- Elevated requires a market backside on-line helped BTC bounce again after a dip beneath $60,000.

- The subsequent goal for Bitcoin may very well be $64,600 or $58,150, relying on upward or downward strain.

Bitcoin [BTC], the cryptocurrency with the biggest market capitalization, briefly dropped beneath $60,000 on the twenty fourth of June. This was the primary time the coin hit such ranges because the third of Might.

Nevertheless, it didn’t take lengthy for BTC to get well. In some unspecified time in the future, AMBCrypto found that Bitcoin reached $62,814, with the broader market anticipating larger costs.

However that didn’t occur as the worth modified palms at $61,107 at press time. Earlier than Bitcoin’s worth fell to $58,890, merchants within the derivatives market had anticipated the transfer.

Robust palms ship BTC again up

Purpose being that the coin skilled heavy sell-offs from the German Authorities on the nineteenth of June.

The unfavorable sentiment grew to become worse after it was confirmed that Mt.Gox, the erstwhile crypto trade would start distributing $8.6 billion price of BTC to its collectors by July.

This growth despatched shockwaves down the backbone of market individuals with many suggesting weaker situations for BTC.

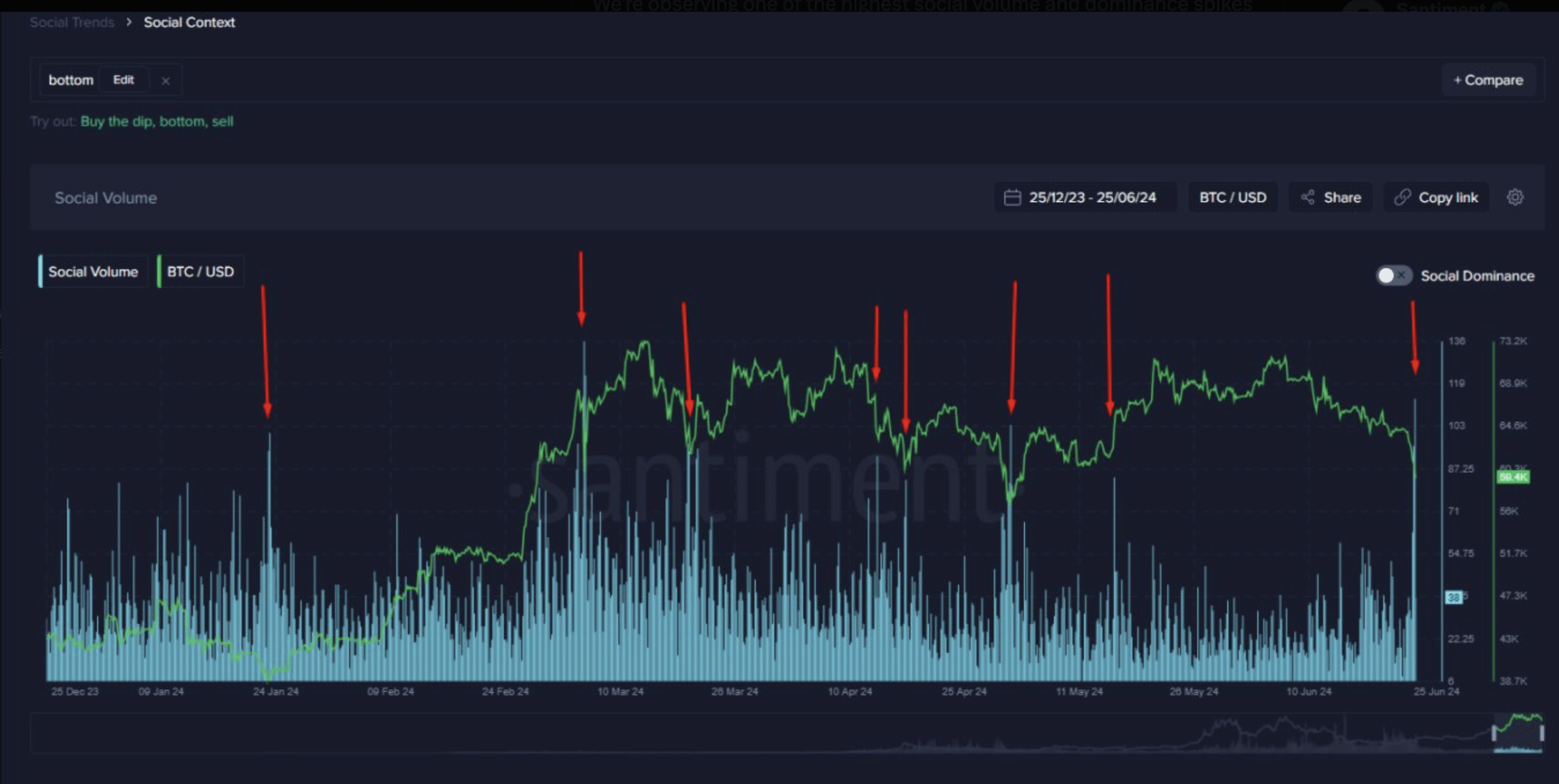

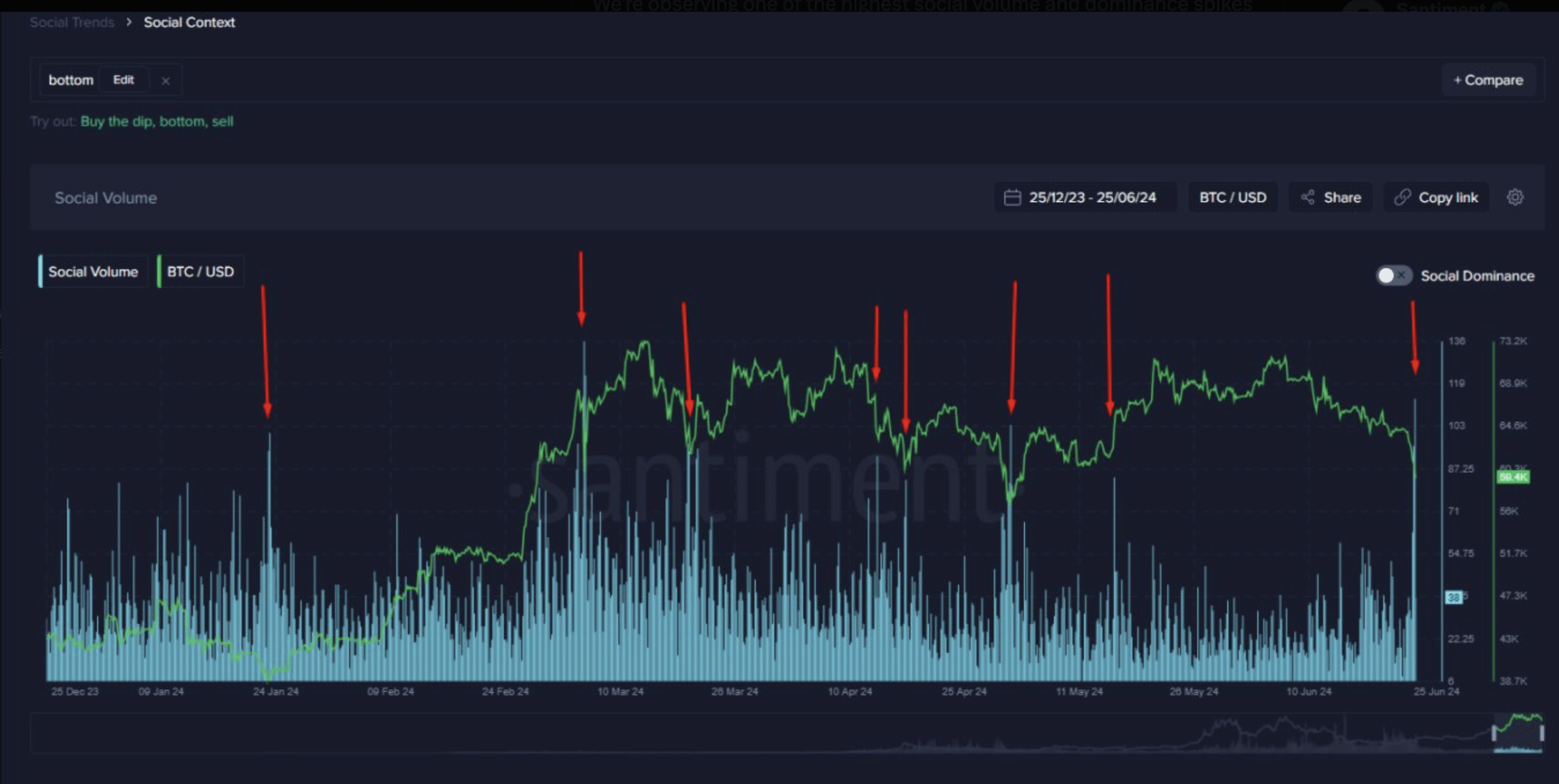

In the meantime, AMBCrypto discovered that elevated requires the “backside” throughout social media was a part of the explanations Bitcoin bounced. The picture beneath obtained from Santiment confirmed this.

Supply: Santiment

Traditionally, when social quantity and dominance of backside calls spike, it results in a major rebound. That was what occurred with BTC earlier.

However with the coin erasing a few of these features, will it bounce once more? Let’s discover out.

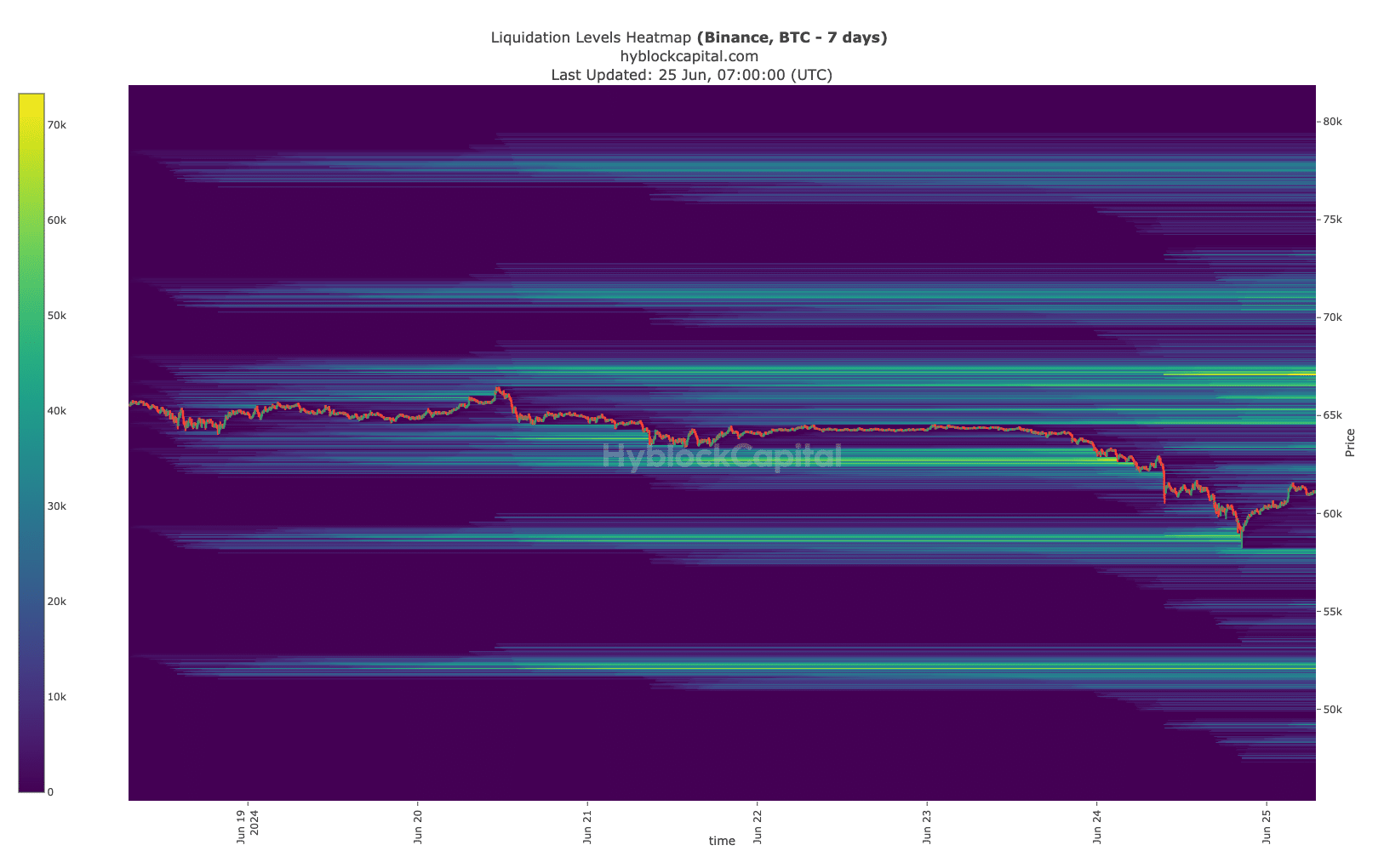

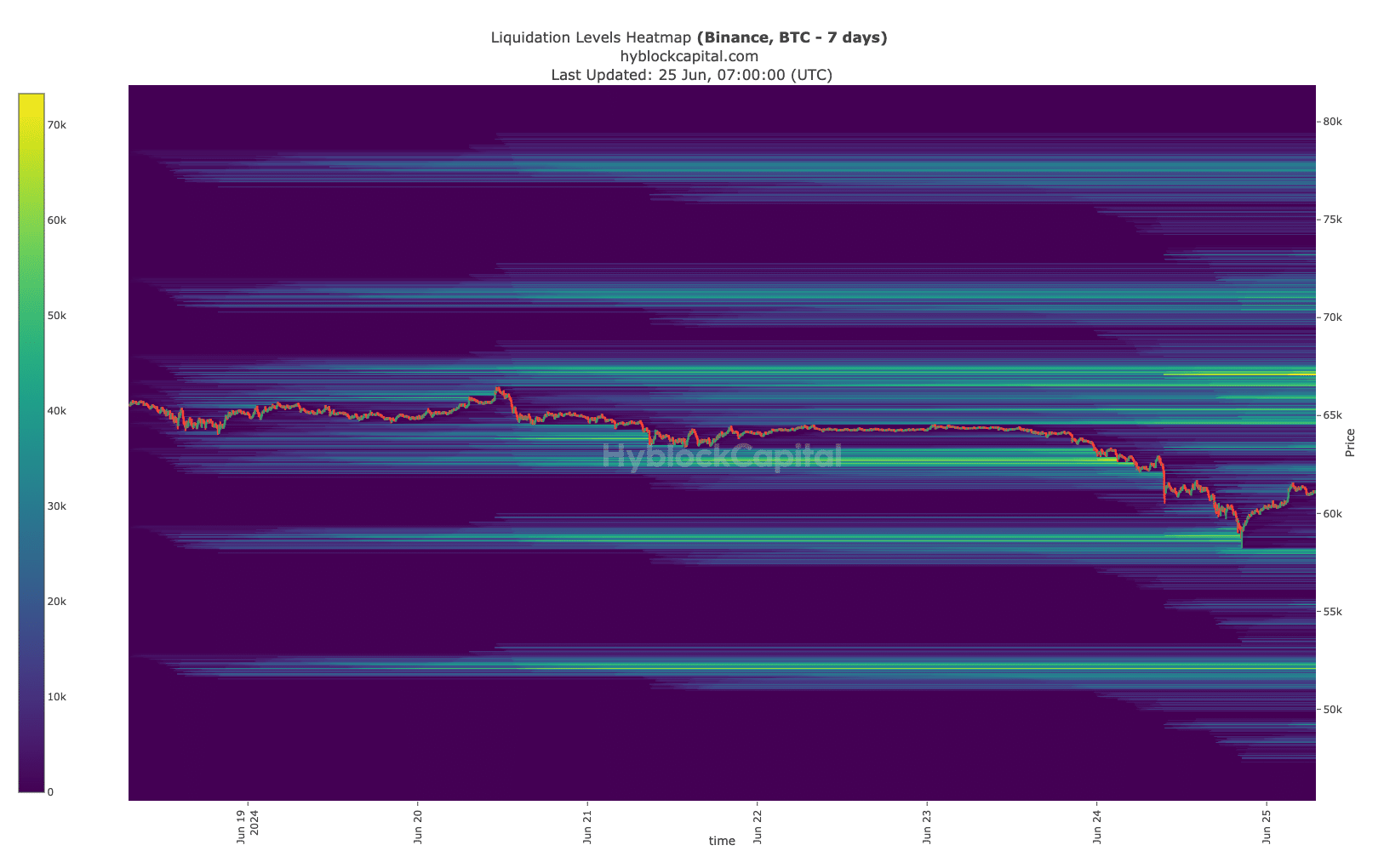

To do that, AMBCrypto examined Bitcoin’s Liquidation Heatmap. This indicator predicts costs the place extreme liquidations may happen.

Knowledge suggests volatility is just not over

Additionally, the excessive areas of liquidity means that costs might transfer in that path. At press time, utilizing information from Hyblock, we noticed excessive liquidity at $64,600. Subsequently, if spot shopping for strain will increase, BTC might hit this degree.

Ought to that occur, many brief positions available in the market may very well be liquidated. To the draw back, one other cluster of liquidity existed at $58,150. Because of this if promoting strain will increase, Bitcoin might fall beneath $60,000 once more.

Supply: Hyblock

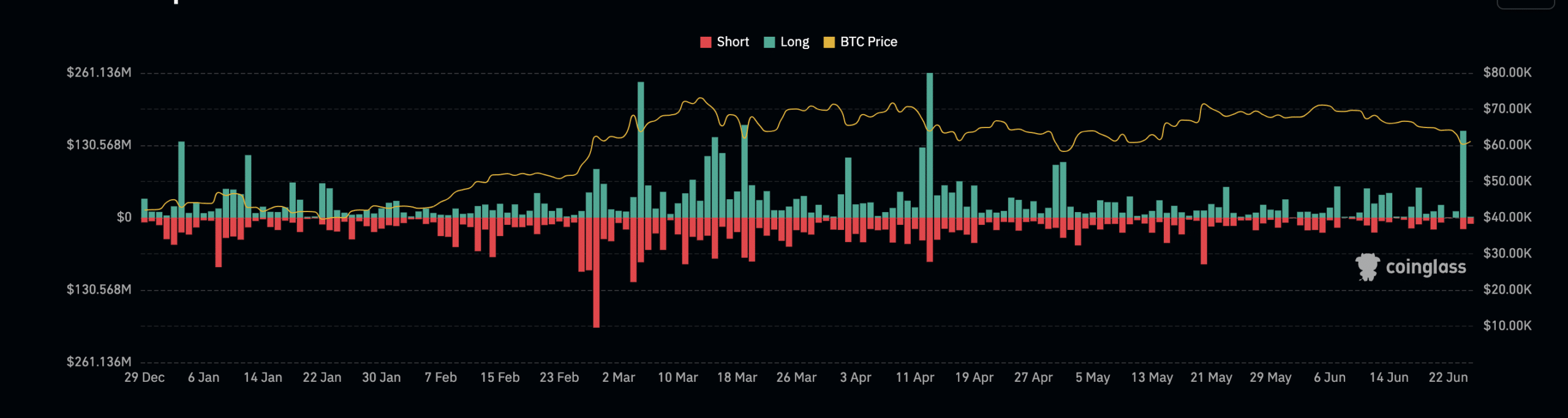

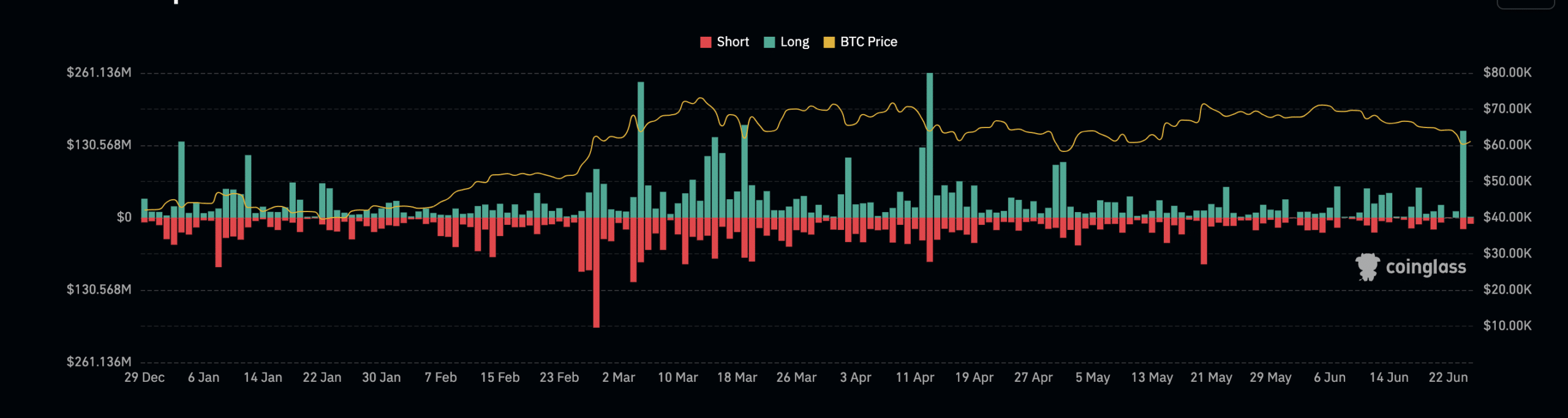

As well as, BTC contracts liquidated within the final 24 hours reached $152.71 million, in keeping with information from Coinglass. Liquidation happens when a dealer can now not fulfill the margin necessities to maintain a place open.

In consequence, an trade closes the place to forestall additional losses. For Bitcoin, the excessive volatility available in the market induced the cascade of liquidations.

Notably, lengthy place have been the highest casualty with $121.65 million worn out in 24 hours. Shorts, alternatively, accounted for $31.06 million.

Supply: Coinglass

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Shorts are merchants predicting costs to lower. Lengthy are, nevertheless, merchants, betting on costs to rise.

Shifting on, merchants may want to use warning contemplating that BTC”s path within the brief time period stays a dicey one.