- Are stablecoin reserves holding again liquidity flows into Bitcoin?

- Bitcoin ETFs have grown considerably these days and might need influenced the crypto’s worth too

Stablecoins play a significant position throughout Bitcoin’s bull and bear markets. They’re the medium via which liquidity flows into BTC they usually additionally present a buffer for holding worth throughout bearish instances. Nevertheless, might stablecoin liquidity be holding again Bitcoin?

CryptoQuant founder Ki Younger Ju postulated in a current evaluation that stablecoins will not be able to driving bullish momentum. The statement assumed probably the most bullish state of affairs, accounting for each Bitcoin and stablecoin reserves. He mentioned,

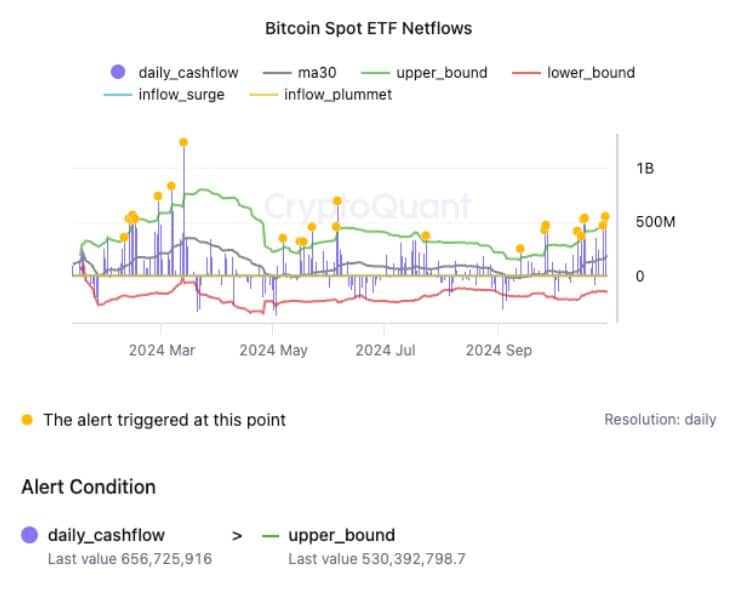

“Over the previous two weeks, we’ve noticed vital ETF inflows, led by BlackRock’s IBIT.

If spot ETF inflows would possibly decelerate in some unspecified time in the future, the BTC/USD buy-side strain from brokerage companies like Coinbase Prime would possibly weaken, doubtlessly main the market again into stagnation.…”

In line with the exec’s evaluation, Bitcoin reserves outpaced stablecoin reserves by greater than 6-fold. Which means the present stablecoin reserves will not be sufficient to match peak Bitcoin demand.

Bitcoin had a $1.38 trillion market cap, on the time of writing. Quite the opposite, the collective stablecoin market cap, at press time, was $172.887 billion.

Right here, it’s price noting that the latter grew from as little as $123.74 billion in September 2024 – Its lowest degree within the final 3 years.

Supply: DeFiLlama

Bitcoin ETFs have been driving demand

The evaluation additionally explored the position of ETFs in Bitcoin’s worth motion. It famous {that a} cooling down in Spot ETFs demand during the last 2 weeks was adopted by weak demand.

The evaluation additionally toyed with the concept Bitcoin’s worth motion risked stagnation if Spot EFT demand slows all the way down to excessive lows.

Supply: X

This remark coincided with the most recent worth motion and ETF flows. For instance, Bitcoin ETFs just lately skilled a slowdown in demand on the final day of October after beforehand reaching every week of optimistic flows.

The most recent ETF knowledge revealed that Bitcoin ETFs have concluded the week with web outflows. For instance, ETFs recorded $54.9 million in outflows on Friday. In the meantime, BTC has been struggling to get well again above $70,000 – Confirming a slowdown in demand.

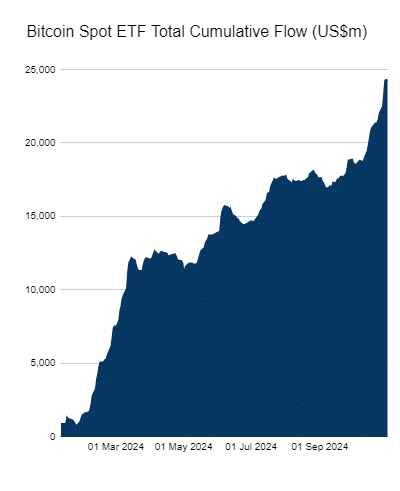

However, Bitcoin ETFs were up by 62% from their approval date earlier this 12 months. Right here’s a have a look at how the ETF flows have carried out to this point –

Supply: Farside.co.ke

On the time of writing, Bitcoin ETFs held over $24.4 billion. This spectacular development is an indication of the rising demand from the institutional class.

In the meantime, the most recent outflows are seemingly related to the uncertainty across the election interval. Will probably be fascinating to see how issues play out after the elections.

Additionally, institutional buyers have been responding to the resurgence of world liquidity, one thing that underscores doubtlessly good tidings for holder. It is because decrease rates of interest have been paving the way in which for a risk-on sentiment.