- AVAX’s instability brought on many lengthy liquidations.

- If the value hit $58.23, one other decline may happen.

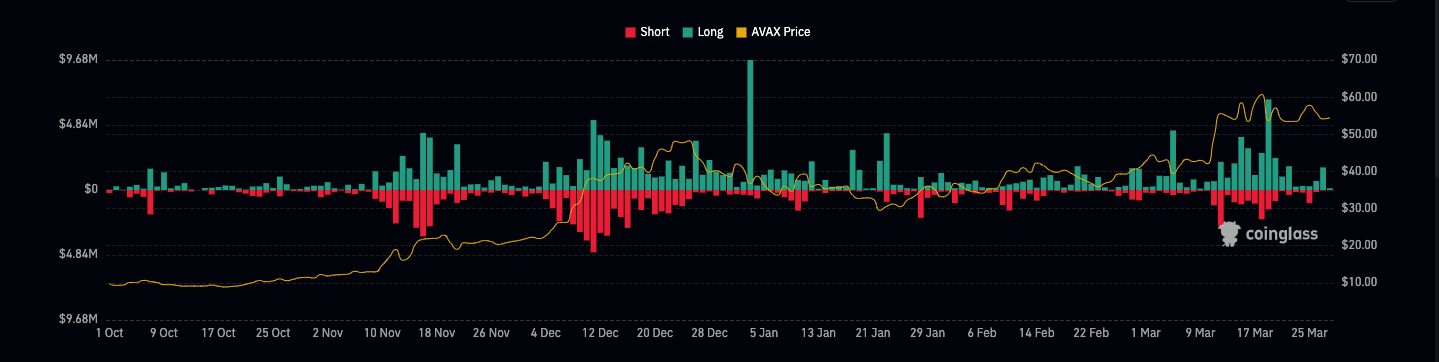

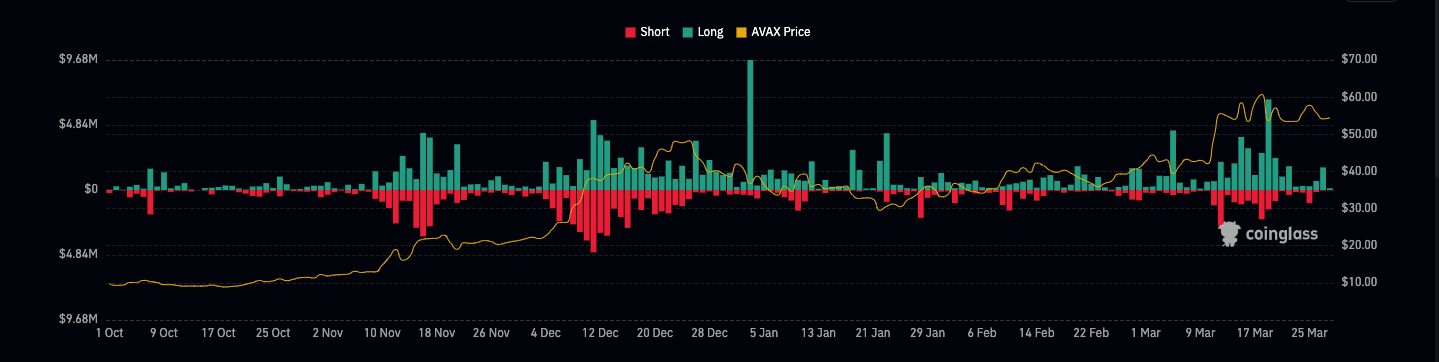

It was not excellent news for merchants who opened lengthy Avalanche [AVAX] positions on the twenty seventh of March. In line with knowledge from Coinglass, contracts valued at $316,200 had been worn out within the final 24 hours.

Out of those positions, longs accounted for $277,890 whereas quick liquidations stood at $38,310. Liquidation happens when an change forcefully closes a dealer’s place.

Supply: Coinglass

This occurs when the dealer doesn’t have the minimal collateral to maintain the place open. Different instances, the market transferring in the wrong way to the expected one might set off it.

Fast swings are dangerous

For AVAX, a big a part of the extermination could possibly be linked to its value motion. At press time, AVAX modified fingers at $54.60. However on the twenty seventh of March, the value virtually reached $55 earlier than volatility hit the market and it retraced to $53.81 in lower than two hours.

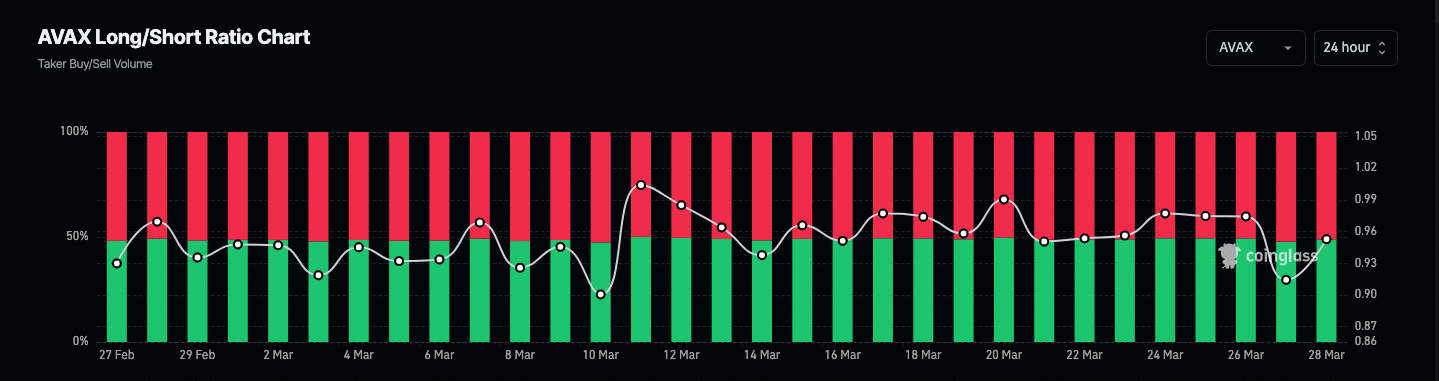

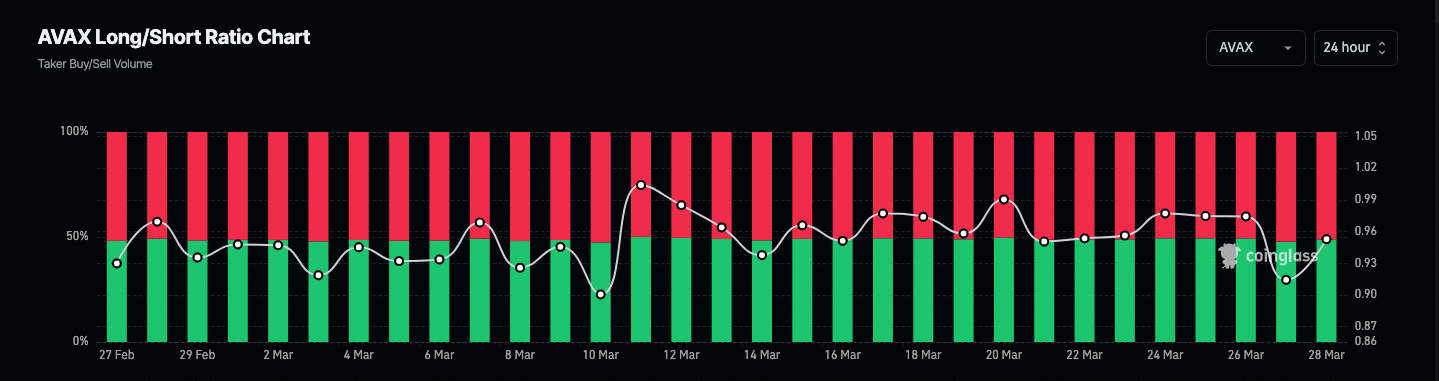

Moreover, AMBCrypto evaluated the Lengthy/Brief Ratio. The metric signifies if buyers have a optimistic or destructive expectation about an asset’s value.

If the worth is over 1, then the sentiment is essentially optimistic and merchants expect a value enhance. Nonetheless, values lower than 1 point out a destructive sentiment.

At press time, AVAX’s Lengthy/Brief Ratio was 0.95, indicating that the common sentiment was bearish.

After we appeared on the metric additional, we found that solely 8% of merchants had been very bullish on the cryptocurrency. Nonetheless, a whopping 33% had been betting on the value to lower. The remainder had been both impartial, barely bullish, or bearish.

Supply: Coinglass

As well as, AMBCrypto analyzed AVAX’s Cumulative Quantity Delta (CVD). Usually, the CVD is used to evaluate merchants’ aggression out there.

At press time, the spot CVD had fashioned a decrease low because the studying was destructive. Although CVD doesn’t paint the total image, the decline implied that perp sellers have grow to be extra aggressive.

If the indicator continues to stay destructive whereas the token tries to hit a better value, longs may not be rewarded. From the technical angle, the 20 EMA (blue) and 50 EMA (yellow) had been across the identical spot.

Entries seem under $54

This means that the value pattern was impartial. Additionally, AVAX has slipped under each EMAs, suggesting that the pattern had extra likelihood to be bearish than bullish.

If shopping for stress enhance, then the token may climb. However the Supertrend flashed a promote sign at $58.23. Subsequently, if AVAX rises that top, a pushback may happen.

Supply: Coinalyze

Is your portfolio inexperienced? Verify the AVAX Revenue Calculator

Conversely, there was a purchase sign at $53.96. If the value declines thus far, then it could possibly be a great entry to open an extended place.

No matter its short-term potential, the token stays one that might carry out properly this cycle. A serious purpose for this prediction is the buzzing Actual World Belongings (RWAs) narrative by which Avalanche’s fundamentals lie.