Kativ

Beazer Houses USA, Inc. (NYSE:BZH) not too long ago delivered spectacular expectations for This autumn 2023 close to gross sales tempo progress, backlog conversion, and helpful figures for 2023. Additionally, with a formidable variety of power environment friendly tax credit which will final for greater than 7 years and not too long ago introduced value discount initiatives, Beazer Houses USA does seem a bit undervalued. I do see dangers from the whole quantity of debt, potential modifications within the rates of interest, or modifications within the worth of land. Nonetheless, I consider that there’s a potential within the inventory worth.

Beazer Houses USA

With actions in 13 states distributed within the East, West, and Southeast of the US, Beazer Houses is an organization devoted to the development of houses with varied worth choices and classes for future householders.

The actions are divided into three segments that correspond to every of the geographical areas indicated above: East, West, and Southeast. The corporate’s exercise is comparable within the three segments, and is aimed on the building of single household houses and multifamily houses, after buying land and creating it to adapt it to the conclusion of the challenge.

Diversification in 17 states – of which Arizona, Nevada, California, and Texas stand out, as a result of the biggest quantity of annual income comes from these states – serves to keep away from publicity to the chance of a selected regional market. Inside this framework and not too long ago in 2016, Beazer Houses launched the Gatherings program, which gives the development of houses for age segments of the inhabitants, with properties with low upkeep prices and aimed primarily at these over 55 years of age. Inside its portfolio, the corporate, along with providing the development of houses with custom-made designs, consists of greater than 200 dwelling fashions, which cowl ornament, furnishings, and landscaping across the dwelling, and are one of many primary gross sales channels.

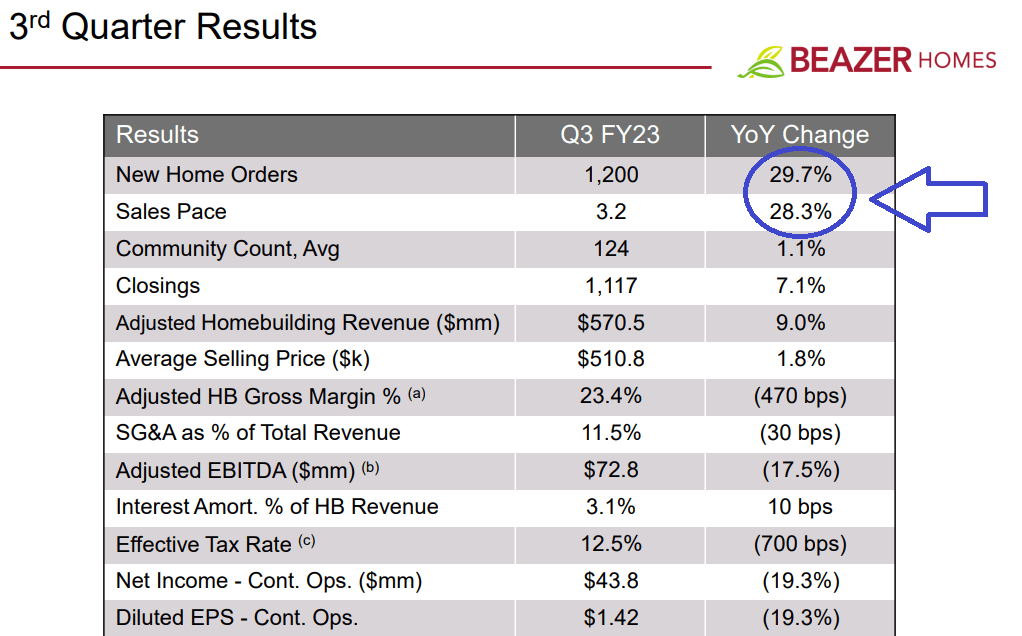

I consider that it’s a nice time for reviewing Beazer Houses USA primarily due to the current quarterly outcomes reported in Q3 and the expectations for This autumn. The corporate reported 29% improve y/y in new dwelling orders in addition to 28.3% y/y gross sales tempo progress. Because of this, adjusted homebuilding income progress was near 9%. For my part, if the corporate continues to ship such impressive figures within the coming quarters, the inventory worth will most certainly pattern increased.

Supply: Presentation To Traders

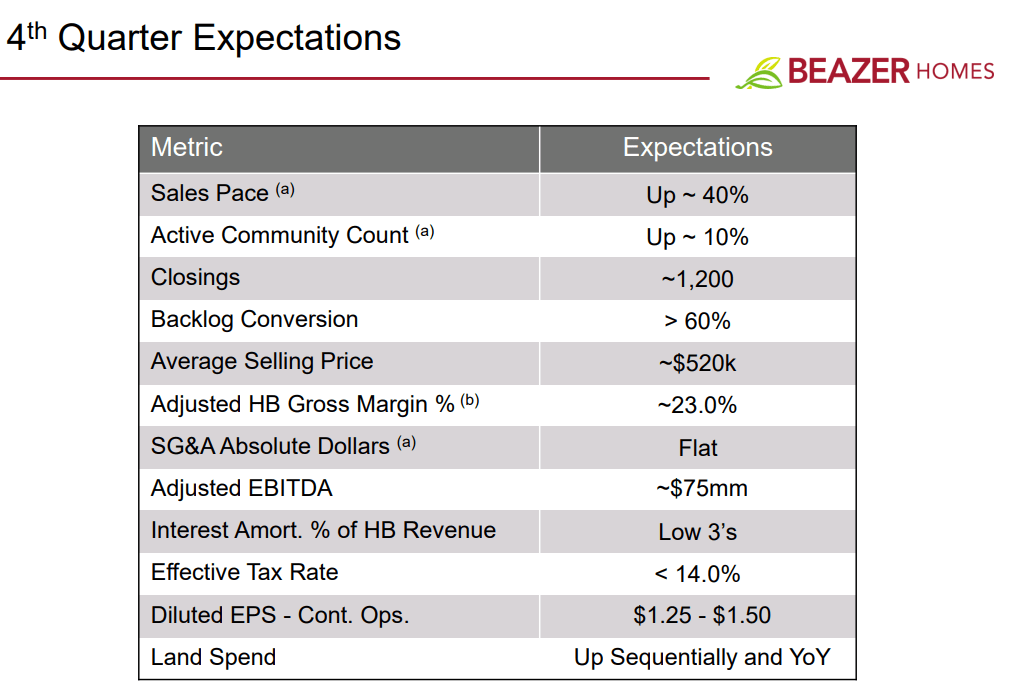

The expectations delivered for This autumn are fairly helpful. Gross sales tempo is anticipated to be near 40%, with backlog conversion of about 60%, and an adjusted EBITDA of about $75 million.

Supply: Presentation To Traders

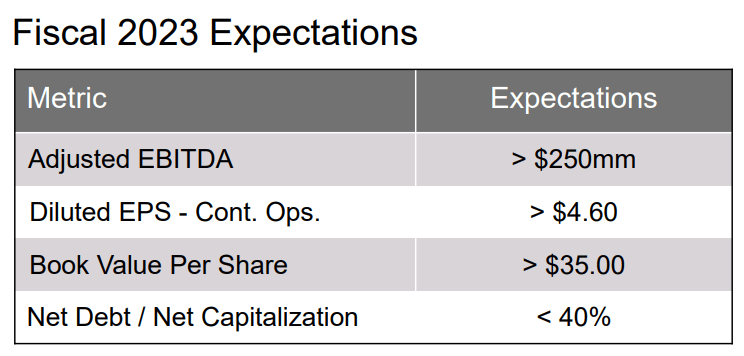

The numbers for 2023 have been additionally given within the final presentation. 2023 Adjusted EBITDA is anticipated to be near $250 million, with a guide worth per share near $35 per share. Taking into consideration the present inventory worth and the anticipated guide worth per share, I consider that Beazer Houses USA seems low cost.

Supply: Presentation To Traders

Useful Expectations

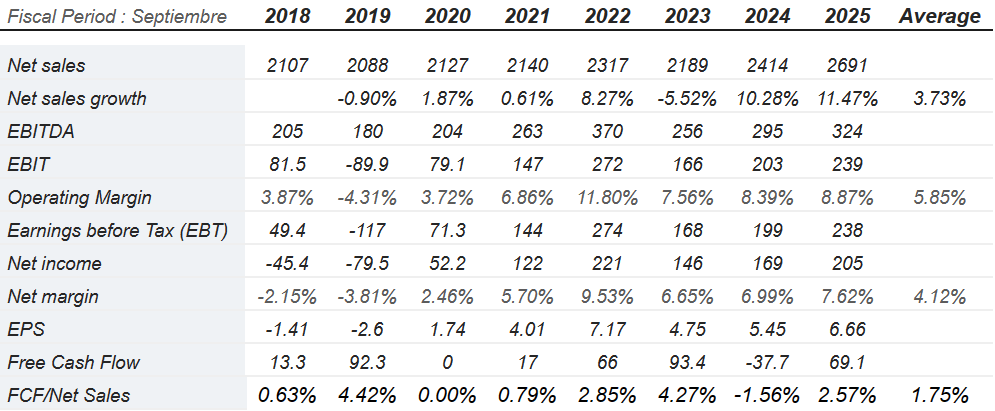

I consider that market expectations for Beazer Houses USA are fairly helpful. Some numbers are price mentioning. Let’s take into account that I did check out the figures of different analysts earlier than designing my very own expectations.

Market analysts count on double digit internet gross sales progress in 2024 and 2025 in addition to working margin progress in 2023, 2024, and 2025. Moreover, the online margin is anticipated to be round 6% and seven% from 2023 to 2025, and the corporate would report constructive free money stream in 2025.

Extra particularly, analysts count on 2025 internet gross sales to be near $2691 million, with internet gross sales progress of 11%, EBITDA near $324 million, and internet revenue near $205 million. Lastly, the EPS is anticipated to be round $6, with free money stream near $69 million, and FCF/net sales of close to 2.57%.

Supply: Market Screener

Stability Sheet

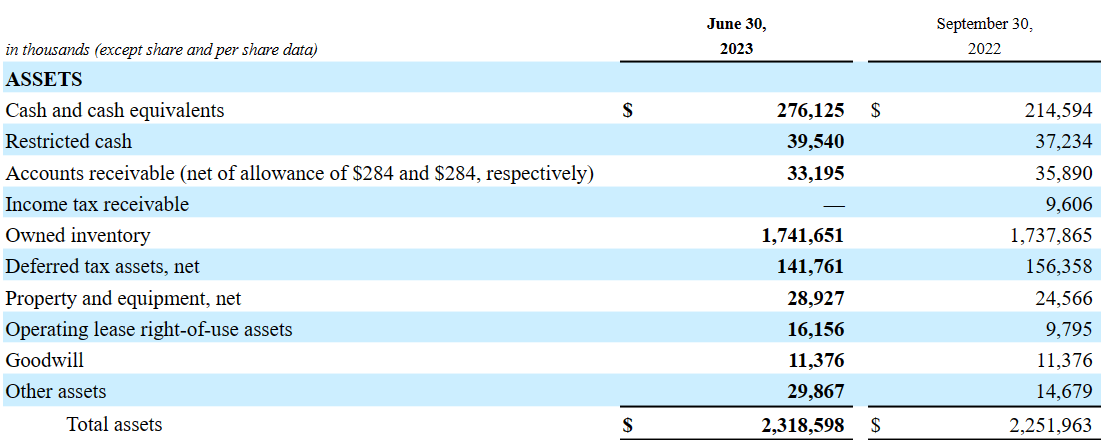

As of June 30, 2023, the corporate reported money and money equivalents near $276 million, with restricted money of about $39 million, accounts receivable of $33 million, and owned stock near $1741 million. Contemplating the whole amount of money in hand and the listing of present liabilities, I consider that liquidity doesn’t appear a difficulty right here.

Lastly, with property and tools of about $28 million, working lease right-of-use belongings near $16 million, and goodwill of $11 million, whole belongings have been equal to $2.318 billion. The asset/legal responsibility ratio is bigger than 1x, so I might say that the balance sheet appears pretty clean.

Supply: 10-Q

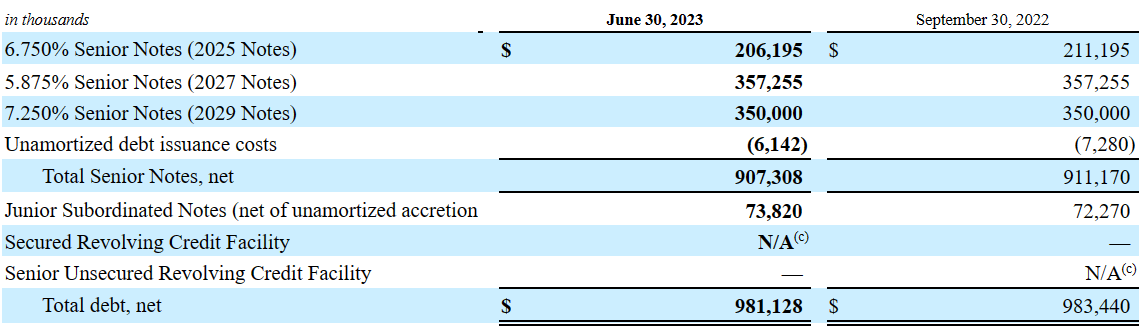

The listing of liabilities embody commerce accounts payable of $136 million, working lease liabilities near $17 million, whole debt of near $981 million, and whole liabilities price $1.273 billion.

Supply: 10-Q

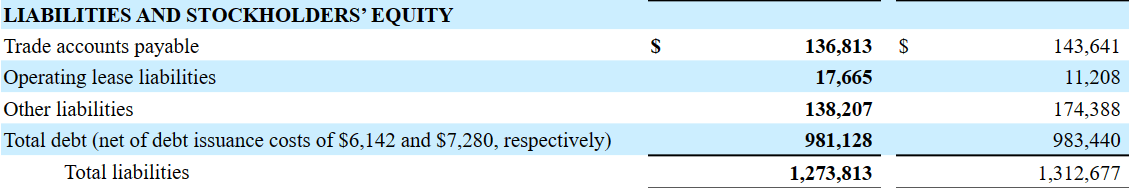

I do consider that the whole quantity of debt seems a bit elevated. With that, it’s fairly helpful that the leverage decreased considerably within the final three years, and administration promised to lower it much more.

Supply: Presentation To Traders

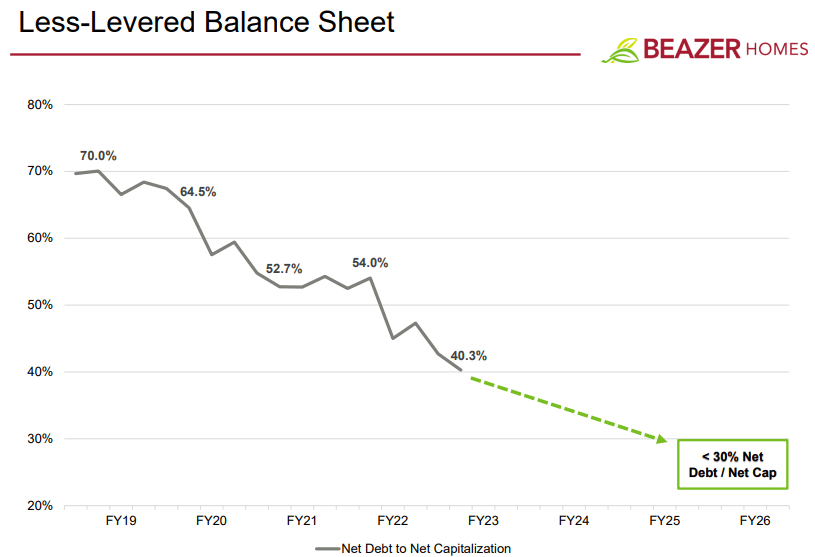

I studied the maturity of the debt. Contemplating the present free money stream generated and debt funds required, I believe that Beazer Houses will most certainly have the ability to negotiate or pay its debt obligations.

Supply: Presentation To Traders

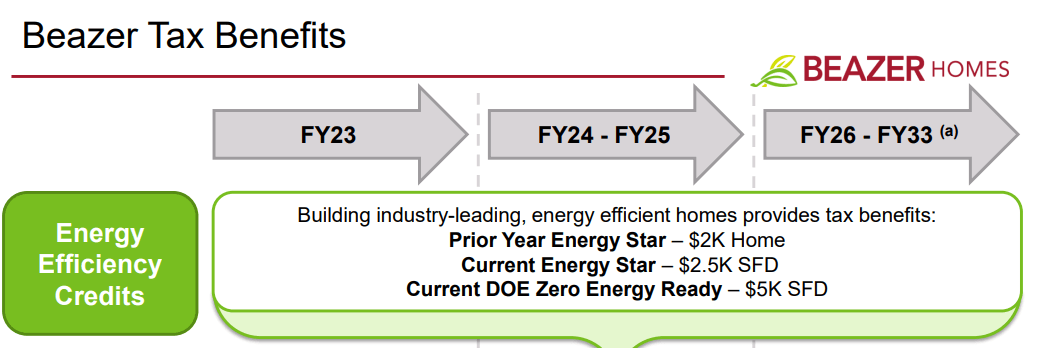

Tax Advantages Might Convey Internet Revenue Will increase In The Coming Years

Beazer Houses not too long ago reported vital power effectivity credit coming from constructing industry-leading power environment friendly houses. The corporate talked about tax advantages in 2024 and 2025 in addition to mentioning the tax advantages from 2026 to 2033. I consider that these tax advantages will most certainly improve future revenue statements and money stream statements. It’s a related issue that analysts on the market will most certainly have in mind.

Supply: Presentation To Traders

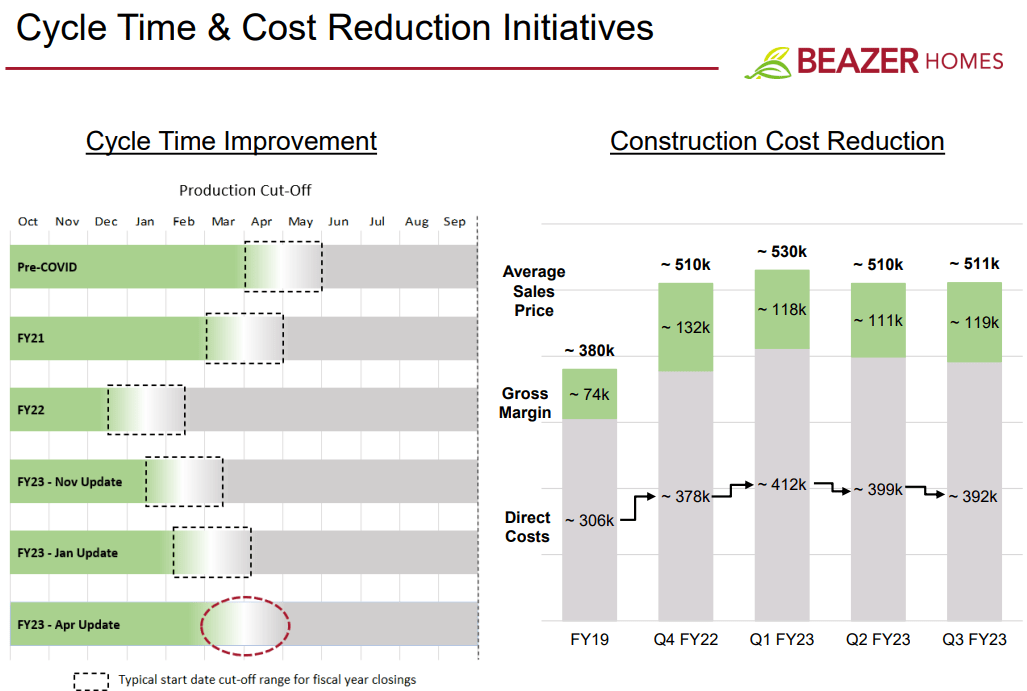

FCF Catalyst: Price Discount Initiatives Will Most Seemingly Convey FCF Development

Within the final quarterly presentation, Beazer Houses USA reported vital cycle time enhancements and building value discount initiatives. As proven within the photographs under, manufacturing cut-off is anticipated to decrease considerably, and direct prices additionally decreased from Q1 2023 to Q3 2023. In my view, additional value discount initiatives would most certainly result in FCF margin will increase and FCF progress.

Supply: Presentation To Traders

Additional Acquisition Of Land Will Most Seemingly Speed up Internet Gross sales Expectations

Beazer Houses’ technique is long-term, and seeks to keep up balanced income progress, with low margins and excessive returns on capital. The acquisition of land performs a elementary function on this sense, as they’re a key issue within the whole value account and the discount of prices, which generate the rise in earnings regardless of sustaining comparable revenue numbers at an annual degree. I assumed that the know-how amassed for buying land will most certainly improve future internet gross sales progress and constructing capability.

Regardless of the present world financial uncertainty, I consider that the long-term building market will proceed to develop in exercise, and the low-cost technique and renegotiation of building contracts can be vital growth factors to attain entry to liquidity that permits reinvestment within the buy of future lands for growth.

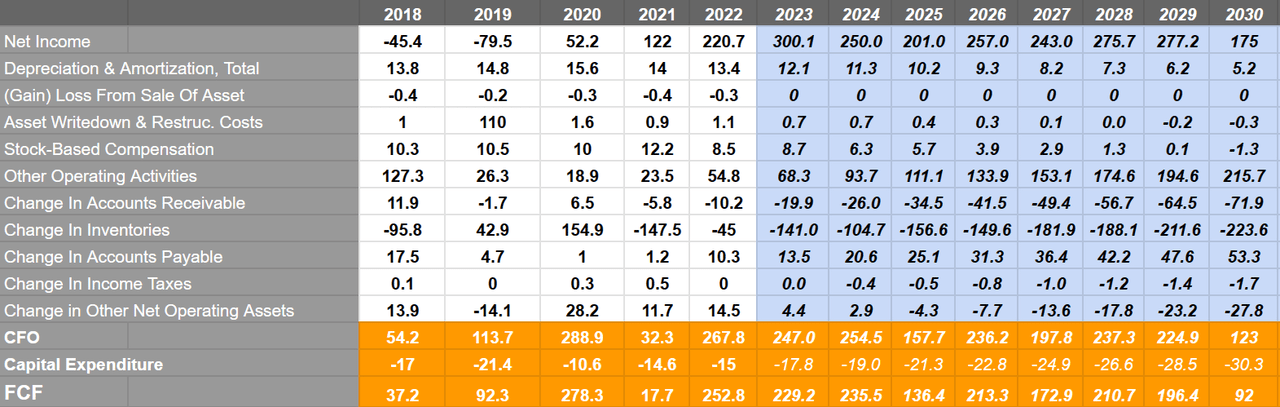

Assuming Earlier Monetary Figures From Beazer And Contemplating Earlier Assumptions, My Monetary Mannequin Signifies That Beazer Houses Seems Undervalued.

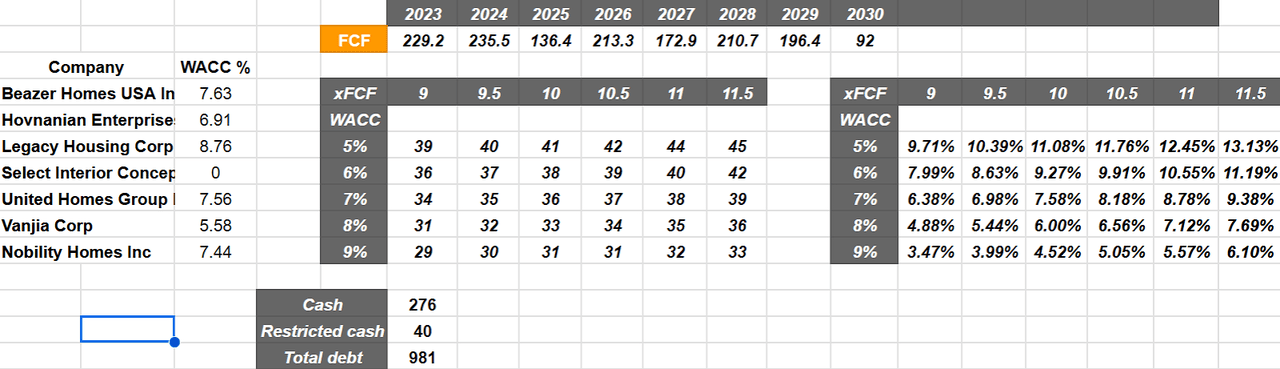

My DCF mannequin included 2030 internet revenue near $175 million, depreciation and amortization of near $5 million, and stock-based compensation of about -$2 million. Apart from, with modifications in accounts receivable of near -$72 million, change in inventories near -$224 million, and alter in accounts payable price $53 million, I obtained 2030 CFO of about $122 million. Lastly, with 2030 capital expenditure of near -$31 million, 2030 FCF could be about $92 million.

Supply: DCF Mannequin

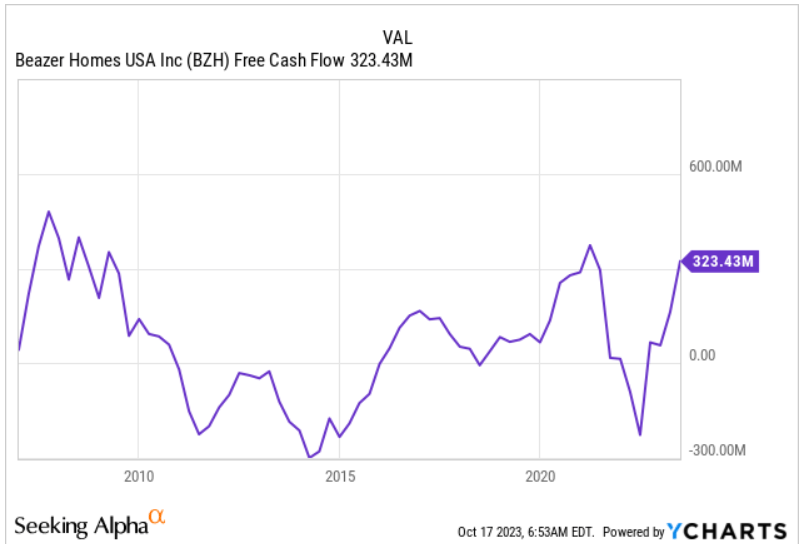

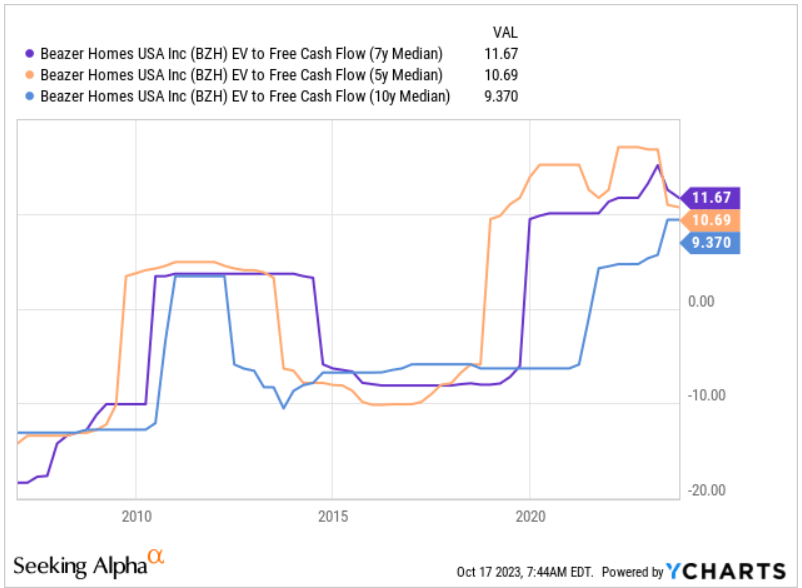

Contemplating earlier free money stream which stood between -$300 million and $324 million, I consider that my FCF outcomes of about $229-$92 million are possible.

Supply: Ycharts

I additionally checked a number of the peers, which reported a WACC of shut to five% and 9%. Moreover, the corporate’s senior notes embody rates of interest shut to five.8% and seven.2%. With these figures, I consider that assuming a WACC between 5% and 9% is sensible.

Supply: 10-Q

I additionally included an EV/FCF of near 9x and 11.5x, which I believe is a correct valuation given the earlier buying and selling multiples.

Supply: Ycharts

With the earlier assumptions, I obtained a goal worth between $29 per share and $45 per share with a median of $36-$37. Moreover, I obtained an IRR shut to three% and 13% and a median IRR near 7%-9%. With these outcomes, I consider that the corporate seems considerably undervalued.

Supply: DCF Mannequin

Opponents

Competitors within the building market isn’t solely excessive, but in addition extremely fragmented, within the fingers of enormous firms with nationwide scope and an expanded geographic footprint, impartial contractors from regional markets, and different firms with a place much like Blazer Houses, with a geographical scope restricted to plenty of figuring out states. The competitors that represents a threat on this sense comes largely from firms with nationwide attain, which have larger monetary capabilities and decrease prices than this firm.

Dangers

Firstly, primarily based on the federal authorities’s financial changes to present inflation, the rise in rates of interest represents a threat issue because the majority of Beazer Houses purchasers entry loans or mortgages for the acquisition of houses, and these will increase could have an effect on the power to pay the loans or mortgages and the next completion of tasks. Likewise, present inflation and market situations generate dangers for the corporate, primarily in relation to the value of the land that it already owns and the power to interpret market situations within the acquisition of future land.

Together with this, you will need to be aware that the share costs of this firm have demonstrated excessive ranges of volatility in current months, and there’s no certainty of stabilization within the brief time period. Because of this, many analysts on the market could use massive WACCs, which can make Beazer Houses look a bit costly. If many individuals assume that the corporate is dear, we may even see a decline within the inventory worth.

Moreover, working margins additionally rely upon plenty of elements associated to dwelling gross sales and land growth cycles, and the numerous quarter-over-quarter decline might also add volatility and uncertainty to the inventory worth of Beazer Houses USA.

Conclusion

Beazer Houses USA delivered a formidable quarterly report, and expects double digit gross sales tempo with backlog conversion of about 60% in This autumn. With these figures, I might count on plenty of new traders taking a look on the enterprise mannequin quickly. Within the long-term, I consider that the power environment friendly tax credit from now to about 2030, additional profitable acquisition of land, and up to date value discount initiatives introduced will most certainly push FCF up. Sure, there are additionally some dangers on the market from the whole quantity of debt, modifications within the rates of interest, and worth volatility, nonetheless I believe that Beazer Houses USA seems undervalued.