MarsBars

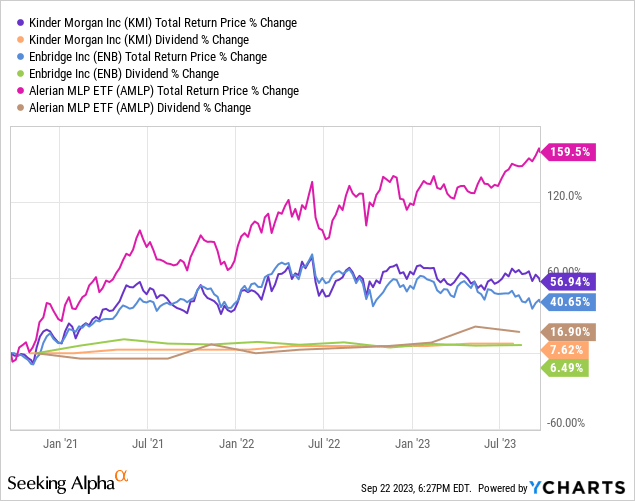

Enbridge (NYSE:ENB) and Kinder Morgan (NYSE:KMI) have each generated constant, albeit sluggish, dividend development, over the previous three years with mediocre complete return efficiency alongside it that has considerably lagged that of the broader midstream sector (AMLP) over that time frame:

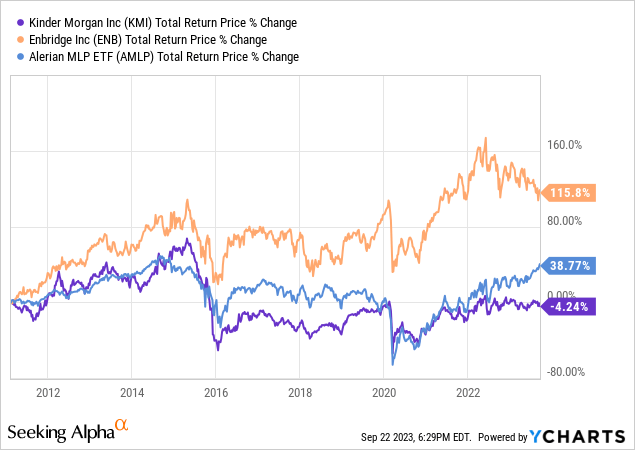

That being stated, thanks largely to a disastrous dividend minimize various years in the past, KMI has dramatically underperformed ENB and even AMLP over the long-term:

On this article, we examine ENB and KMI aspect by aspect and provide our tackle which one is a greater purchase proper now.

ENB Inventory Vs. KMI Inventory: Enterprise Mannequin

ENB’s boasts giant midstream infrastructure enterprise is well-diversified throughout quite a few segments of the midstream house, together with liquid pipelines, fuel transmission and distribution, and a rising renewable energy technology portfolio. ENB additionally not too long ago made a $14 billion acquisition of a number of pure fuel utilities companies from Dominion Power (D), making it North America’s largest pure fuel utility firm.

Along with having North America’s largest pure fuel utility, it owns one of many longest pure fuel transmission pipeline networks in the USA, the biggest pure fuel distribution enterprise in North America, and the longest crude oil pipeline community.

On account of its emphasis on utilities, the vast majority of its pro-forma EBITDA after the closing of the Dominion Power deal will come from regulated property and just about all of its remaining EBITDA will come from long-term take-or-pay contracts and almost all of its counterparties are funding grade. Consequently, it enjoys distinctive stability of money flows, whatever the macroeconomic and power business circumstances are at any given time. Consequently, it boasts a really spectacular 28-year dividend development streak, making it arguably the business’s most dependable dividend development inventory.

Whereas KMI is just not as giant as ENB and doesn’t have almost the identical dividend development observe report, it nonetheless owns very high-quality property. It’s primarily a significant pure fuel infrastructure participant, with 62% of its EBITDA coming from property that serve that section. It advantages from economies of scale and strategically positioned property that make it an indispensable participant within the North American power business, together with North America’s largest CO2 transport capability with ~1,500 miles of CO2 pipelines, largest unbiased terminal operations with 140 terminals and 16 Jones Act vessels, largest pure fuel transmission community with ~70,000 miles of pipelines that gives ~15% of U.S. pure fuel storage and transports ~40% of the USA’ pure fuel manufacturing, and largest unbiased refined merchandise transportation community with ~10,000 miles of refined merchandise and crude pipelines. Moreover, it’s investing in rising its power transition enterprise, with a very sturdy concentrate on RNG manufacturing capability.

Like ENB, it has a really steady money movement profile with 93% of its EBITDA stemming from long-term commodity worth resistant contracts. Whereas it doesn’t have the regulated utility publicity that ENB enjoys, it nonetheless has ample money movement stability within the face of untamed swings in power costs and shifting macroeconomic circumstances.

ENB Inventory Vs. KMI Inventory: Stability Sheet

ENB has one of many highest credit score rankings within the midstream section with a BBB+ score from S&P. It could actually command this increased credit standing regardless of having a lot increased leverage on its stability sheet than lots of its decrease rated friends do due to its extraordinarily high-quality money movement profile with substantial utility publicity, little to no commodity worth publicity, and counterparties which might be nearly all funding grade. One of many beauties of ENB’s stability sheet is that it has a considerable amount of its debt at mounted rates of interest and never maturing for a lot of a long time (together with properly into the second half of the twenty first century). This offers it a fairly predictable value of debt for a few years to return, additional enhancing its distributable money movement stability.

KMI, in the meantime, is available in only a tiny bit behind ENB with its BBB credit standing and has a reasonably low leverage ratio of 4.1x with expectations of ending this yr with a 4.0x internet debt to adjusted EBITDA ratio. Provided that their long-term goal is 4.5x, they’ve substantial flexibility to purchase again inventory and put money into development tasks opportunistically.

Each companies generate plenty of money movement above and past their dividends, enabling them to fund a lot – if not all – of their development capex with retained money movement and lean solely on debt markets when debt comes due for refinancing or when making a big acquisition.

ENB Inventory Vs. KMI Inventory: Dividend Outlook

ENB’s dividend development charge is anticipated to return in between 3-5% yearly for the foreseeable future. Previous to the announcement of the Dominion Power acquisition, analysts forecast a 3.1% CAGR for ENB’s dividend by means of 2027. That stated, ENB’s CEO thinks that its acquisition of the Dominion utilities would additional improve ENB’s skill to develop its dividend over time along with enhancing its earnings high quality. Total, we predict that ENB will doubtless develop its dividend at a 3-4% CAGR for years to return.

KMI, in the meantime, has opted for a sluggish dividend development charge because it has been targeted on deleveraging, investing in a powerful array of latest tasks, and shopping for again inventory when opportunistic to take action. This could enhance considerably transferring ahead, as development CapEx ought to decline a bit bit and the corporate’s leverage has reached a really passable stage. That stated, analysts do not assume it can develop way more than at a 3% CAGR by means of 2027, and to this point KMI has not given traders any motive to assume it can develop sooner than that.

ENB Inventory Vs. KMI Inventory: Valuation

KMI is clearly cheaper than ENB on each an EV/EBITDA and P/DCF foundation. KMI’s present EV/EBITDA stands at an 11.2% low cost to its five-year common EV/EBITDA whereas ENB’s present EV/EBITDA stands at a 6.5% low cost to its five-year common EV/EBITDA.

That stated, ENB does provide an 80-basis level increased dividend yield than KMI does, so earnings traders might choose the upper yield even when it comes at a extra pricey valuation for the underlying money flows.

| Metric | ENB | KMI |

| EV/EBITDA | 11.66x | 8.93x |

| EV/EBITDA (5-Yr Avg) | 12.47x | 10.06x |

| P/2023E DCF | 8.59x | 7.87x |

| NTM Dividend Yield | 7.7% | 6.9% |

Investor Takeaway

Each ENB and KMI are prime quality infrastructure companies which have sturdy counterparties, very low short-term commodity worth money movement publicity, rock strong funding grade stability sheets, a transparent path to rising their dividends for years to return, enticing present dividend yields, and discounted valuations relative to their historic averages.

That stated, ENB’s money movement profile is undoubtedly increased high quality given its larger publicity to regulated earnings and funding grade counterparties and its present dividend yield plus development profile plus dividend development observe report make it seem like a superior dividend inventory. Alternatively, KMI’s stability sheet is arguably higher than ENB’s regardless of its decrease credit standing provided that its leverage ratio is kind of a bit decrease than ENB’s. Furthermore, its valuation is kind of a bit cheaper than ENB’s and it’s retaining considerably extra cash movement which it’s utilizing to purchase again inventory and put money into enticing development tasks.

ENB can also be a 1099 issuing Canadian firm (with associated tax circumstances) that declares its dividends in Canadian {Dollars} whereas KMI is a 1099 issuing American firm (with associated tax circumstances) that declares its dividends in U.S. {Dollars}, so traders ought to preserve that in thoughts earlier than investing.

We like each and charge each as very enticing, low danger Buys proper now and assume that dividend targeted traders who do not thoughts proudly owning a Canadian inventory would in all probability like ENB extra, whereas worth traders and/or traders preferring proudly owning an American firm would in all probability like KMI extra.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.