Rex_Wholster

I wrote about Planet 13 (OTCQX:PLNH) in mid-August after it reported its Q2, calling it low cost. It’s a bit greater now, however it’s down lots because it exploded greater in early September, greater than doubling. It is down once more year-to-date and provides traders one of the simplest ways to speculate straight within the American hashish business operators. Right now, a few weeks forward of their Q3 report, I talk about the chart, the outlook and the valuation.

The Chart

I begin with a have a look at the chart as a result of the inventory has been so unstable. After I wrote about it on 8/20, it had closed at $0.485. It ran as much as $1.20 on 9/6 after the information that the Division of Well being & Human Companies had really helpful to the DEA that it transfer hashish from Schedule 1 to Schedule 3. This bombshell got here out on 8/30 and would eradicate 280E taxation if hashish have been to be rescheduled like that.

Charles Schwab

The inventory made an all-time low proper after my final article. After capturing up, it has collapsed once more and is down year-to-date by 9.4%. it in comparison with the AdvisorShares Pure US Hashish ETF (MSOS), it has carried out lots higher year-to-date, as MSOS has dropped 25.0%. Over the previous yr, although, it has dropped 55%, which is greater than the 49% decline in MSOS. Since 8/29, the day earlier than the potential rescheduling information hit, PLNH has dropped 3% whereas MSOS has superior 8%:

YCharts

The Outlook

10 weeks in the past, analysts, in response to Sentieo, have been on the lookout for 2023 income of $102 million and adjusted EBITDA of $8 million. The 2 analysts at the moment nonetheless anticipate income to fall 3% to $102 million with adjusted EBITDA now anticipated to rise 104% to $7 million.

The outlook for 2024 has improved. In mid-August, the 2 analysts have been anticipating income of $144 with adjusted EBITDA of $18 million, a margin of 12.5%. Now, they venture income will enhance 58% to $161 million. The analysts anticipate adjusted EBITDA will almost triple to $20 million, a margin of 12.5%. It is a pretty low margin in comparison with friends.

As I mentioned in my final article, 2024 ought to present large progress. Florida can be turned on, and the Illinois retailer close to the Wisconsin border can be contributing too. The corporate is a big participant in Nevada and a small one in California, and the way these markets carry out will even impression the enterprise in 2024.

There are not any estimates for 2025 but.

The Valuation

10 weeks in the past, I shared a goal of $0.83 for year-end based mostly on reaching an enterprise worth to projected adjusted EBITDA for 2024 of 8X. I additionally identified that the inventory was buying and selling at simply 1X tangible guide worth, which was considerably higher than friends.

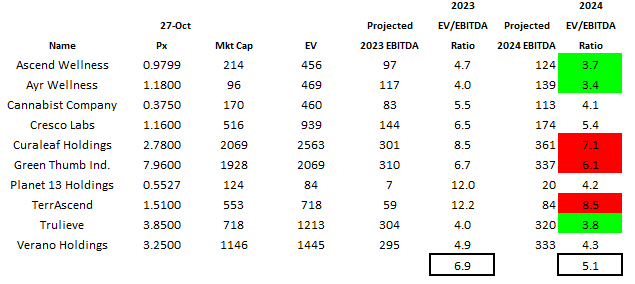

Right here is how Planet 13 compares to the Tier 1 and Tier 2 MSOs on enterprise worth to projected adjusted EBITDA for 2024:

Alan Brochstein, utilizing Sentieo

Planet 13 trades beneath the common of 5.1X at simply 4.2X. It’s the solely firm amongst these to have web money, and it’s buying and selling at the moment at simply 1.1X tangible guide worth. The following closest MSO is Inexperienced Thumb Industries (OTCQX:GTBIF), which trades at 3.5X. Traditionally, traders haven’t minded paying up a bit for the higher stability sheet, and I feel that they need to achieve this at the moment given the capital-raising challenges the business faces.

A yr from now, the inventory can be buying and selling in my opinion at a a number of of projected 2025 financials. As I identified above, these aren’t but out there. My expectation is that analysts will venture that income will develop a bit and that margins will increase. Elevating the 2024 income projection by 10% and boosting the adjusted EBITDA margin to 14% would yield projected adjusted EBITDA of $25 million. The present worth would recommend that this could be an enterprise worth to adjusted EBITDA of three.4X. I feel that 7X is a conservative ratio on the finish of 2024, and this could signify a inventory worth of $0.96, 73% greater than the present worth.

Conclusion

If the DEA strikes hashish to Schedule 3, it is good for Planet 13, however that transfer can be extra useful to the businesses which might be weaker financially. If there isn’t a change and 280E stays, it is going to be very robust on hashish operators. I see Planet 13 as having appreciable upside however restricted draw back. The inventory is among the solely U.S. operators that trades close to tangible guide worth, and its valuation relative to projected income or adjusted EBITDA is low relative to friends.

The 2024 progress is anticipated to be very robust, and I feel traders will begin being attentive to this as 2023 ends and 2024 ends. Searching a yr, I feel that they are going to begin to give attention to the 2025 estimates, which ought to be launched in March by the analysts. I embody a big place that I elevated considerably this week in each of my mannequin portfolios.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.