Retail money-market funds inflows continued this week, and extra troubling (forward of the approaching regional financial institution earnings), utilization of The Fed’s emergency funding facility jumped to a brand new file excessive over $109BN. Massive banks had day as we speak on earnings.

That is the not-so-rosy image forward of tonight’s financial institution deposit knowledge debacle from The Fed.

On a seasonally-adjusted foundation, whole deposits declines by $12.4BN (after two large weekly deposit inflows)…

Supply: Bloomberg

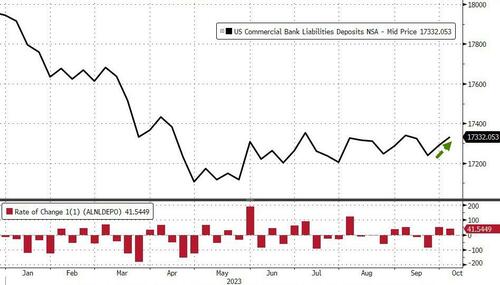

Nevertheless, on an unadjusted foundation, whole deposits rose $41.5BN…

Supply: Bloomberg

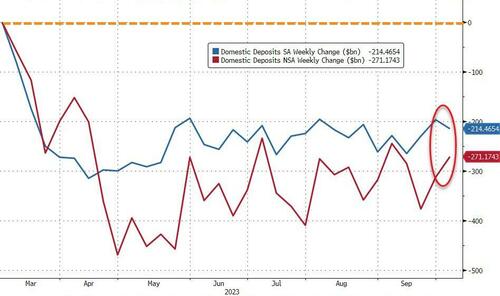

And so, eradicating overseas financial institution flows, we see home banks diverging on an SA vs NSA foundation as soon as once more ($41.6BN inflows NSA, $17.5BN outflows SA)…

Supply: Bloomberg

On the brilliant facet, the hole between SA and NSA deposits outflows because the SVB disaster is narrowing (solely $57BN now)…

Supply: Bloomberg

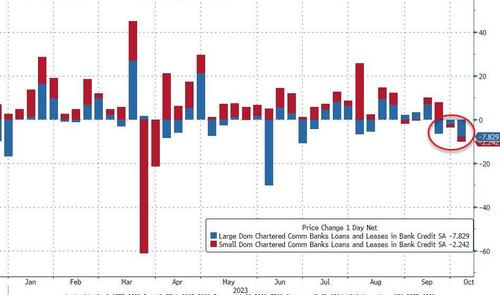

On the opposite facet of the ledger, mortgage volumes shrank once more by over $10BN with giant financial institution mortgage volumes declining for the third straight week…

Supply: Bloomberg

The important thing warning signal continues to pattern decrease (Small Banks’ reserve constraint), supported above the essential degree by The Fed’s emergency funds (for now)…

Supply: Bloomberg

…we positive hope these banks are planning to fill the $109BN gap of their steadiness sheets they’re filling with costly Fed loans.

Loading…