- AVAX struggled with route, with the RSI close to 50 and combined transferring common indicators on the charts

- Increased buying and selling quantity prompt heightened curiosity, however bearish sentiment prevailed

Avalanche (AVAX)’s value has been transferring with no clear route, and it’s staying flat on the charts. The thrill from 20 Might’s breakout try has light, with AVAX seemingly happening on the charts now.

The present hype surrounding the broader market hasn’t affected the altcoin both. Is there an indication wherever that the bulls may take over within the close to future?

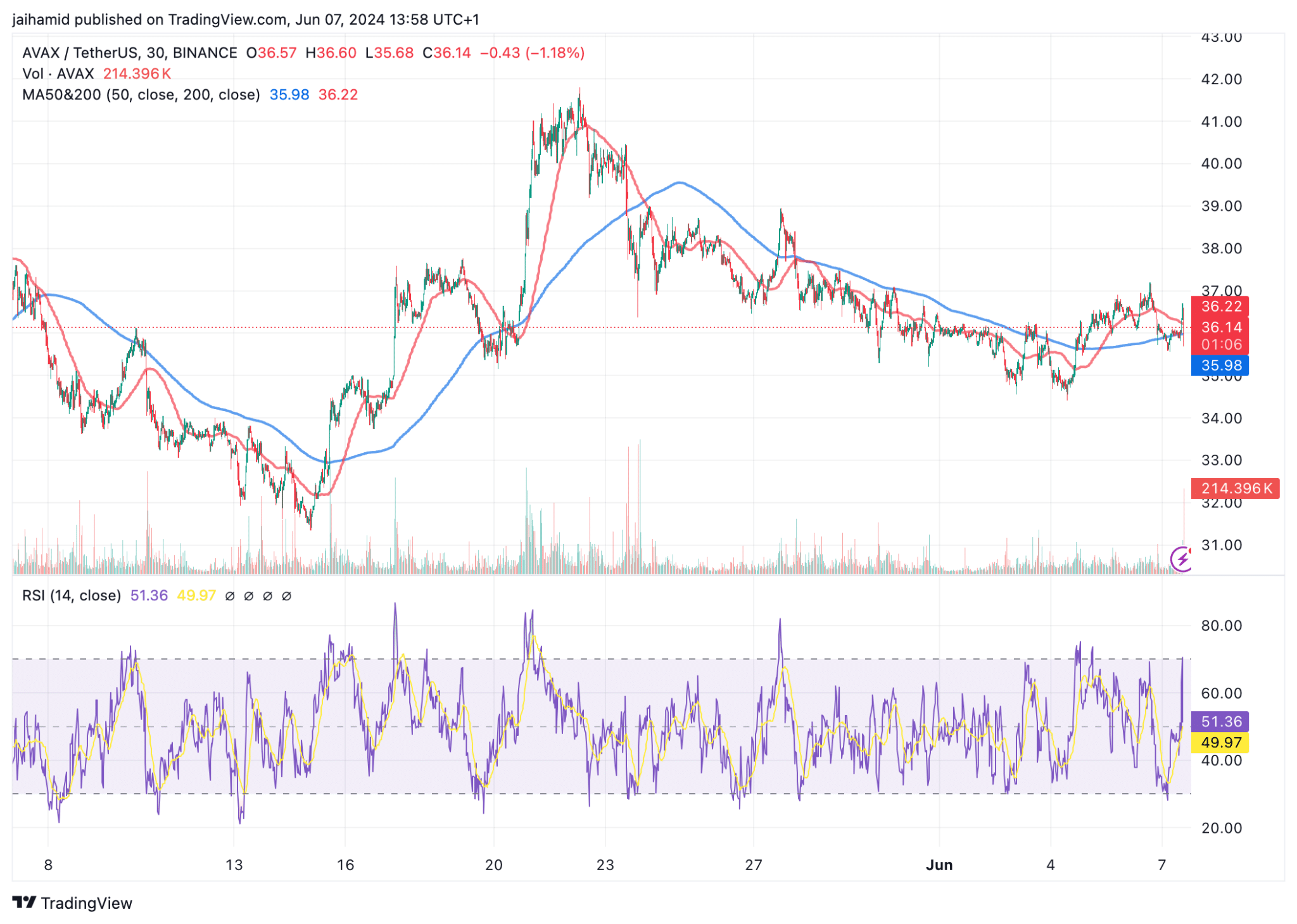

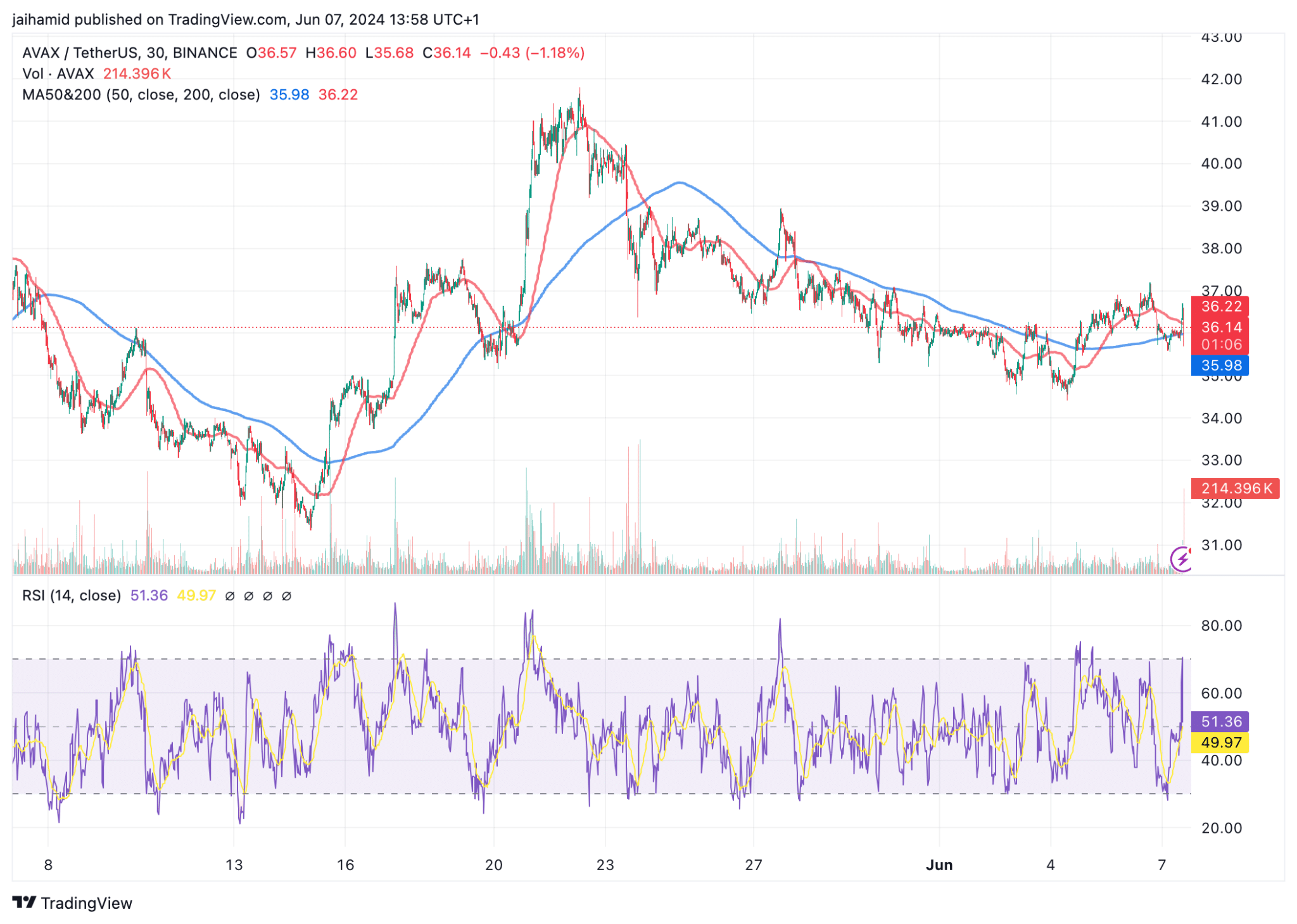

When analyzing AVAX/USDT’s month-to-month chart, we will see the Relative Power Index (RSI) oscillating close to the midline, primarily hovering round 50 – Indicating a scarcity of sturdy momentum in both route. This RSI’s neutrality usually suggests a steadiness between shopping for and promoting pressures, confirming the noticed flat value motion.

Supply: AVAX/USDT, TradingView

The 50-period transferring common (crimson line) and the 200-period transferring common (blue line) noticed a number of crossovers too, which usually sign shifts in short-term momentum.

Nonetheless, the shortage of sustained route after these crossovers is an indication of the bulls’ uncertainty to step in.

AVAX’s value, at press time, was beneath the 200-period transferring common, however trying to remain above the 50-period transferring common – An indefinite bullish impulse.

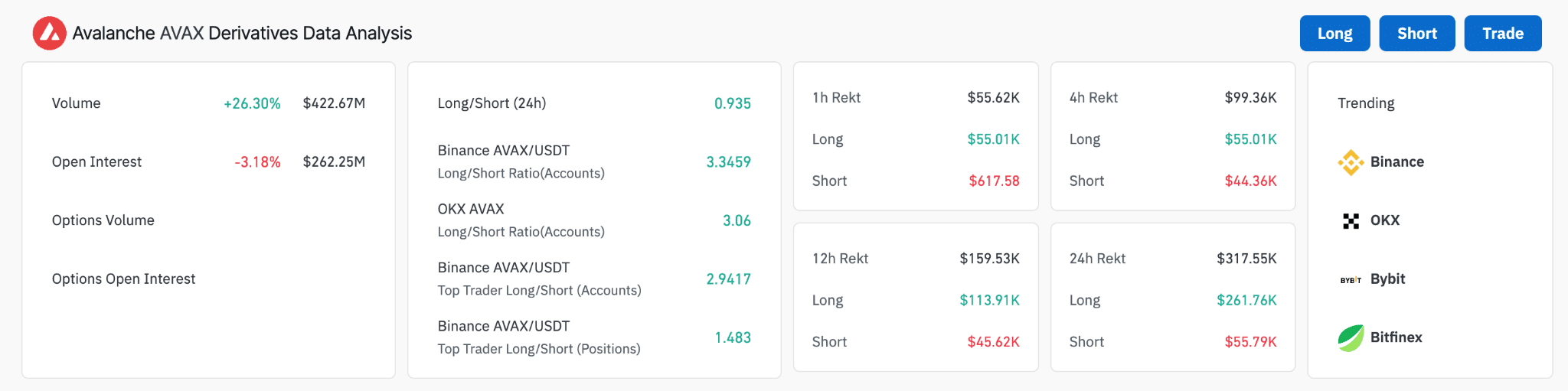

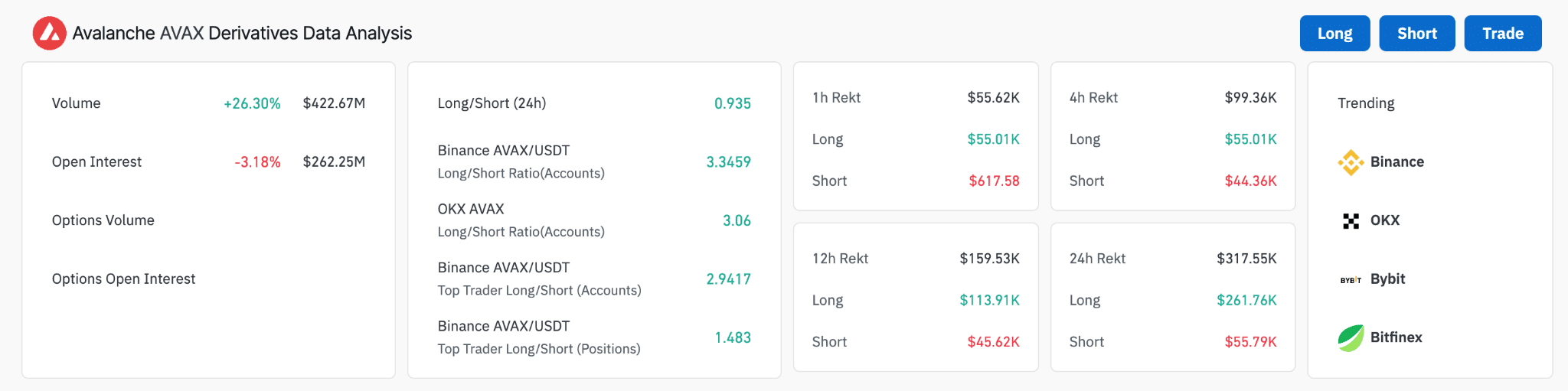

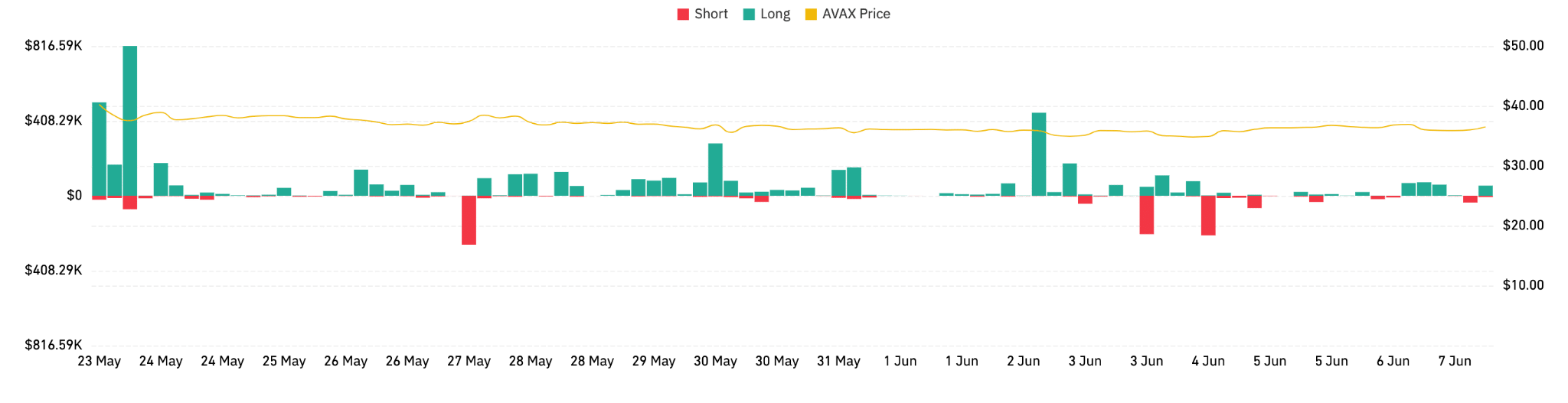

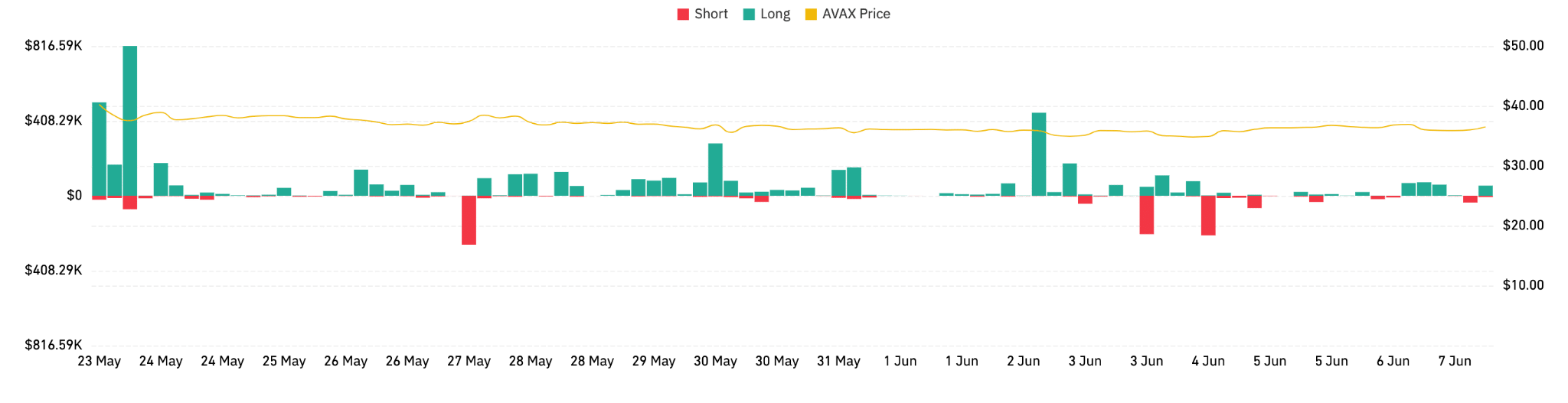

Right here, it’s value noting that the buying and selling quantity for AVAX derivatives rose by 26.30% to $422.67 million. This meant that there appeared to be heightened buying and selling exercise and extra curiosity within the altcoin’s value actions.

Supply: Coinglass

Nonetheless, the general lengthy/quick ratio was 0.935, with a barely greater variety of quick positions relative to longs out there. This appeared to indicate bearish sentiment amongst AVAX’s merchants.

Supply: Coinglass

Given the dominance of lengthy positions over shorts and the comparatively secure value line, AVAX seems to have stable underlying assist. Whereas they’ve been main, the temporary spikes in brief positions may not likely disrupt the general bullish bias.

Curiously, at press time, AVAX’s Worry and Greed Index was at ‘Greed,’ that means traders are fairly bullish proper now. Nonetheless, contrasting indicators reminiscent of unfavourable search curiosity and really unfavourable whale exercise can gave merchants a extra nuanced reply.

In actual fact, regardless of the general market enthusiasm, there’s diminished curiosity in on-line searches and potential promoting strain from massive holders.

This complicated mixture of indicators factors to a cautiously optimistic short-term outlook for AVAX.