- The newest knowledge revealed that Bitcoin’s worth momentum has shifted from unfavourable to constructive.

- Metrics and market indicators seemed bearish on the coin.

After crossing the $69k mark, Bitcoin [BTC] has as soon as once more fallen beneath that degree. Although this may look regarding at first look, the newest knowledge revealed that now may be the proper time to build up BTC.

Let’s have a more in-depth have a look at what’s occurring with the king of cryptos.

Bitcoin’s dilemma

BTC gained bullish momentum because it exceeded $69k on the twenty seventh of July. This gave hope to buyers that BTC would as soon as once more contact $70k.

Nonetheless, that didn’t occur because the bears took management and pushed the coin’s worth down within the following hours. In response to CoinMarketCap, on the time of writing, BTC was buying and selling at $67,481.86 with a market capitalization of over $1.33 trillion.

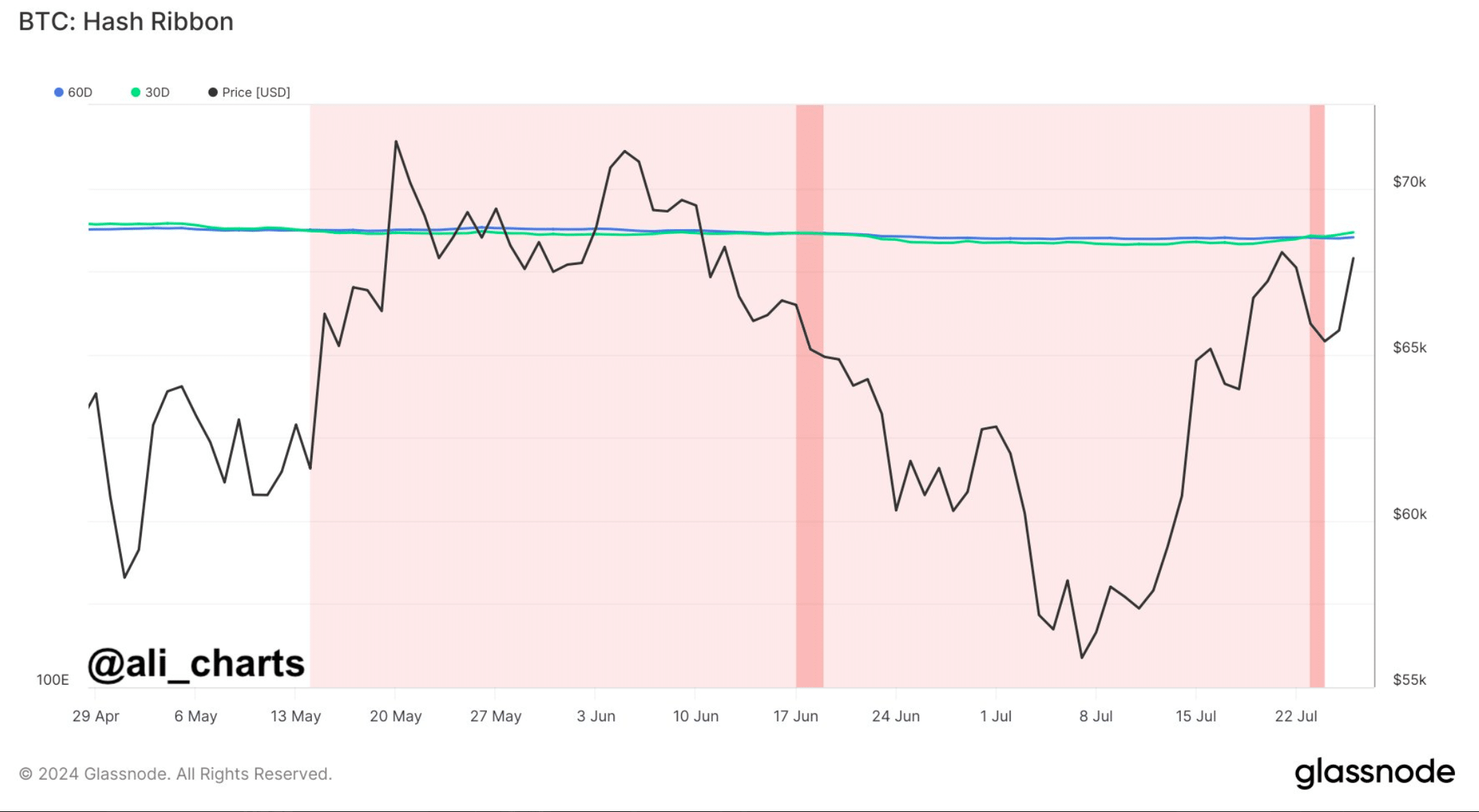

Within the meantime, Ali, a well-liked crypto analyst, posted a tweet revealing an fascinating growth. As per the tweet, BTC’s Hash Ribbon alerts the tip of Bitcoin miner capitulation, suggesting BTC worth momentum has shifted from unfavourable to constructive.

For starters, the Bitcoin hash ribbon present the hash price and worth restoration following miner capitulations, which have traditionally produced highly effective long-term purchase alerts.

Supply: X

Is shopping for strain rising?

Because the above-mentioned indicator urged that there was a shopping for alternative, AMBCrypto checked BTC’s metrics to seek out whether or not buyers have been actively shopping for the coin.

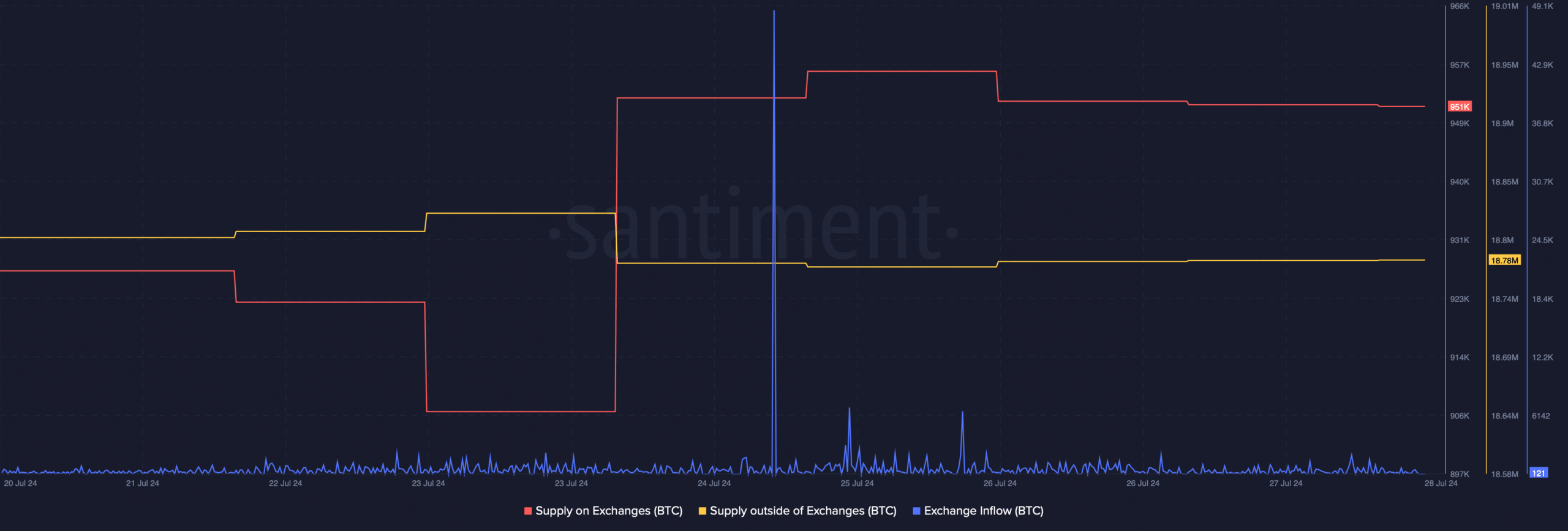

Our evaluation of Santiment’s knowledge revealed that BTC’s provide on exchanges elevated sharply whereas its provide exterior of exchanges dropped. This clearly meant that promoting strain elevated.

The truth that buyers have been promoting BTC was additional confirmed by the spike in its trade outflow.

Supply: Santiment

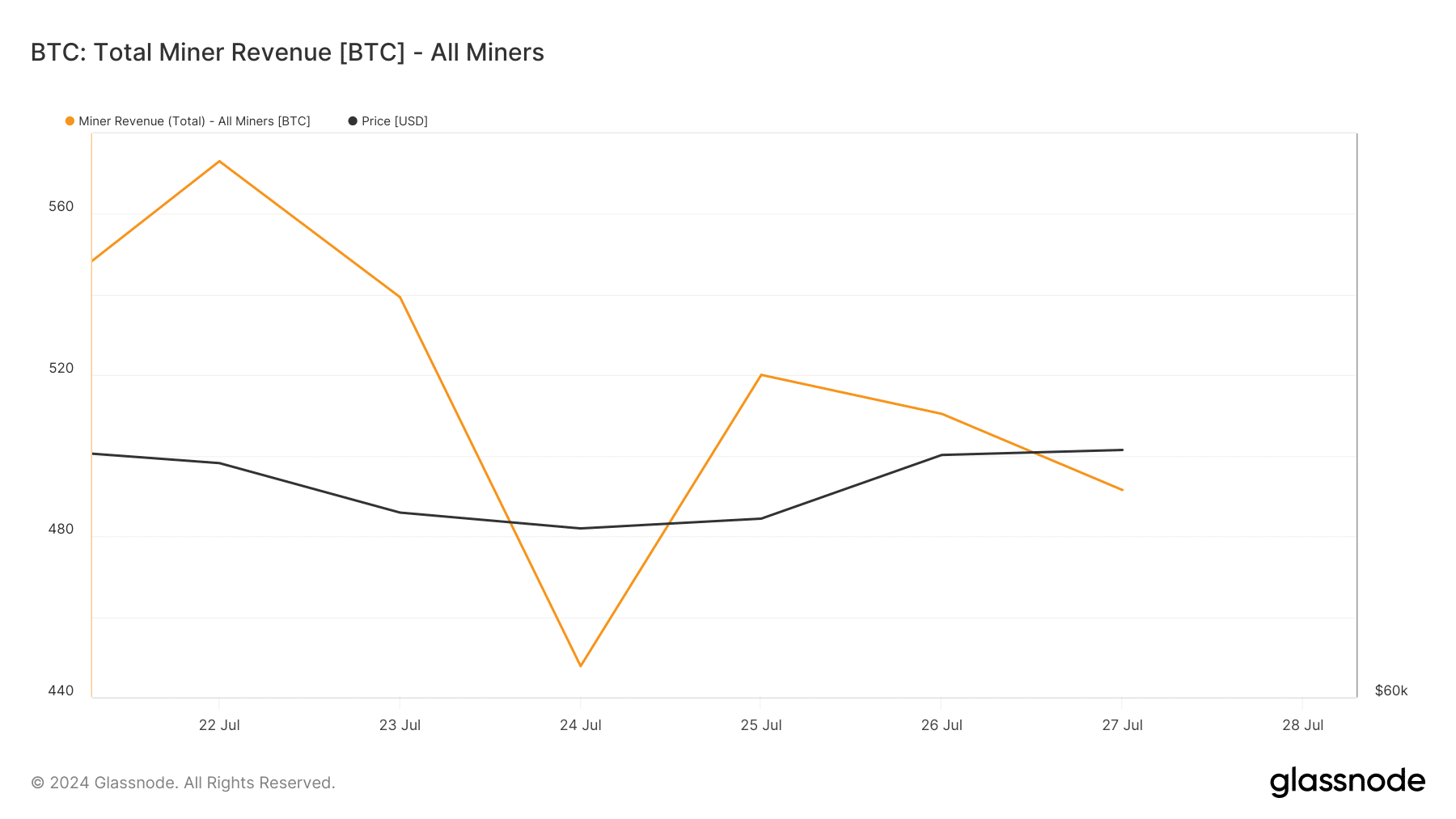

Nonetheless, not like retail buyers, miners thought of holding their BTC. Our have a look at CryptoQuant’s data revealed that BTC’s Miners’ Place Index (MPI) was inexperienced, which means that miners have been promoting much less holdings in comparison with its one-year common.

It was fascinating to notice that whereas miners have been HODLing, their income dropped. This, within the coming days, might set off a pattern reversal and power miners to promote BTC.

Supply: Glassnode

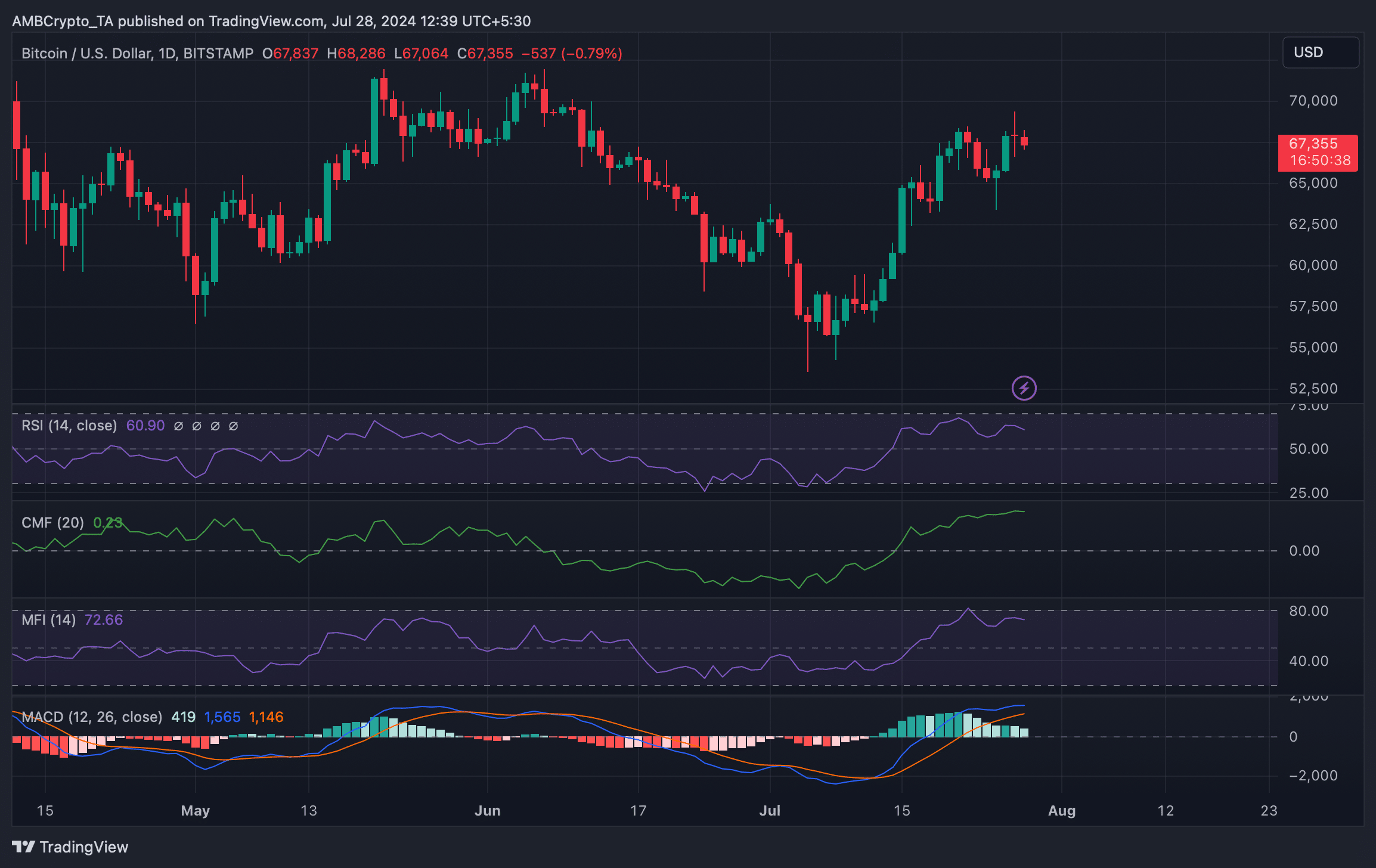

AMBCrypto then deliberate to test Bitcoin’s every day chart to seek out out what to anticipate from the coin. As per our evaluation, BTC’s Relative Energy Index (RSI) registered a downtick. The Cash Circulate Index (MFI) additionally adopted an identical pattern.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Moreover, the technical indicator MACD displayed the potential for a bearish crossover quickly, hinting at a worth correction.

Nonetheless, the Chaikin Cash Circulate (CMF) indicated that there have been probabilities of a worth improve because the indicator moved northwards.

Supply: TradingView