The latest Bitcoin (BTC) worth surge has ignited renewed curiosity and confidence amongst buyers, main many to consider that the BTC bull run is accelerating.

According to dealer and crypto analyst Adrian Zduńczyk, Bitcoin has reached a brand new 52-week closing excessive and has maintained a detailed above the earlier excessive of $32,000 for 3 consecutive weeks.

This sustained upward momentum signifies a robust bullish pattern sentiment and indicators the start of the third wave of the Bitcoin bull run.

Analyst Highlights Key Traits

Zduńczyk factors out a number of dominant traits that contribute to the optimistic outlook for Bitcoin. The rising 200-week and 50-week transferring averages (MAs) spotlight the long-term uptrend energy, with key help ranges at $28,800 and $26,600.

Moreover, there’s a rising correlation with the S&P 500, as evidenced by the 7-week correlation coefficient of 0.34. This alignment with conventional markets means that Bitcoin more and more trades equally to the Nasdaq.

Elementary drivers additionally play a major function in Bitcoin’s upward trajectory. Merchants eagerly anticipate the approval of spot Bitcoin exchange-traded funds (ETFs) and the upcoming fourth halving occasion.

Moreover, in keeping with Zduńczyk, the historic sample of earlier halvings signifies that Bitcoin has rallied considerably after every halving and has by no means retraced to pre-halving costs.

Analyzing the each day pattern, Zduńczyk highlights the technical energy demonstrated by Bitcoin’s dependable breakout above $32,000. Breakouts usually result in new pattern formations that persist over time.

Regardless of occasional volatility, the 50-day common true vary (ATR) pattern and the 50-day relative energy index (RSI) momentum pattern are rising, indicating ongoing optimistic momentum.

Bitcoin’s future seems promising, supported by optimistic market traits, basic drivers, and technical indicators. Nonetheless, warning indicators forged doubt on Bitcoin’s favorable outlook, as famend crypto analyst Ali Martinez pointed out.

Bitcoin Bullish Momentum At Danger?

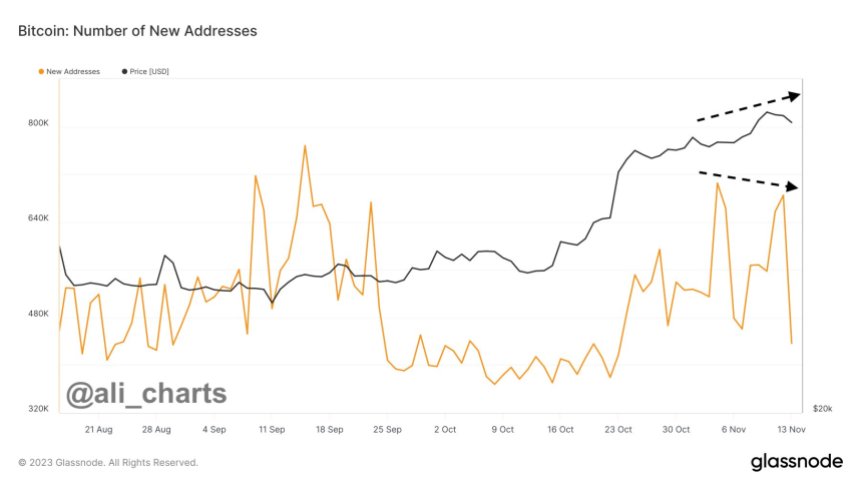

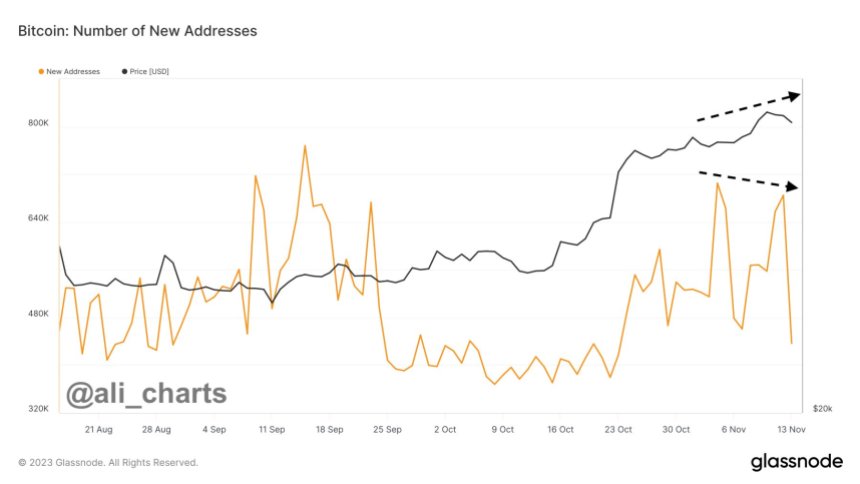

Martinez attracts consideration to the bearish divergence between Bitcoin’s worth and community development, indicating a possible lack of sustained momentum within the ongoing uptrend.

The chart above exhibits a notable disparity between the exponential rise in Bitcoin’s worth and the dramatic decline in new addresses over latest days.

This bearish divergence raises considerations concerning the general energy of the present uptrend. Whereas Bitcoin’s worth has skilled important positive aspects, the variety of new addresses created has decreased considerably.

In accordance with Martinez, this bearish divergence between Bitcoin’s worth and community development serves as an on-chain promote sign that merchants ought to concentrate on. The slowdown in community development regardless of the value surge means that the present upward momentum might not have sufficient energy to maintain.

On the time of writing, BTC is buying and selling at $36,200, down 1.6% over the previous 24 hours. Nonetheless, it’s nonetheless up a considerable 4.6% over the previous 7 days.

It stays to be seen if a surge in new addresses will have the ability to help BTC’s bullish momentum and break the present consolidation section. Alternatively, the cryptocurrency may retest help ranges within the coming days.

Featured picture from Shutterstock, chart from TradingView.com