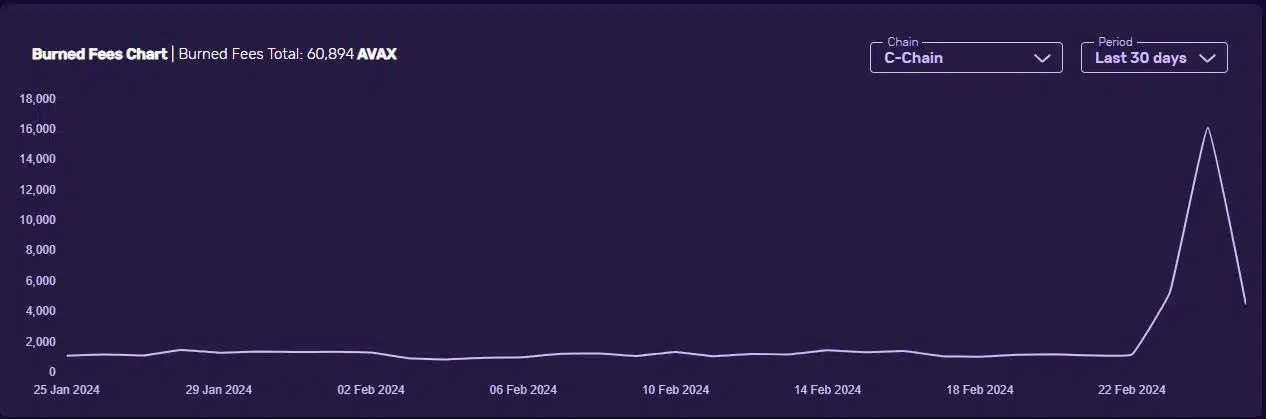

- Final week accounted for greater than half of all AVAX tokens burned during the last 30 days.

- Nevertheless, the spike did not exert any upward stress.

Avalanche’s [AVAX] burn fee spiked sharply within the final week, accelerating the speed at which native tokens have been exiting circulation.

In keeping with AMBCrypto’s evaluation of Avascan information, round 31,650 AVAX cash went up in smoke during the last seven days, with greater than half of this quantity getting burned on the twenty fourth of February alone.

The dramatic spike got here after days of steadiness, the place the each day burn fee hovered within the vary of 1,000-1,300. Consequently, final week accounted for greater than half of all tokens burned during the last 30 days.

Excessive community exercise accelerates burn fee

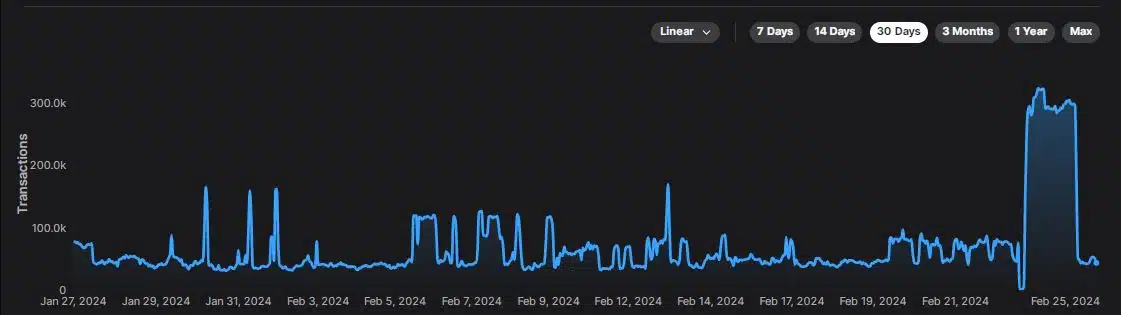

The leap in burn fee adopted the same spike in transactions on the community, AMBCrypto observed, utilizing information from Avalanche explorer.

As per the prevailing framework, Avalanche burns all of the income it generates from transaction charges.

This meant that the upper the community exercise, the upper the charges, and consequently, larger the quantity of AVAX that may be burned.

Sometimes, burn exercise is interpreted as a bullish occasion due to the availability squeeze that it brings about. Nevertheless, final week’s spike did not exert any upward stress on AVAX.

The ninth-largest crypto was down 8.46% during the last week as of this writing, in accordance with CoinMarketCap.

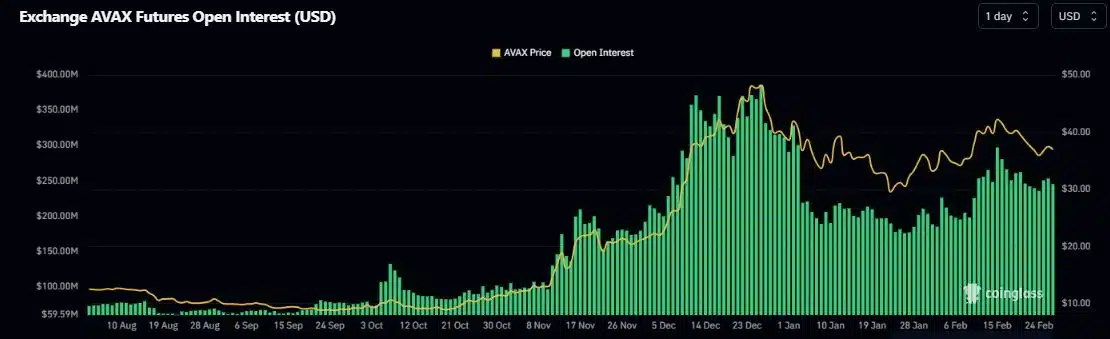

Derivatives market goes bearish in AVAX

AVAX’s value decline impacted speculative curiosity for the token. In keeping with AMBCrypto’s scrutiny of Coinglass’ information, the Open Curiosity (OI) in AVAX Futures dropped 18% within the final 10 days.

In the identical interval, AVAX’s Longs/Shorts ratio did not exceed 1, implying a transparent dominance of bearish leveraged merchants.

What do technical indicators say?

An examination of AVAX’s each day chart supplied intriguing clues about its subsequent strikes.

The Relative Energy Index (RSI) examined the impartial 50 stage as resistance and pulled again. A profitable breaching of this stage may inject some bullish vigor into AVAX within the days to come back.

How a lot are 1,10,100 AVAXs value immediately?

The Transferring Common Convergence Divergence (MACD) line was beneath the sign line as of this writing, indicating a retracement.

Nevertheless, a bullish crossover appeared believable, after which AVAX may resume its uptrend.