The AVAX value grew by 8.15% over the previous week, buoyed by bullish tendencies signaled by the Ichimoku cloud strains, indicating a possible for additional development of Avalanche. Presently, three-quarters of AVAX traders discover themselves within the inexperienced, a big statistic typically previous pivotal asset worth actions.

This upswing in market sentiment and technical indicators fuels hypothesis on whether or not such optimistic indicators may push AVAX’s value towards the $70 mark. Buyers and analysts alike are carefully monitoring to see if this present wave of optimism indicators a transformative section for AVAX.

AVAX Presently Has 75% of Holders at Revenue

A powerful three-quarters of AVAX holders, equating to some 5.72 million addresses, at the moment are seeing earnings following a current uptick within the coin’s worth – a noteworthy shift from the 50-60% profitability vary that had been the norm over the previous months.

The “Historic Break Even Worth”, an important metric revealing the common value at which all present holders would break even, shines a highlight on the funding’s cumulative profitability. Notably, a earlier climb to this 75% profitability threshold in 2021 preceded a pointy improve in AVAX’s value from $75 to $117 in simply 20 days.

Presently, with 21.95% of holders nonetheless within the pink and AVAX buying and selling 59.74% under its peak, the chance will increase that these traders may maintain onto their property in anticipation of additional positive aspects quite than promote, particularly contemplating the coin’s distance from its historic excessive.

Learn Extra: Avalanche (AVAX) Worth Prediction 2024/2025/2030

Ichimoku Clouds Are Drawing a Potential Bullish State of affairs

The Ichimoku evaluation of AVAX reveals a reasonably bullish sentiment because of the value positioning above the cloud, which tends to point an upward development. The cloud seems to be altering colour from pink to inexperienced, suggesting a shift in direction of a bullish market as Span A rises over Span B.

The Conversion Line, which represents short-term value momentum, is above the Base Line, a medium-term momentum indicator, additional confirming the bullish sentiment for AVAX. The Lagging Span, nonetheless, is throughout the value vary from 26 intervals in the past, indicating an absence of sturdy momentum, as ideally, it must be above the worth motion for a robust bullish affirmation.

The Ichimoku Cloud is a technical evaluation technique that paints a dynamic image of market tendencies and potential assist or resistance areas on a chart. It combines 5 strains that present quick to long-term value motion and future projections, forming a ‘cloud’. A value above the cloud indicators bullish circumstances, whereas under signifies bearish tendencies.

The interaction of those strains additionally provides insights into market momentum and might sign potential reversals or continuations of tendencies. The value motion stays above the Base Line, but it carefully follows the Conversion Line, which generally can act as a primary degree of assist in an uptrend.

The absence of a bearish crossover, the place the Conversion Line would drop under the Base Line, maintains the bullish outlook. As proven within the chart, the quantity indicator is comparatively low, which may query the power of the present development, and merchants may search for a rise in quantity to substantiate additional bullish development.

AVAX Worth Prediction: Will It Attain a 2-Yr Excessive?

AVAX’s value hasn’t reached $70 since April 2022. That would occur quickly if AVAX is ready to break some resistances forward.

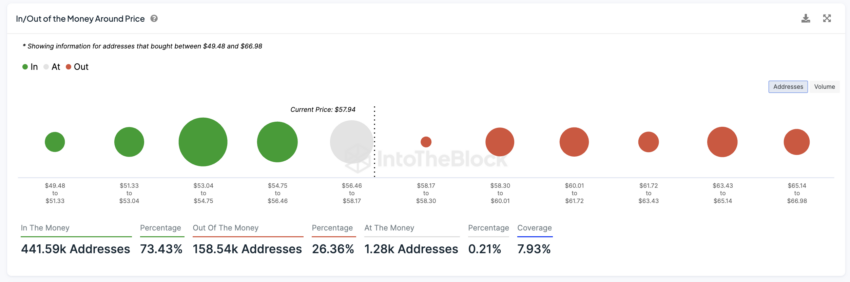

The In/Out of the Cash Round Worth (IOMAP) chart for Avalanche (AVAX) shows a focus of assist on the $53 to $54.75 value vary, the place holders acquired the biggest quantity of AVAX tokens. That is mirrored within the presence of considerable inexperienced bubbles, indicating these holders are ‘within the cash’ and may act as a buffer towards value declines.

The IOMAP chart is a visible software that illustrates value ranges the place vital numbers of asset purchases have occurred, displaying potential assist and resistance zones primarily based on the present value. It highlights the place holders may be making a revenue (‘within the cash’), breaking even (‘on the cash’), or experiencing a loss (‘out of the cash’).

Inexperienced areas sign giant clusters of worthwhile purchases, indicating potential assist, whereas pink areas denote unprofitable ones, suggesting resistance.

Learn Extra: 11 Finest Avalanche (AVAX) Wallets to Think about in 2024

On the flip aspect, resistance is build up within the $63.43 to $65.14 zone, as proven by the pink bubbles, suggesting a large quantity of AVAX tokens have been bought at these ranges, inserting these holders ‘out of the cash.’

Nonetheless, these resistances usually are not as sturdy because the shut helps AVAX present has, which may point out that if it may well break the next resistances, if may simply proceed the uptrend towards $70.

Disclaimer

Consistent with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.