Abu Hanifah/iStock by way of Getty Photographs

Enterprise Growth Corporations (BIZD) have turn out to be more and more in style devices with revenue traders provided that their stability sheet leverage is on par with and even decrease than that of many REITs (VNQ), they make investments primarily in senior secured debt which enjoys a superior spot within the capital stack to that of most fairness REITs, and – better of all – the overwhelming majority of BDCs generate greater earnings when rates of interest rise. This makes BDCs a terrific portfolio diversification software for traders who additionally need to put money into different high-yield devices like REITs, Utilities (XLU), and MLPs (AMLP).

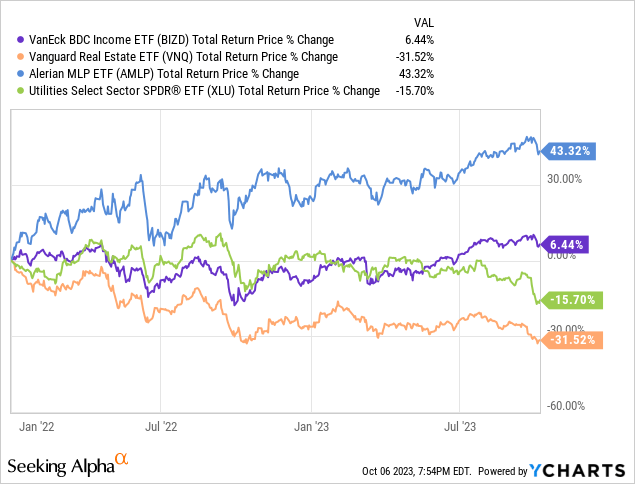

Whereas hovering vitality costs and a renewed concentrate on vitality safety within the wake of the struggle in Ukraine that started in early 2022 has pushed large outperformance within the MLP house, the chart beneath exhibits how BDCs have considerably outperformed Utilities and REITs since charges started rising in early 2022:

That being mentioned, with long-term rates of interest rising quickly in current weeks, concerns are growing over a doubtlessly extreme recession hitting the U.S. financial system. In such a situation, BDCs – which are likely to lend cash to middle-market companies that always have lower than stellar stability sheets – might start to undergo if a pointy financial downturn leads to rising non-accruals and defaults of their portfolios. In consequence, we predict it’s prudent for traders to start specializing in a number of the extra defensive names within the BDC house to be able to reduce the dangers to investor principal ought to a recession certainly present itself.

On this article, we examine two of the least costly, but extra defensively positioned BDCs – Blue Owl Capital Corp (NYSE:OBDC) and Oaktree Specialty Lending (NASDAQ:OCSL) – and supply our tackle which is the higher purchase in the intervening time.

OCSL Inventory Vs. OBDC Inventory: Funding Portfolios

Each companies make investments primarily in senior secured loans and have up to now exhibited robust underwriting efficiency, making them each among the many extra defensive choices within the BDC sector.

OCSL’s funding portfolio displays a sturdy and defensively positioned technique. A considerable 87.1% of its property are allotted to 1st and 2nd lien senior secured loans, together with a whopping 75.5% in 1st lien loans. This allocation displays Oaktree’s conventional emphasis on danger mitigation and avoiding shedding positions, as senior secured loans supply the next diploma of safety within the occasion of borrower defaults. Additionally it is fascinating to notice that – in contrast to a lot of its friends – OCSL takes a extra impartial strategy to the route of rates of interest. Whereas 83.6% of the loans in its funding portfolio are floating charge, almost an equal quantity of its excellent debt (83.2%) is floating charge. With its solely fixed-rate debt not maturing till 2025, OCSL is unlikely to face as many headwinds to its backside line if/when the Federal Reserve pivots to slicing rates of interest throughout an financial downturn.

OCSL’s stellar underwriting efficiency is mirrored in its meager 0.8% non-accrual charge on a good worth foundation.

OBDC’s funding portfolio mirrors OCSL’s conservative posture, putting a major emphasis on senior secured loans with 83.2% of its portfolio allotted to 1st and 2nd lien loans (69.1% in 1st lien loans and 14.1% in 2nd lien loans). Whereas not fairly as conservative in nature as OCSL’s, OBDC’s portfolio just isn’t far behind. OBDC has better publicity to rate of interest volatility as solely 41.8% of its debt is floating charge, which means that if/when the Federal Reserve begins to chop charges once more, will probably be shedding internet funding revenue as its floating charge mortgage revenue will fall extra dramatically than its curiosity expense on its debt.

OBDC additionally has stellar underwriting efficiency with a near-identical non-accrual charge to OCSL’s at 0.9% on a good worth foundation.

Total, we see that OCSL will get the sting over OBDC when it comes to its defensive traits as mirrored by its better allocation to 1st lien and senior secured debt, extra rate of interest impartial strategy to its stability sheet, and its barely higher underwriting efficiency.

OCSL Inventory Vs. OBDC Inventory: Stability Sheets

The monetary well being of a BDC is a essential facet of funding evaluation, and the stability sheet performs a pivotal position in assessing an organization’s stability in addition to its skill to maintain its dividend via good instances and unhealthy.

OCSL maintains a prudent leverage ratio of 1.14x as of the tip of final quarter, leaving it sufficient flexibility to cope with deteriorating financial circumstances whereas nonetheless giving it a powerful return on fairness.

OBDC has an an identical leverage ratio to OCSL’s, and each of those BDCs additionally get pleasure from funding grade credit score scores, giving them entry to debt on cheap phrases.

OCSL Inventory Vs. OBDC Inventory: Dividend Profile

On condition that BDCs are pass-through entities which might be recognized for the excessive yields that they pay out, understanding the dividend outlook is crucial when figuring out whether or not or to not put money into one.

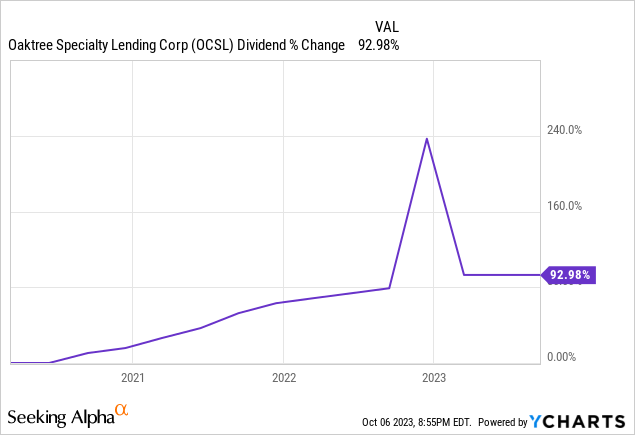

OCSL’s dividend development has been phenomenal since Oaktree assumed administration accountability a number of years in the past:

That is largely as a consequence of administration successfully recycling capital from decrease yielding loans into greater yielding loans that had been underwritten by Oaktree, thereby reaching even higher underwriting efficiency whereas additionally producing superior revenue for traders.

Transferring ahead, OCSL will possible gradual dividend development because it has largely accomplished its mortgage recycling program and rates of interest are close to or at their peak. That mentioned, the present dividend is sufficiently lined at a 1.13x ratio, combining with the robust stability sheet and funding portfolio to offer a fairly dependable dividend payout even when a light recession ought to hit.

OBDC in the meantime, covers its whole dividend payout by an much more conservative ratio of 1.2x and – when subtracting its particular dividend – its common dividend of $0.33 was lined much more simply at a 1.45x ratio. For a BDC with a reasonably conservative stability sheet and funding portfolio, OBDC has a really sustainable common dividend payout and even might doubtlessly develop it a bit extra transferring ahead.

OCSL Inventory Vs. OBDC Inventory: Valuation

In the case of valuation, OBDC is considerably cheaper than OCSL, buying and selling at a 12.39% low cost to NAV in the intervening time in comparison with OCSL’s extra modest 3.63% low cost to NAV. That mentioned, OCSL has a a lot greater dividend yield of 11.66% in comparison with OBDC’s dividend yield of 9.87%. Annualizing their most up-to-date quarter’s internet funding revenue provides OCSL a P/NII of seven.7x and OBDC a P/NII of seven.0x. As such, we are able to conclude that OBDC is about ~10% cheaper than OCSL on each a P/NAV and P/NII foundation, although it’s extra cautious within the quarterly dividend that it pays out to shareholders and as a substitute opts for particular dividends to complement its quarterly dividend.

Investor Takeaway

Each of those BDCs are fairly prime quality and well-positioned to cope with an financial downturn. OCSL advantages from the pedigree that comes with the Oaktree title and its well-known Chairman Howard Marks. Furthermore, its portfolio is barely extra conservatively positioned and is healthier positioned to cope with a decline in rates of interest than OBDC is. Lastly, its quarterly common dividend is meaningfully greater than OBDC’s is whereas nonetheless being fairly nicely lined by NII.

That mentioned, OBDC is significantly cheaper than OCSL is and its common quarterly dividend is significantly better lined by NII. Total, for traders seeking to maximize yield whereas guarding towards draw back to NAV and NII, OCSL is the higher choose. Nonetheless, for traders seeking to maximize whole returns, OBDC possible presents barely extra upside potential relative to incremental danger. We charge each as Buys.