- BTC’s shopping for sentiment within the derivatives market was dominant.

- Bitcoin was down by over 1% within the final 24 hours, and some indicators had been bearish.

After a protracted wait, Bitcoin [BTC] has risen above the $28,000 mark, sparking pleasure amongst buyers. Information from Santiment revealed that the uptrend occurred when numerous BTC tokens had been gathered within the latest previous. Although excessive accumulation was the driving pressure that powered the uptrend, different components had been at play on the identical time.

Is your portfolio inexperienced? Verify the BTC Revenue Calculator

Bitcoin is getting off the leash!

Bitcoin is lastly displaying indicators of restoration as its value has rallied over the previous couple of days. The latest uptrend helped the coin elevate its value above $28,000. On the time of writing, BTC was trading at $28,324.76 with a market capitalization of over $552 billion.

In line with Santiment’s tweet, a serious cause behind the uptrend was BTC’s hike in accumulation.

🐳 #Bitcoin‘s variety of wallets holding at the very least 100 $BTC has jumped to fifteen,970 after the most important single day leap of 2023 on Saturday. Since this accumulation, $BTC‘s value is +5.3%, and so they will not be achieved. We’ll proceed to observe. https://t.co/l0drhvkf7E pic.twitter.com/0mDAmys7N4

— Santiment (@santimentfeed) October 18, 2023

To be exact, the variety of wallets holding at the very least 100 BTC has jumped to fifteen,970 after the most important single-day leap of 2023 on 14 October. Quickly after the buildup, the coin’s value spiked by greater than 5%.

A take a look at BTC’s on-chain efficiency revealed that fairly a couple of different components had been additionally serving to the coin to maneuver up. As an illustration, its alternate reserve was decreasing, that means that it was not beneath promoting stress.

This occurred whereas its switch quantity elevated, which by and enormous is a optimistic sign. Bitcoin’s taker purchase/promote ratio additionally turned inexperienced, suggesting that purchasing sentiment was dominant within the derivatives market.

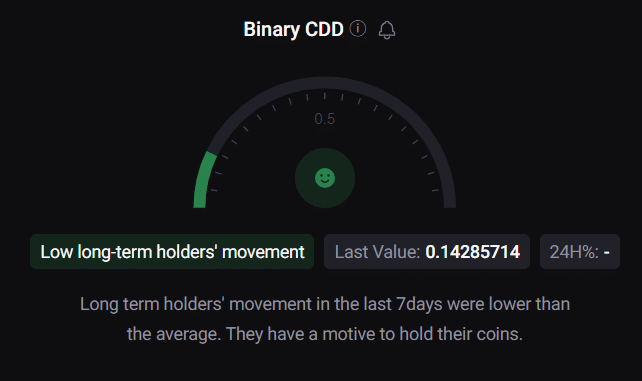

BTC’s binary CDD was inexperienced too. This meant that long-term holders’ actions within the final 7 days had been decrease than common.

Supply: CryptoQuant

The climate was fast to alter

Although Bitcoin’s value registered a promising rally, the situation was fast to alter. The king of cryptos’ value dropped by greater than 1.2% during the last 24 hours. This was additionally accompanied by a drop in BTC’s buying and selling quantity, suggesting that buyers had been unwilling to commerce the coin.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

A test of BTC’s every day chart offered readability on what buyers ought to count on from the coin within the days to comply with. Bitcoin’s Cash Circulate Index (MFI) registered a downtick.

Its Chaikin Cash Circulate (CMF) was additionally resting under the impartial mark, growing the possibilities of continued southward value motion. Nonetheless, the MACD was optimistic because it displayed a bullish crossover.

Supply: TradingView