- Bitcoin’s value continued to fall within the hour instantly following the pivotal occasion.

- The hole between Bitcoin’s provide and demand is anticipated to widen additional

After a lot anticipation, Bitcoin lastly completed its 4th halving within the early hours of 20 April GMT. Owing to the halving, mining rewards have now fallen to three.12 BTC from 6.25 BTC. The once-in-4-years occasion, Bitcoin [BTC] underwent its halving when the 840,000th block was added to Bitcoin’s blockchain.

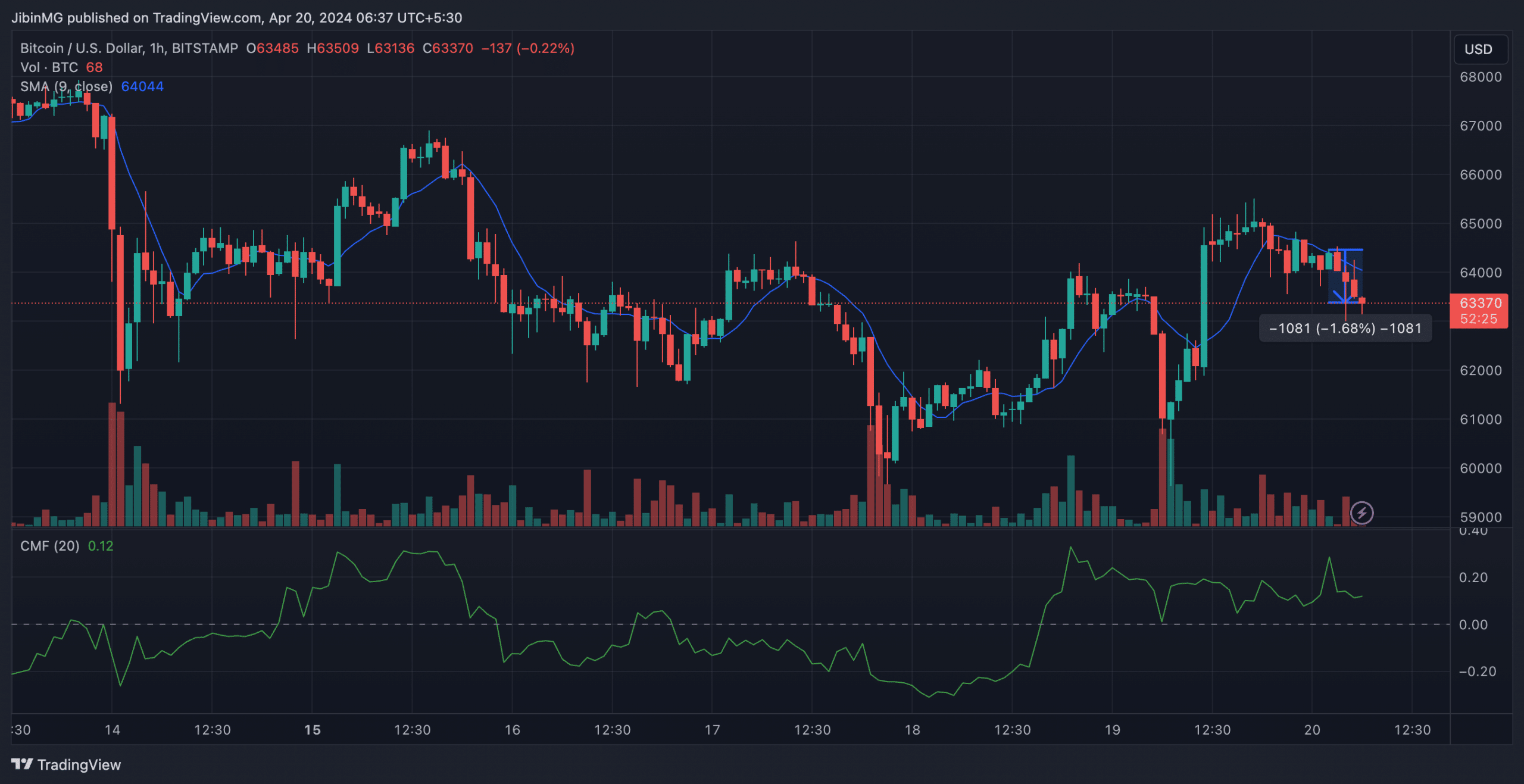

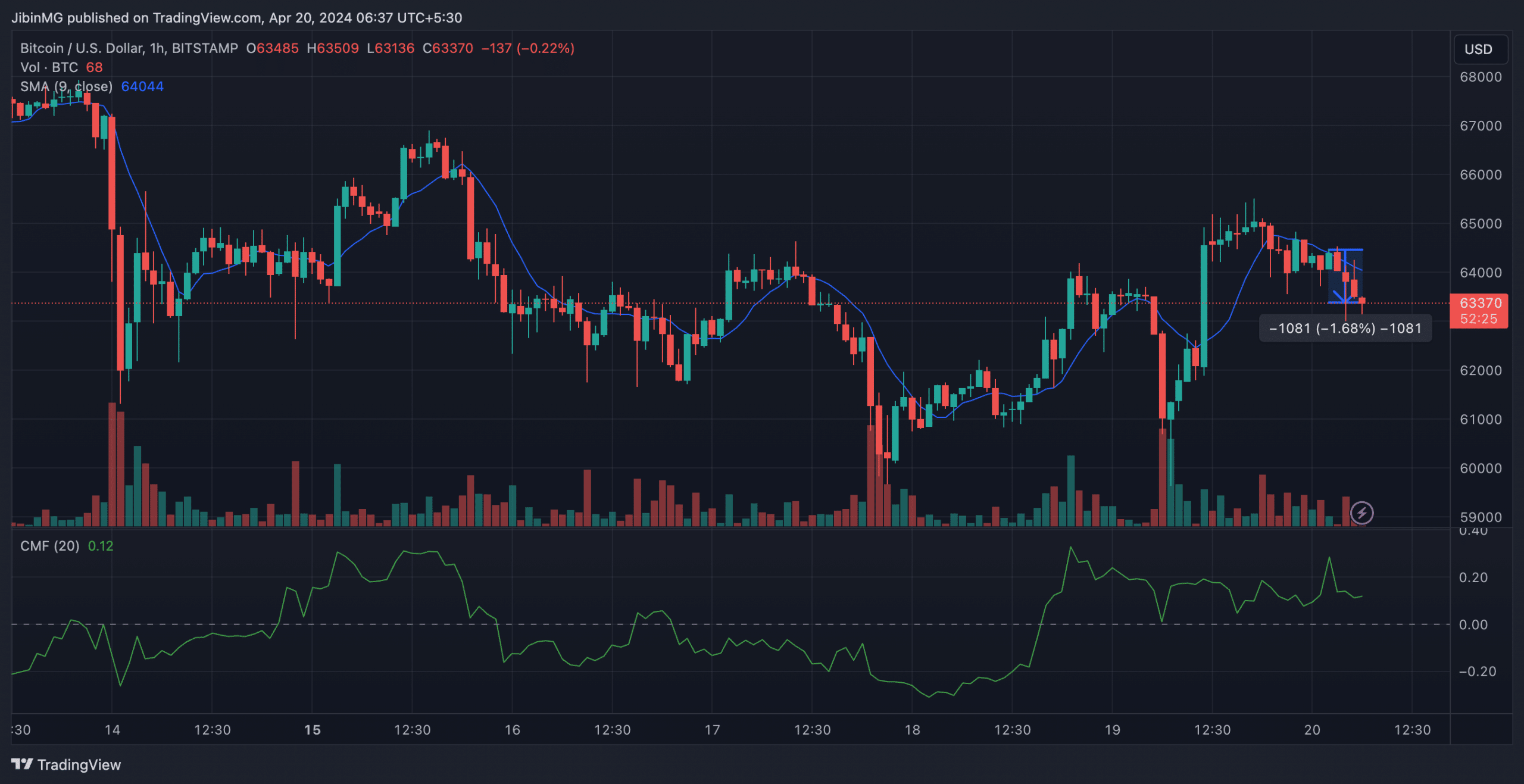

As anticipated, a lot volatility has been the norm on Bitcoin’s value charts over the previous few weeks in gentle of the halving. On the time of writing, BTC was valued at $63,370, having fallen by virtually 2% within the final 6 hours alone. Indicators pointed to bearish inclinations because the Shifting Common was positioned effectively above the worth candles. Then again, the CMF was effectively above zero – An indication of optimistic capital inflows.

Supply: BTC/USD, TradingView

Bitcoin turns into scarcer

Bitcoin was envisaged as a deflationary forex. Merely put, its provide would diminish steadily with every halving till it reaches the exhausting cap of 21 million. Such a provide squeeze when matched with rising demand might bolster its prospects as a retailer of worth asset, akin to how Gold is seen within the mainstream.

Will the king coin rally?

Market members view halving as a bullish occasion because the king coin has traditionally elevated in worth thereafter.

Certainly, the halving in July 2016 was adopted by a 3x rise in BTC’s worth over the subsequent 12 months. Equally, the final halving in Might 2o20 noticed the king coin explode by 500% within the following 12 months, as per AMBCrypto’s evaluation.

Supply: CoinMarketCap

Quite a bit relies on ETF demand

The most recent halving holds significance as a result of it comes amidst what nonetheless seems to be a bull market part.

The demand for Bitcoins has skyrocketed following the itemizing of spot exchange-traded funds (ETFs) within the U.S earlier within the 12 months. The brand new funding avenues have attracted a Cumulative Total Net Inflow of over $12.23 billion since their itemizing. Because of this on common, practically $120 million in Bitcoin flows into these funds each day.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

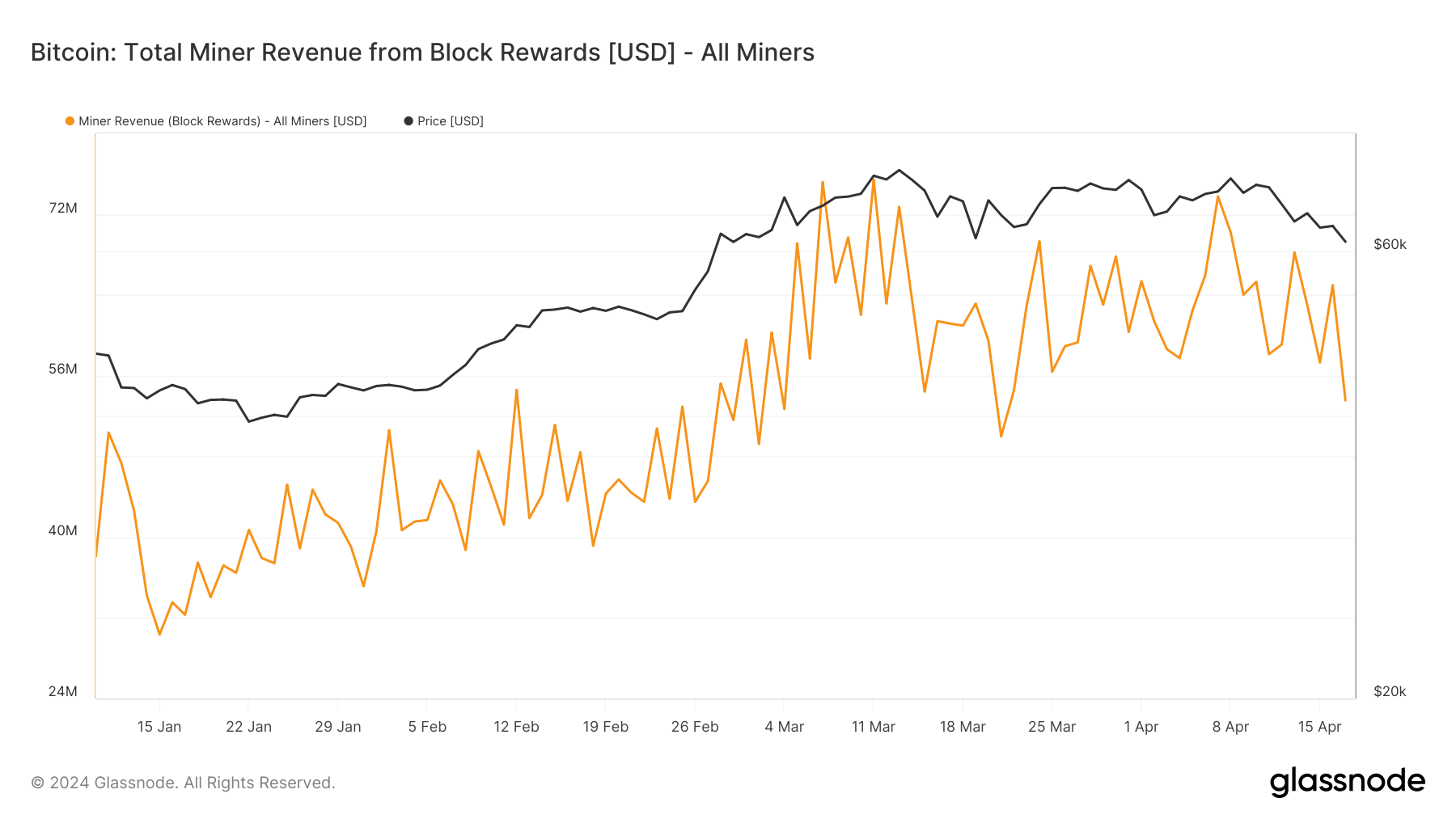

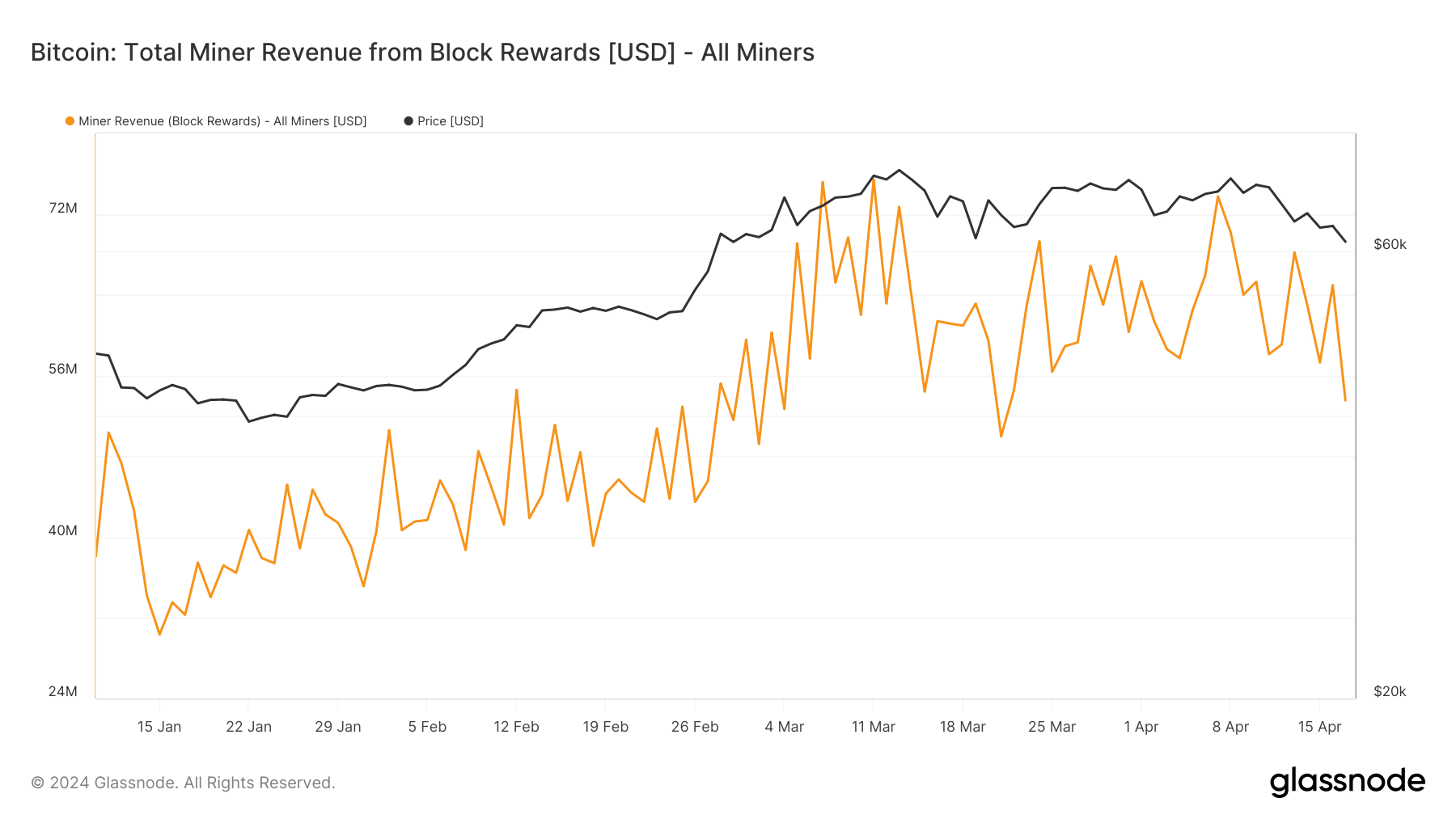

Then again, the variety of new Bitcoins getting mined each day stood at a mean of $50 million, AMBCrypto discovered utilizing Glassnode’s knowledge.

Therefore, the demand exceeded provide by an element of greater than 2x, on the time of writing. With provide set to dip additional, the gulf might be anticipated to widen additional, inflicting Bitcoin to rally.

Supply: Glassnode