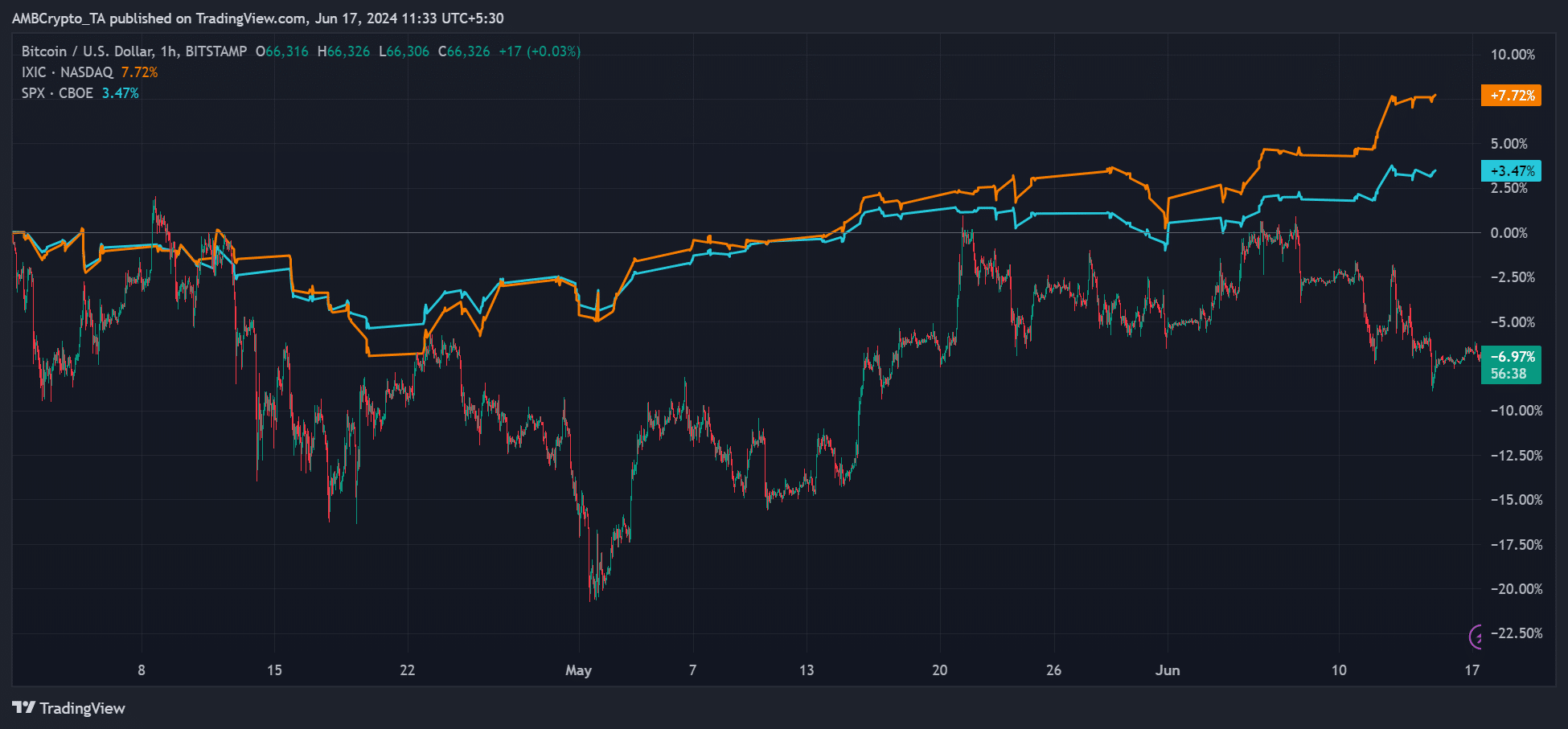

- US tech inventory, primarily based on the Nasdaq Composite, was up 7%, whereas BTC was down by 7% in Q2.

- Crypto fund hedge exec projected BTC may prolong the dismal efficiency into Q3.

Bitcoin [BTC] has underperformed US shares in Q2, and the development may prolong into Q3.

In line with Quinn Thompson, founder and CIO of crypto hedge fund Lekker Capital, BTC’s adverse correlation with main US tech shares may intensify within the subsequent few weeks.

‘I believe over the subsequent 4-6 weeks we get certainly one of these’

Supply: X/Quinn Thompson

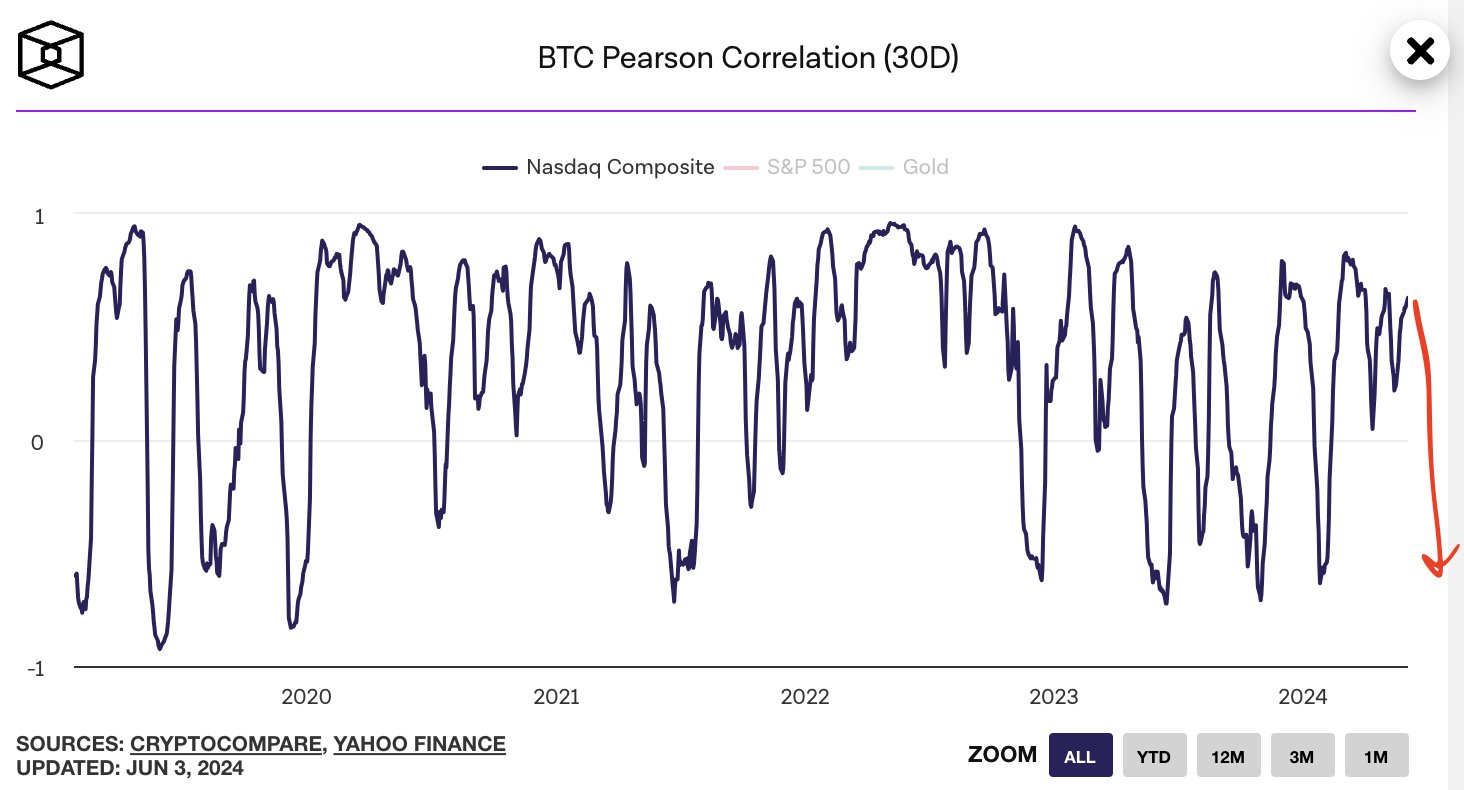

The Nasdaq Composite tracks main US tech shares. The correlation between the index and BTC is often tracked by the BTC Pearson Correlation.

Apparently, the Index has printed a brand new document excessive whereas BTC nosedived to $65K. Per Thompson, the correlation may retreat decrease (marked by the purple arrow) as a result of unfavourable macro situations primarily based on the Fed’s ‘hawkish’ stance.

Do you have to wager on US shares or BTC?

Total, BTC has been outperforming US shares previously seven years. The king coin maintained its win in Q1 2024, too, rising 67%.

Nonetheless, in Q2 2024, gold and US bonds have ‘crushed’ the most important digital asset.

Per current Bloomberg report, JPMorgan analysts had been ‘skeptical’ in regards to the present tempo of crypto inflows extending for the remainder of 2024.

As of press time, BTC was down practically 7% in Q2. Quite the opposite, the Nasdaq Composite (IXIC) and S&P 500 Index (SPX) had been up 7.7% and three.4%, respectively, TradingView information revealed.

Supply: BTC vs US inventory efficiency in Q2

So, per Thompson’s projection, additional decoupling between BTC and US tech shares may counsel that US tech shares may preserve their lead on the king coin within the subsequent month or so.

Nonetheless, on year-to-date (YTD) efficiency, BTC was up double digits in comparison with US indices’ single-digit positive factors.

Quinn Thompson had beforehand talked about that the current Fed stance may imply bother for BTC in Q3.

Nonetheless, Deribit Perception’s data prompt that the bearish sentiment post-FOMC improved following a clearer timeline for spot Ethereum ETF approval, tentatively by 2nd July.

If the improved sentiment is sustained into the brand new week, BTC may bounce from the press time worth of $66K.

Nonetheless, CrypNuevo, a BTC technical analyst, was much less satisfied of a short-term upside. He projected potential retesting of the range-low earlier than BTC eyes the $73.5K degree, which doubled as a serious liquidity cluster.