- Bitcoin’s market cycle backside ROI has hit a brand new low, signaling the beginning of a bullish cycle.

- There was large liquidation above $72K, as MicroStrategy accomplished a inventory break up.

The return on funding (ROI) from the underside of the final Bitcoin [BTC] market cycle has hit a brand new low. Alongside, the share of Bitcoin in revenue additionally dropped to its lowest since October 2023.

As costs surpassed $54K, 71% of holders had been in revenue. The final time this occurred, Bitcoin was priced at $28K.

So, the market has cooled off from overheated ranges to yearly lows, however at double the earlier worth. This section within the Bitcoin market cycle aligns with typical patterns seen in previous cycles.

Understanding the present cycle may also help traders make higher choices as historical past suggests we’re on observe, staying knowledgeable and adaptable is essential because the market adjustments.

Supply: IntoTheCryptoVerse

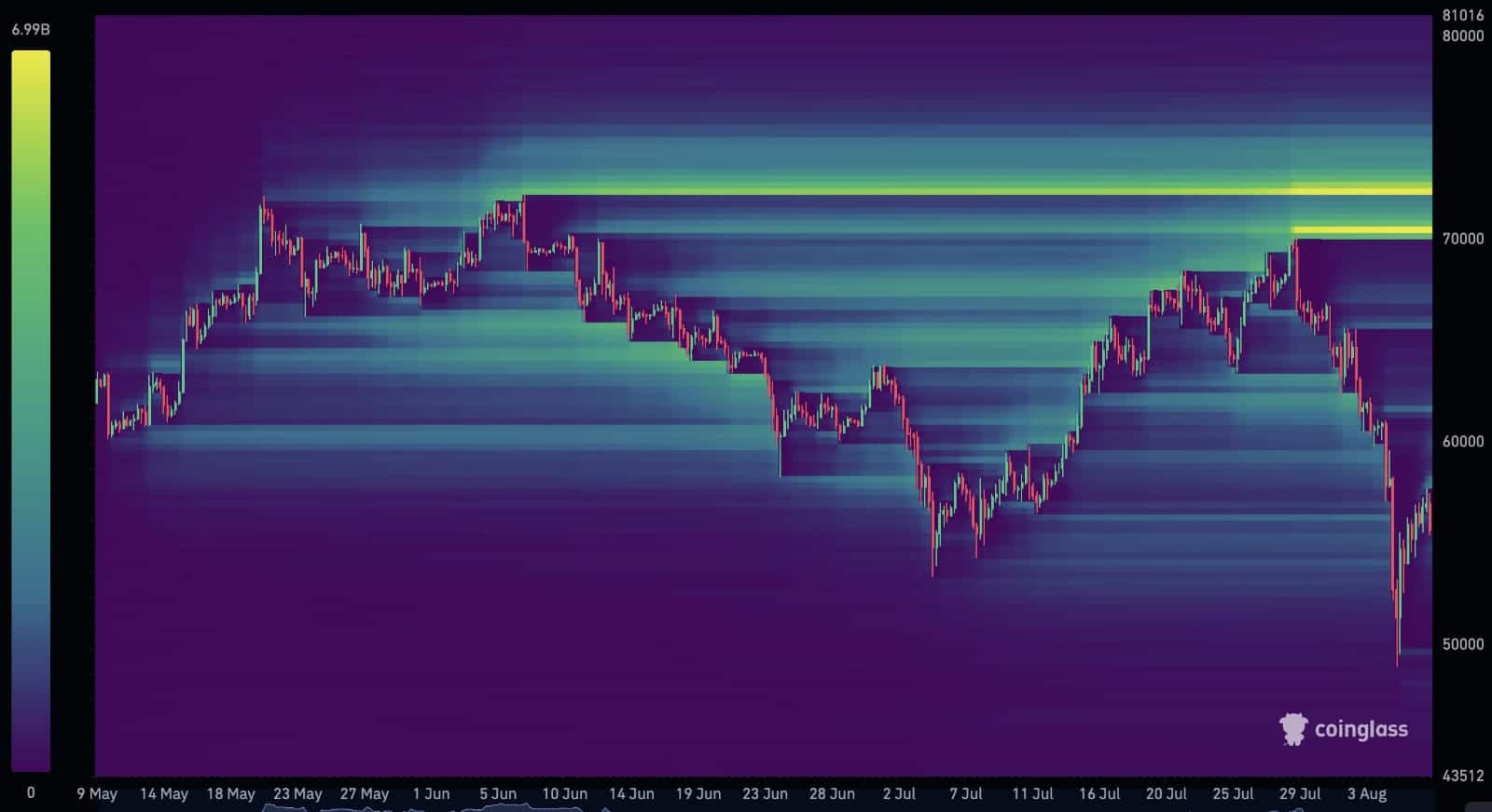

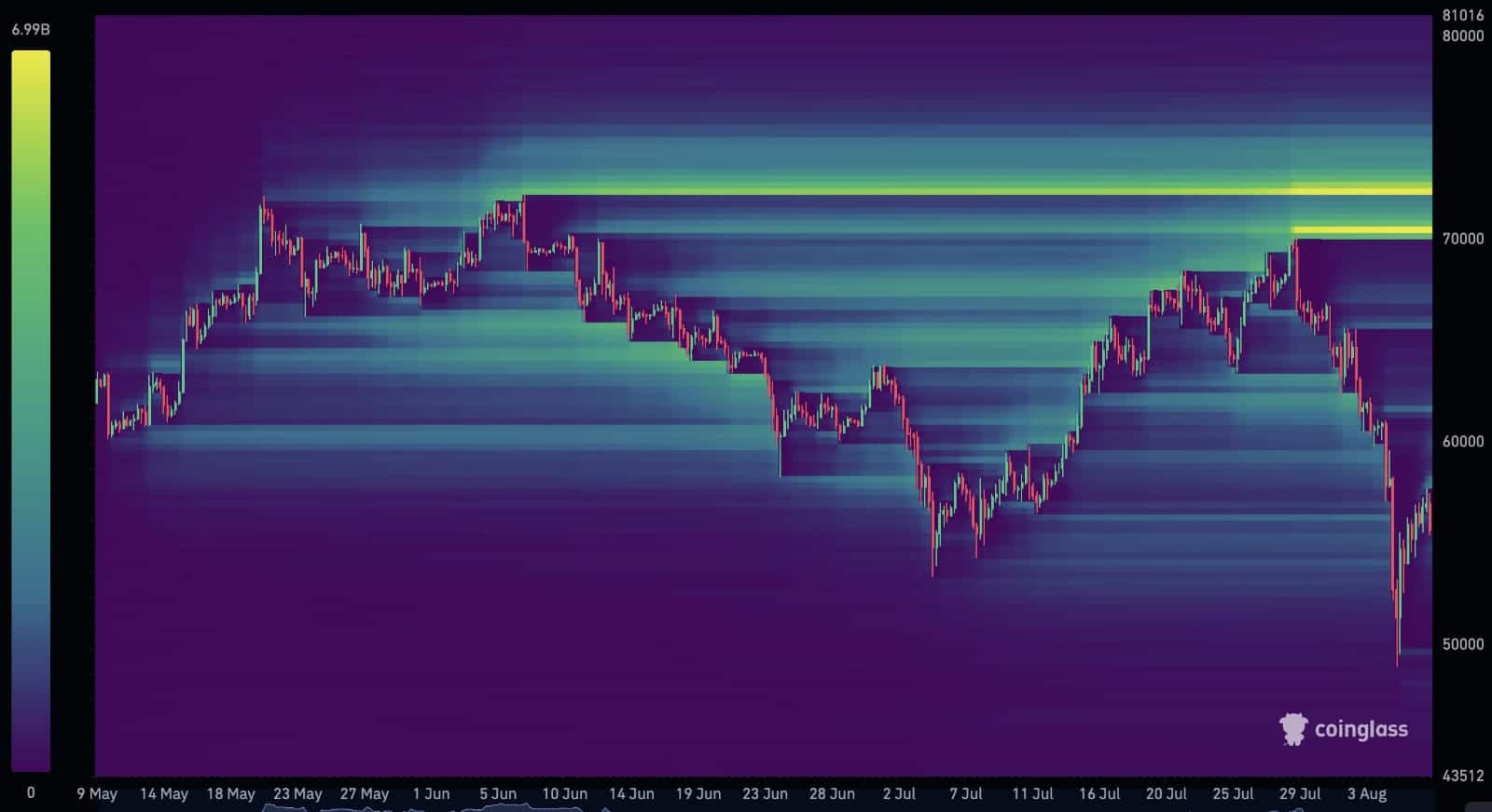

Huge liquidation resting above $72K

Over $15 billion in Bitcoin brief positions are set to be liquidated between $70K and $72K, in accordance with AMBcrypto’s have a look at Coinglass knowledge.

This implies that the following Bitcoin market cycle might start quickly, as the worth approaches the essential $72K resistance stage.

Merchants and traders ought to monitor this metric intently, because it might affect choices on their long-term view of Bitcoin, which appeared bullish at press time.

Supply: Coinglass

Bitcoin bull flag nonetheless holding

Bitcoin’s bull flag sample remained intact at press time. The longer it holds, the extra doubtless a big breakout turns into. If the sample continues to consolidate, we might see a serious worth surge.

That is an thrilling time for these following Bitcoin. The most effective-case state of affairs on this state of affairs can be for Bitcoin to interrupt by way of the $72K mark, signaling robust upward momentum.

Supply: TradingView

MicroStrategy completes inventory break up

Furthermore, MicroStrategy lately accomplished a 1:10 inventory break up, making its shares 10 occasions extra accessible to traders X (previously Twitter) person and market analyst Crypto Rover noted.

The corporate plans to promote as much as $2 Billion in shares to speculate extra in Bitcoin and assist its operations.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

This transfer might be an awesome alternative to diversify your portfolio. Whereas a inventory break up doesn’t change the corporate’s basic worth, it might probably make the inventory really feel extra reasonably priced.

The market’s current rebound has boosted shares of Coinbase and MicroStrategy, with will increase of seven.5% and 9%, respectively.

Supply: Crypto Rover on X