- Avalanche has lackluster capital inflows and signaled bearish momentum within the one-day timeframe.

- The vary formation’s mid-level help at $36 must be defended, however the bulls might fail at this activity.

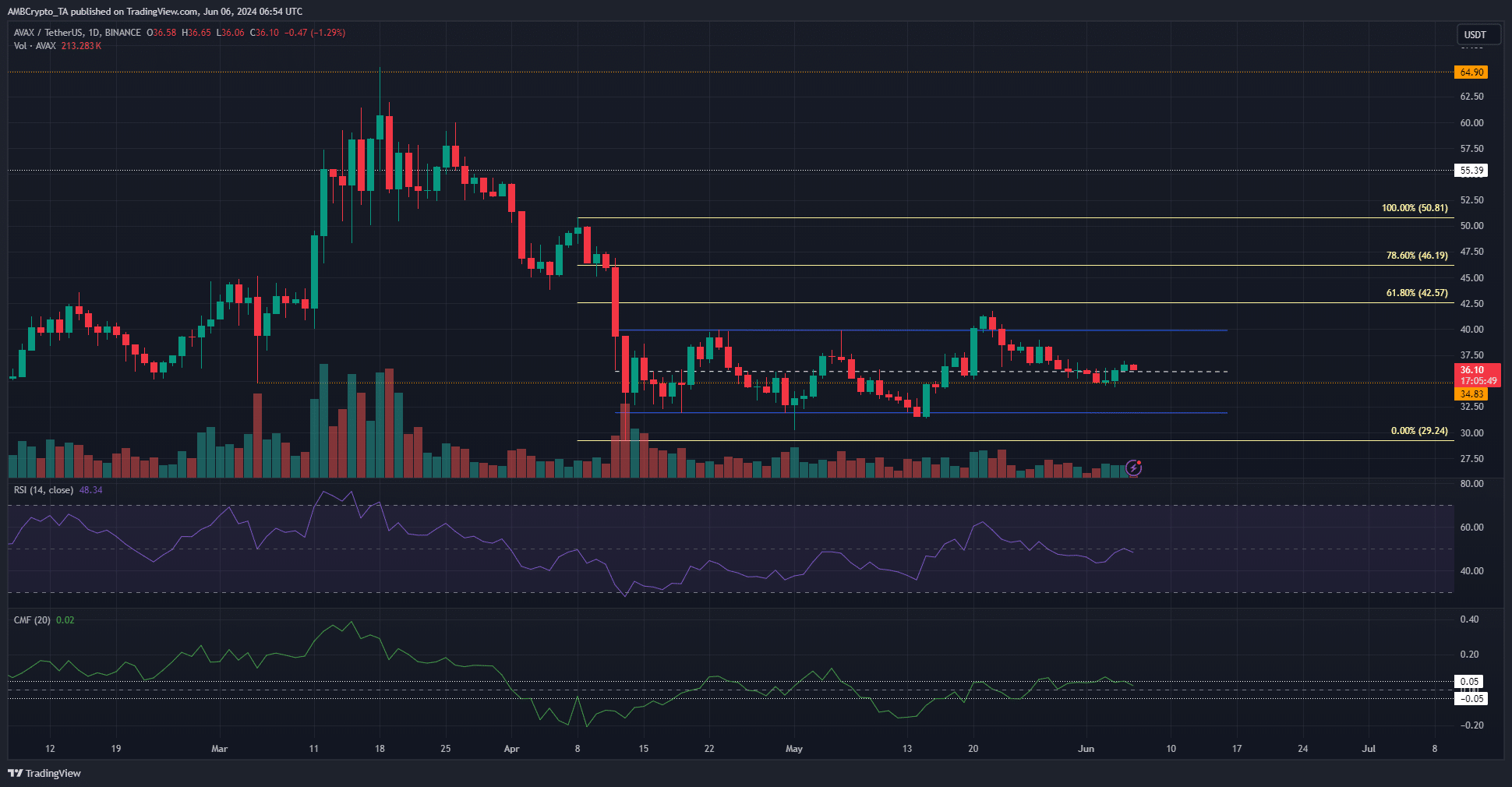

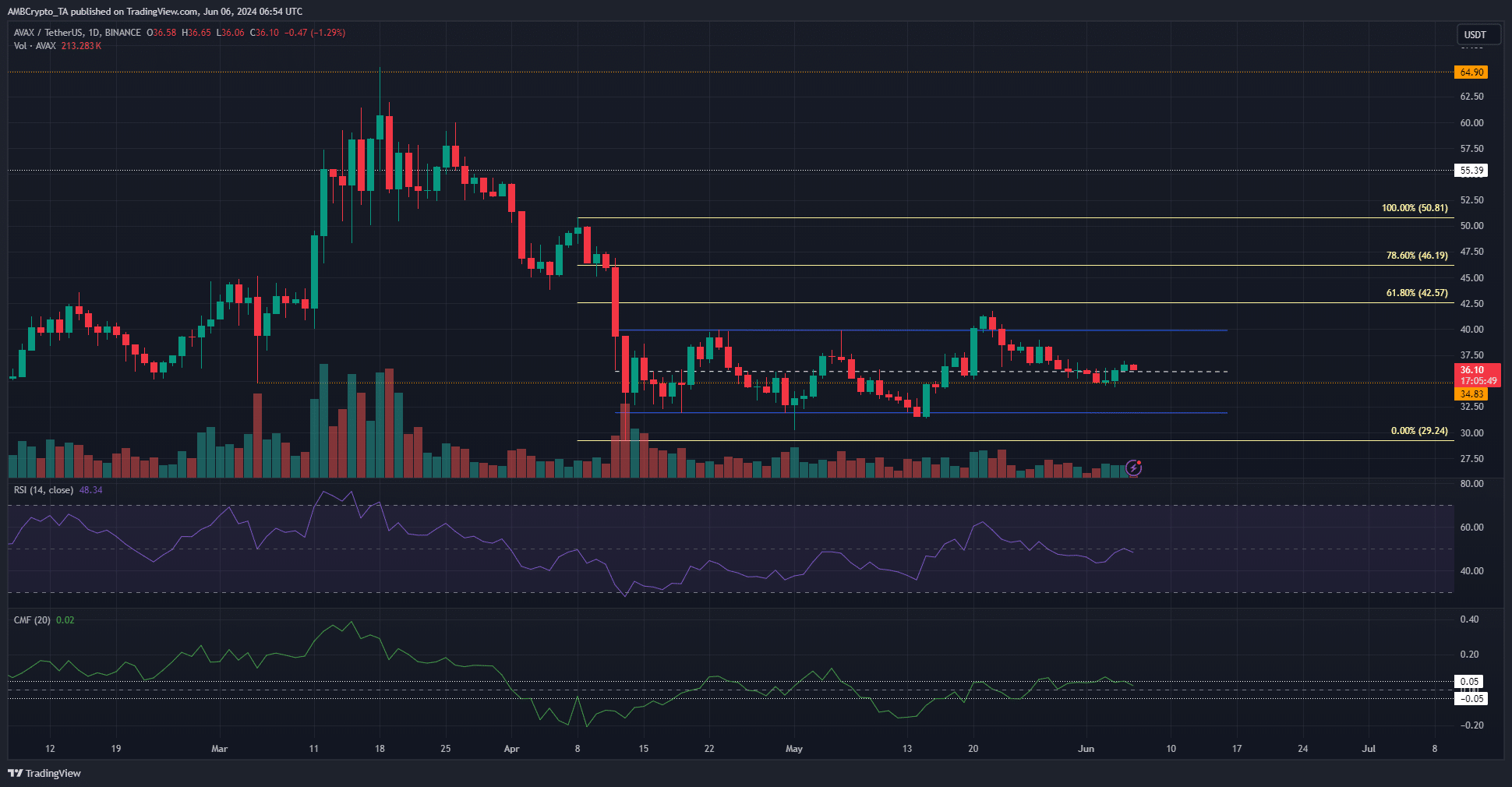

Avalanche [AVAX] continued to commerce throughout the vary formation that was highlighted in an earlier AMBCrypto report. The futures merchants weren’t desperate to go lengthy, and the buying and selling quantity was subdued.

It was an analogous case at press time. Not an excessive amount of has modified. Despite the fact that Bitcoin [BTC] managed to climb previous the $70k stage, AVAX bears remained resolute. Right here’s what merchants can anticipate for the approaching week.

Inspecting Monday’s vary

Supply: AVAX/USDT on TradingView

The worth motion of twentieth June, Monday, noticed the excessive and low at $36.27 and $34.56 respectively. Typically, the week’s buying and selling is confined throughout the Monday’s high and low, forming a short-term vary.

Whereas Avalanche traded inside a two-month vary, within the short-term, it has some bullish momentum. It climbed above the Monday’s excessive on Wednesday, and at press time the bulls had been defending the mid-range stage at $36 as help.

Nonetheless, this momentum would possibly die out shortly. The RSI on the every day chart was nonetheless under impartial 50, and the CMF confirmed an unconvincing capital influx to the AVAX market. Quick sellers might scour the decrease timeframes for entries that swimsuit their system, as the upper timeframe bias was bearish.

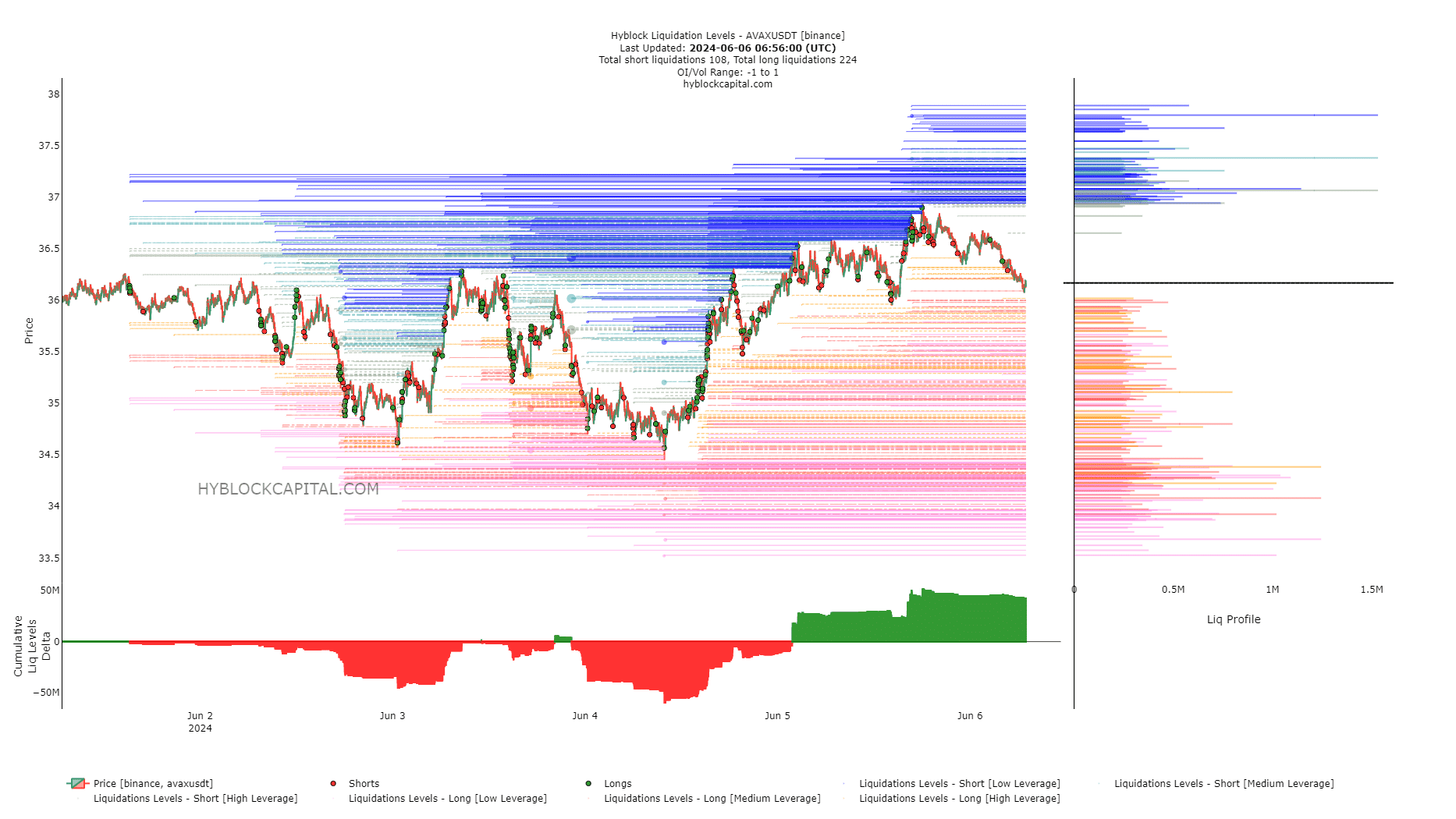

What clues do the liquidation ranges yield?

The cumulative liq ranges delta was optimistic, and excessive sufficient that it would warrant a liquidity hunt northward. The lengthy liquidations outweigh the brief ones, which meant a worth bounce to liquidate these merchants might happen.

Learn Avalanche’s [AVAX] Worth Prediction 2024-25

The cluster of liquidity at $37.06 may be an excellent short-term goal. Scalp merchants might use this bounce to enter brief positions across the $37 stage searching for a transfer towards $34.5 or decrease.

In the meantime, swing merchants and buyers can look forward to a retest of the $30-$32 area to re-enter. Alternatively, a breakout previous the vary highs at $40 could possibly be viable, however it will should be a powerful breakout which could not yield an instantaneous, comfy pullback.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.