Overview

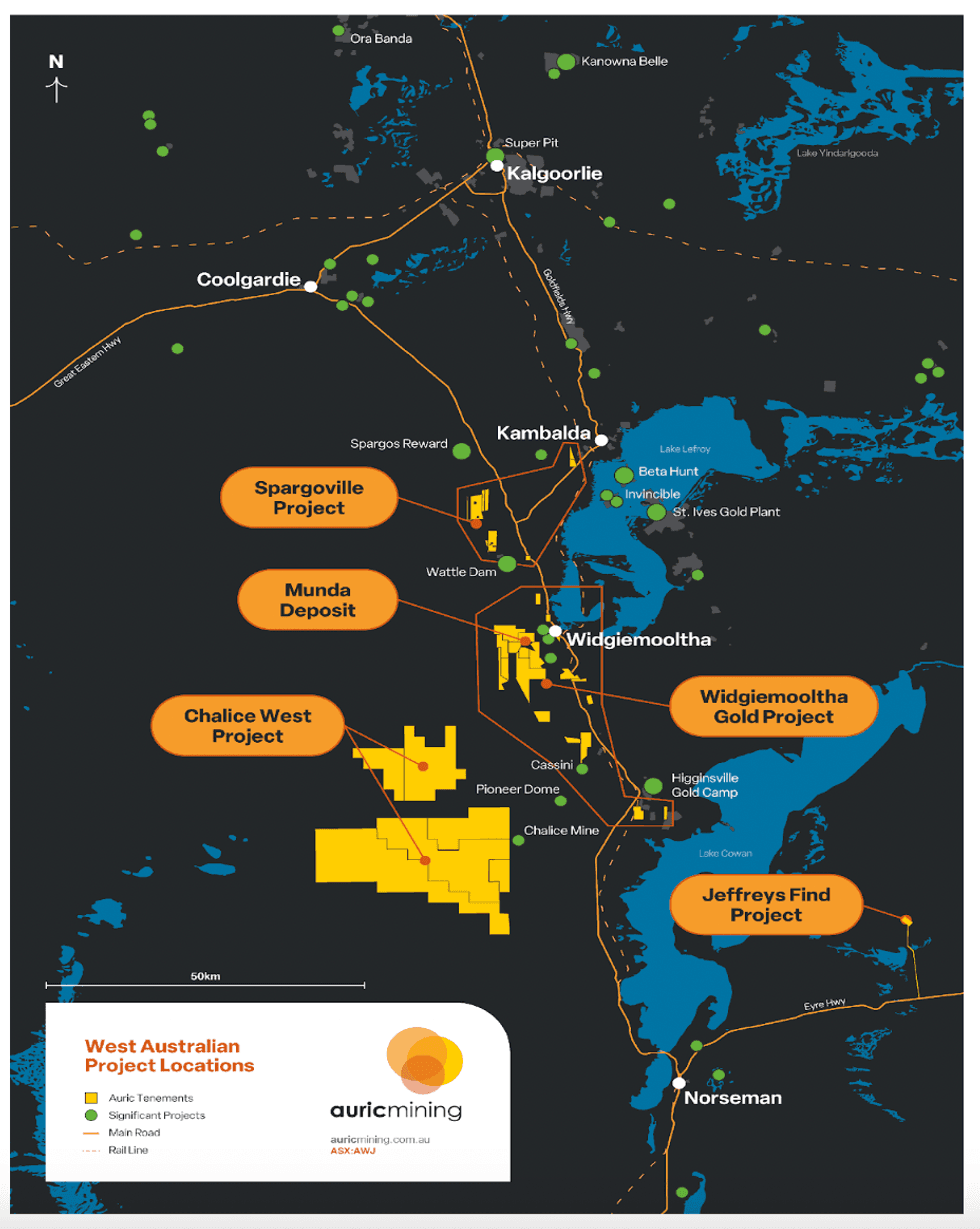

Auric Mining Restricted (ASX:AWJ) is a gold exploration and mining firm based mostly in Western Australia. In lower than three years since its ASX itemizing, Auric has turn into a gold producer on this premier jurisdiction, commencing manufacturing at its Jeffreys Discover Undertaking in Could 2023.

Since floating, it has moved from zero to 250,000 ounces of gold assets and 0 to 640 sq. kilometers of tenements. Auric Mining is within the firm of a number of the largest gold tasks within the Goldfields, together with the St Ives Gold Mine, Karora Sources’ Higginsville Operations & Beta Hunt Mine, all multi-million-ounce mines.

Apart from gold, there are quite a few valuable metals being mined within the space with world-class deposits of nickel, lithium and uncommon earths. Auric is gold-focused and has the potential to turn into the subsequent main gold producer within the area.

First blasting at Jeffreys Discover in Could 2023. Gold mining is underway.

Over the approaching months 100,000 – 150,000 tonnes of ore will likely be hauled to the Greenfields Mill at Coolgardie, the place it will likely be toll handled. Gold produced will likely be forwarded to the Perth Mint for remaining refining and sale.

Partnering with Auric within the enterprise is BML Ventures of Kalgoorlie (BML), a widely known and adept Kalgoorlie contractor. After finishing the preliminary pit, the companions will subtract all prices earlier than splitting the excess proceeds on a 50:50 foundation. This can present Auric with a considerable money enhance.

Gold ore on the ROM Pad at Jeffreys Discover. Ore is now being hauled to Coolgardie for refining.

As soon as the primary section is full, BML will transfer to a deeper open-pit mine in 2024. The challenge life is brief and remaining mining will likely be accomplished inside 12 to fifteen months of graduation. The 2 events are partially exploiting the gold deposit of practically 50,000 ounces with an anticipated whole free money movement surplus from the challenge of between $15,000,000 and $20,000,000. Auric’s share is 50 %.

Successfully, this implies the corporate will likely be self-funding for the subsequent 18 to 24 months and in a position to maintain a considerable exploration program with out want for added capital elevating.

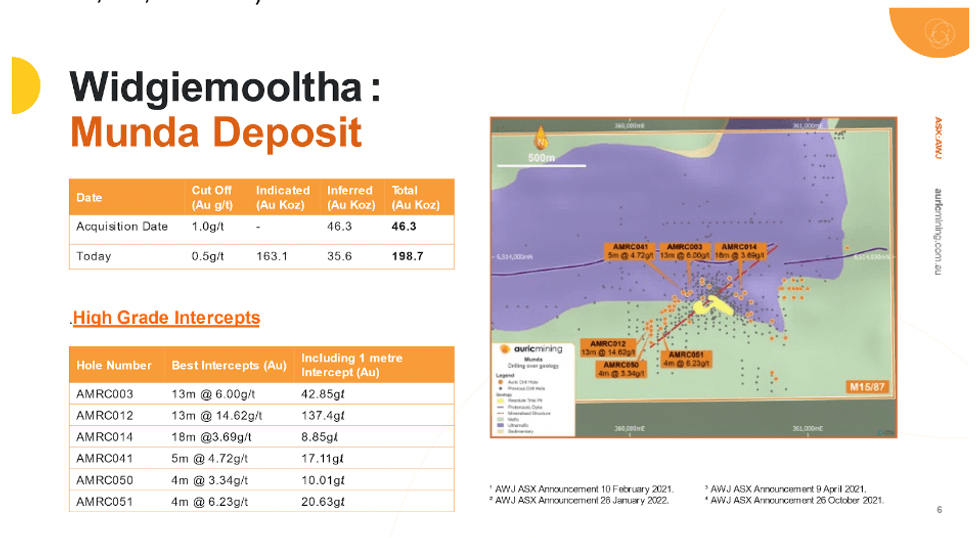

Auric’s main focus, nevertheless, stays on the corporate’s flagship asset – The Widgiemooltha Gold Undertaking, which incorporates the Munda Gold Deposit.

To this point, virtually 200,000 ounces of gold assets have been recognized. The asset is a part of the Widgiemooltha Gold Undertaking, which encompasses 20 tenements.

Munda has the potential to turn into a significant gold challenge. To that finish, the corporate has simply launched to the ASX an impartial third-party scoping research on the economics and potential of open-pit mining.

The scoping research highlights the mining of as much as 120,000 ounces of gold over a three-year mine life. It’s envisaged gold ore could be mined at a close-by gold mill. The research tasks income of between $50 million and $100 million, based mostly on numerous gold costs. Mining may happen as early as 2025.

Auric Mining has been very energetic on the exploration entrance, conducting an inaugural drilling program at The Chalice West Undertaking, extremely potential for gold, nickel and uncommon earths, within the Widgiemooltha-Higginsville space. In all, 227 holes had been drilled as the corporate additional defines the gold imprint of the tenement. Closing outcomes additionally point out widespread, thick clay-hosted mineralization of uncommon earth parts.

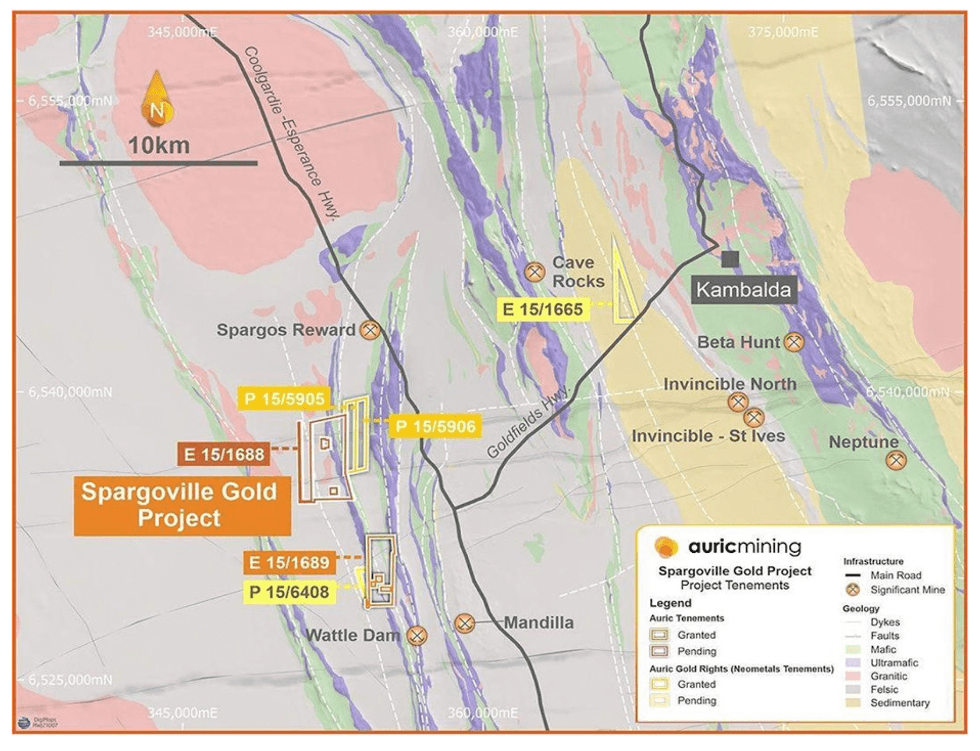

Auric can also be progressing with its Spargoville Undertaking, the place it has tenements ideally positioned alongside strike from the Wattle Dam gold mine, which produced 268,000 ounces at 10 g/t gold between 2006 and 2013.

An skilled and savvy administration workforce leads Auric Mining in the direction of its imaginative and prescient of changing into a major gold producer in Western Australia. With the administrators proudly owning 16 % of the corporate, they’re centered and motivated for achievement.

Auric Mining’s board of administrators: Mark English, Managing Director; Steve Morris, Chair; and John Utley, Technical Director

Steve Morris, non-executive chairman, has greater than 25 years of expertise in monetary and pure assets markets. Mark English, managing director, has a 40-year profession as a chartered accountant and is relaxed with all aspects of working a junior explorer on the ASX together with main fairness and debt raisings. John Utley, technical director, has 35 years of expertise in gold exploration and growth. This vary of experience provides a excessive stage of confidence that the corporate will obtain its objectives.

Firm Highlights

- Auric Mining is a publicly listed firm that has present gold assets of 250,000 ounces – with 200,000 ounces at its flagship asset, The Munda Gold Deposit, close to Widgiemooltha, 600 kilometers from Perth.

- Elsewhere, it has commenced mining at its Jeffreys Discover Gold Mine, close to Norseman, the place it’s partially exploiting practically 50,000 ounces of gold assets and hopes to recuperate round 20,000 ounces over the approaching 12 to 18 months.

- The primary gold ore will likely be processed by the mill at Coolgardie in July 2023 and money movement is anticipated shortly.

- Within the first stage of mining, 120,000 to 150,000 tonnes of ore will likely be despatched for milling the place it’s anticipated to yield round 1.7g/t.

- The Firm goals to be self-funding by the tip of 2024.

- Threat is mitigated on the Jeffreys Discover Gold Mine with Auric’s JV accomplice, BML Ventures of Kalgoorlie bearing all mining and daily operational prices and dealing capital bills.

- As the primary section of mining the preliminary pit involves an finish within the third quarter of 2023, each Auric and BML have agreed to a money break up of surplus funds, after prices and a retention of working capital for the ultimate pit, on a 50:50 foundation.

- As an explorer, Auric has gathered 640 sq. kilometers of tenure because it searches for 1,000,000 ounces of gold between Kalgoorlie and Norseman.

- The realm hosts a number of the richest mineral deposits and mines on the earth. Along with gold, Auric additionally has alternatives for discovery of uncommon earths and nickel.

- Auric has 4 major tasks: The Widgiemooltha Gold Undertaking, which contains the Munda Gold Deposit; Jeffreys Discover Gold Mine; The Chalice West Undertaking, and The Spargoville Undertaking.

- The corporate has a board and management workforce with a monitor report of delivering success for shareholders, notably in discovering and bringing to manufacturing gold tasks.

Key Initiatives

Widgiemooltha Gold Undertaking

Simply launched scoping research tasks the mining of 100,000+ ounces from the Munda Gold Deposit. The research tasks income above $50 million by to $100 million.

Development to open-pit mining is gathering momentum.

This flagship asset comprises 20 tenements of extremely potential gold nation close to Widgiemooltha and consists of the Munda Gold Deposit. Since buying the Munda tenement drilling outcomes affirm indicated and inferred gold assets of just about 200,000 ounces (4.48 mt @ 1.38 g/t with 0.5 g minimize off).

The tenements have substantial protection on the north finish of the Widgiemooltha Dome.

Even with the intensive mining historical past within the space, appreciable exploration prospectivity stays. A number of vital gold tasks found or developed up to now ten years, together with:

- Karora Sources (TSX:KRR); Higginsville Gold Operations (assets of 38.08 Mt @ 1.7 g/t for two,015,000 ounces gold);

- Karora Sources; Beta Hunt (assets of 29.32Mt at 2.5g/t for two,403,000 ounces gold); and

- Astral Sources (ASX:AAR); Mandilla Undertaking (assets of 30.0Mt @ 1.1g/t for 1,030,000 ounces gold).

Auric Mining is now fast-tracking growth alternatives at Munda and has simply launched to the ASX an impartial scoping research on open pit mining. With various gold processing mills within the neighborhood, the transfer to manufacturing is a sensible prospect. Additional drilling is within the works as the corporate appears to be like to extend the dimensions of the useful resource.

In accordance with the scoping research at gold costs from AUD$2,400 to AUD$2,800/oz, the Manufacturing Goal for the Undertaking ranges from roughly:

• 1.67Mt at 2.2g/t producing 112.0koz gold, to

• 2.18Mt at 1.9g/t producing 129.1koz gold.

The Manufacturing Goal generates an undiscounted gathered money surplus after fee of all working capital prices, however excluding pre-mining capital necessities, of roughly $54.7 million to $101.4 million.

Mining is contemplated over an roughly 3-year interval (13 calendar quarters).

Pre-mining capital and start-up prices are estimated to be roughly $0.8 million to $1.7 million.

Working capital necessities of roughly $3.9 million to $8.1 million had been estimated based mostly on a Stage 1 starter pit design which might have a mine lifetime of lower than 3 months.

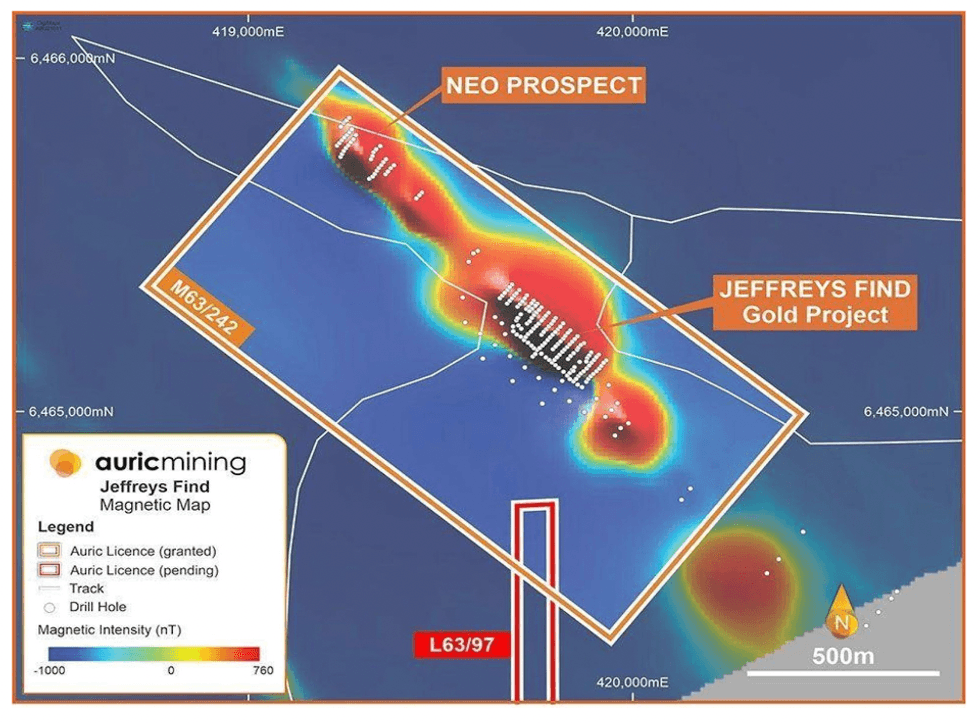

Jeffreys Discover Gold Mine

Gold mining underway as companions look to recuperate 6,000 to eight,000 ounces in first-phase pit with maiden gold pour anticipated in the direction of the tip of July 2023.

The Jeffreys Discover Gold Mine is positioned roughly 45 kilometers northeast of the city of Norseman and 12 kilometers off the primary Eyre Freeway.

Jeffreys Discover is a brief life mine with a complete gold assets estimate of practically 50,000 ounces.

Work on the challenge has steadily superior in the course of the previous 12 months and gold mining is now underway making it a world-class development to manufacturing.

The challenge is a three way partnership endeavor between Auric and well-known Kalgoorlie contractor BML Ventures (BML).

BML will initially be mining and hauling 100,000 to 150,000 tonnes of ore from Jeffreys Discover to Coolgardie, the place it will likely be toll handled on the Greenfields Mill. Gold produced will likely be forwarded to the Perth Mint for remaining refining and sale. Round 6,000 ounces to eight,000 ounces of gold will likely be produced from the preliminary pit.

An impartial scoping research carried out in the midst of 2022 projected a gold yield of 1.3g/t to 1/7g/t with gold thickest close to the floor.

Sizeable money movement will likely be generated from the challenge with estimates starting from 19,000 to 22,000 ounces of gold to be produced throughout an 18 to 24 months mine life.

The preliminary pit takes form at Jeffreys Discover Gold Mine

Magnetic picture of the gold useful resource at Jeffreys Discover

As mining progresses at Jeffreys Discover, operations stay on plan and on funds. The corporate expects to have the primary 30,000 tons of ore to the Greenfields Mill in Coolgardie for processing by the tip of July 2023.

As the primary section of mining the preliminary pit involves an finish within the third quarter of 2023 each Auric and BML have agreed to a money break up of surplus funds, after prices and a retention of working capital for the ultimate pit, on a 50:50 foundation.

Wanting ahead after the primary section is accomplished, each Auric and BML will transfer to a bigger and deeper remaining pit in 2024.

A surging gold worth has made the challenge extremely enticing. The impartial scoping research initially estimated a gold worth of $2,600/oz in July 2022. It now sits round $2,850/oz and this uplift in costs provides additional income and cashflow to the challenge.

Auric’s Managing Director Mark English on web site at Jeffreys Discover

Spargoville Undertaking

Drilling program deliberate as firm appears to be like for gold on strike to Wattle Dam

Situated roughly 35 kilometers southwest of the mining city Kambalda, the Spargoville Undertaking is an underexplored asset with partially examined or fully untested nickel and gold anomalies.

The asset sits north of the Wattle Dam gold mine. The Wattle Dam gold mine produced 268,000 oz of gold at a mean grade of 10 g/t between 2006 and 2013.

Whereas solely partially drilled, preliminary exploration outcomes from the Fugitive Prospect embody an intercept at 14 meters with a grade of two.51 g/t gold, indicating the asset’s promising potential.

A drilling program will happen at The Spargoville Undertaking within the second half of 2023.

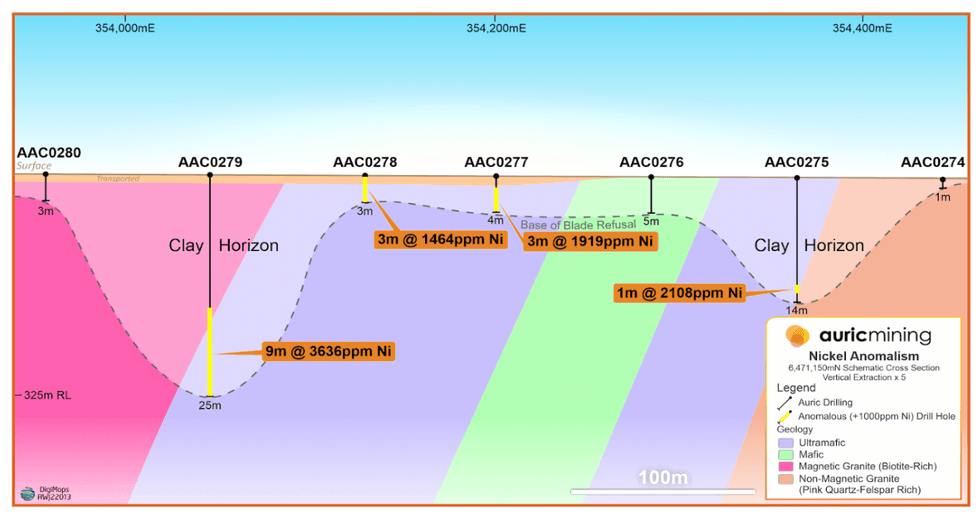

The Chalice West Undertaking

Gold and uncommon earth parts stay focus of exploration on 540 sq. kilometers of tenements.

In 2022, Auric Mining executed an possibility settlement to amass The Chalice West Undertaking. Since then, the Firm has been actively exploring gold and valuable minerals together with nickel and uncommon earths.

On the finish of 2022, a complete of 227 holes had been drilled, and one other eight holes had been drilled early in 2023.

The Chalice West Undertaking is adjoining to The Chalice Mine

The inaugural program noticed 145 aircore holes concentrating on an analogue or analogues to the Chalice Mine solely 8 kilometers to the northeast which produced round 700,000 ounces of gold over seven years from 1995 at a mean grade of 5.2 g/t.

The corporate has now expanded the definition of greenstones on the tenement and decided widespread gold anomalism doubtlessly mirroring that of the Chalice Mine.

Nickel anomalies at Chalice West

Important REE intercepts had been returned for each particular person 1m samples and BOH composite samples representing 25 holes.

Administration Crew

Auric Mining’s Administration and Board of Administrators have a wealth of expertise in gold discovery, in mine operations and throughout the complete spectrum of finance and administration. That have stretches to all elements of the globe.

Board of Administrators

Steve Morris – Non-executive Chairman

Steve Morris is a widely known monetary markets govt with greater than 20 years expertise at a senior stage. He garnered business respect as head of personal purchasers for Patersons Securities, now Canaccord Genuity, and has additionally been managing director of Intersuisse. Mr. Morris has served as a senior govt of the Little Group. From 2014 to 2019, Morris was a non-executive director of De Gray Mining (ASX:DEG), a gold firm now with a $2.4 billion market capitalization. Mr. Morris is nicely linked in finance circles and is vice-chairman of the Melbourne Soccer Membership.

Mark English – Managing Director

Mark English is a Chartered Accountant with greater than 40 years’ expertise in enterprise. English was the founding director of Bullion Minerals Ltd, now DevEX Sources (ASX:DEV) an organization he managed for seven years earlier than taking it to an IPO. Mr. English has appreciable expertise with main fairness and debt raisings. He presently sits on the Board of WA built-in agricultural firm Moora Citrus Group, one of many nation’s largest citrus producers and processors.

John Utley – Technical Director

John Utley has a 35-year profession in mining and exploration with a dominant concentrate on gold belongings. He holds a grasp’s diploma in Earth sciences from the College of Waikato in New Zealand. Utley has labored in Australia, South America, Papua New Guinea and most not too long ago in Canada the place he was the Chief Geologist for Atlantic Gold Company, an organization now owned by St Barbara (ASX:SBM). He spearheaded exploration and growth of the Touquoy Gold Mine in Nova Scotia, Canada, previous to being acquired by St Barbara. Utley beforehand labored with Plutonic Sources (ASX:PLU) and was head of the exploration workforce on the Darlot Gold Mine in the course of the discovery and growth of the two.3-million-ounce Centenary gold deposit.