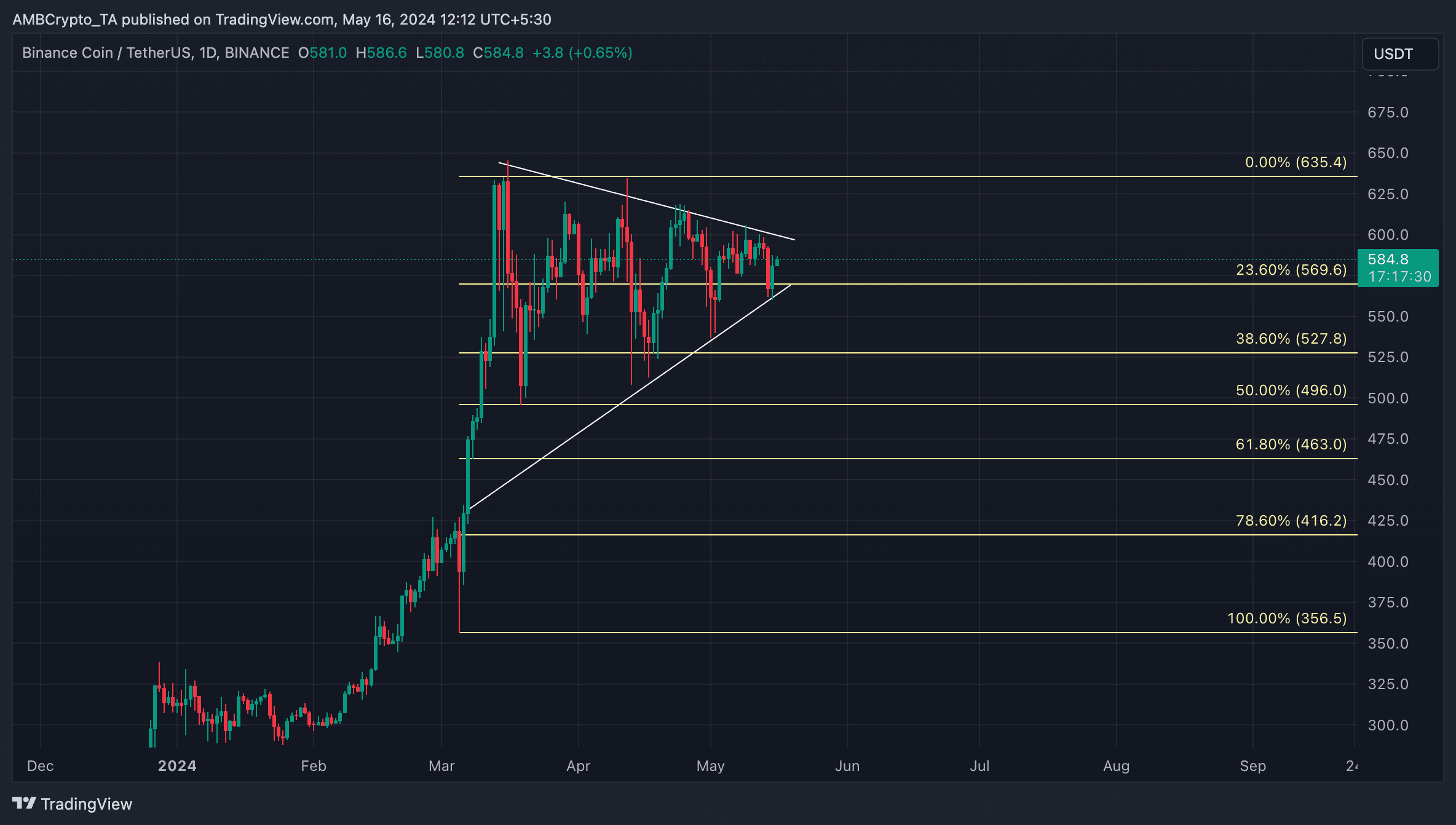

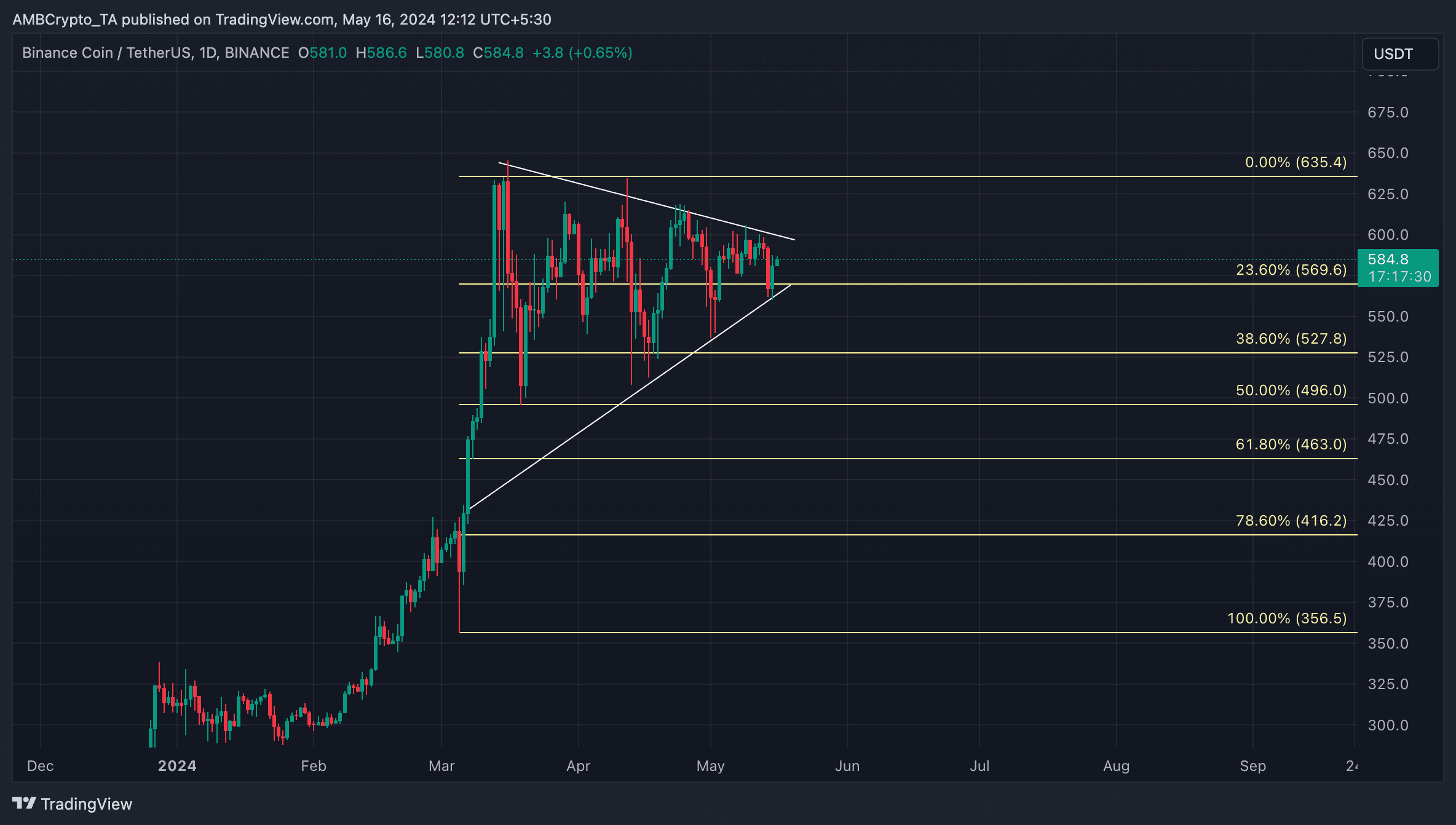

- BNB was buying and selling above the help line of its symmetrical triangle sample

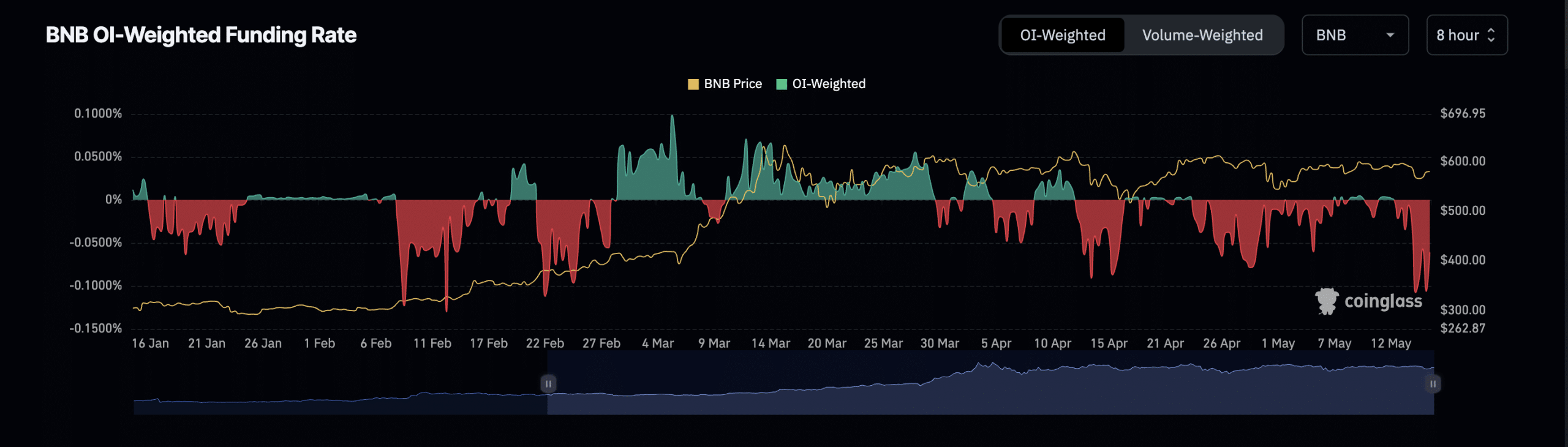

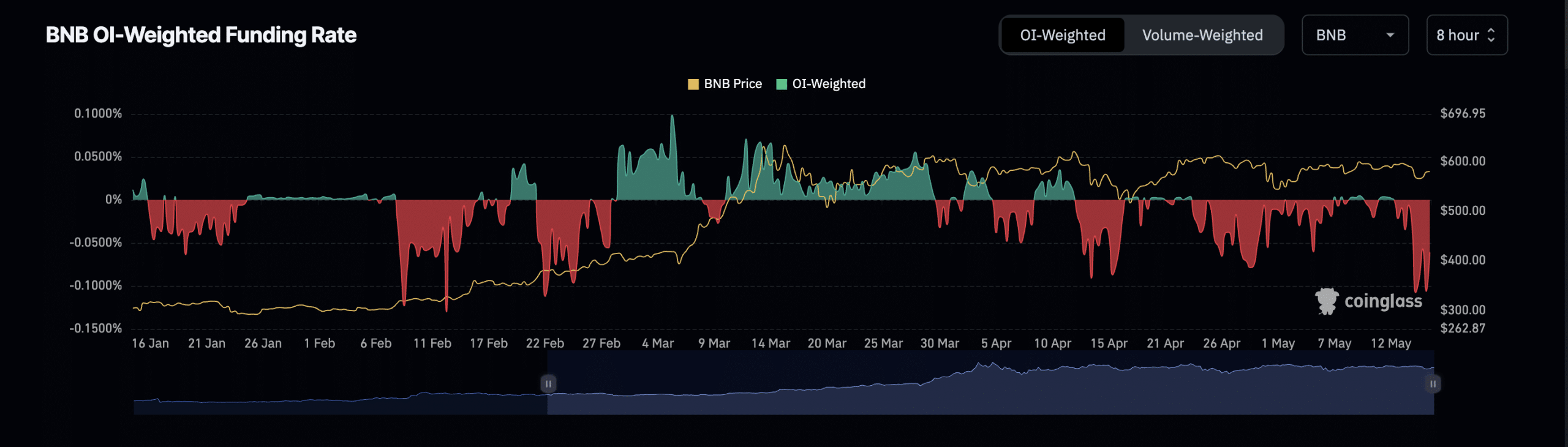

- BNB stays liable to a decline as its funding charge was destructive

The latest market rally has triggered Binance Coin [BNB] to rebound sharply off the help line of its symmetrical triangle sample.

This sample is fashioned when an asset’s worth hits numerous decrease highs and better lows. It signifies that the asset’s worth retains getting squeezed between patrons and sellers, with patrons pushing costs as much as meet the resistance and sellers pushing them down to search out help.

When this occurs, the asset involved is alleged to be consolidating inside a spread.

Will it rally in direction of its resistance?

At press time, BNB was valued at $583.84 following a 3% uptick from its help stage of $566. To evaluate whether or not the altcoin can rally in direction of the higher development line of the triangle and above it, a superb place to begin is to think about the market’s sentiment.

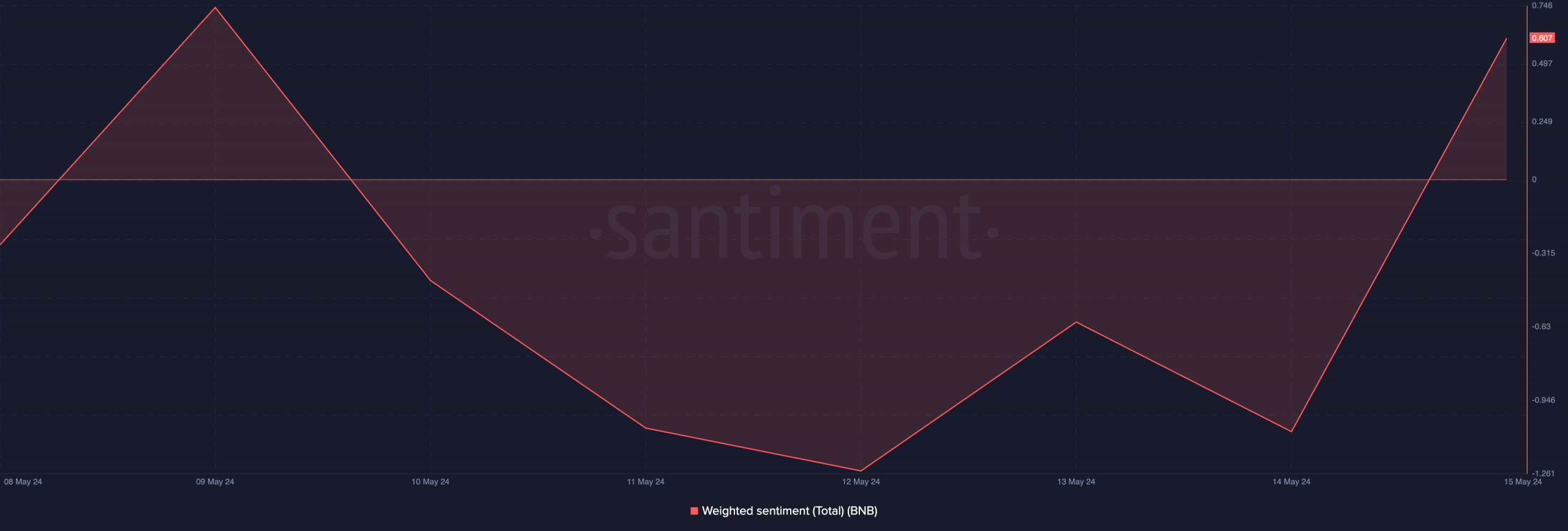

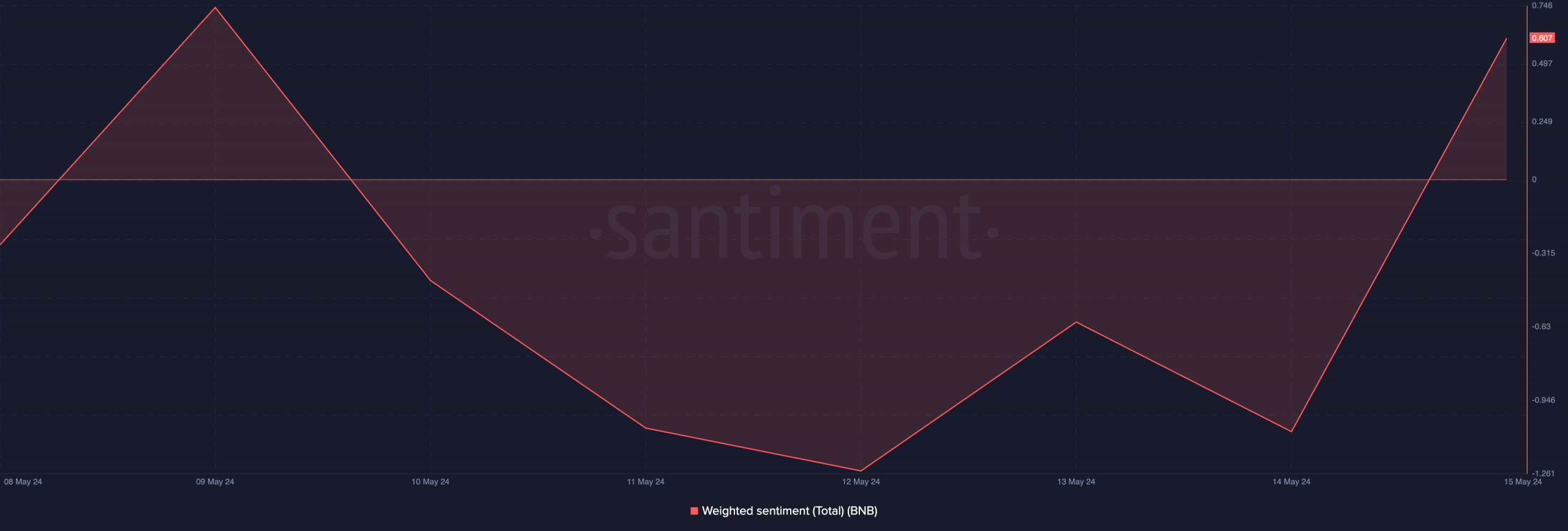

In accordance with Santiment’s information, the coin’s weighted sentiment was 0.607 and on an uptrend at press time. The metric’s constructive worth instructed that the BNB market loved constructive sentiment from its individuals.

Supply: Santiment

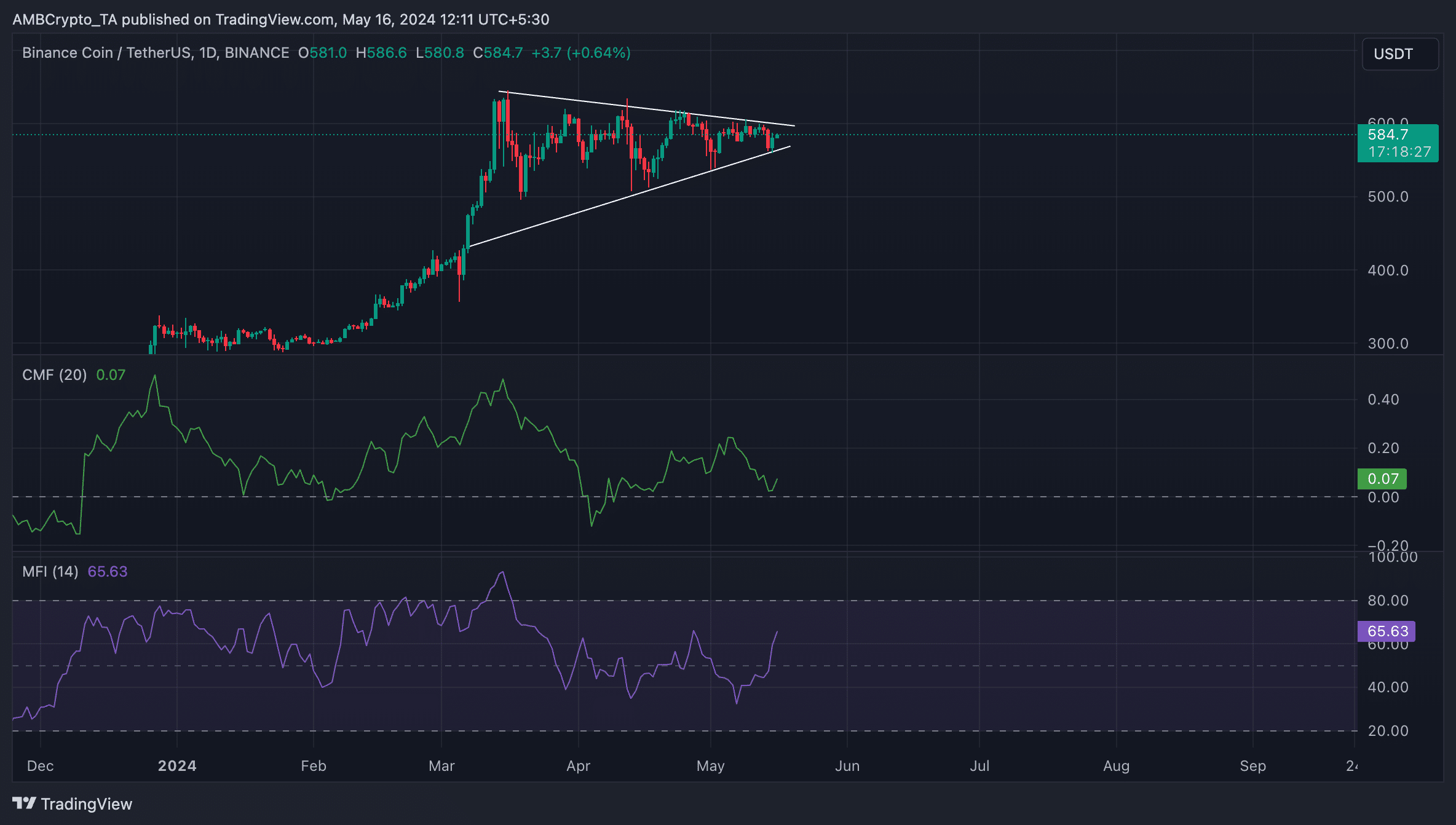

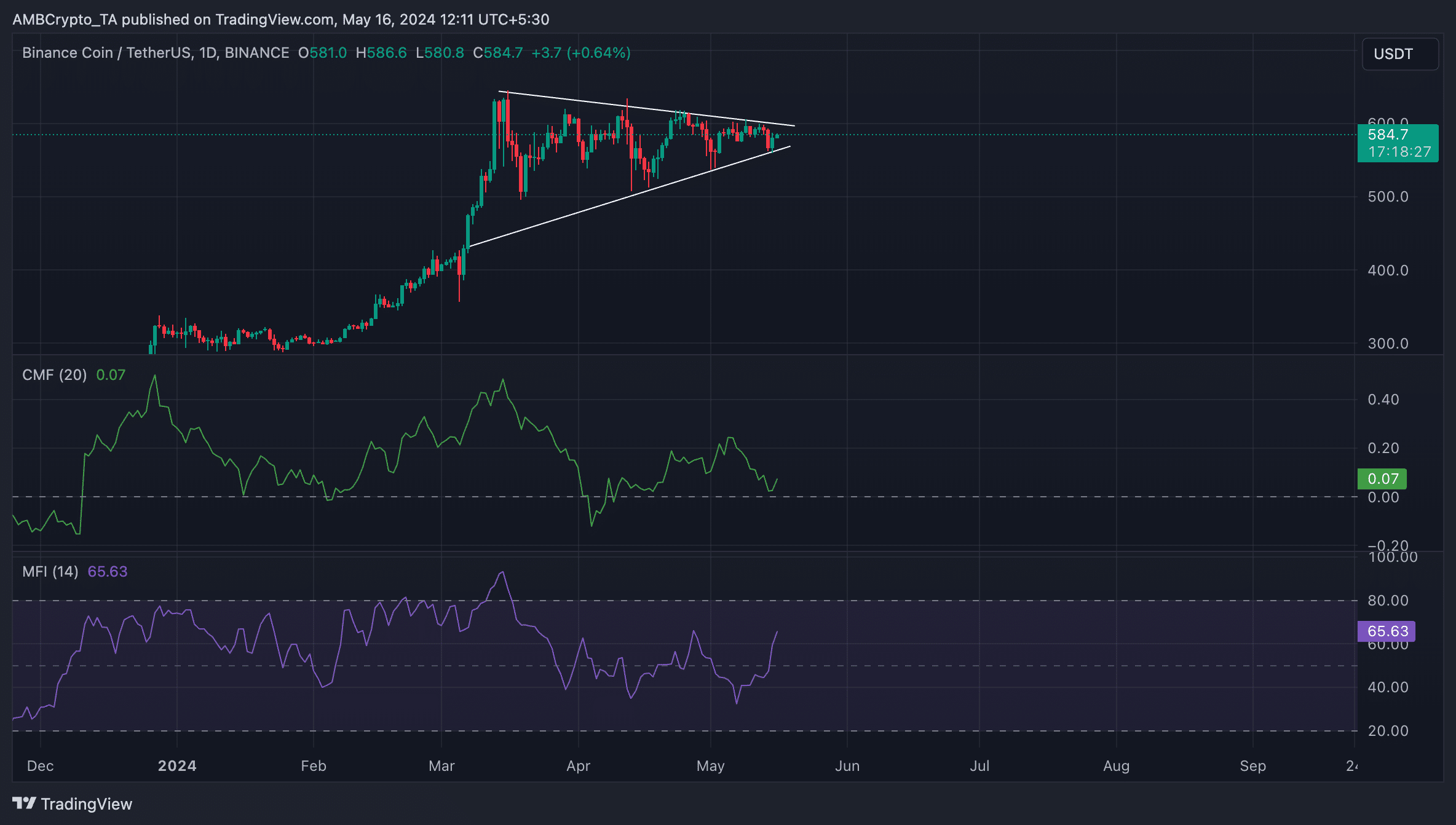

BNB’s key momentum indicators additionally confirmed this bullish outlook. At press time, its Cash Move Index (MFI) was 65.61 and rising, exhibiting that market individuals favoured BNB accumulation over distributing their holdings.

Likewise, the altcoin’s Chaikin Cash Move was on an uptrend and above the zero line at 0.07. This pointed to a gradual influx of liquidity into the BNB market. If this indicator continues to rise, it will imply a hike in demand for the cryptocurrency.

Supply: BNB/USDT on TradingView

If sentiment continues to be bullish, patrons can push BNB’s worth above the resistance line of the triangle. The coin’s worth may surge to $596 after which, to $643.

Is your portfolio inexperienced? Take a look at the BNB Revenue Calculator

BNB stays in danger

Conversely, if this bullish projection is invalidated and bearish strain mounts, BNB’s worth may break under the triangle to commerce across the $520-level.

Supply: BNB/USDT on TradingView

The potential of this taking place is heightened by how vital the altcoin’s destructive funding charge has been over the previous couple of weeks.

In truth, in accordance with Coinglass, this coin has recorded predominantly destructive funding charges since 23 April. As of 15 Could, BNB’s funding charges had dropped to a multi-month low of 0.106%.

The final time the coin’s funding charge was this low was again in February.

Supply: Coinglass

When an asset’s funding charge is destructive, extra merchants maintain quick positions. This implies that extra merchants predict the asset’s worth to fall and are shopping for the asset with the expectation of a worth rally.