Government Abstract: After the profitable conclusion of the Merge and the removing of lock-up intervals, curiosity in Ethereum staking is growing quickly. However staking comes at the price of liquidity. Platforms that supply liquid staking spinoff (LSD) tokens mix the very best of each worlds – passive revenue from staking rewards mixed with the liberty to commerce and make investments staked ETH on DEXs and DeFi platforms by way of spinoff tokens.

LSD tokens come in several designs and architectures – rebasing contracts, non-rebasing tokens, single tokens, and dual-token fashions are the first examples. Buyers should study in regards to the execs and cons of every token and decide one which aligns with their long-term objectives, danger tolerance, and liquidity wants.

Staking rewards from LSD tokens vary from a low of two.00% all the way in which as much as 9.00% APY. For DeFi initiatives, non-rebasing, dual-token methods provide the very best efficiency. Decentralized providers are preferable to centralized platforms as a result of decreased danger of community assault vulnerabilities.

What are Liquid Staking Derivatives (LSDs)?

Clarify Like I’m 5: Liquid staking derivatives are like borrowing a toy that appears and feels identical to your favourite toy, so you’ll be able to play with it whereas retaining your authentic toy protected. You can provide the borrowed toy again whenever you’re completed and get your authentic toy again. It’s a approach to make use of your locked-up cryptocurrency with out really unlocking it.

Liquid staking derivatives are an attention-grabbing new breed of crypto tokens that arose in late 2020. Just like the spinoff devices in conventional finance, LSDs are monetary devices that derive their worth from an underlying asset – on this occasion, staked tokens in Proof-of-Stake (PoS) blockchains like Ethereum.

LSDs are the native token discovered on liquid staking platforms. Rocket Pool, LIDO, and StakeWise are standard examples of liquid staking service suppliers. Once you stake your PoS tokens on these platforms, you obtain an equal quantity of a local LSD token in alternate. (Stake your ETH in Coinbase, get cbETH in return.)

The spinoff tokens are minted on-demand in a 1:1 ratio whenever you deposit your tokens into the platform. And they’re destroyed as quickly as you withdraw your staked tokens. The LSD tokens can then generate extra yield by way of strategies like yield farming.

Any revenue you generate by way of these strategies is along with your staking revenue. If you happen to want quick liquidity, you’ll be able to commerce these tokens on spinoff exchanges or use them as collateral for DeFi loans.

LSD tokens are just like different crypto tokens since they’re absolutely transferable and fractional. They maintain a price that’s just like the underlying token. Their predominant objective is to beat the constraints related to common staking.

Why Put money into Liquid Staking Derivatives?

By January 2023, over 16 million ETH was locked away in staking. Liquid staking swimming pools like Lido and Rocket Pool accounted for 42.7% of the whole, price round $10.7 billion. The success of those platforms signifies the huge demand for ETH staking regardless of the lengthy lock-up interval.

Though the Shanghai-Cappella improve in April 2023 eliminated the withdrawal restrictions, it has not resulted in a sustained exodus of staked ETH from validator swimming pools. As an alternative, deposits exceeded withdrawals barely a month after the improve, indicating renewed curiosity in Ethereum staking.

And it isn’t arduous to see why. To this point, Ethereum staking has yielded rewards price 1 million ETH. Within the absence of necessary lock-ups and the liberty to withdraw, the validators are prone to enhance. When that occurs, the common yield (APR) from staking will lower additional, particularly for staking swimming pools.

Apart from, even after the Shapella improve, traders searching for considerable staking returns will nonetheless need to lock their tokens away for sustained intervals of as much as a 12 months or extra. This, mixed with the specter of decrease staking rewards, makes liquid staking derivatives much more engaging for anybody who can’t afford to run their very own validator nodes.

Finest Staking By-product Charges

Rocket Pool rETH

Rocket Pool rETH

Minimal Stake: 0.01 ETH

Complete Worth Locked (TVL): $1.17 billion

Market Share: 7.16%

Rocket Pool is likely one of the oldest Ethereum staking initiatives. The mission was launched in 2016 when the Ethereum neighborhood was nonetheless debating the blockchain’s transition to the Proof-of-Stake mannequin.

Though it has been overtaken by others like Lido and the newer Coinbase liquid staking protocol, Rocket Pool continues to be the third-largest liquid staking mission for ETH. It retains a loyal following amongst crypto lovers because of its heavy deal with decentralization.

The governance token of the mission is RPL. The LSD token you get in alternate for staking ETH known as rETH. Anybody with 16 ETH and 1.6 ETH price of RPL can create a Rocket Pool ETH staking node.

The remaining 16 ETH is collected from different ETH holders searching for to take part in liquid staking by way of permissionless staking. The minimal stake required is kind of low at simply 0.01 ETH or round $20 at present alternate charges.

The node operators obtain a price starting from 5 to twenty% of the staking rewards for his or her effort. Rocket Pool presents comparatively modest yields of round 5.17%. The protocol earns revenue solely by way of RPL token emissions.

As it’s considerably much less centralized than Lido, with over 2000 validators in comparison with the latter’s 21, Rocket Pool poses minimal danger to the Ethereum blockchain. Not like Lido’s stETH, Rocket Pool’s rETH isn’t a rebasing token.

The worth of rETH consistently appreciates over time to mirror your staking rewards. As well as, non-rebasing tokens are simpler to deploy in DeFi initiatives. These are a number of the predominant causes Rocket Pool maintains its recognition amongst safety-conscious stakers.

StakeWise sETH2

StakeWise sETH2

Minimal Stake: 1 wei

Complete Worth Locked (TVL): $163.94 million

Market Share: 1.00%

StakeWise is likely one of the many liquid staking protocols that appeared in the marketplace after the launching of the Beacon Chain for the Ethereum Merge in December 2020. The LSD token awarded to ETH depositors on the staking service known as sETH2.

Other than sETH2, the protocol additionally has a devoted token for staking rewards known as rETH2, which shouldn’t be confused with the rETH of Rocket Pool. Stakewise LSD token holders will begin receiving rETH2 rewards inside 24 hours of depositing their ETH.

StakeWise makes use of a decentralized system that anybody can apply to change into node operators. However qualification isn’t assured since there’s a rigorous vetting course of, and candidates need to garner the approval of the protocol DAO members.

For the odd ETH stakers, the primary enchantment of StakeWise sETH2 lies in its simplicity and promise of quick rewards. The service accepts minimal stakes beginning on the lowest potential fraction of ETH, or 1 wei.

The twin-token system additionally helps the protocol keep away from the widespread pitfalls related to rebasing tokens. The APY reward potential can be among the many highest, making StakeWise a beautiful alternative for stakers who need a smaller, extra decentralized, and DeFi-friendly different to Lido.

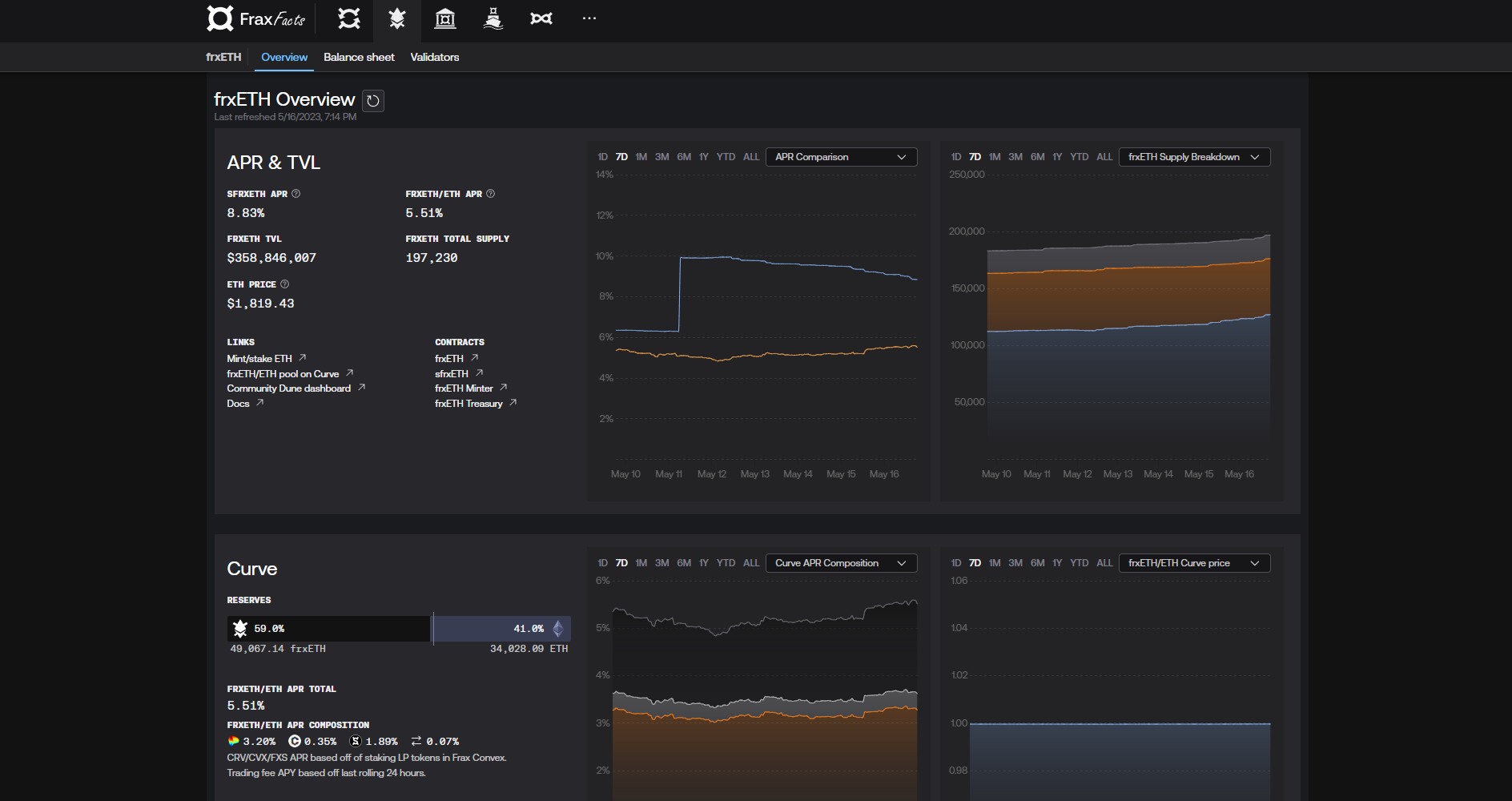

Frax Ether sfrxETH

Frax Ether sfrxETH

Minimal Stake: 1 wei

Complete Worth Locked (TVL): $356.03 million

Market Share: 2.17%

Frax Finance is the issuing authority of the staked Frax Ether token. Moreover, they’re the issuers of the FRAX stablecoin, the primary fractional reserve stablecoin pegged to the US Greenback. It is usually one of many newer entries to the market, with a gentle neighborhood launch in October 2022 and an official launch in January 2023.

The liquid staking service at Frax Ether follows the identical primary precept as StakeWise, with separate tokens for liquidity (frxETH) and staking rewards (sfrxETH). To take part, ETH holders can deposit their tokens into the Frax ETH Minter sensible contract.

Depositors obtain frxETH in a 1:1 ratio. You may commerce or take part in different DeFi actions utilizing the frxETH token on the Curve platform. To entry the staking rewards, it’s essential to convert the frxETH into sfrxETH tokens.

Regardless of its late launch, Frax Ether has attracted over $350 million in TVL with a 40% enhance in staking inside just a few months of launch. It at the moment sits above older, extra mature liquid staking providers like StakeWise. It additionally boasts the very best returns of all LSD tokens, with APY approaching 9.10%.

The principle dangers related to Frax are associated to its algorithmic stablecoin in mild of the latest collapse of Luna/Terra. However to counter that, Frax Finance has collateralized the stablecoin as much as 90% utilizing USDC and maintains deep liquidity on the Curve platform.

Lido stETH

Lido stETH

Minimal Stake: 1 wei

Complete Worth Locked (TVL): $12.22 billion

Market Share: 74.52%

With a market share that has touched 90% prior to now, Lido is the dominant participant in liquid staking by a big margin. It was the primary mover within the liquid staking enterprise after the start of the Ethereum Merge in December 2020, a bonus it has retained within the final two years. The protocol accounts for almost 30% of all ETH staked.

Customers can stake any quantity of ETH on the platform and obtain the stETH token in alternate at a charge of 1:1. Not like different LSD tokens on this web page, stETH is a standalone token used for liquidity and staking rewards.

The tokens are minted when a person deposits ETH on Lido. And they’re burned away when the person withdraws the ETH at a later date. stETH is a rebasing token – its provide is automated by way of a sensible contract to keep up worth stability.

The amount of stETH in provide could change day by day at 12PM UTC if there are any modifications in ETH2 deposits or ETH rewards. Whereas worth stability and decentralization are apparent benefits of rebasing, additionally they have some notable flaws.

Many DeFi apps are merely incompatible with rebasing tokens, probably minimizing the variety of out there initiatives for stETH holders. In excessive market volatility, the rebasing perform also can backfire, contributing to cost instability as a substitute of stopping it.

Lido can be a sufferer of its personal success. The entity’s gigantic market share is a priority as it may possibly result in centralization and enhance the chance of community assaults. Efforts are underway to attenuate this danger and cut back the centralization of the protocol.

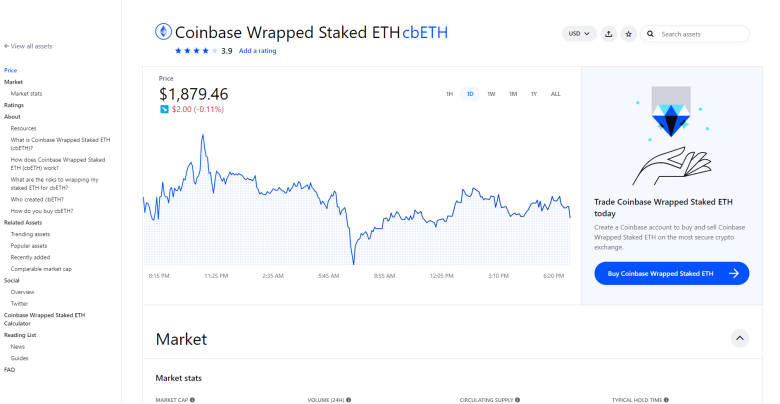

Coinbase Wrapped cbETH

Coinbase Wrapped cbETH

Minimal Stake: 1 wei

Complete Worth Locked (TVL): $2.14 billion

Market Share: 12.58%

Coinbase is a serious centralized cryptocurrency alternate based mostly in the USA. The platform launched its liquid staking providers in August 2022. With the inherent benefit of its giant person base, Coinbase has rapidly change into the second-largest liquid staking protocol with over $2 billion TVL inside 12 months.

The LSD utility token on the platform known as the Coinbase Wrapped Staked ETH, or simply cbETH for brief. It’s an ERC-20 token generated in alternate on your staked ETH in a 1:1 ratio. However since it’s a wrapped token, the costs of cbETH will are usually decrease than the market worth of ETH, and the 1:1 worth isn’t pegged.

You should purchase and stake ETH utilizing the Coinbase app. The wrapped cbETH might be traded on the alternate or moved on-chain and be utilized in varied different DeFi initiatives on platforms like Curve Finance and Aave. As an alternative of staking ETH, it’s also possible to purchase the wrapped token instantly.

Because of the platform bills and different charges concerned, cbETH staking rewards are usually decrease than different decentralized protocols within the liquid staking scene. If you happen to already use Coinbase actively for buying and selling and staking ETH, cbETH could possibly be a great choice for the sheer sake of familiarity and ease of entry.

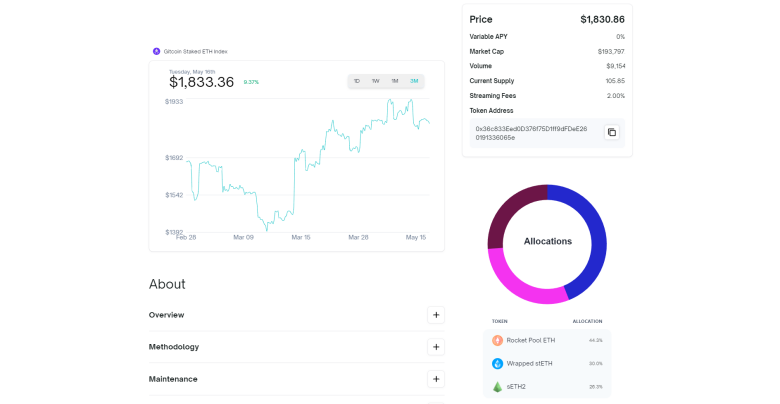

Gitcoin Staked Ethereum Index

Gitcoin Staked Ethereum Index

Minimal Stake: 1.01 ETH

Complete Worth Locked (TVL): N/A

Market Share: N/A

Investing in a single LSD token can expose you to a point of danger from volatility. Spreading your ETH throughout a number of liquid staking providers can mitigate this to some extent, however it isn’t very handy.

Investing in an index token that offers you publicity to the highest LSD tokens available in the market is a extra handy and protected different. One such choice on this house comes from a DAO known as Index. It was launched by Set Labs in October 2020 with the purpose of decentralizing the blockchain finance ecosystem.

Index has launched a number of index tokens that target main LSD tokens from Lido, Rocket Pool, and StakeWise. One such token with a public service motive is the Gitcoin Staked Ethereum Index. The LSD token right here known as gtcETH.

Shopping for gtcETH provides you publicity to the key LSD tokens whereas accruing staking rewards. Index collects a 2.00% streaming price on the platform. Out of this, 1.75% is paid out to Gitcoin, an open-source, decentralized platform that focuses on funding public items initiatives within the Ethereum ecosystem.

Investing in gtcETH is like not directly subscribing to Gitcoin – you might be mainly contributing funds to their initiatives whereas concurrently incomes a portion of staking rewards. Attributable to that streaming price, rewards on gtcETH are among the many lowest of all liquid staking providers. It’s a worthy choice for ETH stakers who wish to diversify whereas contributing to Gitcoin initiatives.

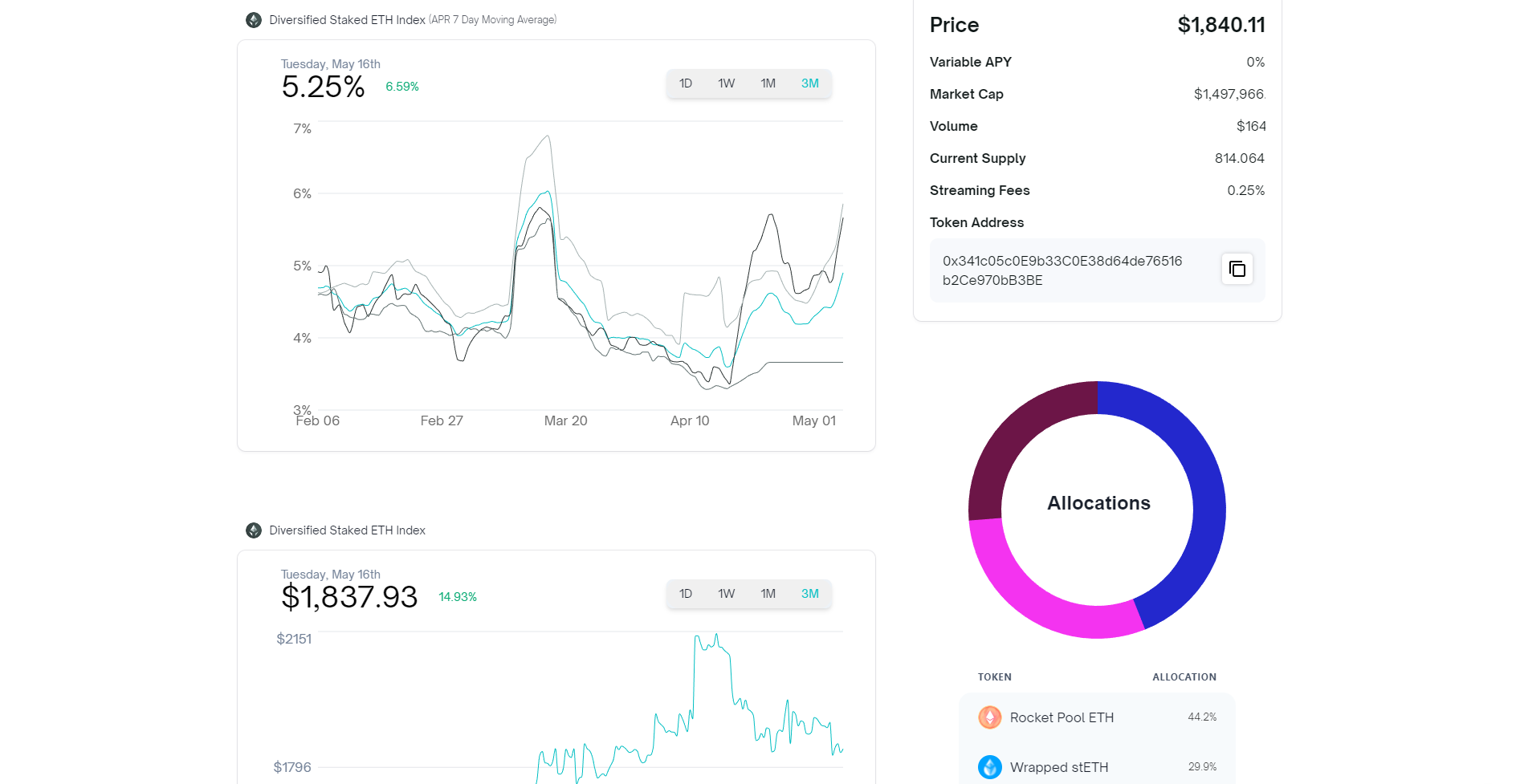

Diversified Staked Ethereum Index

Diversified Staked Ethereum Index

Minimal Stake: 1.01 ETH

Complete Worth Locked (TVL): N/A

Market Share: N/A

That is the second index token from Index DAO. Just like the Gitcoin Index, the Diversified Index tracks the key liquid staking tokens like Lido’s stETH and Rocket Pool’s rETH. However in contrast to the opposite mission, this one guarantees increased rewards.

Streaming charges exist, however right here, you might be simply paying the fundamental 0.25% price to the Index Coop. The LSD token known as dsETH, and you should purchase it on most decentralized exchanges. An alternative choice is to get it by redeeming ETH on the Certainly Coop App by way of a course of dubbed Flash Minting.

Each gtcETH and dsETH are just about an identical, save for the extra funding to Gitcoin within the former. They each enable holders to earn passive revenue whereas spreading the chance throughout a number of LSD tokens within the market.

Within the course of, it’s also possible to contribute to the general decentralization of the Ethereum staking ecosystem. dsETH rewards are corresponding to different main LSD tokens like Rocket Pool or Coinbase, at a mean of 5% APY.

Investor Takeaway

The liquid staking spinoff house is a quickly evolving market. Buyers have already got entry to a plethora of LSD tokens, every with distinctive benefits and weaknesses.

For traders who need the token with essentially the most market share, Lido is the undisputed champion. However issues exist concerning its potential risk to the long-term decentralization of the Ethereum community.

If excessive returns are a precedence, Frax and StakeWise are the optimum selections with the very best APY amongst main tokens.

For traders involved about over-centralization within the Ethereum ecosystem, there’s in all probability no higher choice than Rocket Pool.

If you happen to prioritize diversification above all else and wish to reduce danger as a lot as potential, take into account investing in an index token like dsETH on the Index Coop app.

And if you’re a Coinbase common, the on-chain cbETH might be the most secure, best choice for traders who don’t thoughts the centralized structure.