Riska

Blackstone Lengthy-Quick Credit score Revenue (NYSE:BGX) is a closed-end fund aka CEF that makes a speciality of the technology of revenue for its shareholders. The fund’s very engaging 11.83% yield stands as a testomony to its potential to offer a really cheap supply of revenue for its buyers. The truth is, this yield is consistent with different closed-end funds at present being supplied by different asset managers. We are able to see that right here:

|

Fund |

Present Yield |

|

Blackstone Lengthy-Quick Credit score Revenue Fund |

11.83% |

|

First Belief Excessive Revenue Lengthy/Quick Fund (FSD) |

11.08% |

|

Apollo Tactical Revenue Fund (AIF) |

11.69% |

|

Ares Dynamic Credit score Allocation Fund (ARDC) |

10.96% |

|

Carlyle Credit score Revenue Fund (CCIF) |

15.45% |

Admittedly, a few of these funds use a really completely different technique than the Blackstone Lengthy-Quick Credit score Revenue Fund. Nevertheless, they’re by and enormous designed to be considerably interest-rate impartial. As everybody studying that is actually effectively conscious, one of many greatest issues with most bond funds is that they’re negatively impacted by rate of interest will increase. This is likely one of the explanation why so many of those funds have been crushed out there over the previous two years. The funds within the desk above are designed to scale back that downside and ship optimistic returns no matter modifications to the overall rate of interest atmosphere.

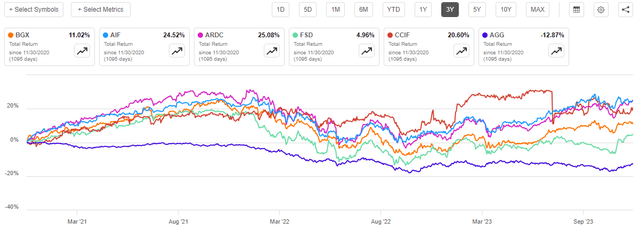

This actually doesn’t imply that these funds at all times succeed at delivering a optimistic return no matter rate of interest environments. As an illustration, the Blackstone Lengthy-Quick Credit score Revenue Fund has seen its value decline by 13.56% over the previous three years. That’s higher than the Bloomberg U.S. Mixture Bond Index (AGG) over the identical interval, however it’s not so good as the Apollo and Ares funds proven within the desk above:

Looking for Alpha

Nevertheless, as I’ve identified earlier than, we are able to generally get a deceptive impression of a fund’s efficiency if we merely have a look at the market value. It is because closed-end funds are inclined to ship nearly all of their whole returns to the shareholders through direct funds. In any case, these firms often pay out all of their funding returns in distributions and easily try to keep up a flat web asset worth. As such, we have to take the distributions that the fund paid out over a given interval as a way to decide how effectively its shareholders really did. Once we do this, we see that the Blackstone fund managed to carry out fairly effectively over the trailing three-year interval, though as soon as once more it was not so good as the Apollo or the Ares funds:

Looking for Alpha

As we are able to see, buyers within the Blackstone Lengthy-Quick Credit score Revenue Fund have acquired a complete return of 11.02% over the previous three years. That’s significantly better than the 12.87% lack of the Bloomberg U.S. Mixture Bond Index ETF. As there was an enormous shift within the total rate of interest atmosphere over the three-year interval, this reveals us that the Blackstone Lengthy-Quick Credit score Revenue Fund’s try to be considerably rate of interest impartial has paid off to a sure extent. That’s one thing that would actually show engaging to any investor immediately, since there may be nonetheless some uncertainty as to the route of rates of interest, regardless of some market commentators suggesting the alternative not too long ago.

Allow us to examine additional and see if this fund may very well be an inexpensive addition to an income-focused portfolio immediately.

About The Fund

In line with the fund’s website, the Blackstone Lengthy-Quick Credit score Revenue Fund has the first goal of offering its buyers with a excessive degree of present revenue. This isn’t notably shocking contemplating that the identify of this fund means that it intends to attain its purpose by investing in a portfolio that primarily consists of debt securities. As I’ve identified quite a few instances previously, debt securities by their very nature haven’t any web capital positive aspects over their lifetimes. These securities are each issued and redeemed at face worth, with the one funding positive aspects over their lifetimes being the common funds that they make to their buyers. These common funds function revenue, so it is sensible {that a} fund like this is able to have present revenue as its major goal versus one thing else.

The usage of the terminology “Lengthy-Quick” within the fund’s identify means that this isn’t a typical closed-end fund that merely purchases bonds or different debt securities and holds them. Quite, the terminology means that this fund will likely be participating in brief gross sales to permit it to revenue from a safety declining in value. The web site explains this in additional element:

Blackstone Lengthy Quick Credit score Revenue Fund is a closed-end fund that trades on the New York Inventory Alternate below the image “BGX.” BGX’s major funding goal is to offer present revenue, with a secondary goal of capital appreciation. BGX will take lengthy positions in investments which we consider supply the potential for engaging returns below numerous financial and rate of interest environments. BGX may take quick positions in investments which we consider will underperform resulting from a better sensitivity to earnings progress of the issuer, default danger or the overall degree and route of rates of interest. BGX should maintain at least 70% of its Managed Property in first- and second-lien floating fee loans (“Secured Loans”), however may put money into unsecured loans and excessive yield bonds.

We are able to in a short time see how this technique offers this fund with a considerably curiosity rate-neutral return profile. As I identified in a number of latest articles, corresponding to this one, secured loans are sometimes floating-rate debt securities. A floating-rate debt safety tends to have a really steady value no matter rates of interest. We are able to see this in a short time by trying on the iShares Floating Charge Bond ETF (FLOT), which tracks the BBG US Floating Charge Notes 5 Yrs and Much less Index. As we are able to see right here, this fund’s share value has been nearly completely flat over the previous three years:

Looking for Alpha

That is even though rates of interest modified considerably over that interval. The rationale for that is merely that floating-rate securities at all times present their buyers with a yield that’s aggressive with newly issued related securities out there. As such, their value doesn’t want to alter to ensure that the yield to be aggressive with new-issue securities. That’s maybe the largest distinction between these securities and conventional bonds.

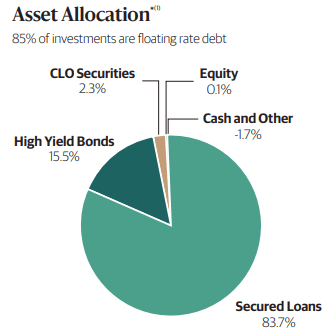

Because the fund’s description states, the BlackRock Lengthy-Quick Credit score Revenue Fund will at all times have at the very least 70% of its securities invested in these floating-rate securities. For the time being, it really has effectively above this degree, which the fact sheet reveals:

Blackstone – Fund Truth Sheet

As we are able to see, 83.7% of the fund’s belongings are at present invested in secured loans. As well as, the fund additionally has 2.3% of its belongings invested in collateralized mortgage obligations, which are also sometimes floating-rate securities. Thus, the fund has totally 85% of its belongings invested in issues that ought to stay comparatively steady whatever the route of rates of interest.

The issue with floating-rate securities comes with the truth that they endure when rates of interest decline. It is because the value nonetheless stays steady, however the quantity of revenue that they supply to their buyers goes down. That is one thing that would weigh on this fund going ahead relying on the route of rates of interest. As of proper now, the market is pricing in 125 foundation factors of cuts to the federal funds fee subsequent 12 months. That’s, to place it mildly, unlikely to occur barring a extreme recession. In line with the CNBC article that was simply linked:

Rate of interest cuts don’t occur throughout good instances, one thing necessary for markets to recollect amid hotly anticipated easing subsequent 12 months from the Federal Reserve.

If the Fed meets market expectations and begins reducing aggressively in 2024, it probably will likely be in opposition to a backdrop of a sharply slowing financial system and rising unemployment, which in flip would carry decrease inflation.

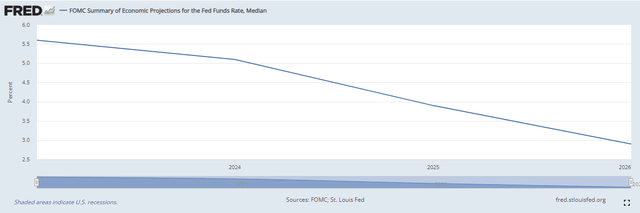

There are actually some indicators that the financial system will enter right into a recession within the close to future if it’s not already in a single. That may very well be ample to immediate the Federal Reserve to chop rates of interest, which seems to be what the market at present expects. Nevertheless, the members of the Federal Open Market Committee don’t at present anticipate something near 125-basis-points of cuts. The median projection proper now could be a single 25-basis level lower in 2024:

Federal Reserve Financial institution of St. Louis

If certainly the projections by the Federal Open Market Committee show to be extra correct than the market, then it appears nearly sure that floating-rate securities will outperform conventional bonds. In any case, these securities ought to keep a steady value in that situation however bonds most actually is not going to because it signifies that charges will likely be increased than are at present priced in. The Blackstone Lengthy-Quick Credit score Revenue Fund’s present positioning ought to work out fairly effectively right here. Nevertheless, if charges are lower in any respect, the fund’s present 85% allocation to floating-rate credit score will trigger its funding revenue to say no.

Nevertheless, it’s doable {that a} extreme sufficient recession will happen that causes the Federal Reserve to chop charges by way more than the 25-basis factors that its members are at present projecting. In that case, we need to have publicity to conventional bonds, as conventional bonds ought to rise in value and their coupon funds don’t decline. The fund does have this publicity, as 15.5% of its belongings are invested in junk bonds, however this isn’t sufficient to trigger this one to outperform a conventional junk bond fund. As such, buyers who’re involved about falling rates of interest could need to think about a fund just like the Ares Dynamic Credit score Allocation Fund, which has a extra balanced portfolio between the 2 kinds of debt safety. With that stated although, the Blackstone Lengthy-Quick Credit score Revenue Fund will nonetheless derive some profit from falling rates of interest as a result of appreciation of these junk bonds, it’s simply not as a lot as it will in any other case be.

The truth that the Blackstone Lengthy-Quick Credit score Revenue Fund can short-sell bonds offers it a little bit of a bonus in rising rate of interest environments as effectively. In any case, conventional bonds fall when rates of interest rise so shorting can present the fund with the flexibility to reap the benefits of that. Nevertheless, the fund at present has no quick positions, which can be a good suggestion contemplating the unsure route of rates of interest proper now. The truth that it could do that may assist it to spice up its efficiency in a rising fee atmosphere, nevertheless. That’s one thing that may very well be engaging to long-term buyers, as we’ve got no possible way of understanding what the long run holds. The truth that the fund can quick bonds may additionally present it with the flexibility to reap the benefits of a quickly rising increase in junk bond default rates. In any case, shorting a junk bond which then goes into default is a reasonably good technique to become profitable.

Briefly, it seems that this fund is well-positioned for rising rates of interest. The floating-rate securities ought to outperform conventional junk bonds in such an atmosphere and the truth that it could short-sell securities provides to its potential to reap the benefits of any occasion that causes the value of all bonds or solely particular bonds to say no. Sadly, the fund doesn’t have as a lot publicity to conventional fixed-income bonds as a few of its friends, so the Blackstone Lengthy-Quick Credit score Revenue Fund may very simply underperform different funds throughout a interval of falling rates of interest.

Leverage

As is the case with most closed-end funds, the Blackstone Lengthy-Quick Credit score Revenue Fund employs leverage as a way of boosting the efficient yield of the belongings that it receives from the investments in its portfolio. I defined how this works in plenty of numerous articles. To paraphrase myself:

Briefly, the fund borrows cash after which makes use of that borrowed cash to buy senior secured loans and junk bonds. So long as the yield that the fund receives from the bought securities is increased than the rate of interest that has to pay on the borrowed cash, the technique works fairly effectively to spice up the efficient yield of the portfolio. As this fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges, this can often be the case.

You will need to observe that using leverage to spice up efficient yields shouldn’t be as efficient immediately with charges at 6% because it was a number of years in the past when rates of interest have been successfully zero. It is because the distinction between the speed at which the fund can borrow cash and the yield that it receives from the bought belongings is way narrower than it as soon as was.

The usage of debt on this trend is a double-edged sword. It is because leverage boosts each positive aspects and losses. As such, we need to make sure that a fund shouldn’t be using an excessive amount of leverage as a result of that will expose us to an extreme degree of danger. I typically don’t prefer to see a fund’s leverage exceed a 3rd as a share of its belongings because of this.

As of the time of writing, the Blackstone Lengthy-Quick Credit score Revenue Fund has leveraged belongings comprising 37.68% of its portfolio. That is actually above the one-third degree that we actually need to see as a way to guarantee an inexpensive steadiness between the chance and the reward. Nevertheless, on this case, it’s most likely not an enormous downside. As we’ve got already seen, the overwhelming majority of the belongings within the fund’s portfolio are floating-rate securities that ought to have fairly steady costs no matter rates of interest or absolutely anything else within the financial system. As such, the volatility right here could be very low, which reduces the likelihood that this fund will encounter any actual issues with its debt. Total, we most likely don’t want to fret an excessive amount of concerning the fund’s leverage on the present degree, however we most likely don’t need it to get a lot increased.

Distribution Evaluation

As talked about earlier on this article, the first goal of the Blackstone Lengthy-Quick Credit score Revenue Fund is to offer its buyers with a really excessive degree of present revenue. In pursuance of this goal, the fund purchases a wide range of floating-rate debt securities, which often have a pretty big unfold over the market rate of interest resulting from the truth that these securities are sometimes backed by firms with below-investment-grade credit score scores. The fund collects the curiosity funds that it receives from these securities right into a pool of cash, and it then borrows cash to buy much more securities, utilizing a part of the cash that it receives to cowl the curiosity funds on the borrowed funds. That reinforces its yield additional. Lastly, the fund pays out the entire cash that it receives to its shareholders, web of its personal bills. We are able to anticipate that this is able to give the fund’s shares a really excessive yield.

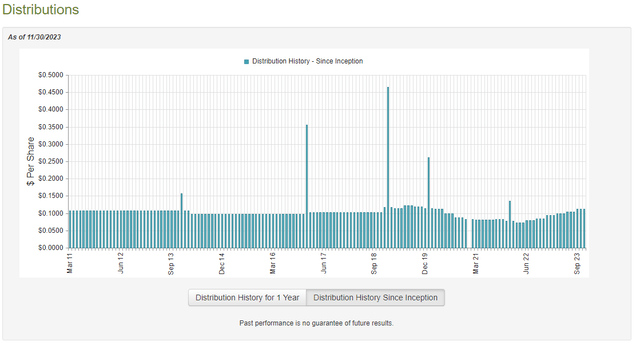

That’s actually the case, because the Blackstone Lengthy-Quick Credit score Revenue Fund pays a month-to-month distribution of $0.1120 per share ($1.344 per share yearly), which provides it an 11.83% yield on the present value. The fund’s long-term distribution historical past sadly leaves one thing to be desired although, because the fund has modified its payout very often over its lifetime:

CEF Join

As we are able to see, the fund’s distribution has been variable over a lot of the previous 5 years, though previous to that it was fairly steady. That is one thing which will show to be a little bit of a turn-off for these buyers who’re searching for a protected and safe supply of revenue to make use of to pay their payments or finance their life. Nevertheless, the truth that this fund has elevated its distribution 3 times previously twelve months helps to extend the enchantment of its proposition. The truth that this fund has been growing its distribution recently is actually not shocking although, as most closed-end funds which have substantial publicity to floating-rate debt securities have been doing the very same factor. This latest distribution progress helps within the face of inflation, which is an issue that we’ve got all been affected by not too long ago.

As is at all times the case although, the fund’s historical past shouldn’t be precisely a very powerful factor for brand spanking new buyers. In any case, anybody buying the fund immediately will obtain the present distribution on the present yield and won’t be negatively impacted by the actions that the fund has needed to take previously. Crucial factor proper now could be how effectively the fund can maintain its present distribution. Allow us to examine this.

Thankfully, we’ve got a comparatively latest doc that we are able to seek the advice of for the aim of our evaluation. As of the time of writing, the fund’s most up-to-date financial report corresponds to the six-month interval that ended on June 30, 2023. This can be a comparatively latest report that covers a really attention-grabbing time period. As everybody studying that is actually effectively conscious, the primary half of 2023 was characterised by a really euphoric market that broadly anticipated rates of interest to begin coming down within the second half of 2023. Whereas that has since been confirmed to be incorrect, there was nonetheless some potential to earn cash by promoting appreciated belongings right into a euphoric inventory and bond market. This report ought to give us a good suggestion of how effectively the fund was capable of reap the benefits of that scenario, though I’ll admit that I’m not particularly optimistic about its capital positive aspects prospects contemplating that this fund is usually invested in floating-rate securities.

Throughout the six-month interval, the Blackstone Lengthy-Quick Credit score Revenue Fund acquired $12,460,646 in curiosity from the belongings in its portfolio. This fund doesn’t obtain revenue from some other supply, in order that determine represents the whole lot of its funding revenue. It paid its bills out of this quantity, which left it with $8,032,147 obtainable for shareholders. That was, fortuitously, ample to pay the $7,510,590 that that fund paid out in whole distributions. Thus, it seems that this fund is well masking its distributions out of web funding revenue, which is precisely what we need to see from a fund like this.

The fund was additionally capable of profit from capital positive aspects in the course of the interval, though to not the diploma that we would actually prefer to see. Throughout the six-month interval, the fund reported web realized losses of $6,111,164 however this was greater than offset by $10,087,644 web unrealized positive aspects. Total, the fund’s web belongings elevated by $4,498,037 after accounting for all inflows and outflows.

This fund seems to easily be paying out its web funding revenue to the shareholders. That could be a good signal, and it means that the fund ought to have the ability to maintain its present distributions so long as its web funding revenue stays across the present degree. So long as short-term rates of interest are at their present degree, we must always not have to fret a few distribution lower.

Valuation

As of November 30, 2023 (the newest date for which information is at present obtainable), the Blackstone Lengthy-Quick Credit score Revenue Fund has a web asset worth of $12.99 per share. The shares, nevertheless, solely commerce for $11.44 every. This offers the fund’s shares an 11.93% yield on the present market value. That’s not as engaging because the 12.99% low cost that the shares have had on common over the previous month, so it’s actually doable that a greater value may very well be obtained just by ready for a bit. Nevertheless, a double-digit low cost is mostly consultant of an inexpensive entry value for any fund so there may be most likely no actual cause to delay shopping for in when you want to add this fund to your portfolio.

Conclusion

In conclusion, the Blackstone Lengthy-Quick Credit score Revenue Fund is an attention-grabbing closed-end fund that’s effectively positioned to reap the benefits of excessive charges going ahead. The fund additionally has some optimistic publicity to declining rates of interest, however it’s admittedly not pretty much as good in that respect as a few of its friends. The fund’s floating-rate publicity may trigger its web funding revenue to say no quickly subsequent 12 months if the Federal Reserve cuts rates of interest as quickly because the market expects, however in the meanwhile that doesn’t appear probably except there’s a extreme recession within the close to future. The truth that this fund can short-sell securities may give it some attention-grabbing potential for income, however it’s not at present exploiting that chance. Total, the fund appears fairly stable except rates of interest actually do decline very quickly subsequent 12 months.

Editor’s Word: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.