- Bitcoin’s value round $61k is a sufferer of market cooling, summer season slowdowns

- Mt. Gox unlocks and authorities gross sales elevate some provide considerations too

The crypto market hasn’t had the very best of instances these days. This was the case at press time too, with the business’s complete market capitalization falling to $2.26 trillion at press time. As anticipated, Bitcoin, the world’s largest cryptocurrency, led the best way, with BTC down by nearly 1% on the charts.

Bitcoin and the market’s prime altcoins weren’t the one ones affected although.

The memecoin market, as an example, additionally registered a downturn, with its market capitalization falling by 1.33% to $47.89 billion. In truth, buying and selling quantity dropped considerably by 19.31% too.

Now, numerous elements have contributed to this market-wide decline, each market-specific occasions and broader financial influences. Therefore, it’s value these elements.

Market cooling after optimistic ETH ETF information

The optimistic information in regards to the potential buying and selling of Ether (ETH) ETFs has led to a cooling interval within the crypto market. United States’ Securities and Trade Fee is reportedly near approving ETFs tied to the spot value of Ether, with expectations for approval as quickly as 4 July.

Whereas this anticipation initially drove market optimism, the next market changes have contributed to the continuing downturn.

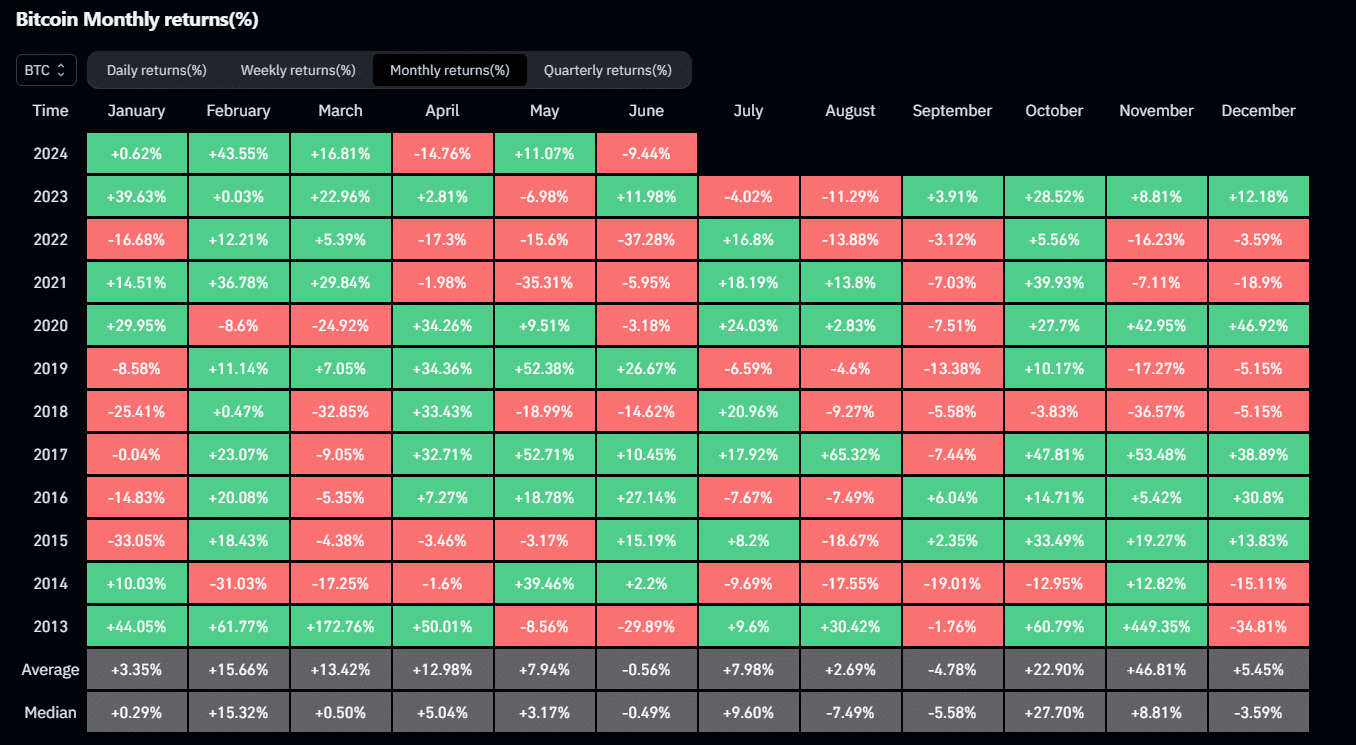

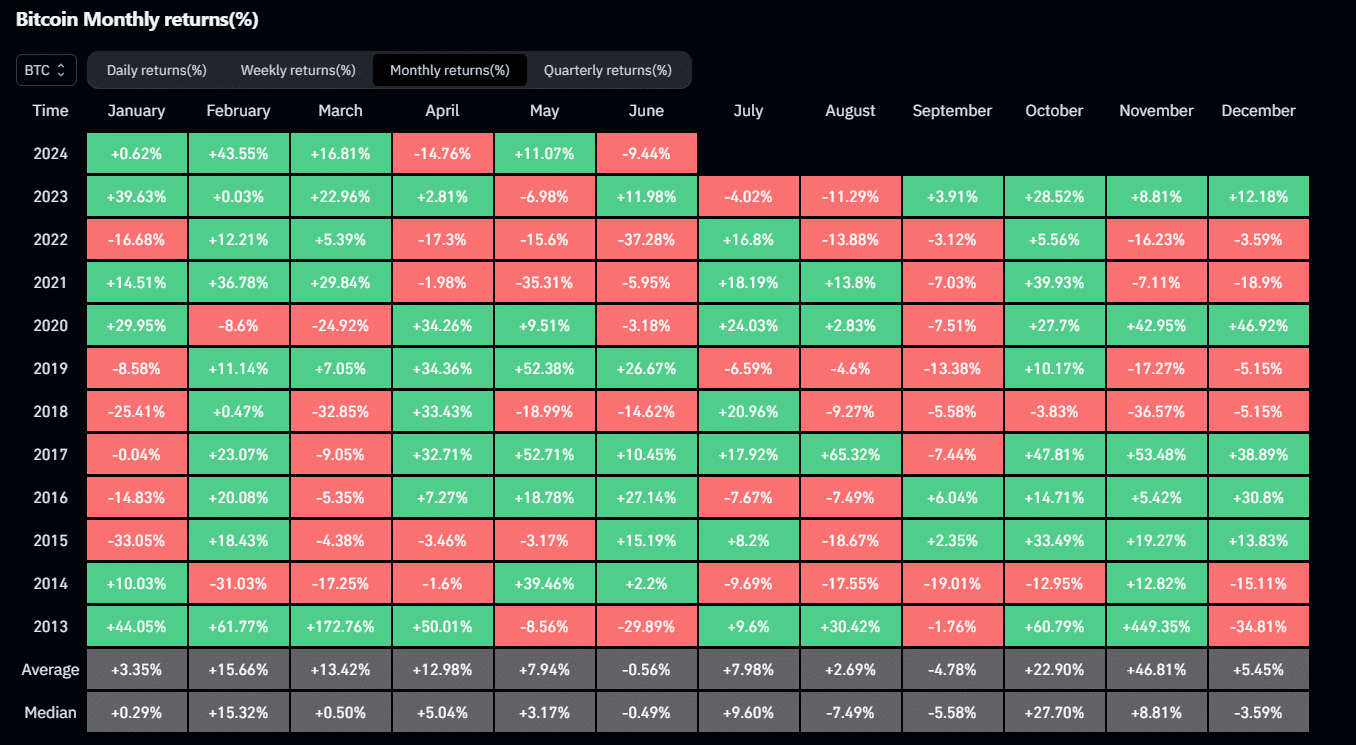

Furthermore, seasonal traits and diminished buying and selling exercise in the course of the summer season months are additionally affecting the market. Traditionally, June has seen combined performances from Bitcoin, with a mean return of -0.56%. Merely put, it has been one of many weakest months for the cryptocurrency.

The identical was lately highlighted by in style market analyst Dan Crypto Trades.

Supply: X

It might thus be argued that the autumn in buying and selling volumes in the course of the summer season trip interval is resulting in much less market exercise and better volatility.

Considerations over Mt. Gox and authorities promoting

The market can also be going through considerations in regards to the potential affect of the Mt. Gox unlocks and promoting actions by authorities our bodies. In truth, the identical was highlighted by QCP’s newest weekend brief on the state of the crypto market.

Now, some consider these provide considerations is perhaps overstated. Even so, the potential inflow of Bitcoin from these sources is inflicting uncertainty and contributing to bearish sentiment.

Help ranges and future projections

Regardless of these bearish headlines, nonetheless, Bitcoin’s help stage round $60,000 has proven resilience. If this help stage weakens although, we’d see the crypto decline additional. By doing so, BTC would possibly presumably check the decrease ranges round $50,000.

In truth, QCP analysts went on to say, ,

“We may check decrease in direction of 50k ranges however the market will discover robust help there, as curiosity from TradFi continues to permeate given the final regulatory easing the world over.”

That being mentioned, the anticipated launch of spot ETFs for different main cryptocurrencies like Solana (SOL) may spark renewed curiosity and supply some market help.

In mild of the prevailing market situations, analysts suggest methods for navigating the downturn. For Bitcoin, producing yield in a sideways market has been recommended, with the potential to make directional bets in This fall.

For Ether, taking a short-term bullish place forward of the ETF launch is perhaps advantageous.