- SEC’s crypto involvement raises questions on partisan regulation in upcoming elections.

- Darius Dale expects Biden-aligned insurance policies in price range deficit financing.

Other than the Bitcoin [BTC] halving, the US 2024 election stands as probably the most anticipated occasions of this 12 months.

Regardless of outstanding progress inside the crypto business beneath President Joe Biden’s administration, regulatory challenges persist.

Notably, the Securities and Change Fee’s (SEC) elevated involvement within the crypto sphere prompts hypothesis: Will the widening partisan hole in crypto regulation affect the strategy taken within the 2024 elections?

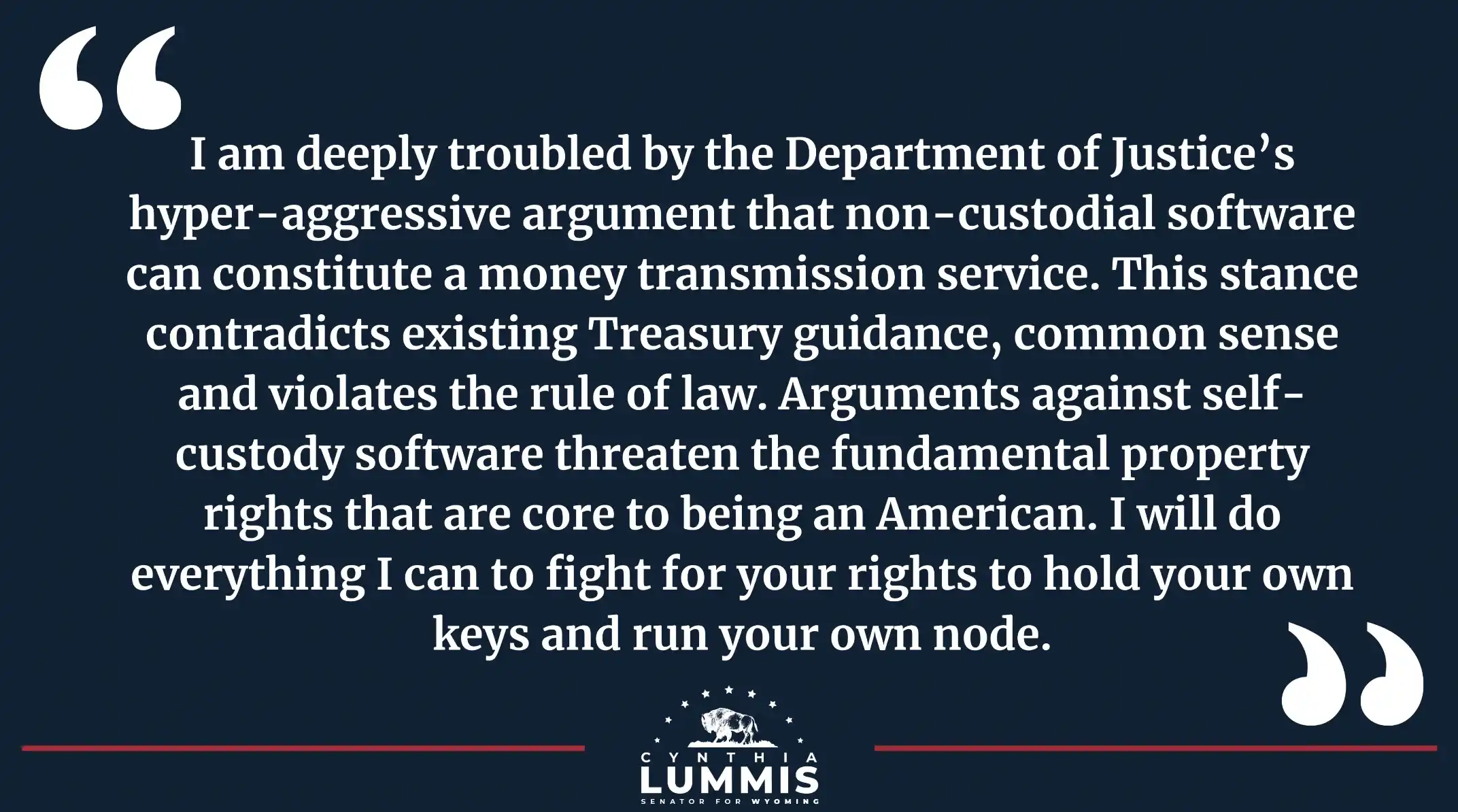

Senator Lummis criticizes DOJ’s Bitcoin stance

Amidst these looming considerations, U.S. Senator Cynthia Lummis just lately criticized the Division of Justice (DOJ) for its interpretation of rules regarding non-custodial software program wallets.

Voicing her apprehension on the identical, Senator Lummis took to X (Previously Twitter) and famous,

“I’m deeply involved by the Biden administration criminalizing core tenants of the Bitcoin community and decentralized finance.’

She added,

Supply: Senator Cynthia Lummis/Twitter

The dispute emerged when the DOJ charged builders linked to Bitcoin mixers like Samourai Pockets and Twister Money. These actions had been deemed unauthorized cash transmission by the DOJ.

Senator Lummis’s remark highlights the contradictory DOJ’s strategy towards previous Treasury steerage, doubtlessly criminalizing core features of Bitcoin and DeFi operations.

Insights from Darius Dale

Individually in an interview with Anthony Pompliano, Darius Dale, CEO of 42Macro, mentioned the influence of varied developments on the crypto market and elections.

Shedding mild on the potential affect of President Biden’s administration on Treasury coverage, notably relating to how the price range deficit is financed. Dale stated,

“The Treasury is aware of the price range deficit goes to be, however how they select to finance the price range deficit is type of a discretionary.”

This underlines the optimistic relationship between Secretary Janet Yellen and Joe Biden, and an expectation for insurance policies that align with the administration’s aims.

Inventory market developments

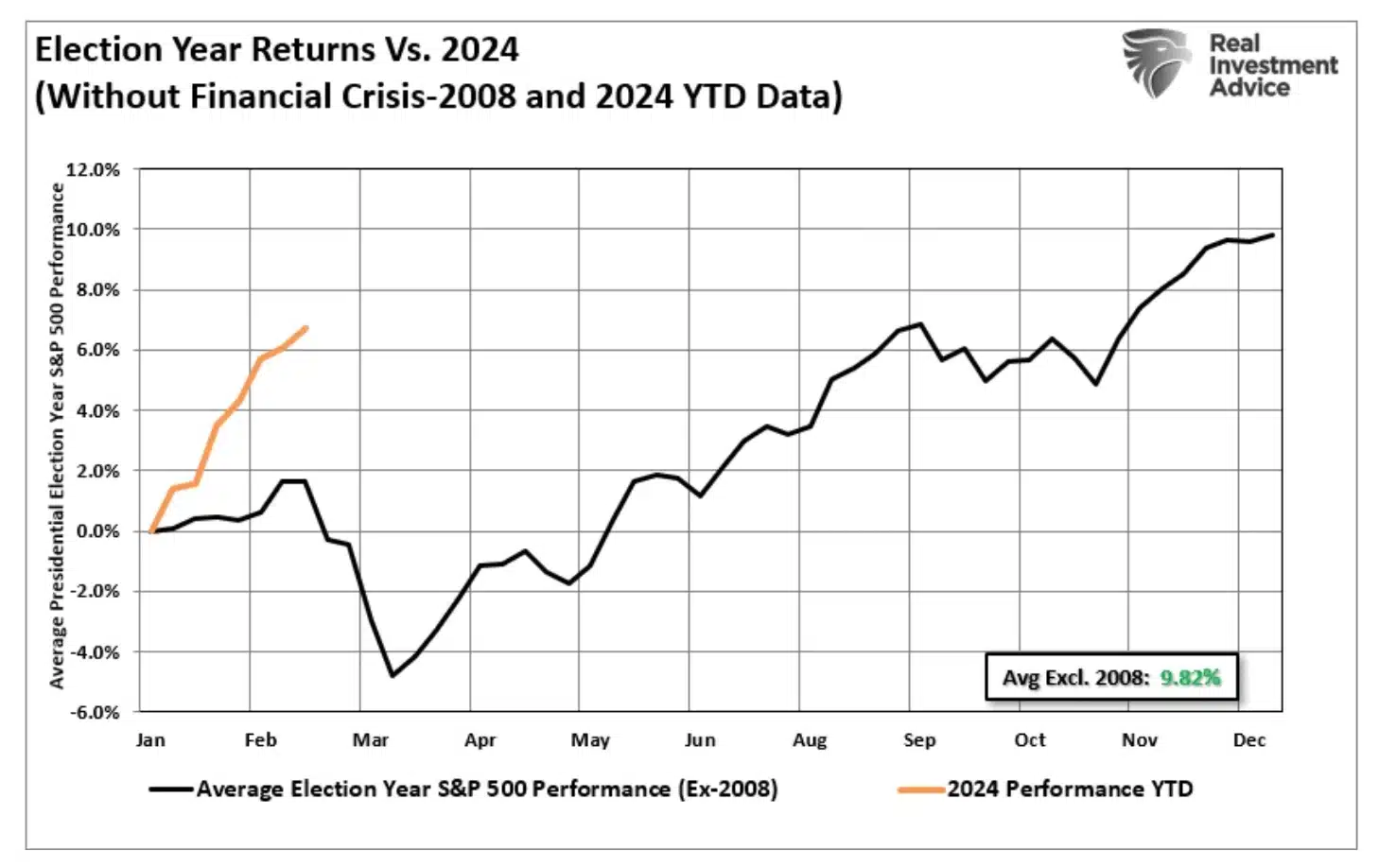

Historic knowledge signifies that the inventory market tends to exhibit robust efficiency within the interval main as much as the presidential elections. In 2024, this pattern is notably exceeding historic averages.

Supply: Investing.com

For sure, Dale emphasised the significance of understanding the interaction between sticky inflation and Treasury coverage responses and claimed,

“We all know we’re form of very a lot in that debate course of, however the early indications of that debate course of are definitely shifting in a hawkish route.”