- BNB’s quantity stays under $3 billion on the chart

- Volatility continues to be low too

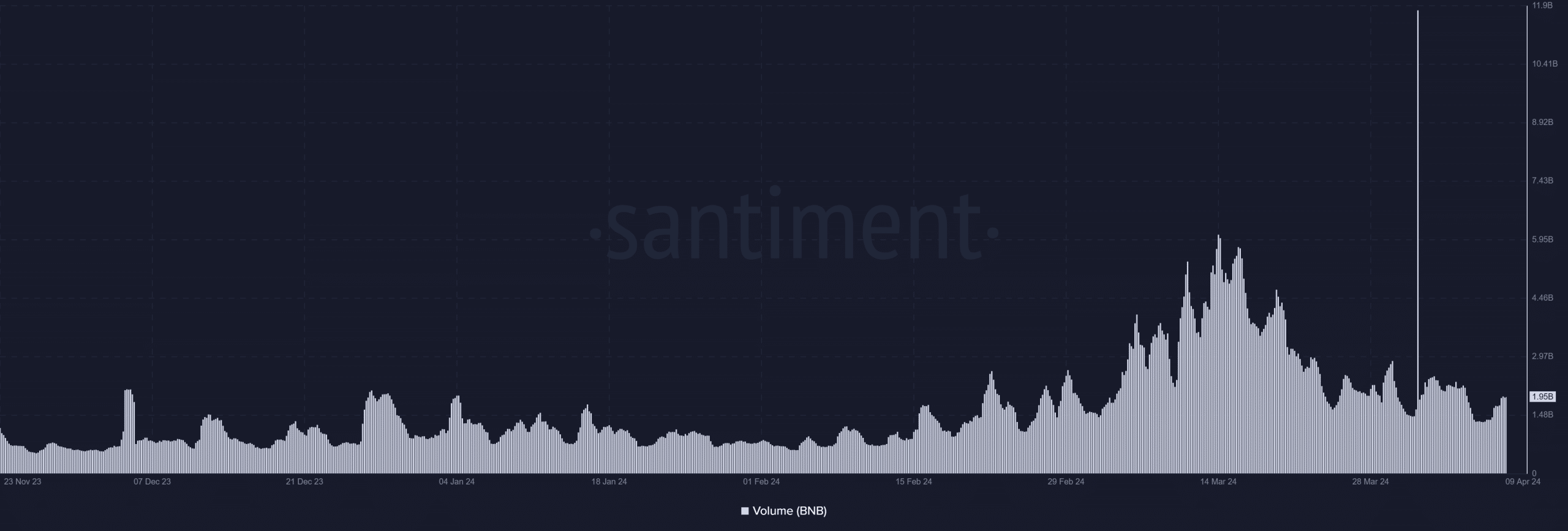

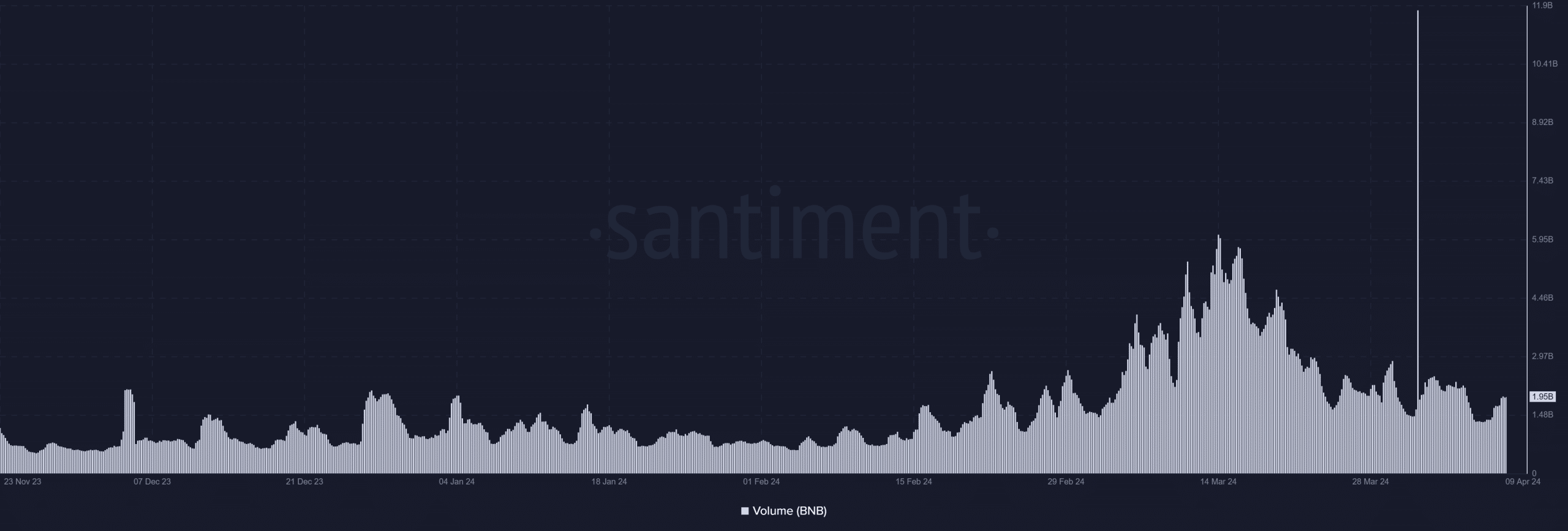

Binance Coin’s (BNB) buying and selling quantity registered a big hike in direction of the start of the month, reaching ranges not seen since 2022. How has BNB carried out since then, and are there indications suggesting a possible for vital worth motion shortly?

Binance Coin’s quantity reverts to regular

Evaluation of Binance Coin’s quantity on Santiment revealed a spike to over $11 billion on 1 April. Nonetheless, this surge was short-lived, as subsequent evaluation indicated a return to its earlier quantity vary. An examination of the chart illustrated that the quantity has remained throughout the $2 billion threshold because the spike.

On the time of writing, the quantity stood at round $1.9 billion. Moreover, there was no notable change in worth since this spike occurred.

Supply: Santiment

Volatility tightens on the chart

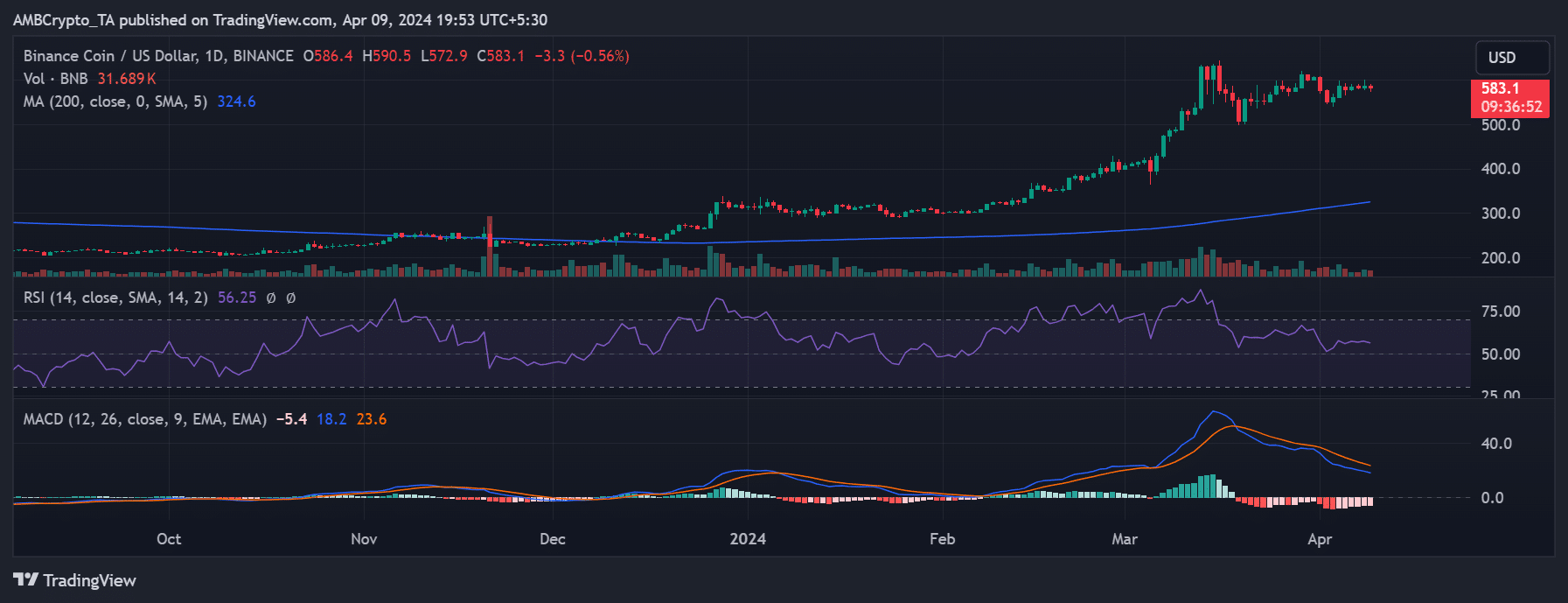

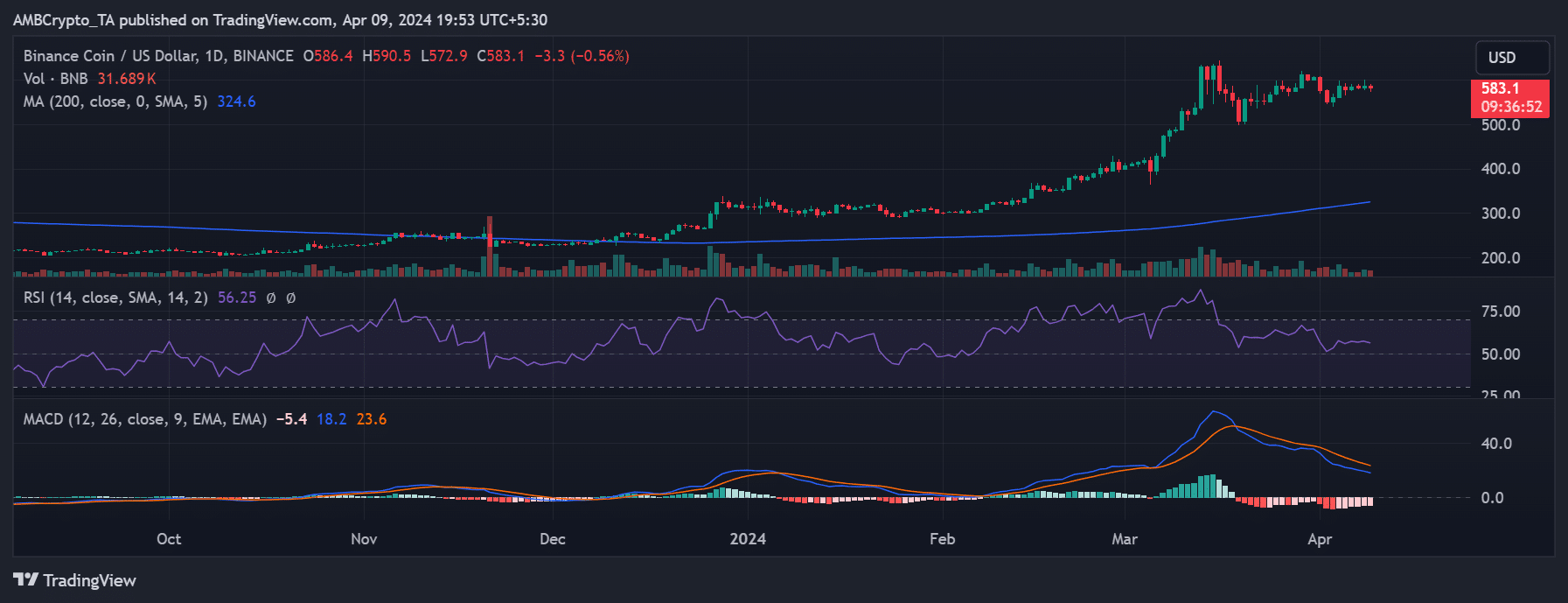

An evaluation of the day by day timeframe chart revealed that Binance BNB’s worth exhibited no vital response on the day its quantity spiked. In actual fact, the chart indicated a worth drop of over 5%, inflicting the worth to say no from over $600 to round $570.

Supply: TradingView

Subsequently, there was an try at worth consolidation round $580. At press time, BNB was buying and selling at round $583, with a decline of lower than 1%. Moreover, an evaluation of its Relative Power Index (RSI) advised that it remained in a steady bull pattern. Moreover, examination of the Bollinger bands indicated minimal volatility, implying a diminished probability of sudden worth fluctuations.

Merchants are cautious as a result of…

An examination of the funding fee chart on Coinglass revealed a gradual ascent again to the optimistic zone, suggesting that BNB patrons had regained management of the market. On the time of writing, the funding fee stood at round 0.02%. Nonetheless, this additionally indicated a comparatively weak sentiment regardless of the guess on a worth hike.

– Is your portfolio inexperienced? Take a look at the Binance Revenue Calculator

Lastly, an evaluation of its worth motion confirmed no vital exercise for the time being. Concurrently, the open curiosity hovered round $600 million, signifying a reasonable money influx.

These metrics collectively indicated that merchants haven’t been absolutely dedicated to BNB. Therefore, main worth motion didn’t appear imminent for BNB, according to the developments seen on the worth chart.