- BTC’s worth elevated by over 10% within the final seven days.

- A couple of market indicators seemed bearish on the coin.

Bitcoin’s [BTC] worth motion continued to stay bullish because it traded above the $65k mark. Whereas that occurred, long-term traders’ confidence within the coin additionally surged. However will that be sufficient to maintain this bull rally? Let’s discover out.

Bitcoin is holding robust

CoinMarketCap’s data revealed that Bitcoin’s worth had risen by greater than 10% within the final seven days. In actual fact, within the final 24 hours alone, the king of crypto’s worth surged by over 3%.

On the time of writing, BTC was buying and selling at $65,362.47 with a market capitalization of over $1.289 trillion.

Within the meantime, IntoTheBlock lately posted a tweet highlighting an attention-grabbing improvement. As per the tweet, long-term Bitcoin holders confirmed confidence final week, including to their holdings.

It was attention-grabbing to notice that this improve in LTH confidence in BTC elevated whereas a number of main gamers indulged in sell-offs. For instance, AMBCrypto reported earlier that the German authorities bought all of its BTC holdings, bringing its steadiness to zero.

Aside from that, one other notable improvement occurred within the current previous associated to Mt. Gox. Lookonchain’s newest tweet identified that Mt. Gox moved 44,527 BTC, value over $2.84 billion, to an inside pockets.

The motive behind this motion is perhaps for reimbursement. Mt. Gox at present holds 138,985 BTC, which is value $8.87 billion.

Will this be sufficient for BTC?

AMBCrypto then deliberate to check out different datasets to see whether or not LTH’s confidence in BTC can be sufficient to maintain the bull rally.

Our evaluation of CryptoQuant’s data revealed that BTC’s alternate reserve was dropping, that means that purchasing strain on the token was excessive.

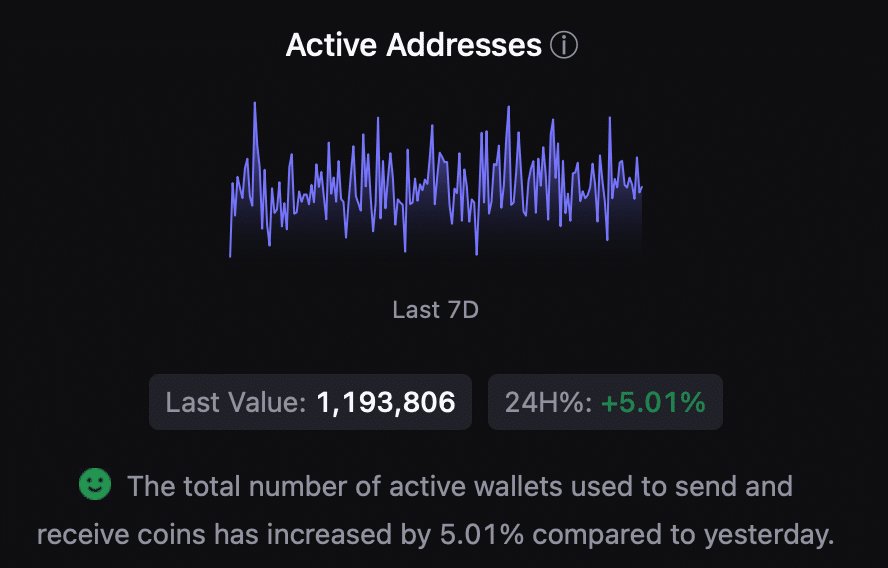

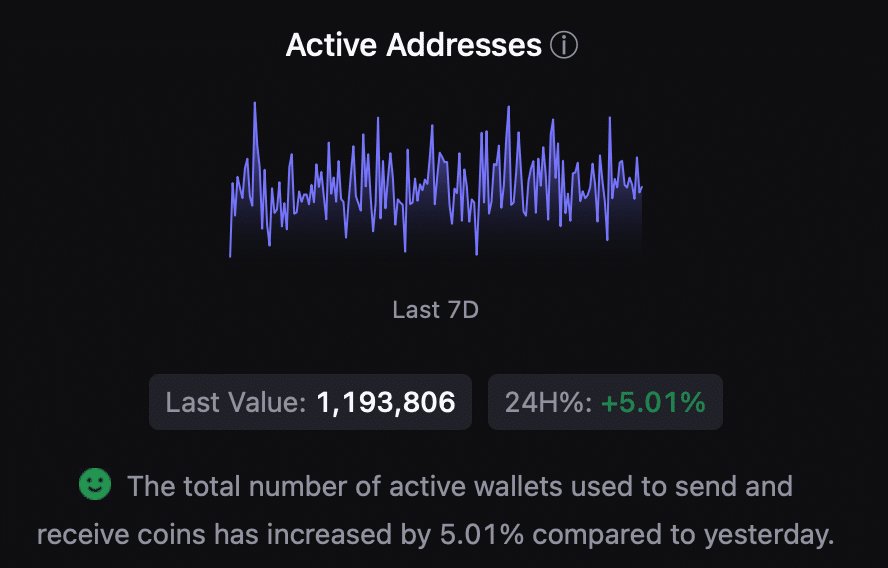

Its Coinbase premium was inexperienced, which urged that purchasing sentiment was robust amongst US traders. On high of that, BTC’s community exercise was rising, which was evident from the rise in its energetic addresses in comparison with the final day.

Supply: CryptoQuant

Nevertheless, on the time of writing, BTC’s fear and greed index had a studying of 75%, indicating that the market was in a “greed” section.

Each time the metric hits this stage, it means that the probabilities of a worth correction are excessive. Subsequently, we assessed the king of crypto’s each day chart to higher perceive what to anticipate.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

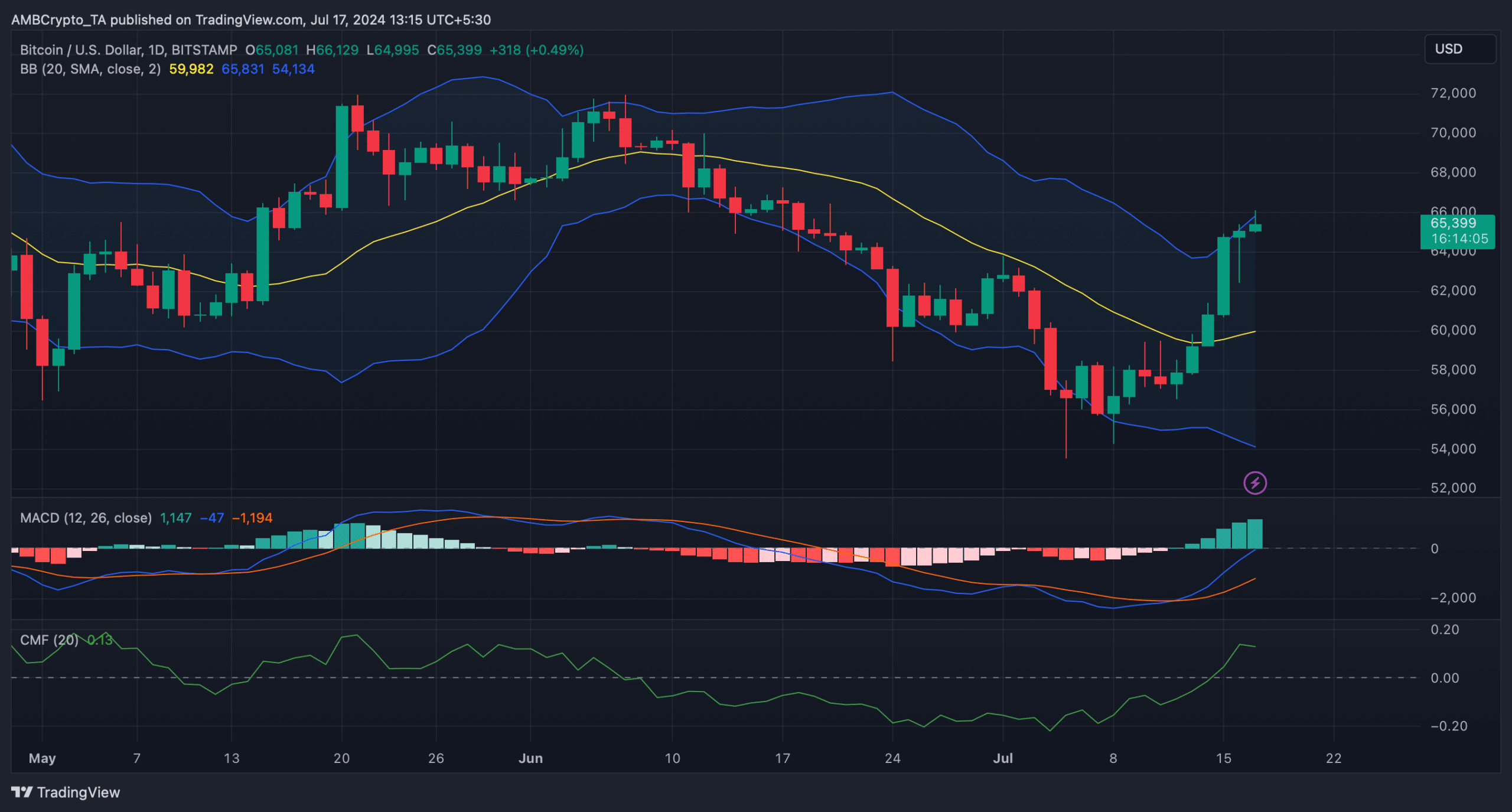

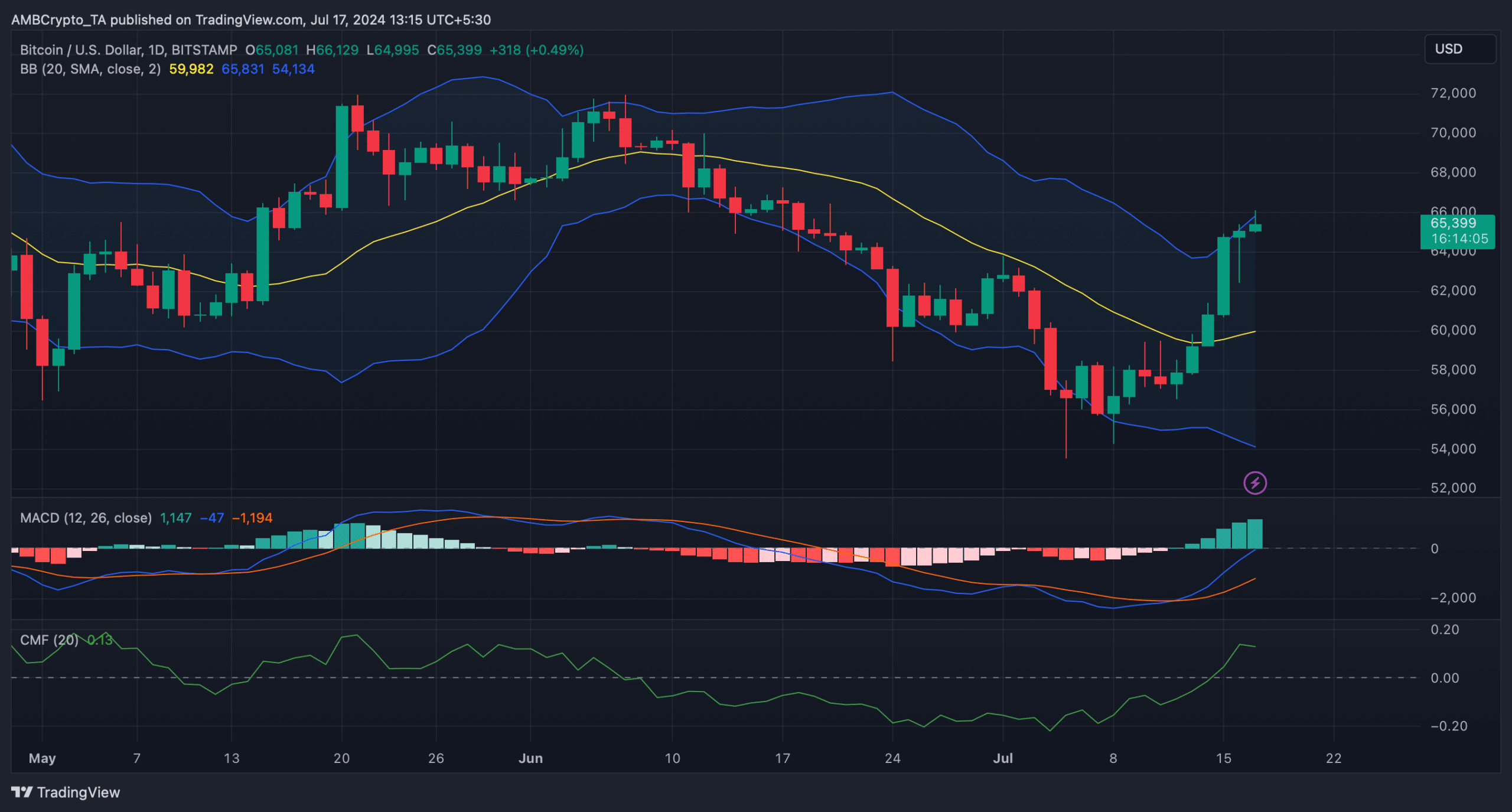

We discovered that BTC’s worth had touched the higher restrict of the Bollinger Bands. Its Chaikin Cash Circulate (CMF) additionally registered a downtick.

Each the indications hinted at a worth correction. Nonetheless, the MACD remained in patrons’ favor because it displayed a bullish benefit.

Supply: TradingView