- The rise in realized losses on-chain signifies that one other BTC rally was shut.

- Historic knowledge introduced by the cycle detector exhibits the coin is just not in a bear part.

If the present cycle continues to be in a bull part, then Bitcoin [BTC] is near its backside. This was the indication AMBCrypto acquired after wanting on the Quick Time period Holder (STH) SOPR.

SOPR stands for Spent Output Revenue Ratio. This indicator offers insights into the realized earnings of all cash traded on-chain. However this time, the main target is on the brief time period.

Are losses nice for Bitcoin’s worth?

If the STH-SOPR is bigger than 1, it signifies that the worth at whereas BTC was bought is bigger than the acquisition worth. This means lots of realized earnings on-chain.

Nevertheless, when, the metric is beneath 1, it means costs bought are larger than weighted shopping for worth. This means realized losses on-chain. Based on CryptoQuant, Bitcoin’s STH-SOPR was right down to 0.98.

Supply: CryptoQuant

Traditionally, when this occurs, it implies that Bitcoin has hit the underside or it’s near it. As seen within the picture above, it was an analogous incidence in September 2023.

Round that point, Bitcoin’s worth was $26, 253. The SOPR had additionally dropped to an analogous area. By November of the identical yr, the coin had reached $35,441.

Different bull cycles like 2021 and 2018 additionally present related pattern, indicating that the sample usually rhymes. Ought to this be the identical case, the worth of Bitcoin may bounce by 34.99% in lower than two month.

At press time, BTC’s worth was $57,154. Going by this calculation, the worth of the coin may commerce round $77,100 in September.

Ought to this grow to be actuality, it signifies that BTC may attain a brand new all-time excessive this quarter.

Nevertheless, no matter the constructive outlook, it is very important examine if the cycle continues to be in a bull part.

Bears, it’s not but your time but!

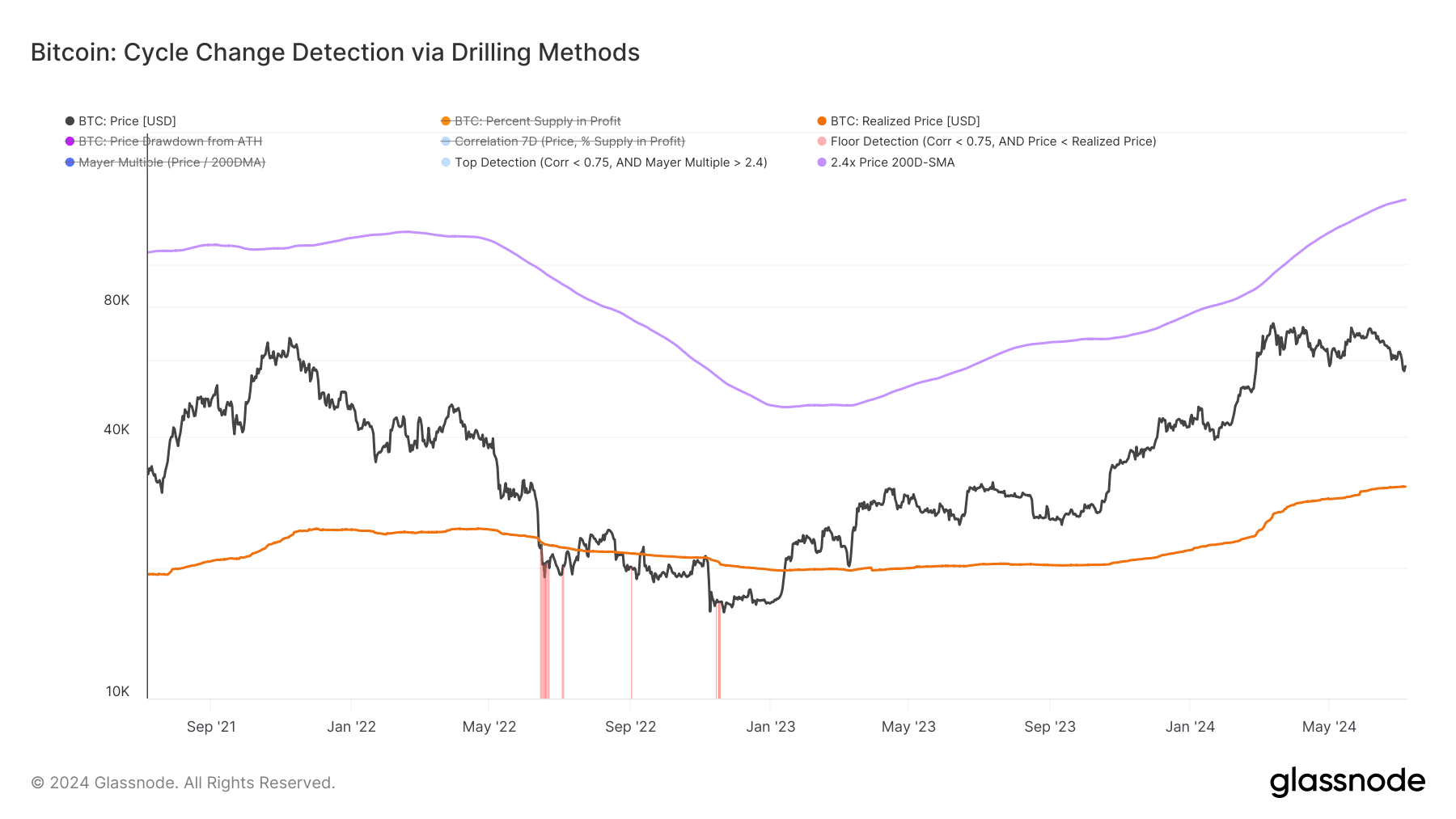

Beforehand, when Bitcoin dropped to $54, 274, there have been calls of a return to the bear market. However opinions don’t validate issues like this. That was why AMBCrypto seemed to Glassnode to have first-hand data of the state of affairs.

To do that, we examined the Bitcoin Cycle Change Detector. This detector spots transitions from a bull market to a bear market. It additionally tells if a bear market has became a bull one.

If the market adjustments to a bear one, the shade on the chart turns pink. This was evident from the market situation of November 2022. However as of this writing, that was not the case.

Supply: Glassnode

Besides the full Bitcoin in circulation hits almost 100% in earnings, the transition to a bear cycle wouldn’t occur. As this was the case, it’s doable that BTC may need hit the underside.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

Due to this fact, the coin would possibly attain a much-higher worth earlier than the quarter ends — presumably between $76,000 and a extremely bullish worth above $80,000.

Nevertheless, this prediction can be invalidated if promoting stress hits the market prefer it did in current weeks.