A chapter court docket is ruling that debtors of bankrupt crypto trade FTX can start promoting a whole lot of tens of millions of {dollars} value of Grayscale and Bitwise shares.

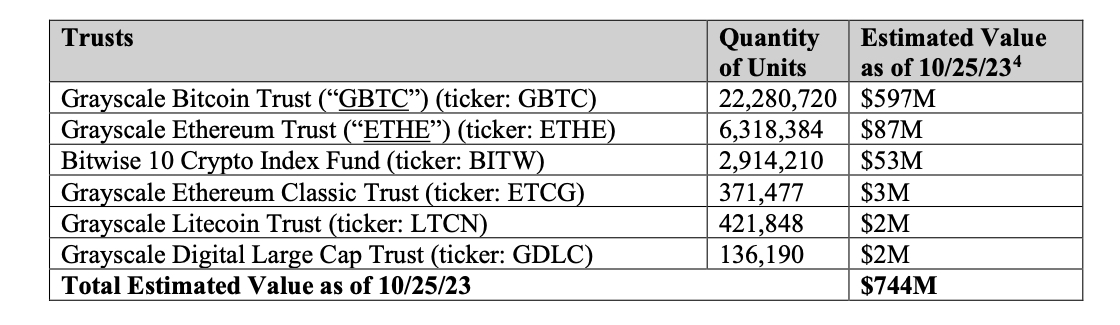

In a brand new submitting, a court docket in Delaware is granting a movement filed earlier this month that might enable the debtors of FTX and its associates to begin promoting $744 million value of belief belongings related to crypto asset administration companies Grayscale and Bitwise.

“Upon the movement (the ‘Movement’) of FTX Buying and selling Ltd. and its affiliated debtors and debtors-in-possession (collectively, the ‘Debtors’) for entry of an order (this ‘Order’) authorizing and approving (i) procedures for the sale or switch of the belief belongings and (ii) the sale or switch of such belief belongings in accordance with such procedures free and away from any liens.”

In line with earlier stories, the belief belongings set to be bought embrace 5 completely different Grayscale Trusts valued at $691 million in addition to holdings of a Bitwise-managed belief valued at $53 million.

Earlier this month, on-chain knowledge from blockchain tracker Lookonchain discovered that FTX out of the blue started shifting round tens of millions of {dollars} value of digital belongings Polygon (MATIC) and Avalanche (AVAX) to outstanding crypto trade platforms comparable to Coinbase and Binance.

FTX initially filed for chapter final November and its disgraced founder, Sam Bankman-Fried, was charged with mishandling billions of {dollars} value of buyer funds in addition to defrauding buyers. He was discovered responsible earlier this 12 months and sentenced to many years behind bars.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Bushko Oleksandr