utah778

Expensive Baron Actual Property Revenue Fund Shareholder:

Efficiency

On September 28, 2023, we hosted a shopper instructional webinar, titled “Demystifying Actual Property: An Optimistic Perspective on the Prospects for Actual Property.” A replay of the webinar could be accessed on our Baron web site homepage at baronfunds.com within the “Insights & Experiences” part. A sampling of the important thing messages from the webinar could be discovered beneath after the “Efficiency” part of this letter.

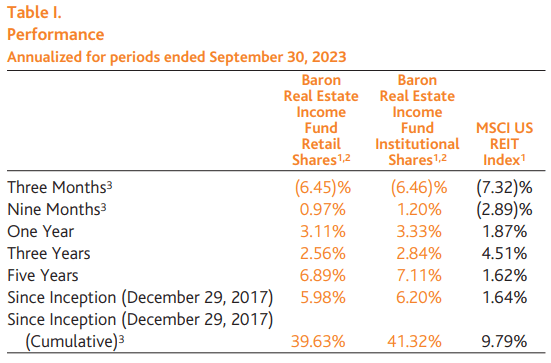

Following a powerful first six months of 2023, the inventory market, most REITs and non-REIT actual property corporations, and the Baron Actual Property Revenue Fund® (MUTF:BRIFX, MUTF:BRIIX, MUTF:BRIUX) (the Fund) declined within the third quarter. The Fund declined 6.46% (Institutional Shares), modestly outperforming the MSCI US REIT Index (the REIT Index), which declined 7.32%.

Within the first 9 months of 2023, the Fund has elevated 1.20%, outperforming the REIT Index, which declined 2.89%.

Within the third quarter, a number of elements weighed on shares, together with greater curiosity and mortgage charges, greater oil costs, the prospect that financial tightening might persist for a number of quarters as inflation stays above central financial institution targets, considerations about China’s financial progress prospects, a number of firm earnings disappointments, and the potential of further financial progress headwinds together with the lag results of the Federal Reserve’s tightening, scholar mortgage funds, and union strikes.

Although we’re aware of key dangers to the fairness and actual property market outlook, we stay optimistic concerning the prospects for the Fund. We consider the Fund is populated with attractively valued best-in-class REITs and non-REIT actual property corporations with robust long-term progress prospects. We consider the Fund’s two- to three-year return prospects are compelling.

Since inception on December 29, 2017 by way of September 30, 2023, the Baron Actual Property Revenue Fund is the #2 ranked actual property fund in line with Morningstar – solely trailing the three share courses of the Baron Actual Property Fund. The Fund’s cumulative return of 41.32% far exceeds the REIT Index, which has elevated 9.79%.

|

As of 9/30/2023, the Morningstar Actual Property Class consisted of 253, 230, 213, and 225 share courses for the 1-, 3-, 5-year, and since inception (12/29/2017) durations. Morningstar ranked Baron Actual Property Revenue Fund Institutional Share Class within the sixteenth, sixty fourth, third, and 2nd percentiles for the 1-, 3-, 5-year, and since inception durations, respectively. On an absolute foundation, Morningstar ranked Baron Actual Property Revenue Fund Institutional Share Class because the fortieth, 151st, fifth, and 4th greatest performing share class in its Class, for the 1-, 3-, 5-year, and since inception durations, respectively. Morningstar calculates the Morningstar Actual Property Class Common efficiency and rankings utilizing its Fractional Weighting methodology. Morningstar rankings are primarily based on complete returns and don’t embody gross sales fees. Whole returns do account for administration, administrative, and 12b-1 charges and different prices mechanically deducted from fund property. © 2023 Morningstar. All Rights Reserved. The data contained herein: (1) is proprietary to Morningstar and/or its associates or content material suppliers; (2) will not be copied, tailored or distributed; (3) is just not warranted to be correct, full or well timed; and (4) doesn’t represent recommendation of any sort, whether or not funding, tax, authorized or in any other case. Consumer is solely liable for guaranteeing that any use of this info complies with all legal guidelines, laws and restrictions relevant to it. Neither Morningstar nor its content material suppliers are liable for any damages or losses arising from any use of this info. Previous efficiency is not any assure of future outcomes. MORNINGSTAR IS NOT RESPONSIBLE FOR ANY DELETION, DAMAGE, LOSS OR FAILURE TO STORE ANY PRODUCT OUTPUT, COMPANY CONTENT OR OTHER CONTENT. |

As of September 30, 2023, the Fund has maintained its prime 3% rating amongst all actual property funds for its 5-year efficiency interval.

We’ll deal with the next subjects on this letter:

- Demystifying actual property: an optimistic perspective on the prospects for actual property

- Portfolio composition and key funding themes

- High contributors and detractors to efficiency

- Latest exercise

- Concluding ideas on the prospects for actual property and the Fund

|

Efficiency listed within the above desk is internet of annual working bills. The gross annual expense ratio for the Retail Shares and Institutional Shares as of December 31, 2022 was 1.32% and 0.96%, respectively, however the internet annual expense ratio was 1.05% and 0.80% (internet of the Adviser’s price waivers), respectively. The efficiency knowledge quoted represents previous efficiency. Previous efficiency is not any assure of future outcomes. The funding return and principal worth of an funding will fluctuate; an investor’s shares, when redeemed, could also be value kind of than their authentic value. The Adviser reimburses sure Fund bills pursuant to a contract expiring on August 29, 2034, until renewed for one more 11-year time period and the Fund’s switch company bills could also be diminished by expense offsets from an unaffiliated switch agent, with out which efficiency would have been decrease. Present efficiency could also be decrease or greater than the efficiency knowledge quoted. For efficiency info present to the latest month finish, go to baronfunds.com or name 1-800-99-BARON. 1 The MSCI US REIT Index Internet (USD) is a free float-adjusted market capitalization index that measures the efficiency of all fairness REITs within the US fairness market, aside from specialty fairness REITs that don’t generate a majority of their income and earnings from actual property rental and leasing operations. MSCI is the supply and proprietor of the logos, service marks and copyrights associated to the MSCI Indexes. The index and the Fund embody reinvestment of dividends, internet of withholding taxes, which positively impression the efficiency outcomes. The index is unmanaged. Index efficiency is just not Fund efficiency; one can not make investments instantly into an index. 2 The efficiency knowledge within the desk doesn’t replicate the deduction of taxes {that a} shareholder would pay on Fund distributions or redemption of Fund shares. 3 Not annualized. |

Demystifying Actual Property: An Optimistic Perspective on the Prospects for Actual Property

The extremely uncommon and difficult previous couple of years (e.g., COVID-19, a pointy and fast rise in curiosity and mortgage charges, credit score market stress, and multidecade excessive inflation) have left many anxious and anxious concerning the prospects for actual property. Accordingly, final month, we thought it will be well timed to host a shopper instructional actual property webinar. The objective of our webinar was to demystify actual property – make it clearer, simpler to grasp, separate the info from fiction – and supply our extra optimistic perspective on the prospects for actual property. A sampling of our key messages is as follows:

Notion vs. Actuality: We consider there are a number of perceptions about actual property that don’t replicate actuality. A number of examples are listed beneath.

Notion: A industrial actual property disaster is on the horizon.

- Actuality: Prospects for many of business actual property are encouraging.

Notion: 6% to 7% mortgage charges will cripple the brand new dwelling gross sales market.

- Actuality: New dwelling gross sales are robust.

Notion: The American Dream to personal a house is over.

- Actuality: Millennials are shopping for properties.

Notion: Workplace actual property is “useless.”

- Actuality: Components of workplace actual property are performing effectively – globally and by kind.

Manufactured Housing

- Secular tailwinds: Price range-conscious dwelling consumers and excessive improvement boundaries

Information Facilities

- Secular tailwinds: Rising knowledge consumption, cloud computing, IT outsourcing, synthetic intelligence (AI)

Wi-fi Towers

- Secular tailwinds: Strong cellular knowledge progress, 4G and 5G adoption

Senior Housing

- Secular tailwinds: Getting older child boomers and 80-plus inhabitants (“silver tsunami”)

Life Science

- Secular tailwinds: Pharmaceutical R&D and drug improvement

Self-Storage

- Secular tailwinds: Make money working from home

Inns

- Secular tailwinds: Journey rising as a share of pockets share

The Case for Public Actual Property & Key Funding Themes: We consider there’s a robust long-term case to allocate capital to public actual property in an actively managed technique.

Lengthy-Time period Case

- Inflation safety

- Diversification and low correlation to equities/bonds

- Sturdy historic long-term returns with ongoing potential

Close to- to Medium-Time period Case

- A lot of public actual property has lagged

- A number of public actual property corporations are low cost

- Could also be close to the tip of the Fed tightening interval – traditionally bullish for actual property

- We see typically enticing demand vs. provide prospects

- Stability sheets are in stable form

- Wall of personal capital is focusing on public actual property

Advantages of Energetic Administration

- Managers can deal with what they consider to be actual property winners and keep away from the losers

- Managers can exploit mispricings

- Managers can embrace a benchmark-agnostic method

Portfolio Composition and Key Funding Themes

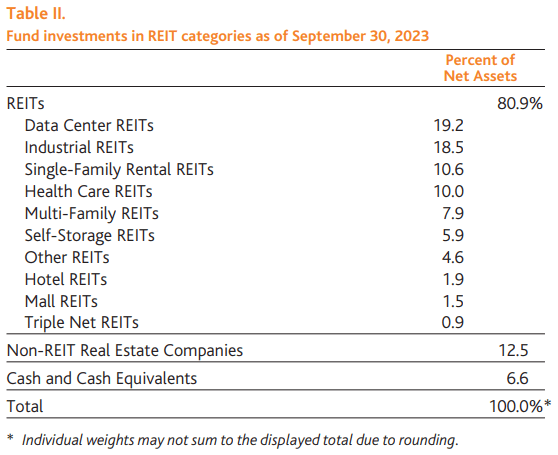

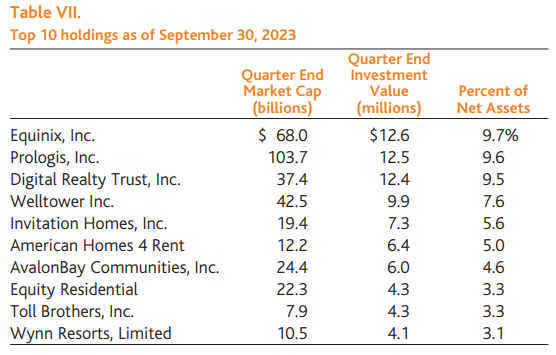

As of September 30, 2023, the Fund’s internet property had been invested as follows: REITs (80.9%), non-REIT actual property corporations (12.5%), and money (6.6%). We at present have investments in 10 REIT classes. Our publicity to REIT and non-REIT actual property classes relies on our analysis and evaluation of alternatives in every class on a bottom-up foundation (See Desk II beneath).

REITs

Enterprise fundamentals and prospects for a lot of REITs stay stable though, most often, progress is slowing because of debt refinancing headwinds, a moderation in natural progress (occupancy, lease, and/or expense pressures), and diminished funding exercise (acquisitions and improvement). Most REITs get pleasure from occupancy ranges of greater than 90% with modest new aggressive provide forecasted within the subsequent few years because of elevated building prices and contracting credit score availability for brand new building. Stability sheets are in good condition. A number of REITs have inflation-protection traits. Many REITs have contracted money flows that present a excessive diploma of visibility into near-term earnings progress and dividends. Dividend yields are effectively lined by money flows and are rising.

Following the 25% decline within the REIT Index in 2022 and modest declines within the first 9 months of 2023, REIT valuations have turn out to be enticing on an absolute foundation relative to historical past and relative to non-public market valuations, however not relative to mounted earnings options. If financial progress contracts and evolves into no worse than a light recession and the trail of rates of interest peaks at ranges not a lot greater than present charges, we consider the shares of sure REITs might start to carry out comparatively effectively. Ought to long-term rates of interest start to say no and credit score spreads compress, REIT return prospects can also profit from an enchancment in valuations as valuation multiples increase (e.g., capitalization charges compress).

We proceed to prioritize secular progress REITs and short-lease length REITs with pricing energy:

- Secular progress REITs: Our long-term focus is on REITs that profit from secular tailwinds the place cash-flow progress tends to be sturdy and fewer delicate to a slowdown within the economic system. Examples embody our investments in knowledge facilities, industrial logistics, and life science REITs. As of September 30, 2023, secular progress REITs represented 39.7% of the Fund’s internet property.

- Brief-lease length REITs with pricing energy: We’ve got continued to emphasise REITS which are in a position to increase rents and costs regularly to fight inflation’s impression on their companies. Examples embody the Fund’s investments in single-family rental, multi-family, and self-storage REITs. As of September 30, 2023, short-lease length actual property corporations represented 24.4% of the Fund’s internet property.

Secular progress REITs (39.7% of the Fund’s internet property)

Information Middle REITs (19.2%): Within the third quarter, we elevated the Fund’s publicity to knowledge middle REITs from 15.1% to 19.2%. We consider the multiyear prospects for actual property knowledge facilities are compelling. Information middle landlords resembling Equinix, Inc. (EQIX) and Digital Realty Belief, Inc. (DLR) are benefiting from file low emptiness, demand outpacing provide, and rising rental charges. Concerning the demand outlook, a number of secular demand vectors are contributing to sturdy demand for knowledge middle area globally. They embody the outsourcing of data expertise, elevated cloud computing adoption, the continuing progress in cellular knowledge and web site visitors, and AI as a brand new wave of information middle demand.

Industrial REITs (18.5%): Although we count on lease progress to reasonable from its frenzied tempo of the previous couple of years, we stay optimistic concerning the long-term prospects for industrial REITs. With industrial vacancies at lower than 4%, new provide anticipated to reasonable in 2024, rents on in-place leases greater than 50% beneath market, and multi-faceted demand drivers together with the continuing progress in e-commerce and firms searching for to enhance stock supply-chain resiliency by carrying extra stock (shift from simply in time to only in case stock), we consider our investments in industrial warehouse REITs Prologis, Inc. (PLD), Rexford Industrial Realty, Inc. (REXR), EastGroup Properties, Inc. (EGP), Terreno Realty Company (TRNO), and First Industrial Realty Belief, Inc. (FR) have compelling multi-year cash-flow progress runways.

Life Science REITs (2.1%): Alexandria Actual Property Equities, Inc. (ARE) is the life science business chief and sole publicly traded life science pure-play REIT. At its present discounted valuation, we consider considerations about aggressive provide and misery for a few of the firm’s biotechnology and well being care tenants are overblown and sufficiently discounted within the firm’s valuation. We consider the administration crew has assembled a fascinating actual property portfolio, enjoys a number one market share place in its geographic markets, and has stable expectations for long-term demand-driven progress.

Brief-lease length REITs (24.4% of the Fund’s internet property)

Single-Household Rental REITs (10.6%): Following robust second quarter outcomes, we modestly elevated our investments in single-family rental REITs Invitation Houses, Inc. (INVH) and American Houses 4 Hire (AMH). Demand circumstances for rental properties are enticing as a result of sharp decline in dwelling affordability; the propensity to lease as a way to keep away from mortgage down funds, keep away from greater month-to-month mortgage prices, and preserve flexibility; and the stronger demand for dwelling leases in suburbs quite than residence leases in cities. Rising building prices are limiting the availability of single-family rental properties within the U.S. housing market. This restricted stock mixed with robust demand is resulting in sturdy lease progress.

Each Invitation Houses and American Houses 4 Hire have a possibility to partially offset the impression of inflation on condition that their in-place annual leases are considerably beneath market rents. Valuations are compelling at mid-5% capitalization charges, and we consider the shares are at present valued at a reduction to our evaluation of internet asset worth.

We stay aware that expense headwinds and slower top-line progress might weigh on progress later in 2023 and 2024. We’ll proceed to intently monitor enterprise developments and can alter our exposures accordingly.

Multi-Household REITs (7.9%): Within the third quarter, we maintained our publicity to residence REITs Fairness Residential (EQR) and AvalonBay Communities, Inc. (AVB) at 7.9% of the Fund’s internet property. We consider public valuations stay discounted relative to the non-public market. Tenant demand stays wholesome and lease progress has modestly improved because the first quarter of 2023. Rental residences proceed to profit from the present homeownership affordability challenges. Multi-family REITs present partial inflation safety to offset rising prices because of leases that may be reset at greater rents, in some instances, yearly. We proceed to intently monitor new provide deliveries and job losses in key geographic markets.

Self-Storage REITs (5.9%): Within the third quarter, we diminished our publicity to self-storage REITs – Public Storage (PSA), Further Area Storage Inc. (EXR), and CubeSmart (CUBE) – as a result of we count on progress might proceed to reasonable in 2023.

Long run, there’s a lot to love about self-storage companies. Month-to-month leases present a possibility for landlords to extend rents and fight inflation. Self-storage services don’t are inclined to require vital ongoing capital expenditures. Elevated building prices are constraining new building. Ought to financial progress proceed to decelerate and maybe result in a recession, self-storage enterprise fundamentals have traditionally held up effectively throughout financial downturns. We additionally consider there’s a wall of capital from non-public fairness corporations which are occupied with buying self-storage actual property ought to valuations within the public market turn out to be enticing relative to different alternatives.

Different REIT and non-REIT actual property investments (29.3% of the Fund’s internet property)

Well being Care REITs (10.0%): We stay optimistic about our well being care REIT investments in Welltower Inc. (WELL) and Ventas, Inc. (VTR) Well being care actual property fundamentals are bettering (lease will increase and occupancy beneficial properties) in opposition to a backdrop of muted provide progress within the subsequent two to 3 years because of rising financing and building prices and supply-chain challenges. The long-term demand outlook is favorable, pushed partly by an getting old inhabitants, which is anticipated to speed up within the years forward. Regardless of our optimism for long-term prospects for well being care actual property, we’re intently monitoring near-term expense headwinds mixed with a slower-than-expected restoration in leasing and occupancy.

Different REITs (5.9%): We’re optimistic about our REIT investments in Tanger Manufacturing unit Outlet Facilities, Inc. (SKT), Americold Realty Belief, Inc. (COLD), and the latest addition of DiamondRock Hospitality Firm (DRH). Tanger owns and operates the second largest outlet middle portfolio within the U.S. Tanger is the one mall REIT that focuses solely on retailers and, consequently, there’s much less threat from division retailer closures. We consider the shares are attractively valued and provide stable prospects for progress. Americold is the second largest owner-operator of chilly storage services within the U.S. and globally. We consider the shares of Americold ought to profit from regular progress in meals consumption, restricted new provide, and enhancements in its operations, which ought to assist stable progress. We focus on lodge REIT DiamondRock in higher element beneath within the “High internet purchases” part.

Triple Internet REITs (0.9%): We’ve got barely decreased our already modest publicity to the triple internet gaming REIT VICI Properties Inc. (VICI), an proprietor of high quality gaming, hospitality, and leisure properties. The corporate pays a 6% dividend that’s effectively lined, has a powerful monitor file of creating accretive acquisitions, and has further alternatives for progress within the years forward.

Non-REIT Actual Property Corporations (12.5%): We emphasize REITs however have the pliability to put money into non-REIT actual property corporations. We are inclined to restrict these to not more than 20% to 25% of the Fund’s internet property. At instances, a few of our non-REIT holdings might current superior progress, dividend, valuation, and share worth appreciation potential than many REITs.

We’re bullish concerning the prospects for the Fund’s non-REIT actual property investments, which embody: Toll Brothers, Inc. (TOL), Wynn Resorts, Restricted (WYNN), Brookfield Company (BN), Brookfield Asset Administration Ltd. (BAM), Lowe’s Corporations, Inc. (LOW), Journey + Leisure Co. (TNL), and Brookfield Infrastructure Company (BIPC).

High Contributors and Detractors

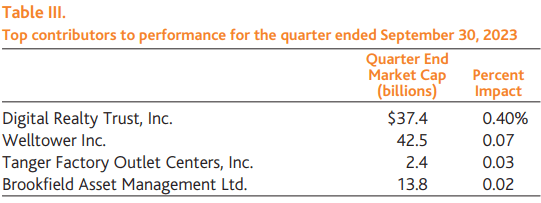

Following robust quarterly enterprise outcomes, the shares of Digital Realty Belief, Inc., a worldwide knowledge middle operator with 290 knowledge facilities, continued to carry out effectively within the third quarter. As famous within the Fund’s second quarter shareholder letter, we consider the multi-year prospects for actual property knowledge facilities are compelling – maybe as robust as they’ve ever been. For our extra full ideas on Digital Realty and the Fund’s different knowledge middle REIT funding in Equinix, Inc., please see “High internet purchases” later on this letter.

Welltower Inc., an proprietor and operator of senior housing and medical workplace buildings, was a contributor to efficiency through the quarter because of robust cash-flow progress in its senior housing portfolio pushed by wholesome lease progress and occupancy beneficial properties, sturdy demand from new residents, bettering labor bills, and superior capital deployment by administration. Welltower owns and operates senior housing and medical workplace buildings within the U.S. and internationally. We consider the corporate continues to be well-positioned to profit from cyclical and secular progress over the approaching years and has a reputable path to double its senior housing working money stream organically over the subsequent 4 to 5 years. As well as, we consider the present constrained financing atmosphere will create enticing exterior progress alternatives for the corporate to amass high quality property at enticing costs.

The shares of Tanger Manufacturing unit Outlet Facilities, Inc., an actual property proprietor of the second-largest outlet middle portfolio within the U.S., elevated modestly following robust quarterly outcomes. We met with CEO Stephen Yalof and CFO Michael Billerman earlier this 12 months and got here away impressed. The administration crew continues to search for alternatives to handle the enterprise extra profitably, prioritize Tanger’s digital transformation, and increase outlet middle choices. Tanger, not like mall REITs, focuses solely on stores so it’s immune from division retailer tenant threat. We consider the shares are attractively valued and are optimistic concerning the firm’s long-term prospects.

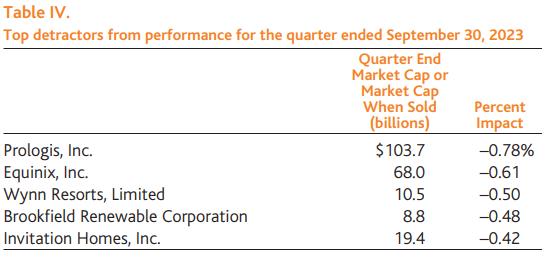

The shares of Prologis, Inc., the world’s largest industrial REIT, declined within the third quarter of 2023 together with most REITs. We’re massive followers of CEO Hamid Moghadam and Prologis’ administration crew, and we stay optimistic concerning the firm’s long-term progress outlook.

Prologis owns a high-quality actual property portfolio that’s concentrated in main world commerce markets and enormous inhabitants facilities throughout the Americas, Europe, and Asia. Prologis has an unmatched world platform, robust aggressive benefits (scale, knowledge, and expertise), and enticing embedded progress prospects. The corporate is the one industrial REIT with an A credit standing.

We proceed to consider the appreciation potential for Prologis shares stays compelling on condition that the corporate’s rents on its in-place leases are greater than 65% beneath present market rents, thus offering a powerful runway for progress within the subsequent three to 5 years.

The shares of Equinix, Inc., the premier world operator of network-dense, carrier-neutral colocation knowledge facilities with operations throughout 32 international locations, declined 7.1% within the third quarter following a 20.4% acquire within the first six months of 2023. In the previous couple of months, now we have hung out with CEO Charles Meyers and CFO Keith Taylor and are inspired concerning the firm’s long-term prospects. Finally, we consider the underlying demand vectors, robust pricing energy, favorable provide backdrop, and interconnection focus will assist roughly 10% cash-flow-per-share progress for the subsequent a number of years with upside from additional scaling of digital companies, incremental AI demand, and choose M&A alternatives. We stay optimistic concerning the prospects for Equinix shares over the subsequent a number of years.

The shares of Wynn Resorts, Restricted, an proprietor and operator of motels and on line casino resorts, declined 14.5% through the interval held within the third quarter.

We stay optimistic concerning the multi-year prospects for the corporate. We consider the re-emergence of enterprise exercise in Macau will drive further shareholder worth. If money stream returns to the extent achieved in 2019 previous to COVID-19, we consider Wynn’s shares will improve to $150 per share, or greater than 60% greater than the place they’ve just lately traded.

We consider further drivers for future worth creation past a re-emergence in Macau enterprise exercise embody: (i) our expectation for long-term progress alternatives within the firm’s U.S.-centric markets of Las Vegas and Boston, together with an enlargement of Wynn’s Encore Boston Harbor resort; (ii) Wynn’s plans to develop an built-in resort within the United Arab Emirates with 1,500 lodge rooms and a on line casino that’s comparable in dimension to that of Encore Boston Harbor; (iii) alternatives to enhance cash-flow margins by rightsizing labor and attaining decrease workers prices in Macau; (iv) the likelihood that Wynn is granted a New York on line casino license in 2023; and (v) an enlargement within the firm’s valuation a number of to ranges achieved previous to the pandemic.

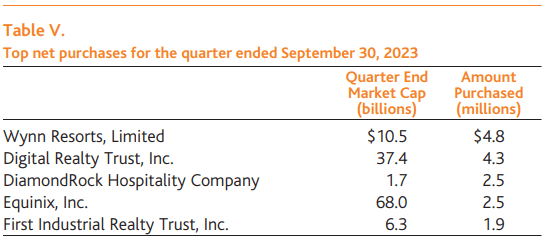

Latest Exercise

Within the third quarter, we re-acquired shares of Wynn Resorts, Restricted, which we mentioned intimately above.

We consider the multi-year prospects for actual property knowledge facilities are compelling – maybe as robust as they’ve ever been. Accordingly, we just lately elevated our publicity to knowledge middle REITs by buying further shares in Digital Realty Belief, Inc. and Equinix, Inc.

Information middle landlords resembling Equinix and Digital Realty are benefiting from file low emptiness, demand outpacing provide, extra constrained energy availability, and rising rental charges. A number of secular demand vectors, that are at present broadening, are contributing to sturdy fundamentals for knowledge middle area globally. They embody the outsourcing of data expertise infrastructure, elevated cloud computing adoption, the continuing progress in cellular knowledge and web site visitors, and AI as a brand new wave of information middle demand. Put merely, annually knowledge continues to develop exponentially, and all of this knowledge must be processed, transmitted, and saved – supporting elevated demand for knowledge middle area. As well as, whereas it’s nonetheless early innings, we consider AI couldn’t solely present a supply of incremental demand but additionally additional speed up present secular tendencies by driving elevated prioritization and extra funding in digital transformation amongst enterprises.

We just lately hung out with the administration groups at each Equinix and Digital Realty and are optimistic about their prospects. We consider Equinix, the premier world operator of network-dense, carrier-neutral colocation knowledge facilities, is well-positioned to develop its money stream per share by greater than 10% yearly for the subsequent few years.

Digital Realty is a worldwide knowledge middle operator with 290 knowledge facilities throughout North America, EMEA, APAC, and LATAM. Over the previous couple of years, the corporate has been present process a enterprise transformation, which accelerated after its acquisition of Interxion in March 2020, a pure-play European network-dense knowledge middle operator. The corporate has been shedding non-core slower progress property, investing and increasing in Europe, rising its retail colocation enterprise, bettering its steadiness sheet, and including operational experience by supplementing new administration management. We’ve got spent a big period of time with CEO Andy Energy over time and consider the investments the corporate has made are on the cusp of bearing fruit and can pay dividends for years to return. As well as, we consider the basics in its core enterprise are at an inflection level with sturdy demand/bookings, pricing energy, hyperscale cloud gamers outsourcing a better share of their digital infrastructure wants, and restricted aggressive capability. We consider these elements will result in progress within the core enterprise in 2023 and are optimistic concerning the long-term prospects for the corporate.

We initiated a place in DiamondRock Hospitality Firm through the quarter. DiamondRock owns high-quality lodge property skewed in direction of resort and leisure. Whereas macroeconomic considerations have restricted near-term share worth efficiency, we proceed to consider that the worth of the irreplaceable leisure-focused portfolio the corporate has curated over the previous 20 years will finally be realized both within the public or non-public markets. There’s a vital quantity of undeployed non-public fairness capital on the sidelines geared towards the precise forms of property that DiamondRock owns. Shares remained attractively valued each on a relative and absolute foundation with the corporate being conservatively capitalized relative to its friends and with no near-term debt maturities.

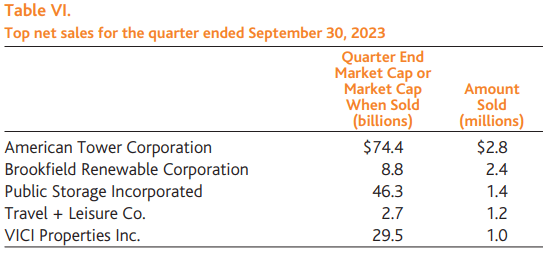

Early in 2023, we diminished the vast majority of our place in American Tower Company (AMT), a worldwide operator of over 200,000 wi-fi towers, and exited our small place within the third quarter. Whereas we’re constructive on the long-term secular tendencies underpinning American Tower’s enterprise, we concluded in late 2022 and early 2023 that progress expectations had been too excessive given forthcoming headwinds from considerably greater financing prices (20%-plus publicity to floating charge debt), upcoming debt maturities, continued cost shortfalls from a key tenant in India, overseas trade headwinds, and a attainable discount in cellular provider capital expenditures.

As shares have turn out to be extra attractively valued, progress headwinds are higher understood, and with a possible monetization occasion of its India enterprise, we might look to re-acquire shares.

Shares of Brookfield Renewable Company (BEPC) underperformed considerably within the quarter. The approximate 100 foundation level improve in risk-free charges through the quarter made yield shares much less enticing to buyers. As well as, choose business headwinds resembling supply-chain points, improvement delays, and decrease return targets weighed on the shares as effectively. Whereas Brookfield Renewable has not, so far, been impaired by ongoing business points, we exited our place because of ongoing business considerations and reallocated capital to higher-conviction concepts. We might revisit Brookfield Renewable as a few of the clouds clear and return prospects turn out to be extra evident.

We just lately trimmed our funding in Public Storage, a REIT that’s the world’s largest proprietor, operator, and developer of self-storage services, because of expectations that lease and total cash-flow progress might proceed to reasonable.

Public Storage’s almost 2,500 self-storage services throughout the U.S. serve multiple million clients. The corporate has achieved the #1 market place in 14 of its prime 15 markets. Regardless of our near-term warning, we’re optimistic concerning the firm’s long-term prospects because of our expectations for robust occupancy, restricted new provide, the resumption of stable long-term natural cash-flow progress, and the potential for M&A because of its well-capitalized and low-leveraged steadiness sheet and its means to extend rents month-to-month to offset inflation headwinds. We consider Public Storage’s shares are at present valued at a reduction to non-public market self-storage values.

Concluding Ideas on the Prospects for Actual Property and the Fund

We stay aware that the present financial and funding local weather is difficult. Although we wouldn’t have a crystal ball relating to the macroeconomic and geopolitical outlook, we stay optimistic concerning the long-term prospects for the Fund.

We consider now we have assembled a portfolio of best-in-class competitively advantaged REITs and non-REIT actual property corporations with compelling long-term progress and share worth appreciation potential. We’ve got structured the Fund to capitalize on compelling funding themes. Valuations and return prospects are enticing.

We consider the Fund’s method to investing in REITs and non-REIT actual property corporations will shine even brighter within the years forward.

For these causes, we stay constructive on the outlook for Baron Actual Property Revenue Fund.

I and the remainder of our Baron actual property crew – David Kirshenbaum, George Taras, and David Baron – stay energized, targeted, and busy assembly with and talking to actual property administration groups. We proceed our complete analysis, talking to a broad swath of actual property corporations – each owned and never owned – in lots of instances a number of instances every quarter to verify our analysis stays present and knowledgeable. We consider our company relationships and entry to administration are essential components that contribute to aggressive benefits for our actual property crew versus lots of our friends.

I, and our crew, stay absolutely dedicated to doing our greatest to ship excellent long-term outcomes, and I proudly proceed as a serious shareholder, alongside you.

Sincerely,

Jeffrey Kolitch, Portfolio Supervisor

Buyers ought to contemplate the funding goals, dangers, and fees and bills of the funding fastidiously earlier than investing. The prospectus and abstract prospectus include this and different details about the Funds. It’s possible you’ll receive them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99-BARON or visiting baronfunds.com. Please learn them fastidiously earlier than investing.

Dangers: Along with basic market circumstances, the worth of the Fund will likely be affected by the power of the true property markets in addition to by rate of interest fluctuations, credit score threat, environmental points and financial circumstances. The Fund invests in debt securities that are affected by adjustments in prevailing rates of interest and the perceived credit score high quality of the issuer. The Fund invests in corporations of all sizes, together with small and medium sized corporations whose securities could also be thinly traded and tougher to promote throughout market downturns.

The Fund might not obtain its goals. Portfolio holdings are topic to vary. Present and future portfolio holdings are topic to threat.

Discussions of the businesses herein usually are not supposed as recommendation to any individual relating to the advisability of investing in any specific safety. The views expressed on this report replicate these of the respective portfolio managers solely by way of the tip of the interval said on this report. The portfolio supervisor’s views usually are not supposed as suggestions or funding recommendation to any individual studying this report and are topic to vary at any time primarily based on market and different circumstances and Baron has no obligation to replace them.

This report doesn’t represent a suggestion to promote or a solicitation of any provide to purchase securities of Baron Actual Property Revenue Fund by anybody in any jurisdiction the place it will be illegal beneath the legal guidelines of that jurisdiction to make such a suggestion or solicitation.

The portfolio supervisor defines “Finest-in-class” as well-managed, competitively advantaged, faster-growing corporations with greater margins and returns on invested capital and decrease leverage which are leaders of their respective markets. Be aware that this assertion represents the supervisor’s opinion and isn’t primarily based on a third-party rating.

BAMCO, Inc. is an funding adviser registered with the U.S. Securities and Trade Fee (SEC). Baron Capital, Inc. is a broker-dealer registered with the SEC and a member of the Monetary Business Regulatory Authority, Inc. (FINRA).

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.