Binance Analysis, the analytical arm of the world’s main cryptocurrency alternate, performs a vital function in dissecting the tendencies and potential futures of blockchain and decentralized finance (DeFi). Their latest report, “Breakthrough DeFi Markets,” takes a deep dive into the present state and evolving dynamics of the DeFi panorama, showcasing the speedy development and revolutionary platforms shaping the way forward for the sector.

DeFi TVL soars 75% in 2024

DeFi TVL is up 75.1% in 2024

DeFi has witnessed important capital inflows in 2024, resulting in a 75.1% improve in complete worth (TVL), which now stands at $94.9 billion. This development advantages nearly each sector inside DeFi, from stablecoins to on-chain derivatives. The rate of interest markets have seen extraordinary growth, rising 148.6% to a TVL of $9.1 billion. Pendle, recognized for its on-chain rate of interest derivatives, reveals this improve with a staggering 1962% improve in TVL, which now stands at $4.8 billion.

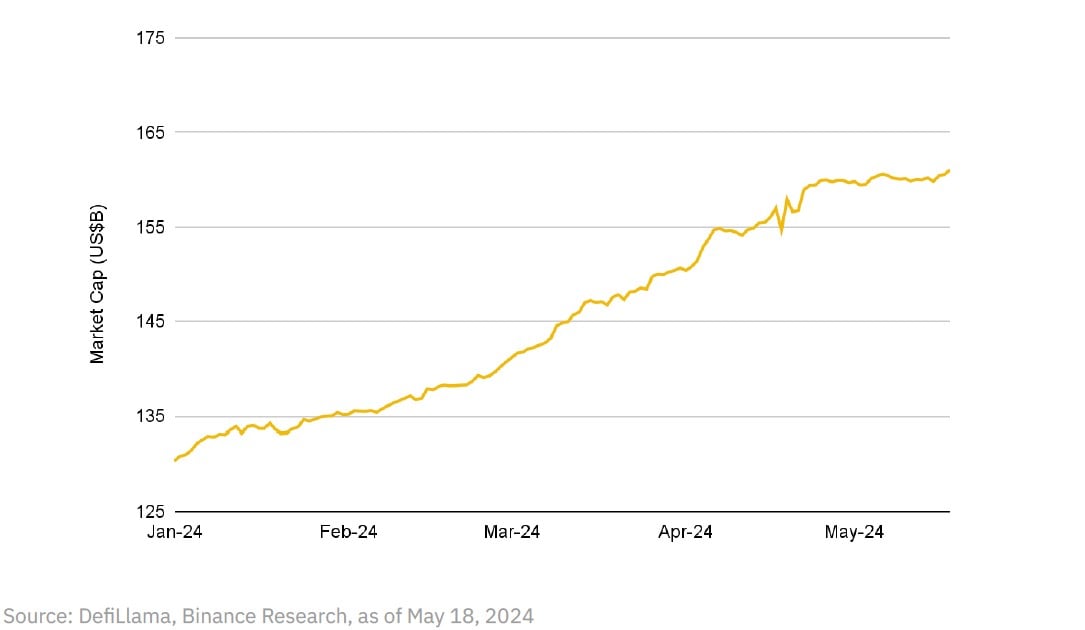

The market capitalization of stablecoins continues to rise

Stablecoins are among the many DeFi use circumstances which have achieved significant product-market match and are proving to be efficient monetary devices in each DeFi and CeFi. The stablecoin market capitalization has risen to $161.1 billion, the very best in two years, pushed by the present excessive rate of interest surroundings that has made the stablecoin enterprise very engaging.

The stablecoin market is dominated by centralized entities akin to Tether’s USDT and Circle’s USDC, which account for 90% of the market share. This dominance creates excessive limitations to entry for brand new gamers and illustrates that the stablecoin sector is way from completely aggressive. Whereas the curiosity generated by stablecoins like Tether doesn’t profit holders, demand for decentralized and yield-bearing stablecoins is growing, pushed by the provision of upper risk-free rates of interest.

The options supported by RWAs and CDPs have confronted challenges akin to capital inefficiency and scalability points. together with his USDe he steps in to fill this hole with a brand new method, providing a yield-bearing stablecoin that avoids these pitfalls. If the value continues to rise, it may problem the 2 centralized stablecoins.

Cash market protocols have seen outstanding development in TVL

Cash market protocols have proven outstanding development, as evidenced by the rise in Whole Worth Locked (TVL), which has proven a formidable improve of 47.2% in 2024, reaching a outstanding $32.7 billion. This sector is principally dominated by main gamers akin to , , and revolutionary platforms akin to SparkLend from MakerDAO. These key protocols have considerably formed the panorama by integrating synergistic merchandise that improve person engagement and monetary liquidity. The dynamics throughout the cash market sector are shifting, with growing demand for the usage of a wider vary of long-tail property as collateral.

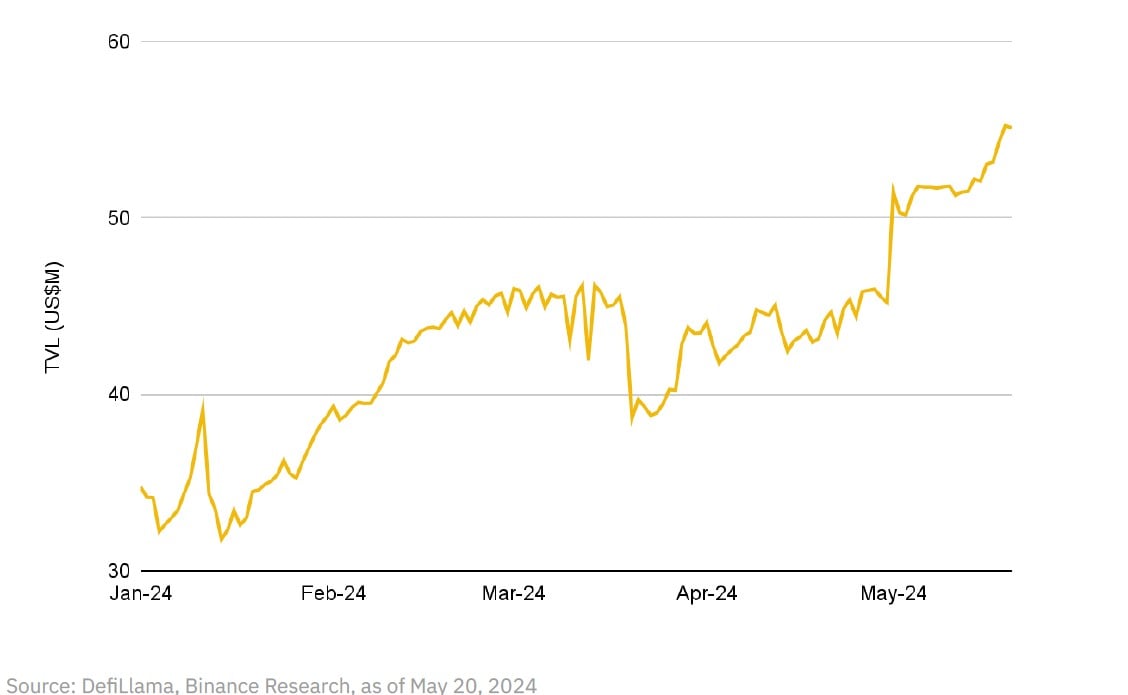

Prediction markets have reached an all-time excessive in TVL

The prediction markets, whereas smaller in dimension in comparison with the beforehand talked about markets, have reached a file $55.1 million in TVL. The expansion on this sector is principally pushed by the rise in actions surrounding the upcoming American elections. This uptick alerts a rising curiosity in utilizing blockchain for betting on real-world occasions, predicting and speculating on the end result of future occasions.

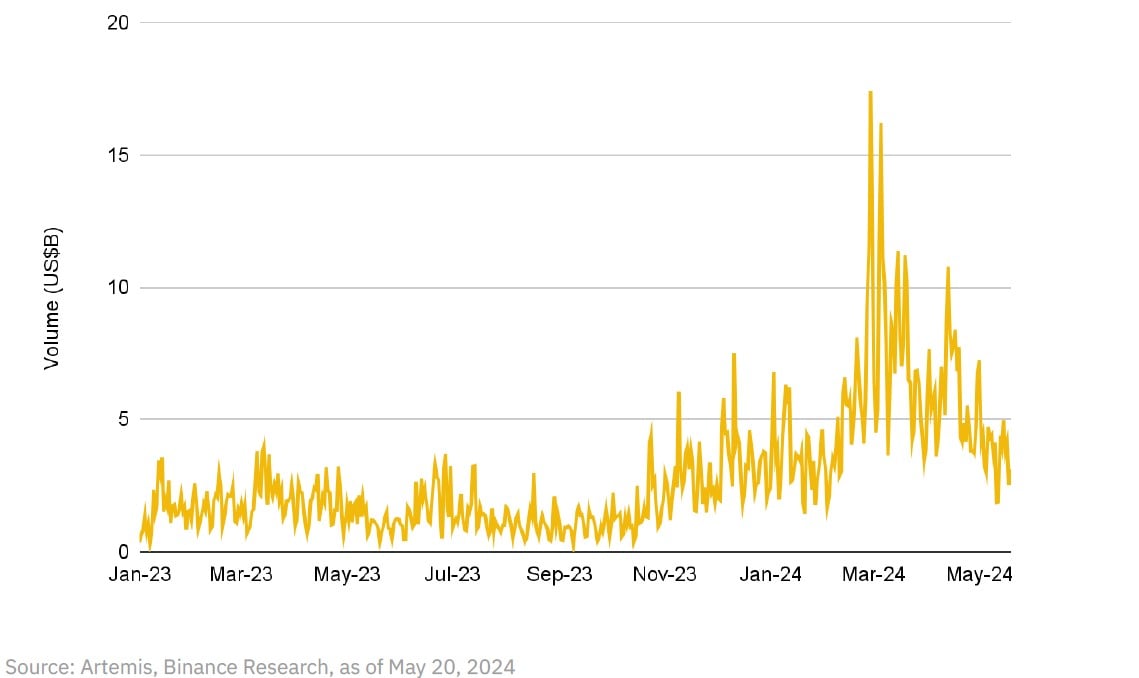

Derivatives market is exhibiting important revival

Exercise within the discipline of on-chain derivatives has additionally elevated noticeably. Common day by day volumes have elevated from $1.8 billion final 12 months to $5.4 billion this 12 months. Amongst different issues, Hyperliquid has emerged as a serious participant, capturing 18.9% of the market share and changing into the second largest by way of buying and selling quantity, after dYdX. This highlights the evolving sophistication and utility of derivatives within the DeFi house, offering individuals with extra advanced monetary and danger administration instruments.

To dam

Binance Analysis’s ‘Breakthrough DeFi Markets’ report presents an optimistic view of the way forward for decentralized finance. It underlines the trade’s sturdy development trajectory and the continued innovation driving it ahead. DeFi will develop its affect into extra mainstream monetary functions, probably remodeling the worldwide monetary panorama.