Michael Vi

Inventory Snapshot

Heading into the house stretch this vacation buying season, in the present day’s analysis word covers a serious US retailer, Finest Purchase Co. (NYSE:BBY).

Just a few quick facts about this inventory are that it has +1,000 shops in US and Canada, launched a number of “teen tech facilities” by way of its non-profit Finest Purchase Basis, and moreover retail areas has a strong eCommerce web site (BestBuy.com) with a deal with electronics, dwelling workplace equipment, and associated merchandise.

Personally, I’ve shopped at this model dozens of instances in varied cities within the US, however for a second I need to step outdoors the field of a buyer and into the motive force’s seat of a possible investor on this firm.

Scoring Matrix

This text makes use of a 9-point scoring matrix that holistically considers a number of angles of the inventory, with an emphasis on dividend-income potential for traders and elementary traits from the important thing accounting statements such because the stability sheet and earnings statements, in addition to a future-looking outlook on this inventory.

I proceed to check this system in my very own portfolio, on shares I do not cowl right here, and it’s my normal for constructing a long-term dividend-income portfolio that grows annually. So, I personally have a capital stake on this method being profitable.

In the present day’s Ranking

Finest Purchase – rating matrix (writer evaluation)

Primarily based on the rating complete within the rating matrix above, this inventory is getting a score of maintain.

Evaluate to the consensus score on In search of Alpha, I’m principally agreeing wholeheartedly with the consensus from analysts, Wall Avenue, and the quant system as of in the present day:

Finest Purchase – score consensus (In search of Alpha)

Dividend Revenue Development

This part makes use of dividend development information to explores the ten 12 months dividend earnings development for a hypothetical investor proudly owning 100 shares, to find out whether or not this inventory is a superb dividend earnings alternative.

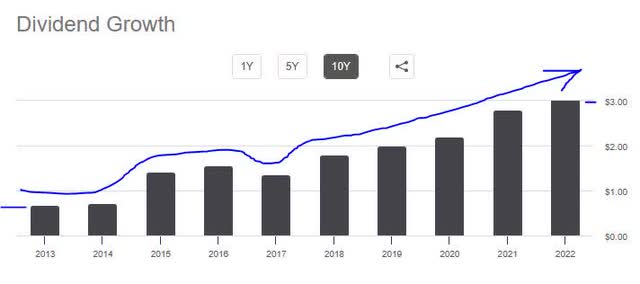

Finest Purchase – dividend development (In search of Alpha)

If we research the above development chart we will see that in 2013 the annual dividend was $0.68, which might make us $68/12 months in dividend earnings on 100 shares held. Had we then held these shares till 2022, when the annual dividend was $3.52, our earnings could be $352. That’s an over 400% development in 10 years.

That in my view is a formidable triple-digit development to date, however what about going ahead? Nicely, we will see that for 2023 the annual dividend is already as much as $3.68 ($0.92/share quarterly) so it continues to develop, an indication of this firm’s potential to proceed returning capital again to shareholders.

Only for kicks, if the identical development fee of 400% continues till 2032, and we nonetheless held the identical 100 shares by then, our portfolio might see upwards of +$1,760 in annual dividend earnings.

On this class, I’d name this a robust purchase alternative, on the premise of confirmed triple-digit dividend development over 10 years, and continued development heading into 2024.

Dividend Yield vs Friends

This part makes use of dividend yield information to check the trailing dividend yield vs 2 or 3 comparable friends in the identical sector, to find out if this inventory presents essentially the most aggressive dividend yield on capital invested.

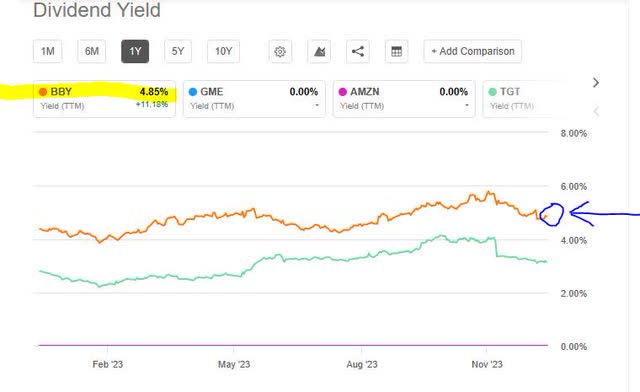

Finest Purchase – dividend yield vs friends (In search of Alpha)

On this chart above, I used the helpful dividend yield comparability device from In search of Alpha to check my focus inventory of Finest Purchase in opposition to three shares I’d name friends. I picked these 4 corporations simply realizing the place prospects normally might go to buy issues like electronics or video games, for instance. These embody Finest Purchase, Amazon (AMZN), GameStop (GME), and Goal (TGT).

Pondering like a dividend investor, I’m trying to decide the perfect yield for my capital invested. On this group, Finest Purchase led the best way with a 4.85% yield.

Whereas GameStop and Amazon don’t seem to pay dividends, fellow retailer chain Goal does, with a yield within the +3% vary.

On this class I’d name Finest Purchase a powerful purchase on the premise of almost 5% dividend yield and higher than the friends talked about.

Income Development

This part explores this firm’s income development traits over the past 12 months, utilizing information from the earnings assertion.

What it tells us is that within the quarter ending October the corporate achieved $9.75B in complete income, vs $10.58B in Oct 2022, a 7.8% YoY decline.

On the similar time although, gross revenue grew to $7.24B from $6.83B in Oct 2022, a 6% YoY development.

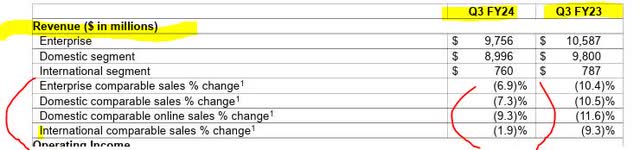

From its present FY24 Q3 earnings release that got here out on November twenty first, we will see that though the corporate has income diversification it has seen gross sales declines in a number of segments:

Finest Purchase – declines by section (firm outcomes)

Of their home US market, they cited as drivers of gross sales weak point as “home equipment, computing, dwelling theater and cell phones. These drivers had been partially offset by development in gaming.”

Wanting ahead, their top-line steerage for FY24 is lower than favorable, anticipating “comparable gross sales decline of 6.0% to 7.5%, which compares to prior steerage of a decline of 4.5% to six.0%.”

To make sense of those gross sales headwinds, I turned to retail trade portal RetailDive which steered of their late November article that extra prospects are being hesitant to buy electronics recently:

Finest Purchase continues to wrestle with uneven client demand.

With shoppers holding again on big-ticket purchases, or selecting to make use of their funds elsewhere, Finest Purchase dangers dropping out not simply on gross sales but additionally foot site visitors that usually drives extra purchases, in response to GlobalData Managing Director Neil Saunders.

I’d name this inventory a promote on this class then, on the premise of declining income efficiency, declining full-year gross sales forecasts, weak point in a number of enterprise segments not only one, and proof of headwinds to electronics demand.

Earnings Development

This part explores this firm’s earnings (web earnings) development traits over the past 12 months, additionally utilizing information from the earnings assertion.

What this information can inform us is that web earnings of $263MM was achieved within the final quarter, vs $277MM in Oct 2022. This can be a +5% YoY decline.

We will see from the earnings assertion that curiosity prices elevated considerably to $14MM, vs $10MM in Oct 2022. Nonetheless, on the similar time it seems that working bills declined on a YoY foundation.

The corporate is forecasting the next: “on the profitability aspect, we anticipate our This autumn FY24 non-GAAP working earnings fee to be in a variety of 4.7% to five.0%, which compares to a fee of 4.8% final 12 months.”

Bear in mind additionally that the following earnings outcomes that come out in late February should have the total vacation season outcomes.

In line with CEO Barry of their current quarterly outcomes commentary:

We’re excited for the necessary vacation season and are ready for a buyer who could be very deal-focused with promotions and offers for all budgets, new buying experiences, an expanded product assortment, and quick and free achievement..

Constructive tailwind to assist this sentiment is current information as reported by Forbes magazine, indicating a powerful begin to the season early on:

Within the first couple days of the vacation buying season, data have shattered. In line with the Nationwide Retail Federation, 200.4 million folks shopped on-line or in shops between Thanksgiving Day and Cyber Monday this 12 months. This is a rise of two% from 2022, and the very best quantity NRF has tallied because it began monitoring vacation outcomes.

So, I’ll name it a maintain on this class as a result of though there was a YoY earnings decline it was barely 5%, and the forecast by the corporate is looking for profitability, whereas third-party information is exhibiting vacation buying energy, and I do know the significance of gross sales for a corporation like this between November and New Years Day, in all probability essentially the most vital month for retail.

Fairness Constructive Development

This part explores this firm’s fairness (e-book worth) development traits over the past 12 months, utilizing information from the stability sheet.

Right here we see a YoY drop in fairness because it fell to $2.81B this October, vs $2.99B in Oct 2022, a 6% YoY decline.

We will see nonetheless that the corporate continues to have capital energy. In line with its quarterly launch:

On a year-to-date foundation, the corporate has returned a complete of $873 million to shareholders by means of dividends of $603 million and share repurchases of $270 million.

Why the comparatively low fairness quantity then for a corporation with $16.8B in complete property? Nicely, the very fact is that it additionally has $14.07B in complete liabilities, so liabilities are almost 84% of property. That’s comprehensible in a enterprise mannequin impacted by the excessive overhead prices of managing a whole bunch of shops, warehouses, and a large supply-chain. It prices cash to run a brick-and-mortar enterprise, in spite of everything, regardless of it additionally having a strong eCommerce enterprise too.

So, on this case I’ll name this a maintain within the class of fairness as a result of e-book worth/fairness solely declined round 6% and the corporate has capital energy to return capital to shareholders by way of dividends/repurchases, nonetheless the bigger difficulty is that fairness is comparatively low to start with as they’re heavy on liabilities. One in all them is long-term debt, lingering round $1.1B.

Share Worth vs Transferring Common

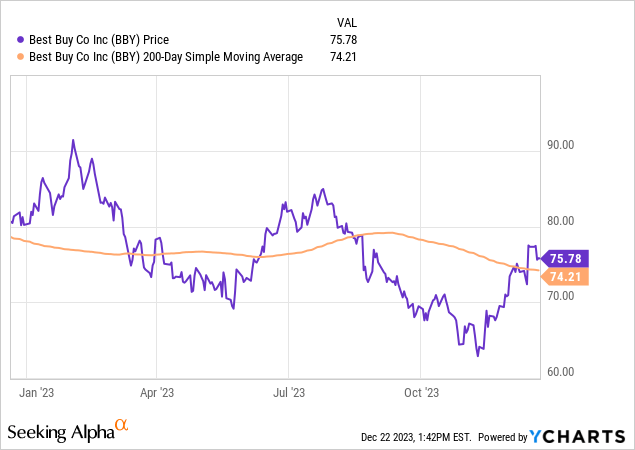

This part makes use of the YChart device to discover the present share worth in comparison with the 200-day easy shifting common, to determine if it at the moment presents a purchase, maintain, or promote alternative. The 200-day SMA is my normal long-term development indicator I desire for its simplicity and smoothing out the worth motion.

From the YChart above, we will see a share worth of $75.78 and the 200-day easy shifting common I’m monitoring. As of this text writing, the worth is about +2% above the shifting common.

It seems from this chart that I missed out on the autumn worth dip into the low $60 vary, so now I’d name this extra of a maintain on the $75 vary as a result of they didn’t impress with any nice earnings or income YoY development and have a stability sheet burdened by liabilities, in addition to current demand weak point for electronics.

The opposite canary within the coal mine for some time now could be the huge quantity of competitors this sort of enterprise has on-line when it comes to promoting comparable merchandise. The client tactic of perusing the product at Finest Purchase or Goal to get a really feel for it after which logging on to attempt to scoop up the identical merchandise at a significantly better worth just isn’t so uncommon by now, so Finest Purchase I believe should compete additional onerous to get these prospects who’re on the verge of shopping for and persuade them it’s Finest Purchase they need to get the product at first.

With that mentioned, as an investor I’d maintain this inventory till we see the vacation gross sales outcomes and earnings launch in February, so would contemplate it a dividend earnings play within the meantime.

Valuation: Worth-to-Earnings

This part makes use of valuation information to discover the ahead P/E ratio and whether or not it presents an undervaluation alternative or seems overvalued.

On this metric, we will see a GAAP-based ahead P/E ratio of 12.56, almost 30% under its sector common.

Tying this a number of of 12.5x earnings again to the financials and share worth, we will see a mixture of the share worth rising above its shifting common whereas earnings have seen a slight decline.

Once more, I say maintain on this one as a result of the valuation at 12.5x is under common but additionally the market is pushing up the “worth” aspect of this a number of it appears whereas earnings haven’t caught up but. A blowout vacation quarter might give earnings that enhance they should catch up and decrease this a number of some extra.

Valuation: Worth-to-E book Worth

This part makes use of valuation information to discover the ahead P/B ratio and whether or not it presents an undervaluation alternative or seems overvalued.

On this metric, we see a ahead P/B ratio of 5.12, almost 93% above its sector common.

Tying this a number of of over 5x e-book worth again to the sooner metrics I mentioned, it seems what’s driving it’s the spike in share worth mixed with a declining e-book worth, making this inventory seem overvalued.

I do not assume a valuation of 5x presents a purchase alternative so I’ll cross on this one, and name it a maintain as an alternative. Once more, because of the e-book worth /fairness declining whereas the market is driving up the share worth above its shifting common.

Danger Evaluation

This part identifies a key danger to think about about this firm and what its likelihood and influence could possibly be to the enterprise.

This being a retail enterprise that can be very recessionary, trying past the gross sales surge this vacation season we additionally need to put money into a enterprise with sustainability past only one vacation season, since in spite of everything there are 12 months in a 12 months.

In line with the Dec. 19th analysis from international consultancy Bain & Co:

Globally, all of the elements for continued financial fragility and uncertainty are current. The dangers of an hostile shock—monetary or geopolitical—stay excessive. With uncertainty unlikely to dissipate any time quickly, it’s vital for corporations to arrange for a variety of financial and geopolitical situations.

A significant American journal like US News & World Report of their Dec. nineteenth article appeared to point out a combined sentiment on this difficulty:

Inflation and rising charges haven’t but dragged down the U.S. financial system. The U.S. added 199,000 jobs in November, and the unemployment fee stays traditionally low at simply 3.7%, in response to the U.S. Bureau of Labor Statistics.

Traders ought to proceed to watch the labor market in coming months as tight financial coverage usually has a lagging influence on financial development. U.S. GDP grew 5.2% within the third quarter of 2023, however the newest Federal Reserve financial projections counsel that development will gradual to simply 1.4% for the total 12 months in 2024.

So, so far as the draw back danger of a recession in 2024, I’d say the proof suggests a middle-of-the-road method is finest now, indicating a maintain score could be warranted on this inventory.

By the way, an upside danger to say could possibly be that the Fed begins reducing rates of interest a lot ahead of anticipated, thereby making a domino impact of decrease credit score prices all through the financial system, and cheaper to finance that new electronics buy too, spurring extra gross sales.

Nonetheless, that’s much less more likely to happen, as CME Fedwatch predicts solely a 16.5% likelihood that the Fed lowers charges at its subsequent assembly which isn’t till Jan. thirty first.

Fast Abstract

Briefly summarizing in the present day’s word, I’m going impartial on this inventory by giving it a maintain score as I’m not impressed with its YoY development numbers and weak point in gross sales, contemplating that gross sales is the lifeblood of a retail product enterprise.

On the similar time, it has a confirmed dividend earnings development development and continued capital energy to assist its dividend, so extra of a dividend earnings play proper now and so as to add some publicity to this sector in my portfolio of non-retail shares.

This will probably be a vital vacation gross sales season and presently we do not know the total end result till the season is over and the figures are tabulated.