- Bitcoin skilled a big decline over the previous month.

- The declining short-term Sharpe ratio left analysts eyeing a rebound.

Bitcoin [BTC], the biggest cryptocurrency by market cap, has skilled a sustained decline over the previous 30 days. Nonetheless, the final 24 hours have seen the crypto make reasonable good points.

As of this writing, it was buying and selling at $58,820 after a 1.10% enhance over the previous day.

Previous to this, the king coin was in a declining development, dropping by 6.32% over the previous seven days. Equally, it has declined by 4.37% over the previous month.

Regardless of the latest good points on each day charts, BTC remained 20% under its ATH of $73737 recorded earlier this yr.

Regardless of the latest poor efficiency, key stakeholders together with analysts remained optimistic in regards to the crypto’s course.

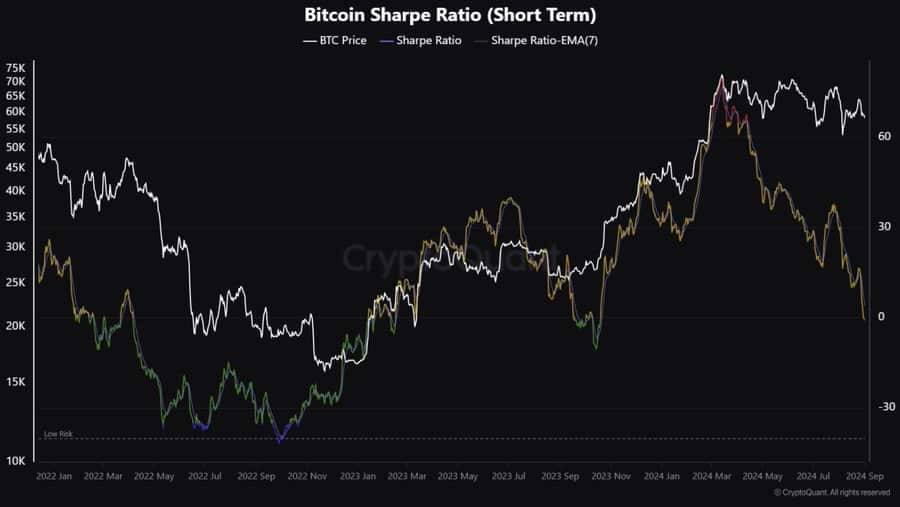

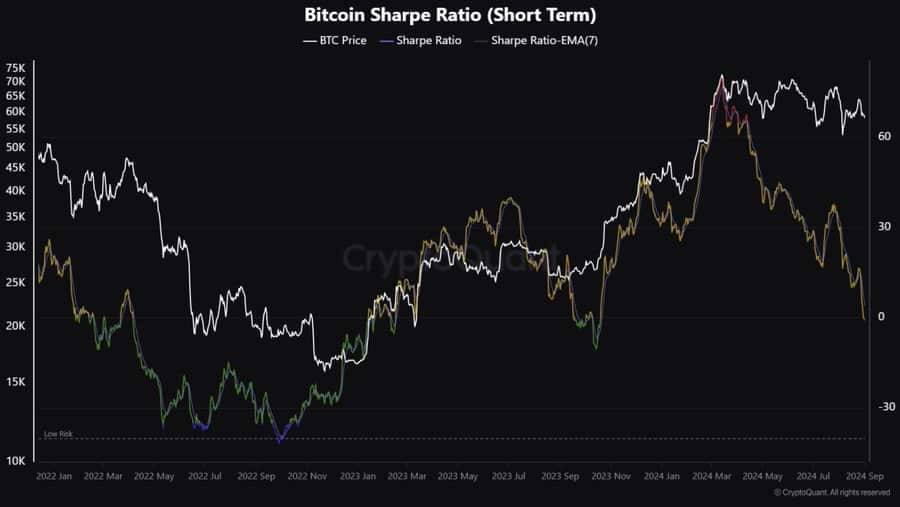

For example, CryptoQuant analyst Kripto Mevsimi eyed a rebound from the recorded draw back, citing short-term Sharpe ratios.

Market sentiment

In his evaluation, Mevsimi cited the 2023 cycle, arguing that the present short-term Sharpe ratio mirrored the earlier yr’s cycle.

Supply: X

In the course of the earlier cycle, when the short-term Sharpe ratio declined, BTC costs surged from a low of $26675 to a excessive of $35137.

Based mostly on this historic efficiency, those that are bullish view it as a attainable rebound sign.

Nonetheless, the analyst supplied a opposite view for bearish buyers, positing {that a} bearish interpretation could point out a sustained volatility.

In totality, a declining short-term Sharpe ratio implied elevated volatility with out a proportional enhance in funding returns, thus making investments much less enticing.

If the evaluation is solely based mostly on the historic cycle in relation to the short-term Sharpe ratio, BTC may rebound.

Accordingly, this bullish evaluation is additional strengthened by Santiment’s evaluation, which posited that BTC was performing effectively with out counting on S&P 500, suggesting independence from equities.

Supply: Santiment

What BTC’s charts recommend

This evaluation supplied a optimistic outlook for future value motion. Due to this fact, it’s important to know what different indicators recommend.

Supply: CryptoQuant

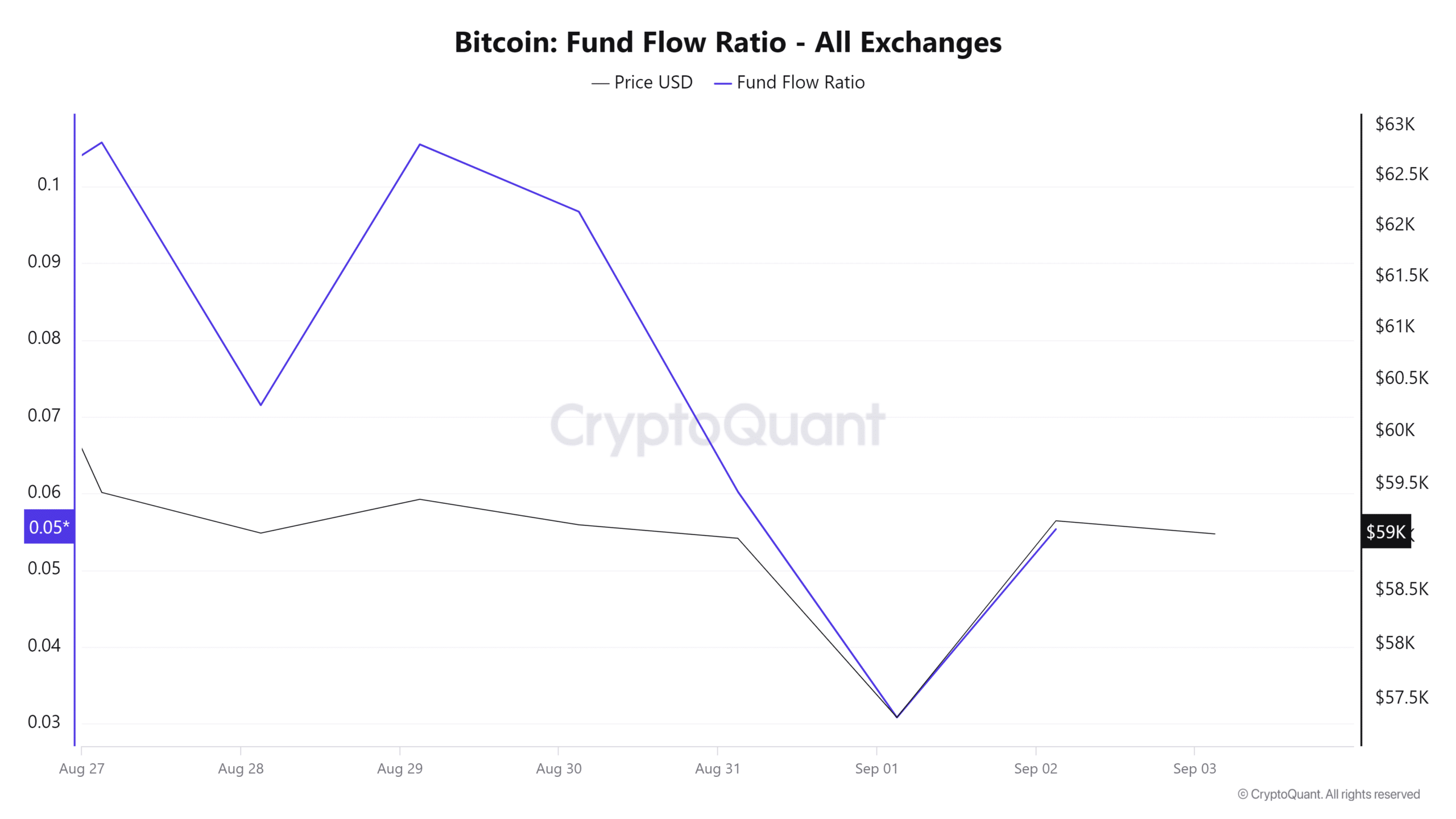

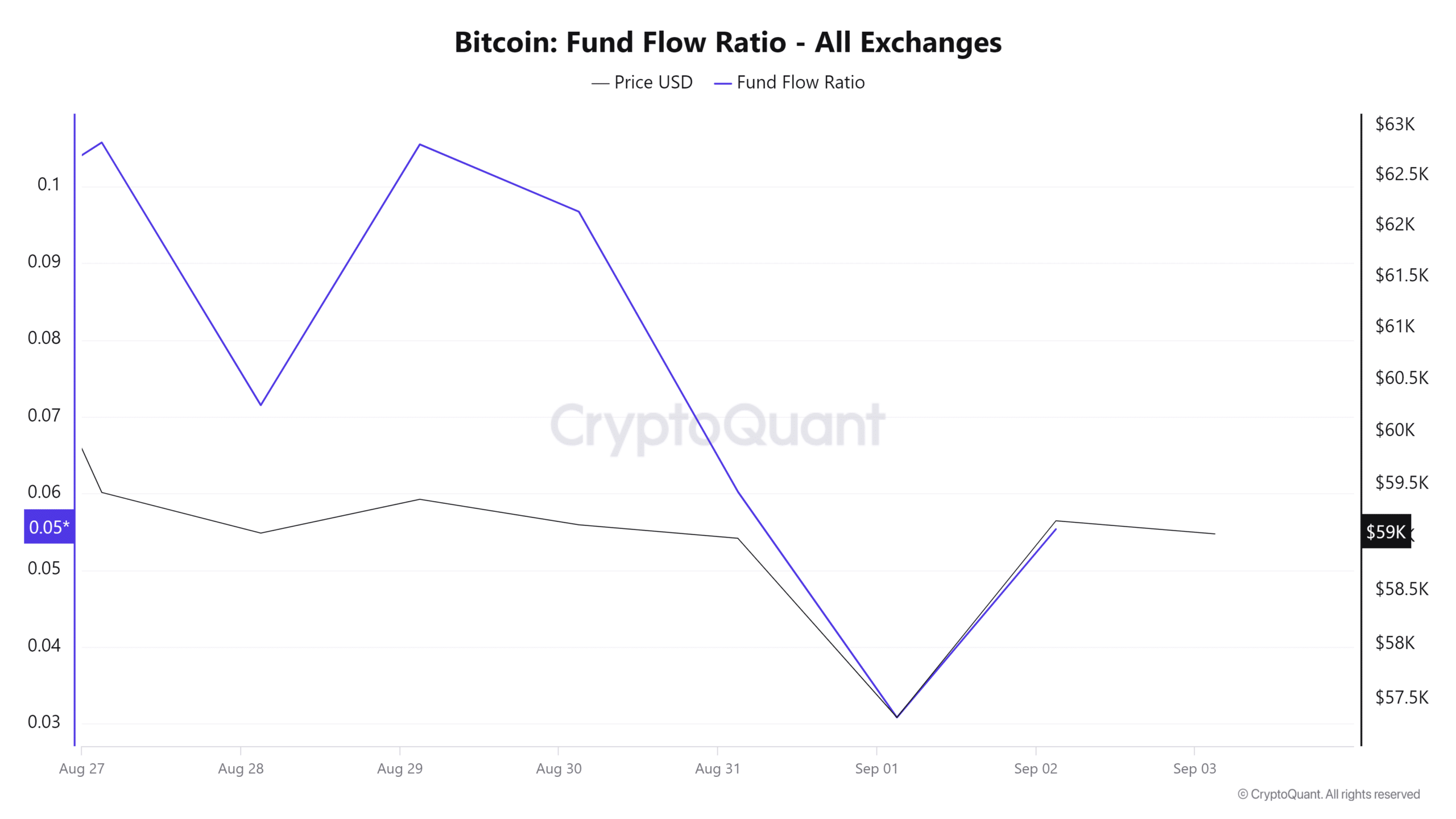

For starters, Bitcoin’s Fund Circulate Ratio declined over the previous seven days. A decline within the fund stream ratio implied that buyers had been selecting to HODL their property reasonably than promote.

This signaled long-term confidence, with buyers holding their funds in chilly storage reasonably than exchanges. Such market conduct ends in accumulation in anticipation of the long run value enhance.

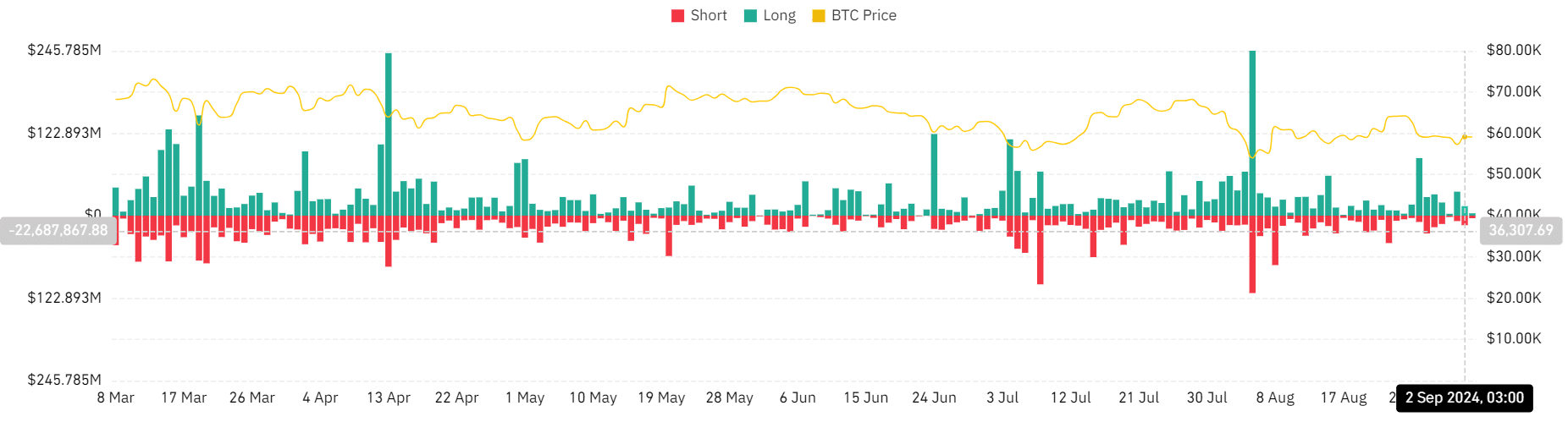

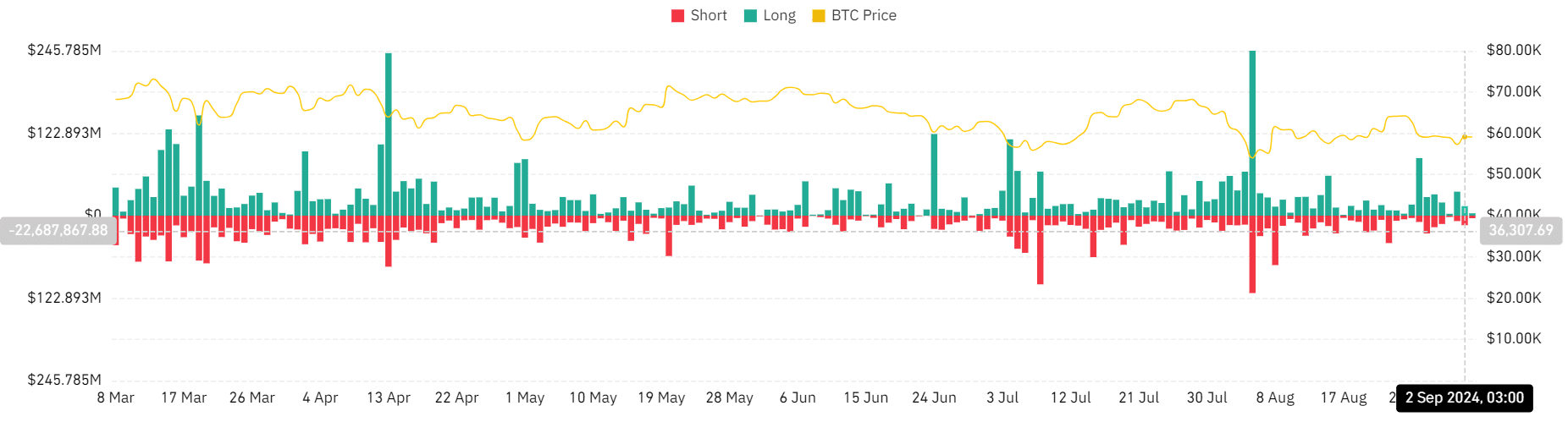

Supply: Coinglass

Moreover, BTC’s liquidation has lowered over the previous three days. Lengthy place has declined from $35.7 million to $3.4 million at press time.

This confirmed investor confidence in long-term value will increase, as they had been prepared to pay a premium to carry these positions.

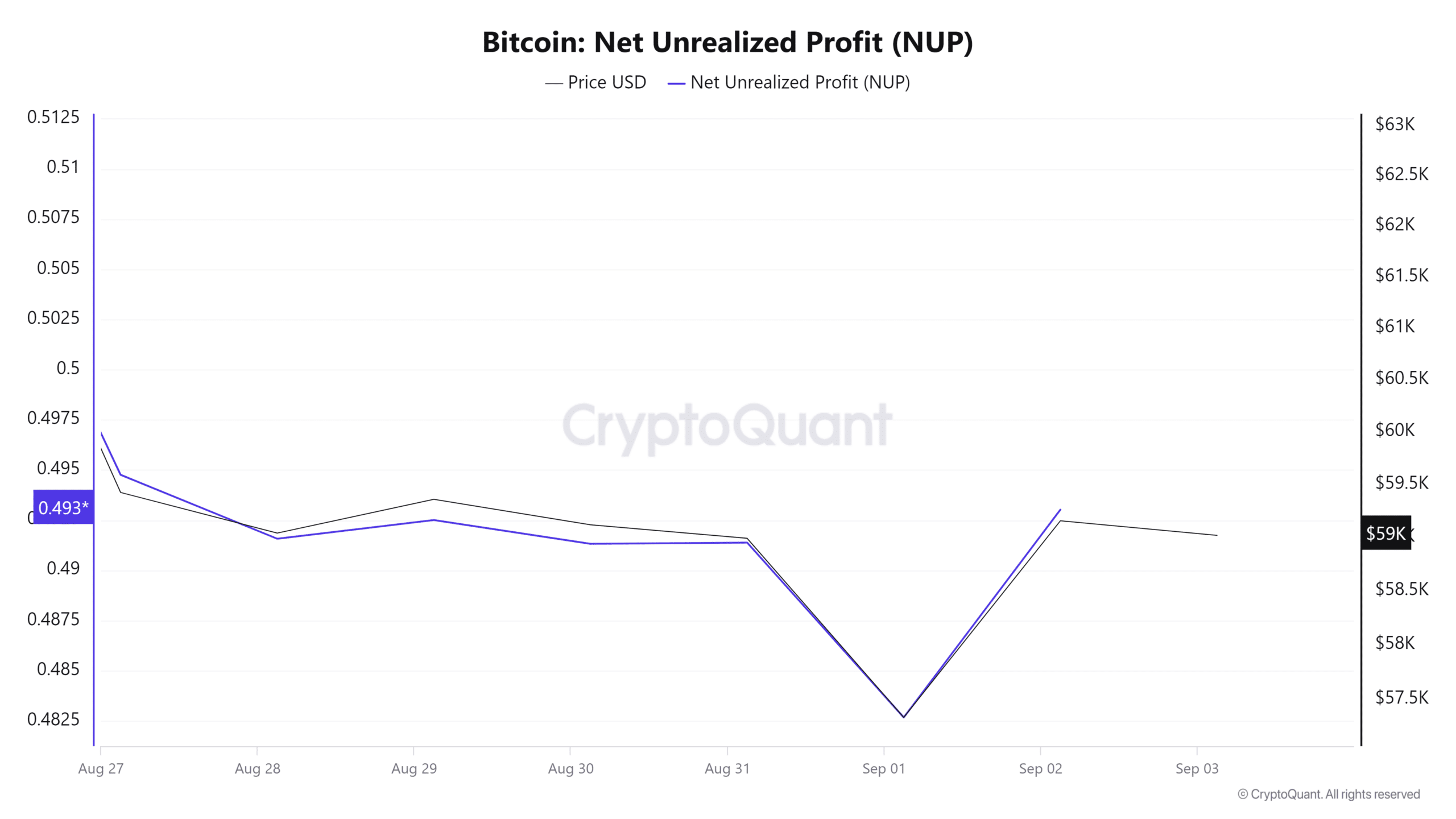

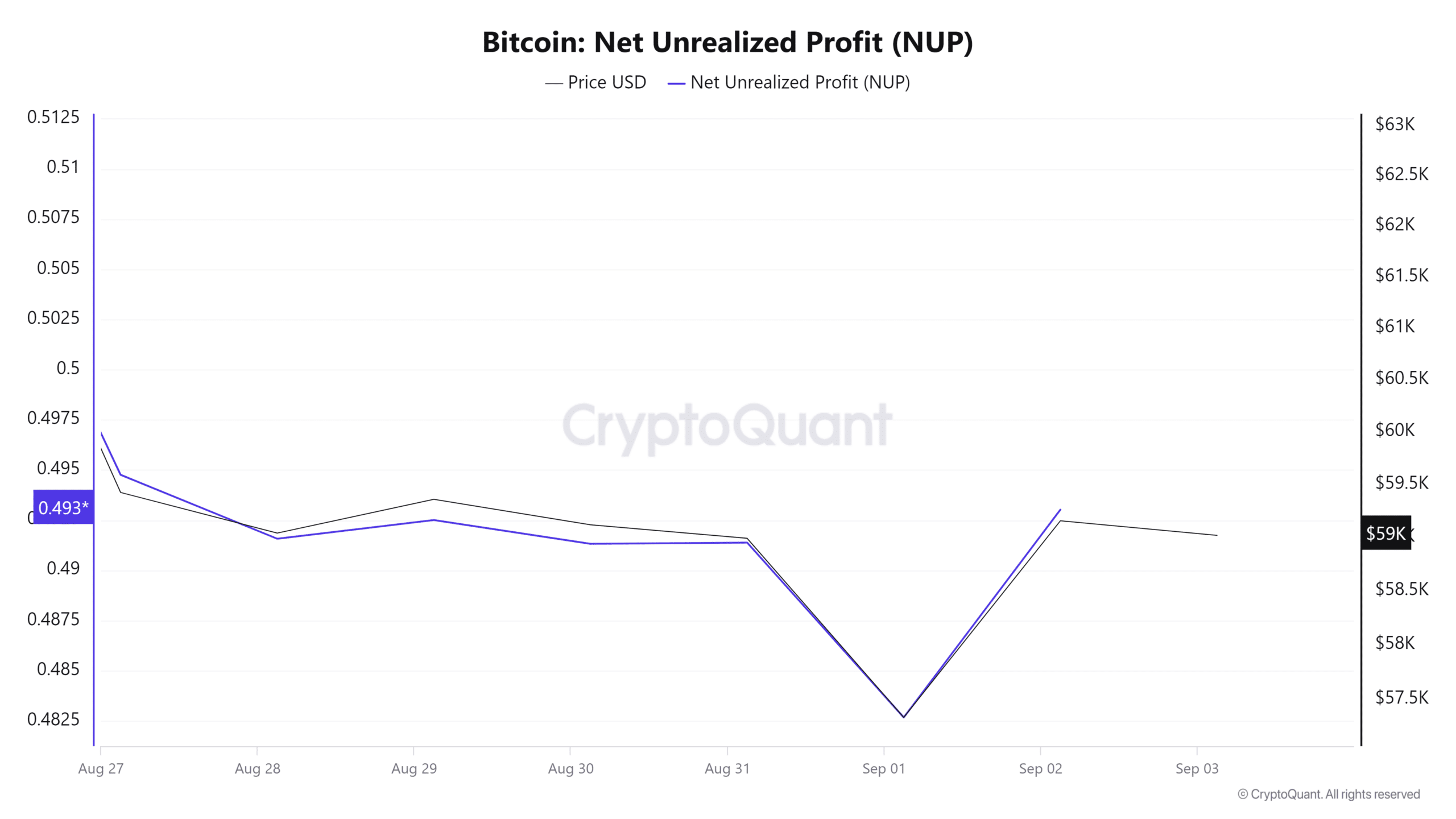

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Lastly, BTC’s web unrealized revenue was at 0.49, indicating that the prevailing market sentiment was optimistic. At this charge, though there was some profit-taking, it was unlikely to lead to a significant correction.

Due to this fact, if the prevailing market sentiment holds, BTC is effectively positioned to interrupt out of the cussed resistance degree round $60k and problem the $64,752 resistance degree.