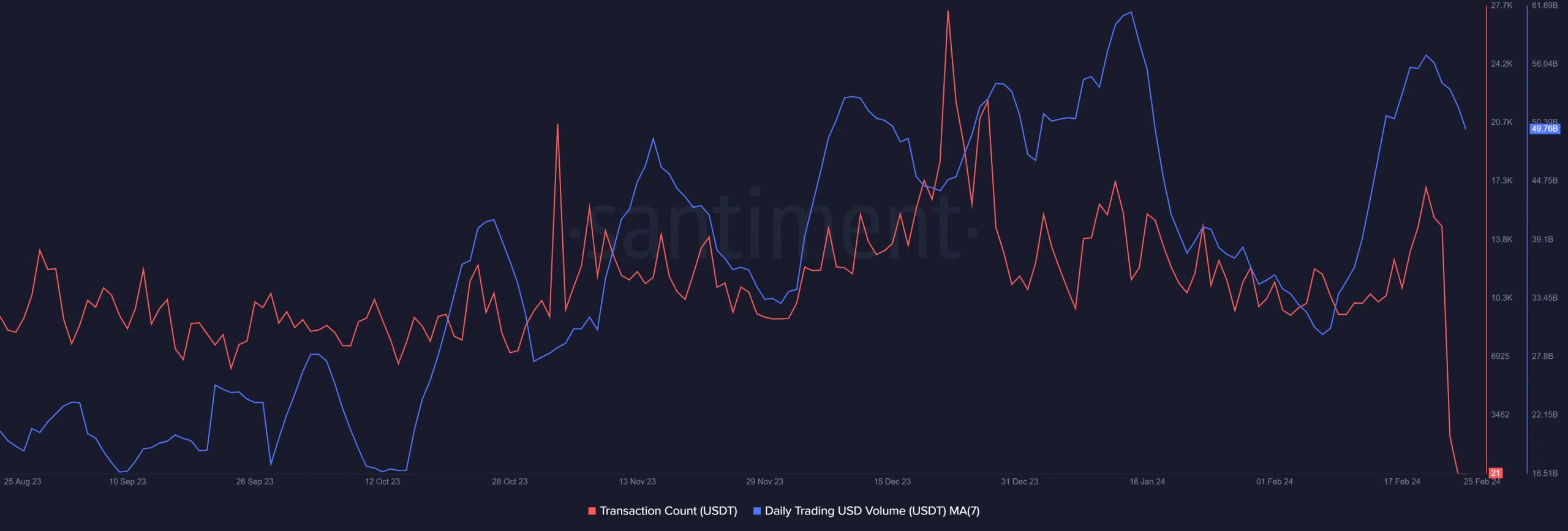

Tether [USDT] buying and selling volumes picked up strongly over the previous month as altcoin and BTC costs soared larger.

The institutional demand for BTC is prone to develop by means of 2024. Thousands and thousands of {dollars} continued to circulate into Bitcoin ETFs.

AMBCrypto’s have a look at some stablecoin metrics and the USDT Dominance chart proved insightful.

The stablecoin provide ratio tendencies upward as soon as extra

Knowledge from CryptoQuant confirmed that the Stablecoin Provide Ratio (SSR) noticed a pointy drop from the eighth to the twenty third of January. It has since risen larger than the January highs.

The rise of the SSR metric confirmed that the shopping for energy of the press stablecoin provide was lowered relative to Bitcoin.

Given Bitcoin’s value trajectory up to now month, this was comprehensible. However the SSR rally additionally signifies potential bearish sentiment — although we’re but to see sturdy proof of that.

The market cap of Bitcoin rose from $755 billion on twenty third January’s lowest level to face at $1.013 trillion.

Equally, the market cap of the altcoins, excluding Ethereum [ETH], rose from $439.86 billion to $546.7 billion at press time.

Whether or not the market would proceed to register beneficial properties might be higher understood by analyzing stablecoin metrics.

USDT transaction rely has trended decrease in 2024

Supply: Santiment

AMBCrypto checked out Tether metrics on Santiment. The buying and selling quantity noticed a powerful resurgence in February after falling in January.

This was per the rally in costs that we noticed because the twenty third of January, which was additionally accompanied by a rise in buying and selling volumes.

The transaction rely has trended down because the latter half of December. It picked up in mid-February however was nowhere close to the December highs.

The USDT Dominance chart is a measure of Tether’s market capitalization, as a share of the entire crypto market cap. The D3 chart from TradingView confirmed that it has trended downward since early November.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

At press time, the dominance was at 5.09%. Technical evaluation confirmed the 4.9% stage was a powerful assist.

If the dominance chart falls decrease than 4.9%, it will be a powerful indication that Bitcoin is ready to rally past the $53k resistance to achieve $58k. The altcoin markets would additionally comply with the worth surge.