- Binance founder faces a 36-month jail time period, spotlighting illicit actions within the crypto house.

- Authorized actions towards Binance and earlier FTX elevate questions on crypto adoption.

Amidst ongoing authorized battles, Changpeng Zhao, the founding father of Binance [BNB], finds himself at a essential juncture.

Scheduled for sentencing on the thirtieth of April in a Seattle courtroom, Zhao faces a pivotal second as U.S. prosecutors pursue a 36-month jail time period.

What’s the difficulty?

The allegations revolve round his alleged failure to forestall in depth cash laundering on the Binance platform, marking a big improvement within the dialogue surrounding him.

In response to the Justice Division in a sentencing memorandum filed final week, the prosecutors stated,

“Zhao’s willful violation of U.S. legislation was no accident or oversight.”

They added,

“He made a enterprise resolution that violating U.S. legislation was one of the simplest ways to draw customers, construct his firm, and line his pockets.”

This highlighted Zhao’s wilful neglect to determine an efficient anti-money laundering program mandated by the Financial institution Secrecy Act.

In actual fact, the choice for a three-year jail time period, exceeding the really useful 18 months, underscores the gravity of Zhao’s purported offenses and the crucial for strict adherence to the legislation.

Grounds of allegations

Zhao allegedly facilitated Binance in processing transactions tied to illicit actions, together with these involving People and sanctioned people.

Prosecutors attribute unreported suspicious transactions and poor controls to Zhao’s management. They’ve additionally underlined the involvement of some designated terrorist teams like Hamas and al-Qaida.

In response to the allegations, final 12 months in November, Zhao stepped down as CEO of Binance, and only recently, he admitted his breach of the Financial institution Secrecy Act.

In a letter to the overseeing decide, he expressed regret for failing to implement satisfactory compliance controls at Binance, acknowledging that there was “no excuse” for his actions.

“I apologise for my poor selections and settle for full accountability for my actions. In hindsight, I ought to have targeted on implementing compliance adjustments at Binance from the get-go, and I didn’t. There isn’t any excuse for my failure to determine the mandatory compliance controls at Binance.”

Curiously, Binance’s founder had as soon as informed his group, that it’s “higher to say sorry than permission” in issues of authorized compliance.

This assertion provides intrigue as observers await Zhao’s response, whereas prosecutors stay agency of their stance.

Different situations of money-laundering

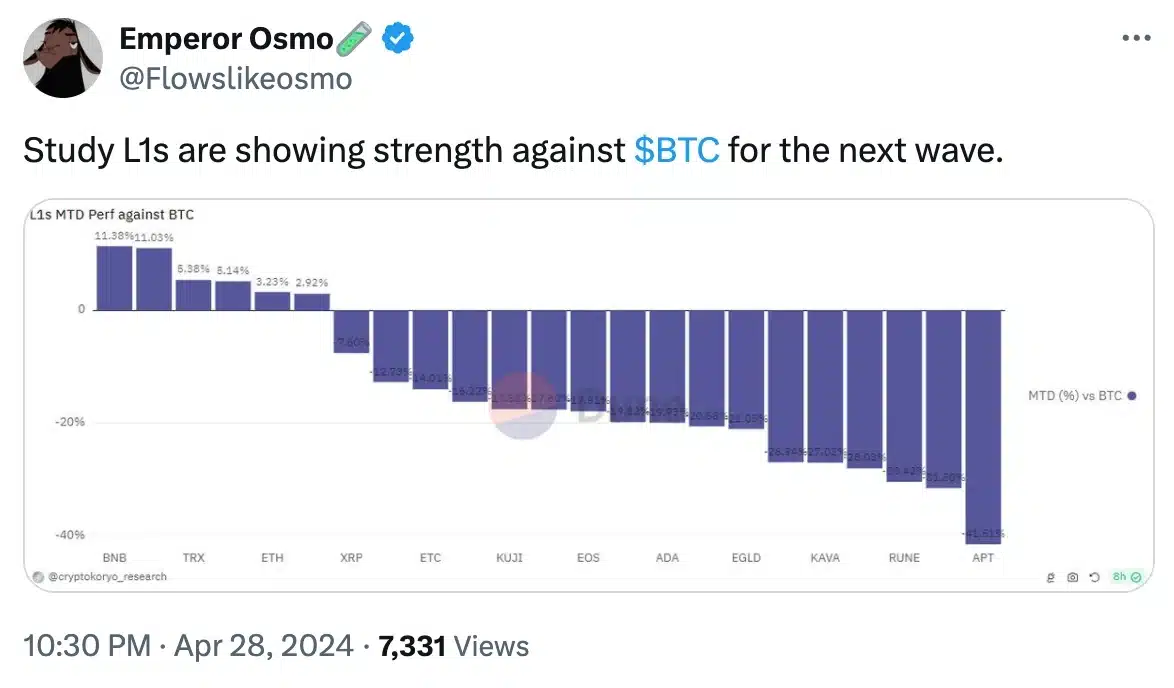

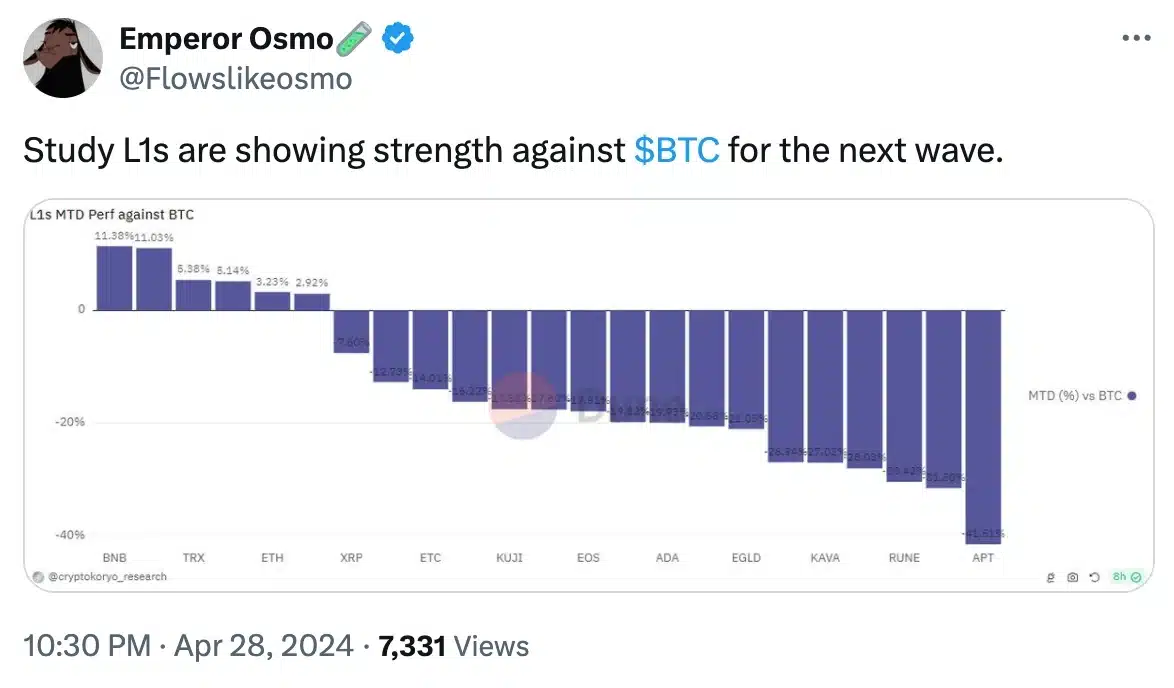

Regardless of Binance’s latest challenges, the efficiency of its BNB token and different L1s towards BTC remained sturdy, as famous by a crypto researcher, Emperor Osmo,

Supply: Emperor Osmo/Twitter

Nicely, Binance is just not the primary one to bear such allegations. Lately, Nigeria has made headlines by in search of to prosecute Binance and two of its executives on expenses of cash laundering and tax evasion.

Moreover, FTX too confronted a downfall in 2022, resulting in Bankman-Fried’s conviction for fraud and a 25-year jail sentence.

This underscores the regulatory hurdles confronting main gamers in crypto.