- Dormant Bitcoin whales have woke up, with decade-old addresses reactivating.

- Now, FOMO might spark a push to $73K, however there’s a catch!

An ideal storm of macro elements – starting from the post-halving surge, the “Uptober” frenzy, the approaching finish of the election cycle, and Fed fee cuts – has fueled a parabolic rally, driving Bitcoin [BTC] to $69K in simply 10 buying and selling days.

Nonetheless, not like earlier rallies, the bulls this time have been actively defying bearish stress, with each day lows barely exceeding 1%.

Whereas this fast ascent might spark worry amongst merchants, main them to lock in good points and exit positions, the market now wants a key catalyst – seemingly the conviction of whales – to view the present worth as a main entry level.

An extended-dormant Bitcoin whale resurfaces

A post on X (previously Twitter) revealed {that a} dormant Bitcoin pockets, inactive for over a decade, was not too long ago reactivated. This pockets incorporates 25 BTC, valued at round $1.7 million.

It’s essential to take a look at the timeline of this motion. The reactivated pockets has held its 25 BTC since 2013, when Bitcoin’s worth ranged from $100 to $266.

With Bitcoin’s latest meteoric rise, the proprietor of this pockets now possesses a priceless asset. Notably, this marks the second time in simply two days that an outdated whale has resurfaced.

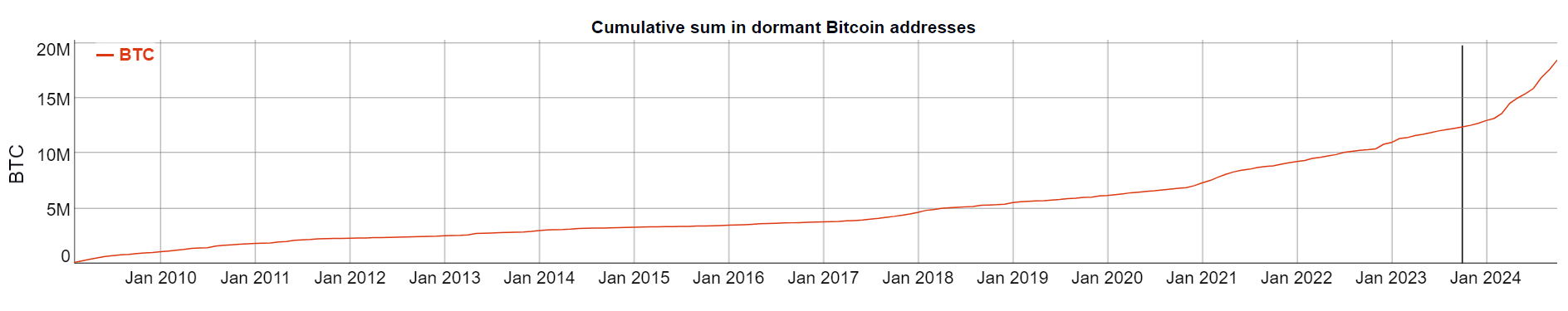

Supply : BitInfoCharts

Over the previous decade, the quantity of BTC saved in dormant wallets has reached an ATH of 19 million BTC. At a worth of $69K, this interprets to roughly $1.311 trillion.

A rising sum in dormant wallets often indicators a bullish development, exhibiting that holders select to attend for potential worth appreciation slightly than cashing out. Nonetheless, it additionally means there’s a big provide of Bitcoin that would flood the market if these dormant holders determine to promote.

With these wallets changing into lively once more, it’s essential to observe their exercise. If the house owners view the present worth as an opportunity to money in, it might draw in additional consumers and spark FOMO available in the market. On the flip aspect, in the event that they suppose there’s little room for development, we would see a big pullback.

Belief from large gamers is important

Apparently, AMBCrypto has uncovered a compelling sample that would sign rising volatility available in the market.

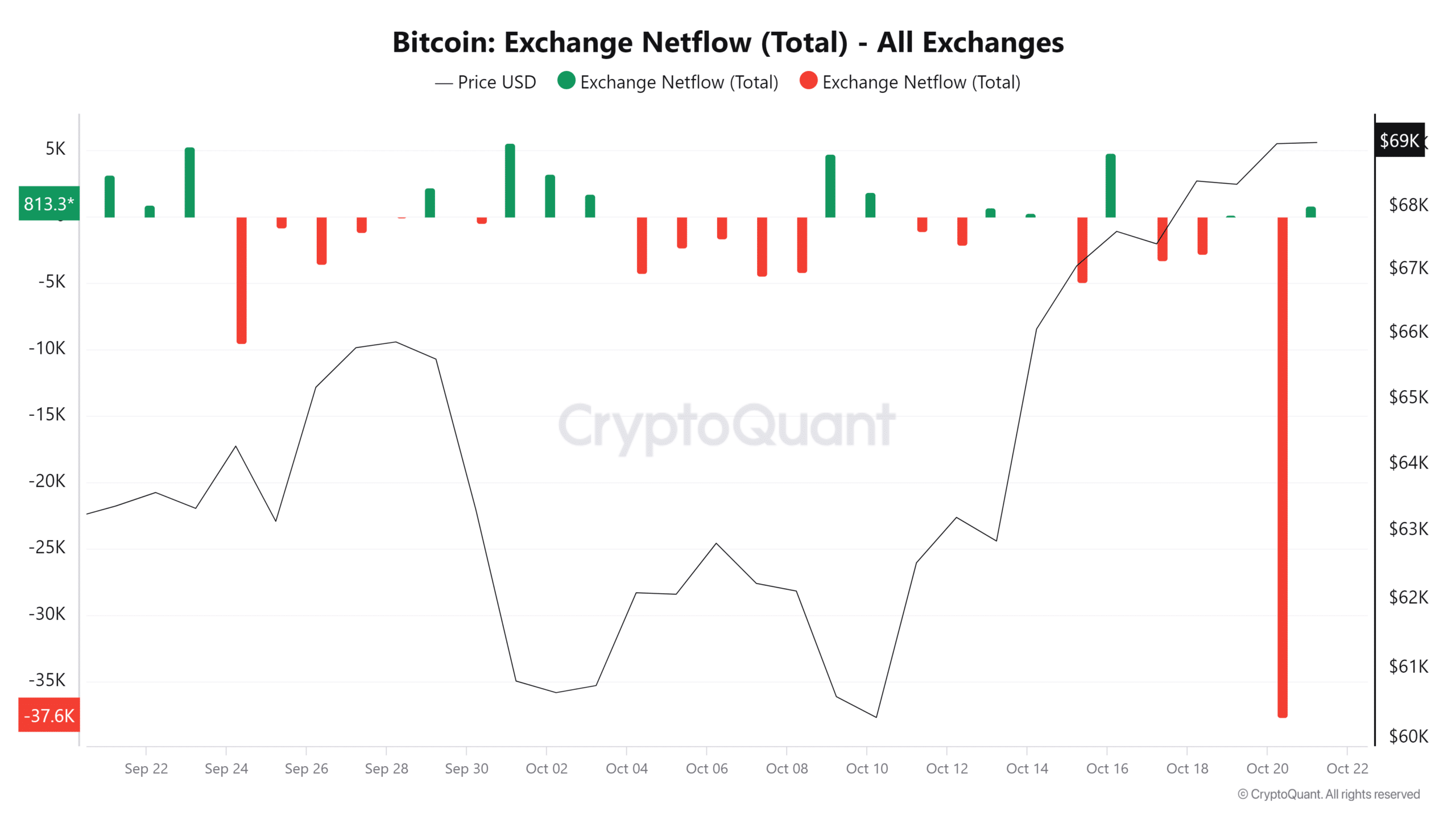

Only a day in the past, a large lengthy purple candle appeared on the chart under, exhibiting that just about 38,000 BTC moved into exchanges. This inflow led to a noticeable spike in alternate reserves.

Supply : CryptoQuant

Nonetheless, regardless of this aggressive sell-off, Bitcoin’s worth motion remained comparatively secure, closing above $69K – a stage it hadn’t reached in 4 months.

This anomaly can seemingly be attributed to whale intervention, which absorbed a lot of the promoting stress. In truth, this isn’t simply hypothesis; it’s backed by actual knowledge. As proven within the chart, practically 40,000 BTC had been bought by massive holders on the identical day.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Total, whales play a crucial position on this cycle. Their help is important to forestall the market from overheating, which might in any other case sign a possible high and set off mass capitulation.

Nonetheless, if their confidence wavers, a retracement might be imminent.