- Gox FUD threatens to push Bitcoin costs decrease regardless of the most recent restoration makes an attempt.

- A have a look at the subsequent potential worth backside primarily based on Fibonacci, if BTC bears lengthen their dominance.

Bitcoin [BTC] skilled six days of consecutive draw back. This efficiency mirrored the prevailing cautious sentiment because of the U.S. elections, however a brand new FUD occasion would possibly guarantee extra draw back within the coming days.

The pockets holding Mt. Gox Bitcoin has reportedly transferred 32,371 BTC to an unknown pockets. The worth of the transferred cash was estimated at roughly $2.9 billion.

Many analysts have been anticipating a bearish final result when the Mt. Gox payout finally takes place.

The bearish expectations are primarily as a result of the holders awaiting fee have been ready for years and are deep in revenue.

Thus, they is perhaps incentivized to promote, doubtlessly triggering one other main worth meltdown for Bitcoin.

Will Mt. Gox FUD add extra gasoline to the Bitcoin bears?

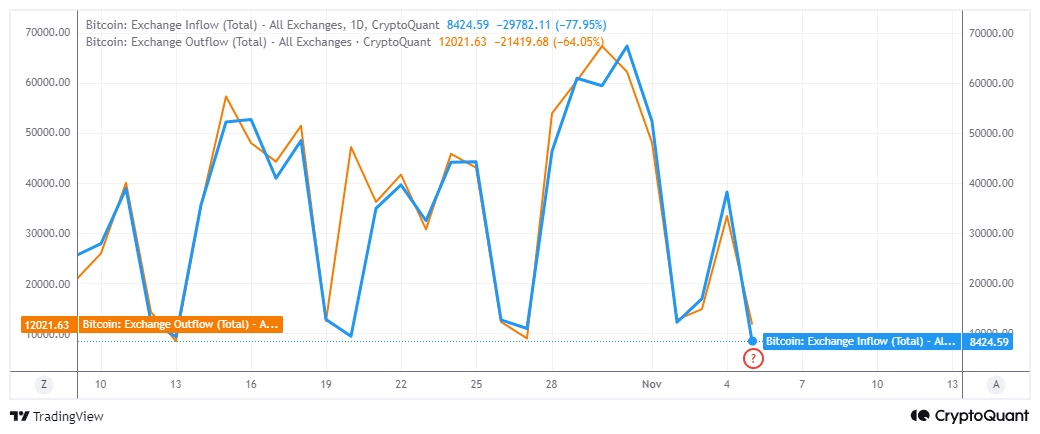

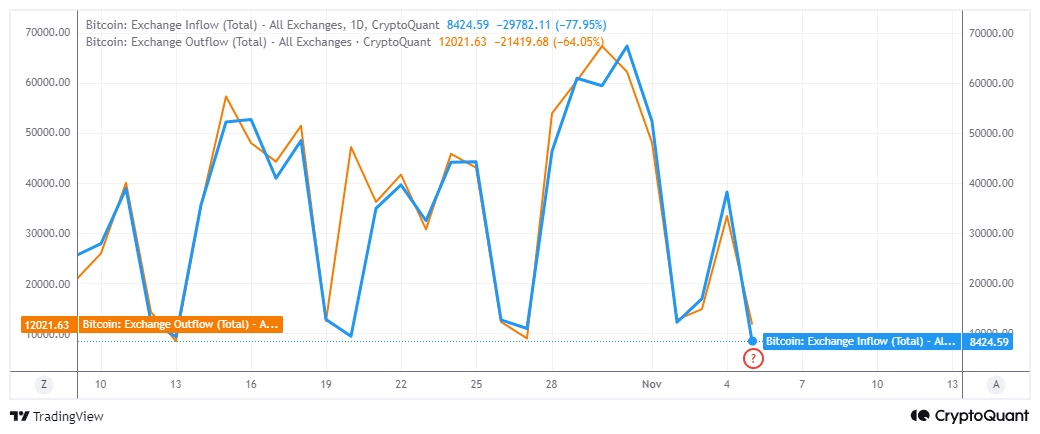

Trade flows have been declining because the finish of October and have since tanked to a traditionally related degree.

A pivot might be on the playing cards, which means the battle between BTC bulls and bears is about to accentuate.

Nevertheless, the percentages of a robust bullish restoration are decrease, particularly now that Mt. Gox FUD is including to the promoting strain beforehand fueled by U.S. election considerations.

Bitcoin change inflows not too long ago slowed down to eight,424 BTC within the final 24 hours, on the time of writing.

Trade outflows had been notably larger at 12,021 BTC, which prompt that the wave of promote strain cooled down, permitting for some shopping for at discounted costs.

Supply: CryptoQuant

The upper change outflows versus inflows mirrored within the type of some restoration within the final 24 hours.

At press time, BTC bounced again to $68,778 after bottoming out at $66,813 on yesterday. This bounce occurred earlier than the Mt. Gox information, therefore the chance that the information might erase the slight confidence coming again into the market.

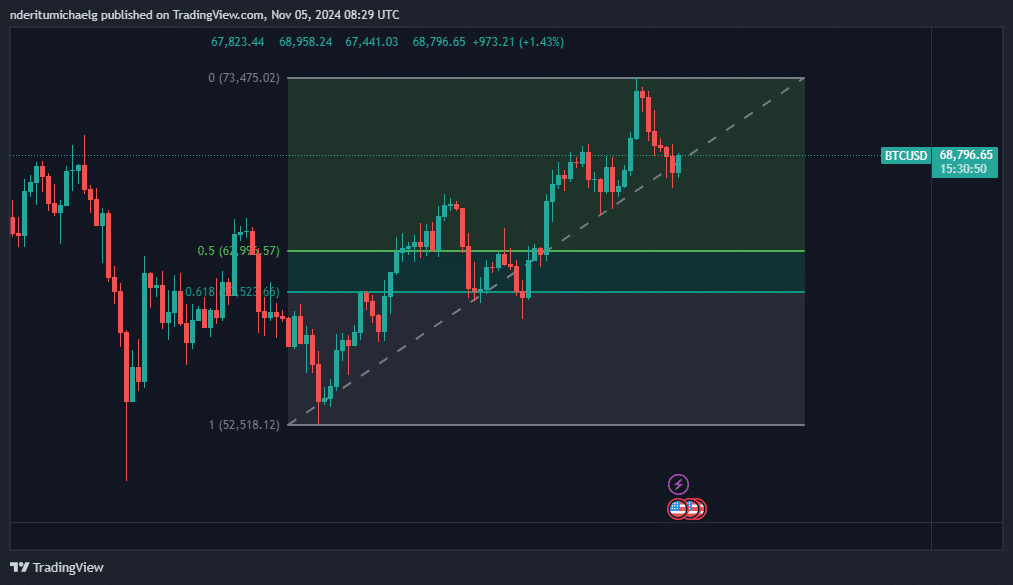

However what ought to merchants anticipate in case the bears resume dominance?

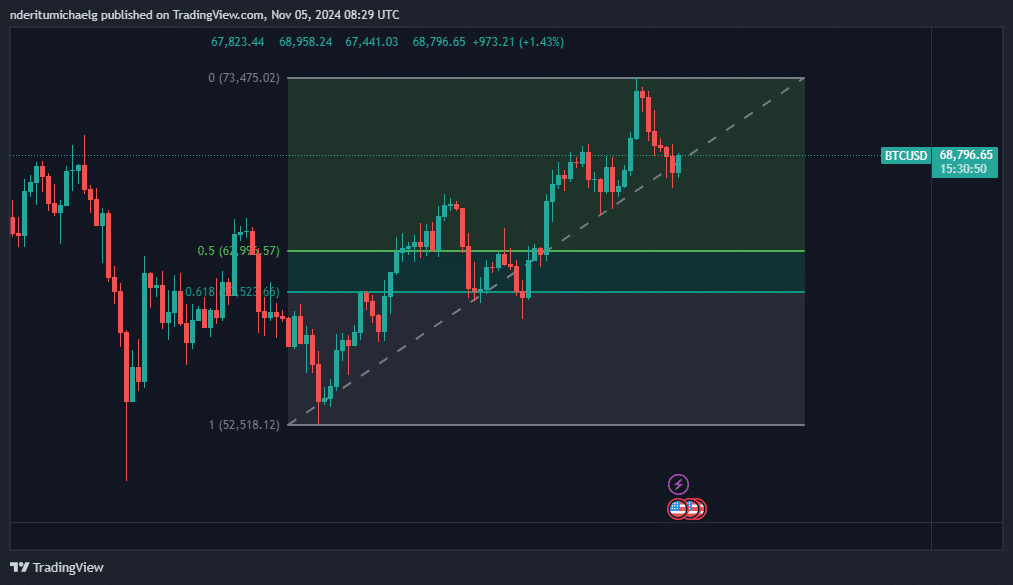

Fibonacci retracement identified that Bitcoin may discover the subsequent main help between $60,000 and $63,000. That is primarily based on the uptrend from September lows to its newest native excessive in October.

Supply: TradingView

Learn Bitcoin (BTC) Value Prediction 2024-25

Whereas it’s potential that Bitcoin may pull again in direction of the $60,000 vary, the U.S. election final result might protect the worth from extra draw back.

A good final result might ship BTC again above the $70,000 vary, however that is still to be seen.