By Bre Bradham, Bloomberg markets dwell reporter and analyst

When US banks kick off the third-quarter earnings season Friday, it’ll mark the primary in a protracted line of hurdles the group must clear as a way to assuage investor fears.

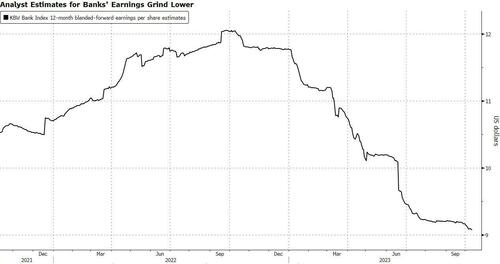

Financial institution shares are hovering close to the bottom stage of the 12 months, a mark hit in Could following First Republic Financial institution’s collapse. The KBW Financial institution Index has tumbled 24% this 12 months, a pointy underperformance to the S&P 500 Index’s 13% acquire. 5 of the most important US banks, excluding JPMorgan Chase & Co., have mixed to lose about $100 billion in market capitalization this 12 months.

“Buyers within the financial institution house simply have a couple of half-dozen points which can be on the market that must get resolved to their higher satisfaction,” Piper Sandler analyst R. Scott Siefers stated.

Among the many challenges are new regulatory proposals that might impose larger capital necessities on banks, unrealized losses of their securities’ portfolios and rising dangerous mortgage write-offs. The demise of three banks within the S&P 500 earlier this 12 months can also be nonetheless contemporary in buyers’ minds.

The sector fell 1% on Thursday, underperforming the broader market as yields climbed.

“Buyers are kind of taking a look at issues and saying, the spring was an precise disaster with three massive financial institution failures. The summer season was downward estimates revisions because of rates of interest and funding pressures, and now you’re telling me we’re on the cusp of a possible credit score cycle,” Siefers stated. “The trade is in kind of a show-me section proper now.”

The weak spot in latest weeks has been pushed partly by issues over unrealized losses because of rising bond yields. With the Federal Reserve’s path of interest-rate hikes remaining unsure and situations of financial institution charge-offs because of borrower misery rising, buyers will possible stay bolted to the sidelines.

“Third-quarter shouldn’t be prone to flip a change from good to dangerous, however it’s prone to affirm an upward development of mortgage losses from what’s been unusually favorable ranges,” Wells Fargo analyst Mike Mayo stated about credit score.

For Keefe, Bruyette & Woods analyst Christopher McGratty, it’s going to take time to get extra constructive on financial institution shares. The market can’t account for credit score weak spot till it might probably get a way of simply how deep it’ll run.

“There’s a excessive diploma of unpredictability,” stated McGratty. His agency has a market-weight stance on the sector.

In the meantime, banks’ web curiosity revenue outcomes shall be in focus amid the upper deposit prices, as companies proceed to compete for enterprise amid the tumult sparked by the collapses of regional lenders like Silicon Valley Financial institution in March. JPMorgan, one of many first companies scheduled to report third-quarter outcomes on Friday, is predicted to be an NII outlier amongst its greatest friends due to its acquisition of First Republic.

Shares of the nation’s greatest financial institution gained greater than 8% this 12 months, including $30 billion in market capitalization. That’s made JPMorgan roughly twice as massive because the second-largest US financial institution by market worth, Financial institution of America Corp.

Analysts anticipate steering to mirror relative stability, following downward revisions from many banks over the summer season.

After all, the uncertainties may very well be resolved in a good option to banks. The Fed may engineer a delicate touchdown, charge cuts may alleviate deposit prices and closing variations of regulatory proposals could also be tempered.

On condition that the sector’s buying and selling at such low cost valuations, some analysts have argued for buyers to take a stock-picking method. Others warn the group has change into woefully undervalued and poised for a bounce. Earnings season will deliver “micro” elements to “heart stage” and banks may outperform, in accordance with Citi analysts.

“Giant-cap banks seem materially oversold,” UBS analyst Erika Najarian wrote in a word just lately. “As soon as once more, shares are reflecting what we expect are unwarranted existential issues, quite than the basic points.”

Loading…