Base is rising its underlying app exercise, even after the delay of memes and AI brokers. The expansion of Morpho -lending and the general Defi worth locked is the growth of the premise.

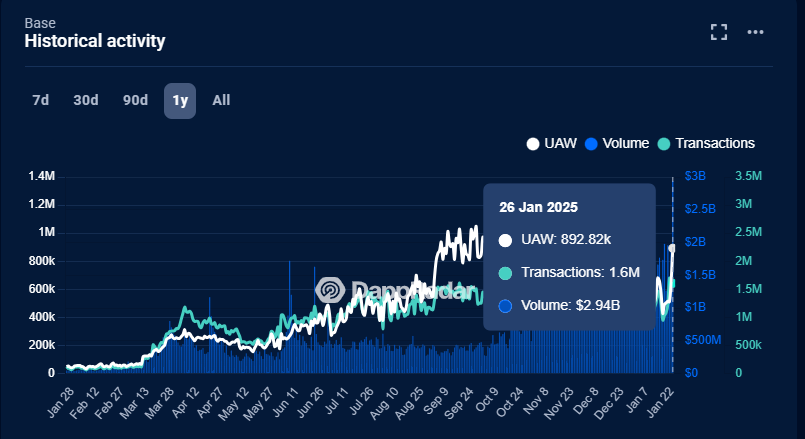

Base continues to develop on the premise of Defi -Loingen, as a result of the app exercise The app exercise has risen by 129%. The chain wears greater than 500 Decentralized appsThough Prime Defi Hubs are trending at first of 2025. Exercise on the token -free chain expanded to greater than 2m every day lively customers in January, as a result of the chain elevated liveliness up to now three months.

Fundamental app-based volumes reached a peak of all time after a lift from Morpho Labs and Defi loans. | Supply: D -appadar

The exercise of the Synfutures Dex and Morpho Defi Lending stimulates adoption. Base began as a sequence for enjoyable NFT and meme experiments, however is now shifting ahead with Defi, with a rising turnover of CBBTC commerce. Morpho expanded after he was promoted by Coinbase as a supply of loans supported by Crypto. The app provides entry to Coinbase customers to borrow towards a collateral Bitcoin (BTC).

The opposite issue that stimulated the premise was the addition to Phantom Pockets, which was used to frame extra new customers on board within the final quarter of 2024.

Base app Volumes reached a file excessive in January, after months of accumulating customers. Initially, the bottom primarily produced site visitors with low worth, with accessible transactions and meme -based actions. At present Base additionally has $ 2.27 billion in CBBTC, which additional stimulates liquidity for Defi actions.

In the midst of time, the bottom locked $ 3.47 billion in complete worth, though different studies rely the next worth to lock in sensible contracts. Morpho Blue, the essential model of the credit score protocol, locks in complete in complete $ 3.56 billion On all chains it kinds a substantial a part of the essential influx. The credit score protocol not too long ago expanded its belongings and loans to a brand new of all time.

Decentralized app -activity and complicated interactions with Defi protocols are growing transit For primary or fuel spent on each transaction. Base is forward of different L2 in transit statistics, with fixed development because the launch of the chain.

Prime Defi apps improve the essential earnings

Base Base $ 2.44 billion within the high, primarily based on D -reports of D studies Defi Apps, or $ 1.59 billion in tailored worth. One of the best apps from the chain embody Uniswap V2 and V3, Aerodrome, Morpho and Moonwell. The trail chosen by the essential is ready to compete with Solana, though the chain continues to be lagging behind in most statistics.

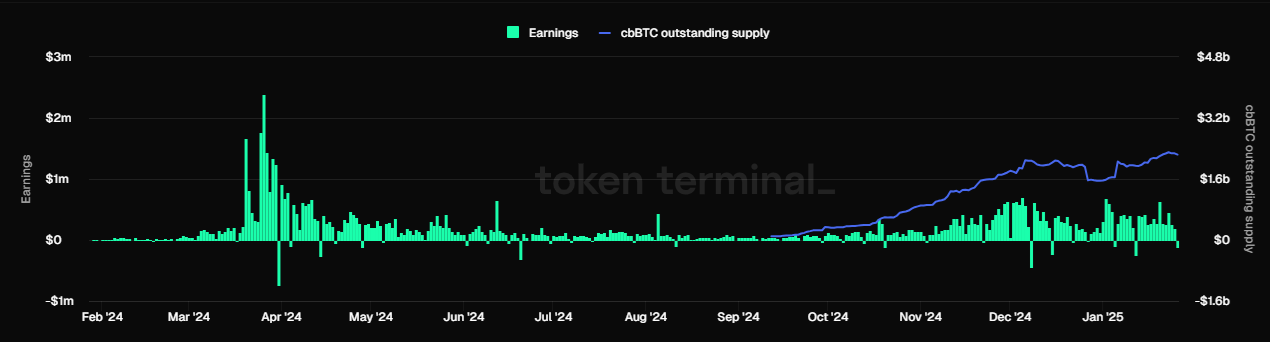

The elevated app exercise additionally translated into larger prices for the chain. Base reached greater than $ 12 million reimbursements For December, and greater than $ 11.48 million for January so far. The idea is without doubt one of the few chains with a comparatively low earnings prices and manages to retain the vast majority of the revenue on the chain. Previously three months, Base has achieved greater than $ 8 million in withheld revenue after paying incentives.

The bottom earnings elevated because the vary of CBBTC grew over the previous three months. | Supply: Token Terminal

The fundamental earnings grew once more within the final quarter of 2024, though they didn’t attain the height ranges from April. The exercise of the chain is now extra sustainable and coincides with the growth of CBBTC. The current primary growth follows a interval of intentional advertising, which, nonetheless, produced a lot decrease site visitors.

Base solely pays a couple of thousand {dollars} to confirm his transactions on Ethereum, in order that hardly cuts within the earnings of the chain. Fundamental stays one of many most cost-effective L2 to deal with. TThe present app exercise may be extra natural as a result of the premise has not indicated on the airdroping of a token. The chain has a lot of low worth or nulkost transactions, however there isn’t any rapid expectation of the Air drop.

Base picks up the exercise of Ethereum

After the primary success of Arbitrum, the premise for the chain that takes on the exercise and liquidity of Ethereum. Arbitrum retained its standing because the chain for DEX swaps and dangerous commerce, whereas retaining its comparatively excessive influx of the L1 chain. Arbitrum continues to be the chief of $ 5.6 million in stablecoin liquidity, whereas the premise slowly catches up $ 3.6 billion in Stablecoins.

Liquidity actions from Ethereum to base reached $ 3.44 billion, with a share of 5% Stablecoins and the absorption of ETH and bridged tokens. A complete of 612,691 ETH bridged Primarily based on liquidity and DEX commerce.

Fundamental continues to be one of many main chains for Defi and Cefi exercise, however with the efforts of Coinbase to supply client crypto merchandise. Base continues to be primarily based on the regulated standing of Coinbase and the fame of USDC, essentially the most used Stablecoin. The idea is without doubt one of the main chains for token transfers and common on-chain utility.