- Analysts anticipate Fed and U.S Treasury strikes to have an effect on the market in a gradual, however constructive approach

- Hayes eyes Solana, “doggie cash” for momentum buying and selling as liquidity improves

Market analysts anticipate a light bullish impression on Bitcoin [BTC] and total markets from the current “dovish” Fed price choice and the U.S Treasury QRA (Quarterly Refunding Announcement).

In accordance with Singapore-based institutional crypto-trading agency QCP, the U.S Fed and QRA had been “extra dovish than anticipated.” It noted that,

‘At FOMC, Powell stated that the Fed will not be seeking to hike charges and introduced the slowing of Quantitative Tightening (QT) from $60bn month-to-month to $25bn. For QRA, the Treasury will hold issuances for longer maturities unchanged, lowering fears of a spike in longer-term yields. This could assist push down the USD rally, which is constructive for danger property.”

BitMEX co-founder Arthur Hayes echoed comparable sentiments, however underlined that the liquidity impression will likely be delicate on the charts.

“The impression of this QRA is mildly greenback liquidity constructive….However it’s going to assist pump our baggage slowly over time.”

Hayes eyes Solana, “doggie cash” for momentum buying and selling

Hayes added that the present unfavourable value motion will dampen as liquidity slowly improves every month. The truth is, he expects BTC to reclaim $60k and stay range-bound inside $60k-70k till August.

That’s not all although, with the exec anticipating different altcoins to carry out higher. For his half, Hayes is eyeing Solana [SOL], dogwifhat [WIF], Dogecoin [DOGE] for momentum buying and selling. A part of his assertion learn,

“I’m shopping for Solana and doggie cash for momentum buying and selling positions.”

Momentum buying and selling is a method that entails shopping for or promoting an asset that strikes extraordinarily in a single route, adopted by exits when value flash reversal indicators. Asset supervisor Franklin Templeton additionally has a bullish inclination in the direction of Solana.

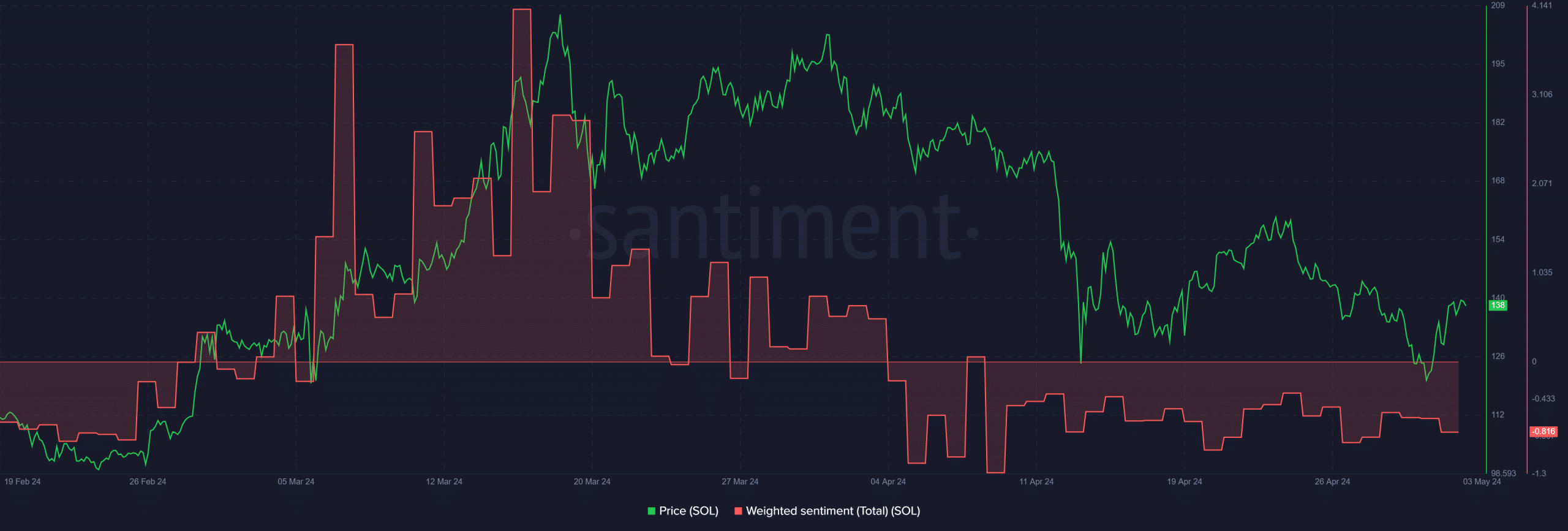

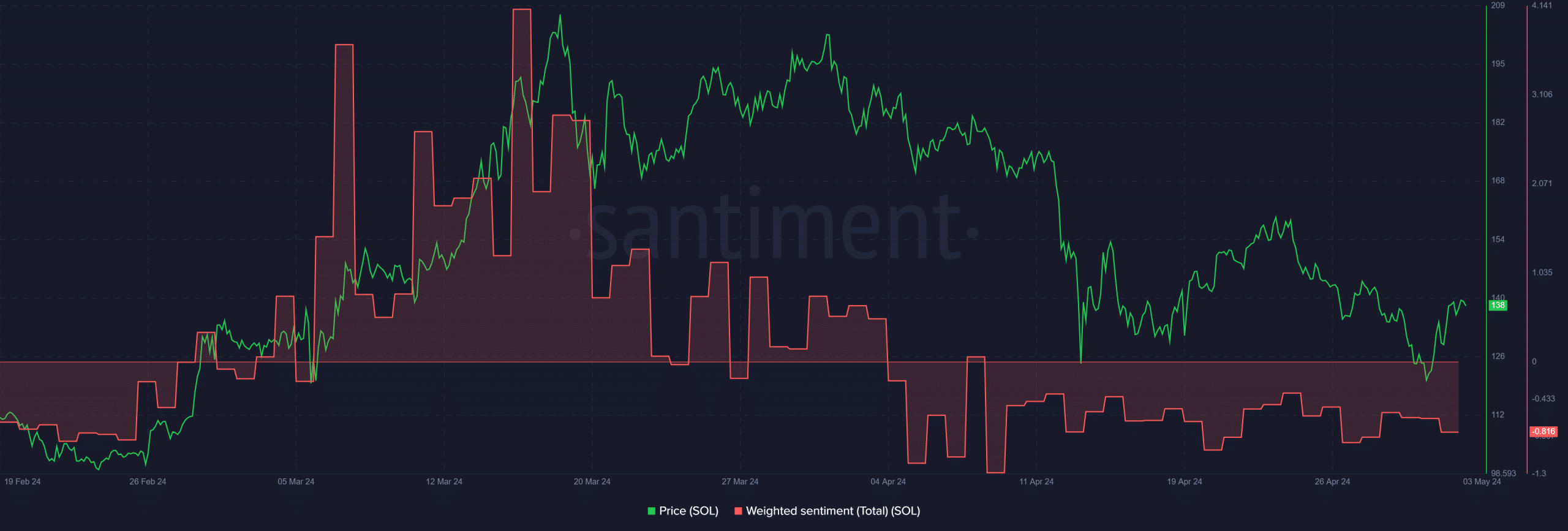

Nonetheless, SOL’s newest value motion chalked a downtrend and revealed that quick merchants have profited from the market dump. It was buying and selling at $136 at press time, down 35% from its file excessive of $210 in mid-March.

Nonetheless, bulls have defended the $126 short-term help twice, in mid-April and early Could. Even so, a decisive pattern reversal may materialize provided that the value strikes above the earlier decrease excessive of $160.

Moreover, Santiment information confirmed that total market sentiment round SOL was nonetheless unfavourable, as indicated by the weighted sentiment’s unfavourable studying. So, a powerful bullish reversal is unlikely within the short-term.

Supply: Santiment