- The proof at hand reveals that Bitcoin is probably going headed a lot larger.

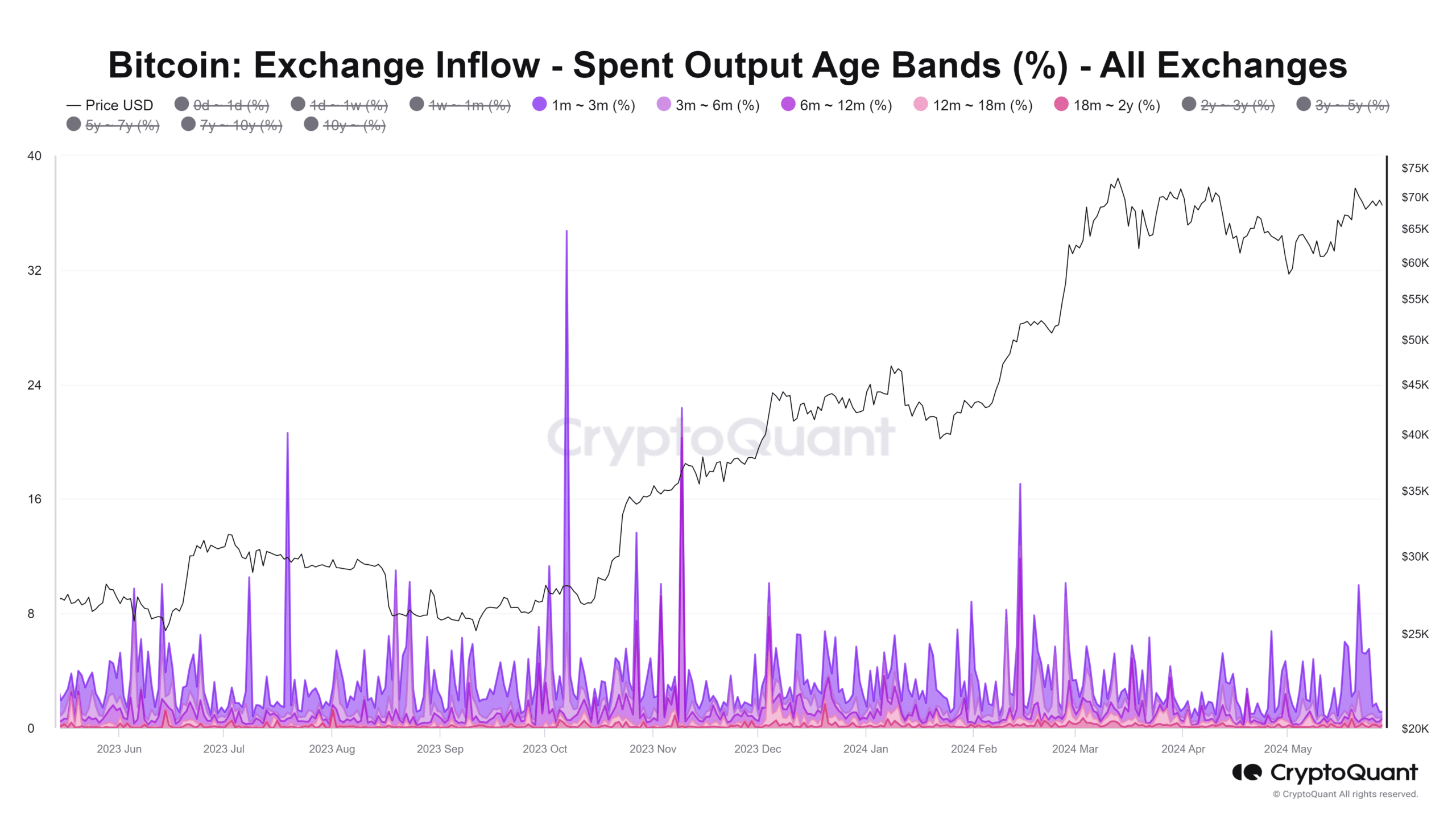

- Bitcoin aged 6 months and above noticed diminished exercise prior to now two months.

Bitcoin [BTC] has stalled after the latest breakout previous the $67k resistance. The bullish transfer final week reached $72k on the twenty first of Might however has receded by 5.7% to commerce at $67.8k at press time.

The demand for Bitcoin-backed funding merchandise was explored in a latest report, with a lot of the inflows coming from the USA.

The latest dip has reduce quick bullish sentiment, and it appeared that the bulls may not be prepared for a transfer previous $71.5k but.

Nonetheless, the long-term outlook stays bullish, and in accordance with one metric, we’re simply midway by a bull run.

Bitcoin’s bull run nonetheless has some gas left

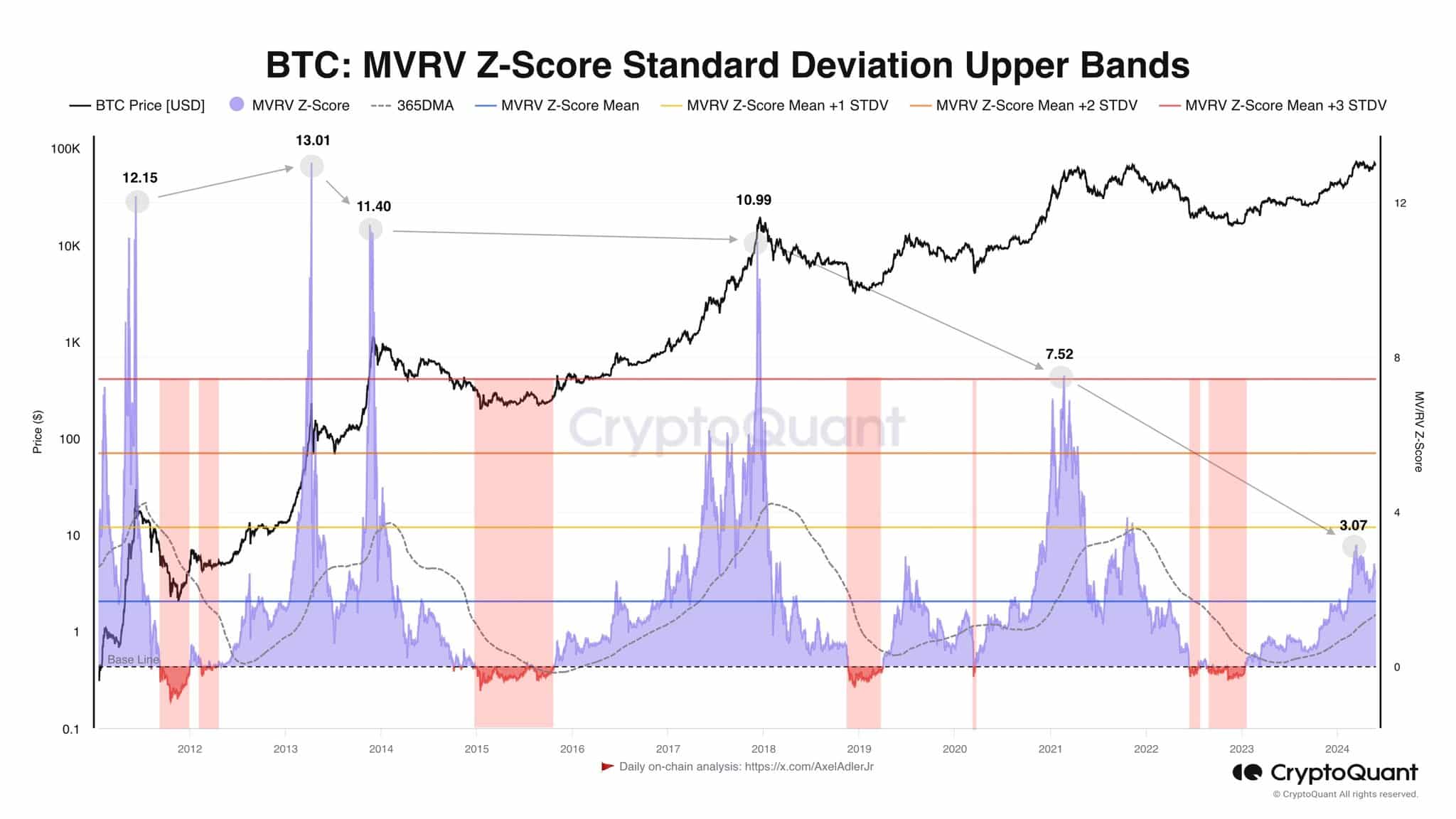

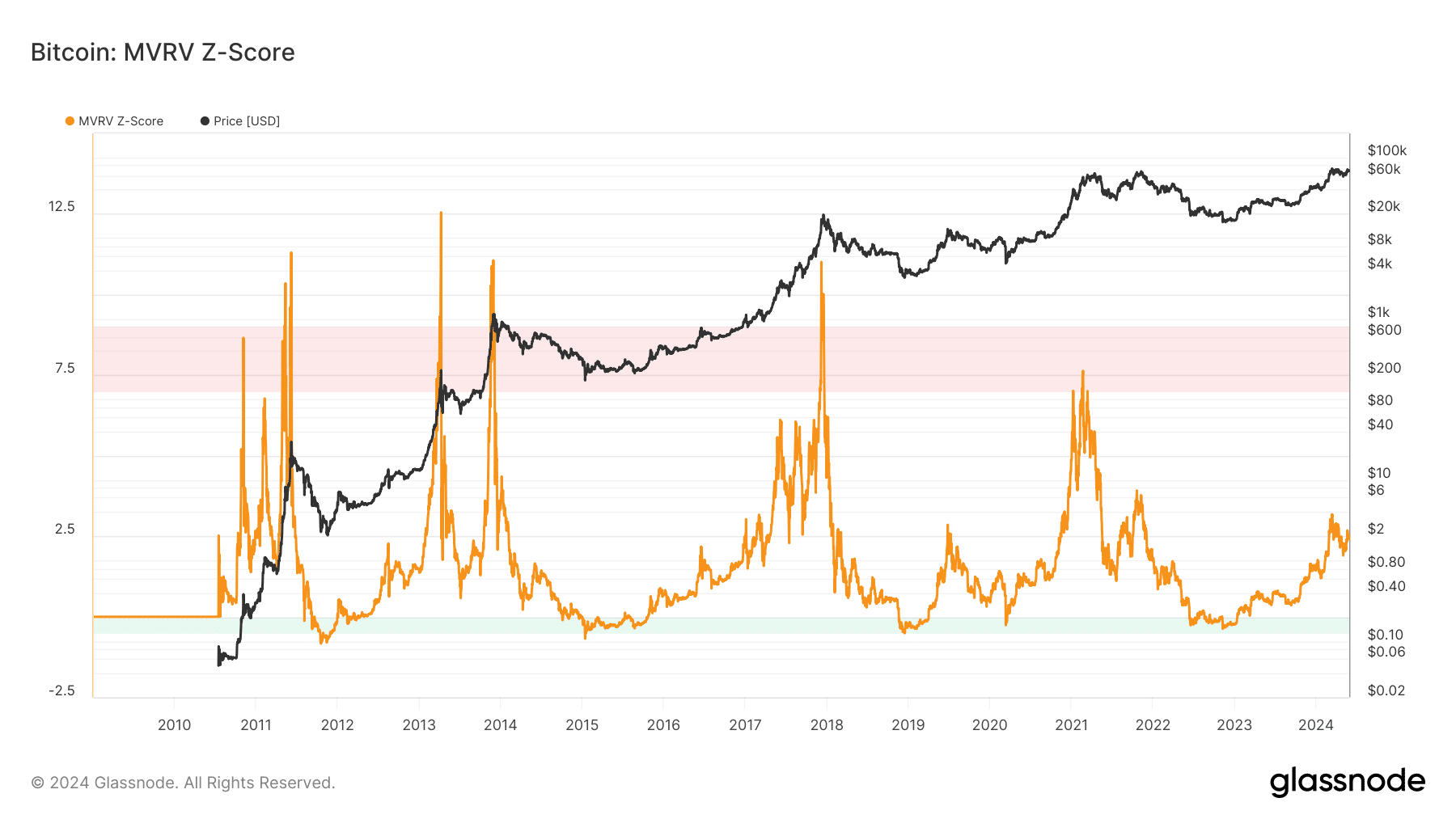

Crypto analyst Axel Adler used the Bitcoin MVRV Z scores for example that the present cycle is barely midway accomplished in a post on X (previously Twitter).

This metric evaluates whether or not Bitcoin is overvalued or undervalued by evaluating it with its honest worth.

MVRV stands for market worth to realized worth to match the asset’s market capitalization to the cumulative capital influx into the asset. When the previous is way larger, it alerts a possible high.

The MVRV Z-score compares the MVRV distinction with the usual deviation of the market cap of Bitcoin. Within the earlier cycles, an MVRV-Z rating of seven or above has marked the cycle tops.

This run noticed the metric climb as excessive as 3.07, which implies it’s extremely probably that we see additional value features within the coming months.

Lengthy-term holders have been diamond palms prior to now two months

The cohort of BTC holders aged six months and above noticed a flurry of exercise on the twenty eighth of February. The three-6 month age band was notably energetic and illustrated the profit-taking exercise from that group.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Equally, over the previous two months, it has been the 1-3 month-long holders who’ve been comparatively energetic available in the market and registered a spurt of promoting on the twenty first of Might when costs climbed above $70k.

Nonetheless, a lot of the older holder teams didn’t see intense promoting exercise to exchanges in April and Might. This was probably on account of expectations of a value rally publish halving, and this expectation has not worn out but.